Earlier today, currency bulls tried to take EUR/USD above the upper border of the short-term declining trend channel, but despite their determination they failed for the second time in a row. Is this price action a repetition of what we have already seen at the end of July? Can the consequences also be similar?

- EUR/USD: short (a stop-loss order at 1.1746; the initial downside target at 1.1343)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: long (a stop-loss order at 1.3018; the initial upside target at 1.3333)

- USD/CHF: none

- AUD/USD: none

