On Friday, the euro extended losses against the greenback, which resulted in a test of the January low. After that EUR/USD rebounded, signaling that the buyers are quite active in this area. But are they? What could happen if they fail at current levels?

In our opinion the following forex trading positions are justified - summary:

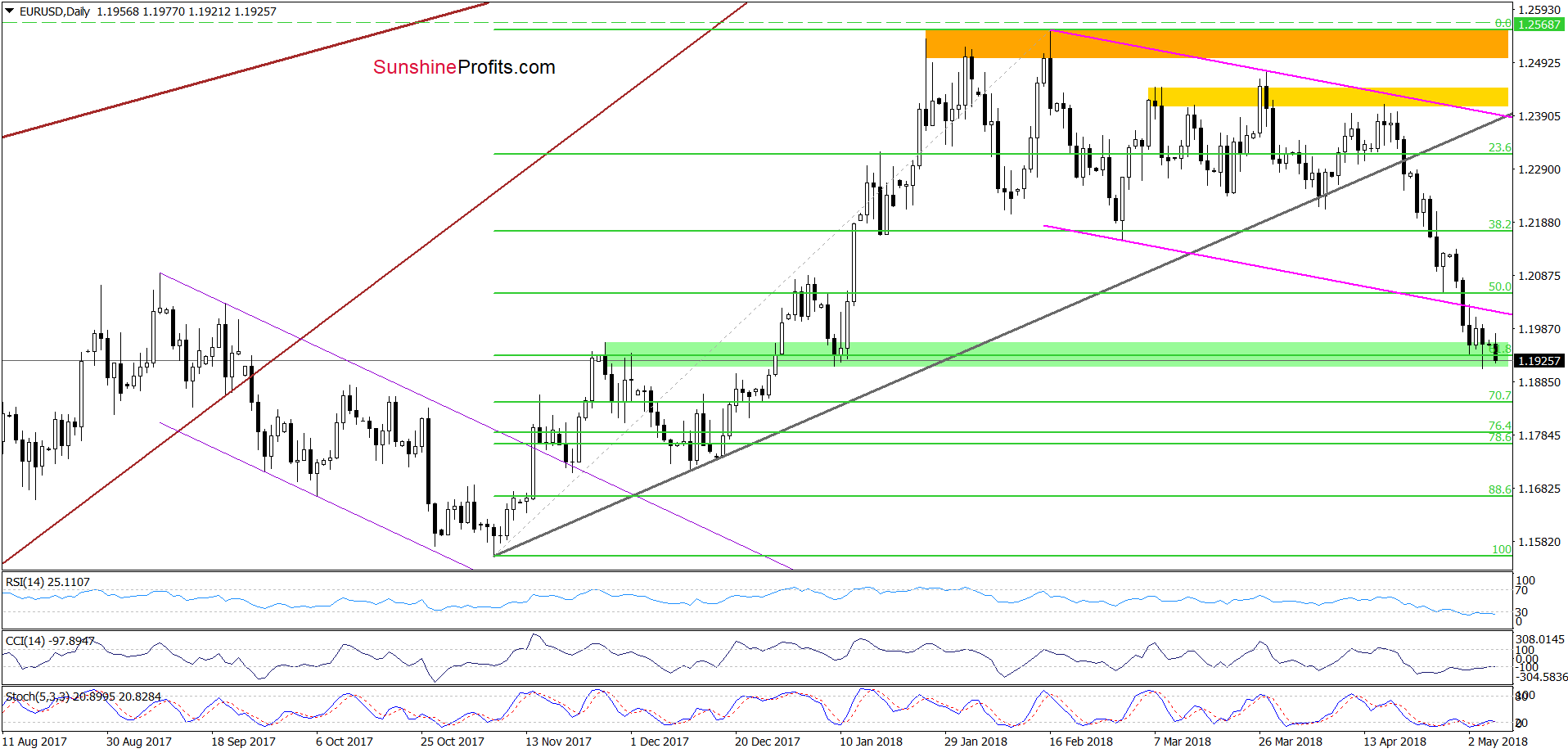

EUR/USD

From today’s point of view, we see that although EUR/USD bounced off the January lows on Friday, the sellers came back to the market earlier today. This suggests a re-test of the recent low later in the day.

At this point it is worth noting that the current position of the indicators suggests that reversal is just around the corner, but as we saw in recent days it's definitely not enough to stop the sellers. Therefore, we think that we should also consider pro-bearish scenario.

What do we mean by that? If currency bears manage to close the day (todays or one of the following sessions) under this support, we could see a drop to around 1.1850 (the 70.7% Fibonacci retracement) or even to 1.1732-1.1770, where the next support area (created by the 78.6% Fibonacci retracement and mid-December lows) is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

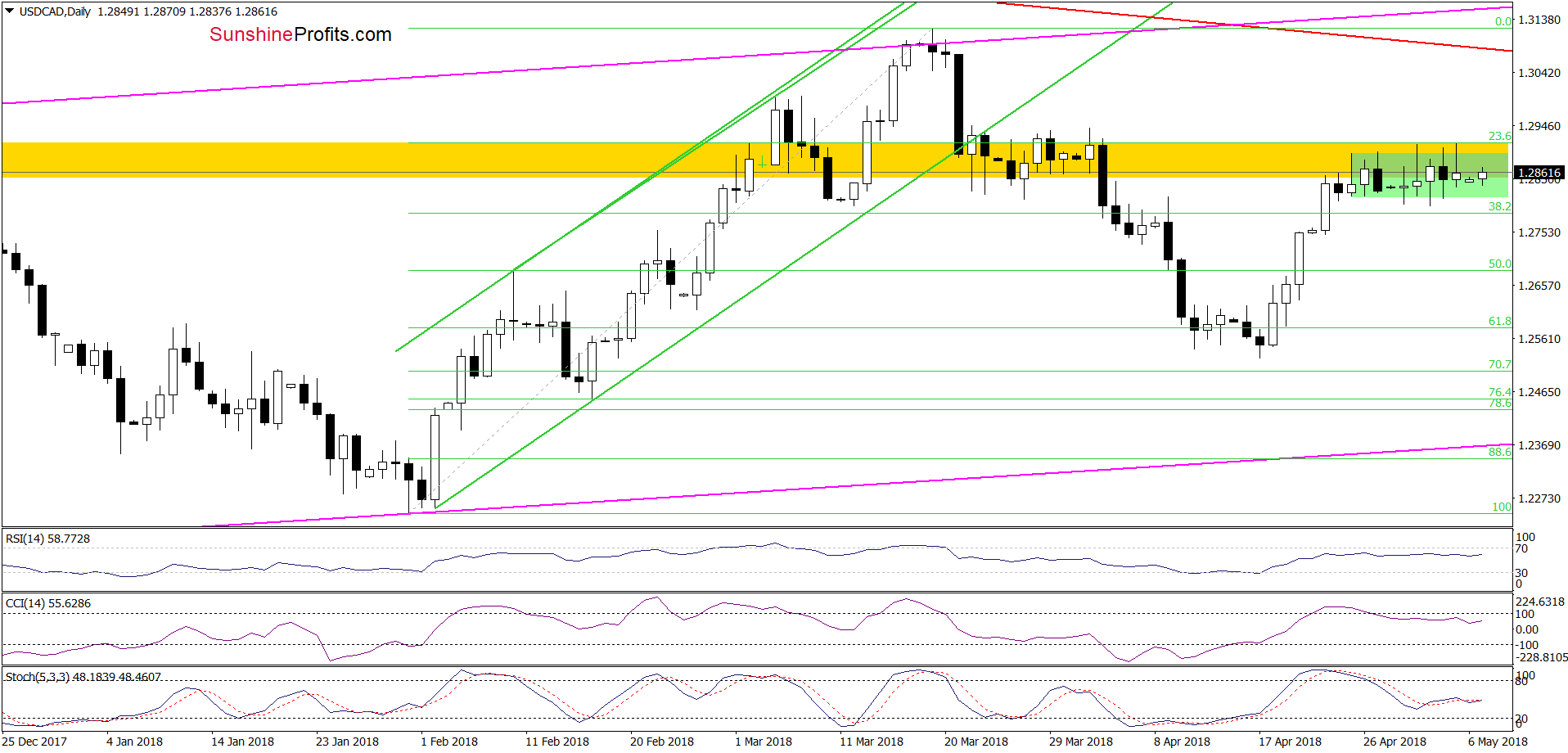

USD/CAD

As you see on the daily chart, we see that the overall situation hasn’t changed much since we commented it on Thursday, therefore, what we wrote back then remains up-to-date also today:

(…) USD/CAD is still trading in the green consolidation slightly below the yellow resistance zone (which is currently reinforced by the 61.8% Fibonacci retracement based on the recent March-April decline). This means that as long as there is no breakout above this area, higher values of USD/AD are not likely to be seen.

When can we expect a breakthrough? In our opinion, if currency bears successfully break under the lower border of the above-mentioned formation. In this case, we’ll consider re-opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

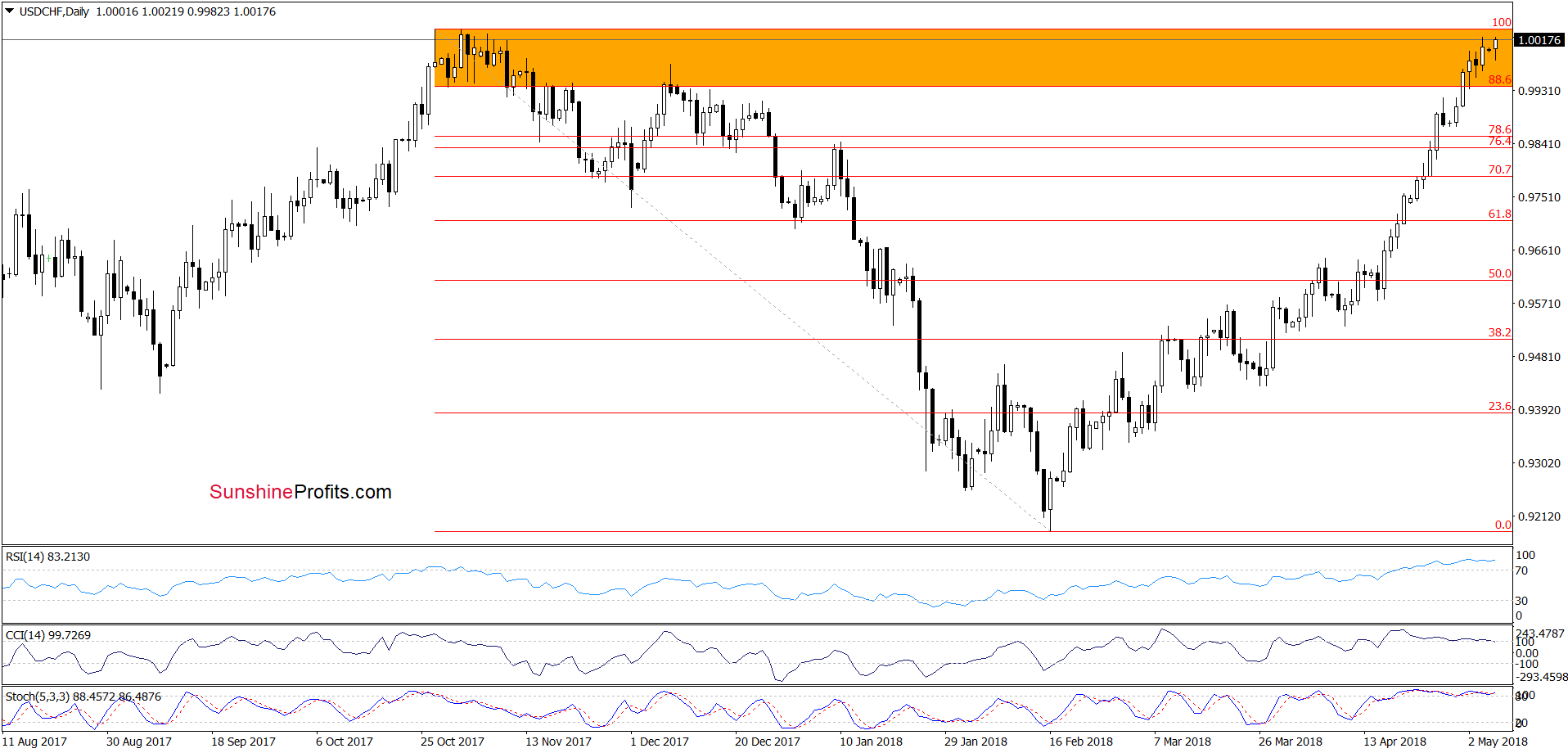

USD/CHF

Looking at the daily chart, we see that although USD/CHF moved a bit higher earlier today, the exchange rate is still trading in the major resistance zone (marked with orange) created by the previous highs.

The current position of the daily indicators indicates that reversal is just a matter of time (very short time), but similarly to what we wrote in the case of EUR/USD, it’s not enough to justify opening any position at this moment as the situation is to unclear.

Nevertheless, if we see reliable signs of the buyers weakness (or a show of strength and a breakout above the above-mentioned resistance zone) we’ll consider to go short (or long) in the following days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, due to travel plans, there will be no Forex Trading Alerts in the following several days. The next Forex Trading Alert is scheduled for Friday, May 11, 2018.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts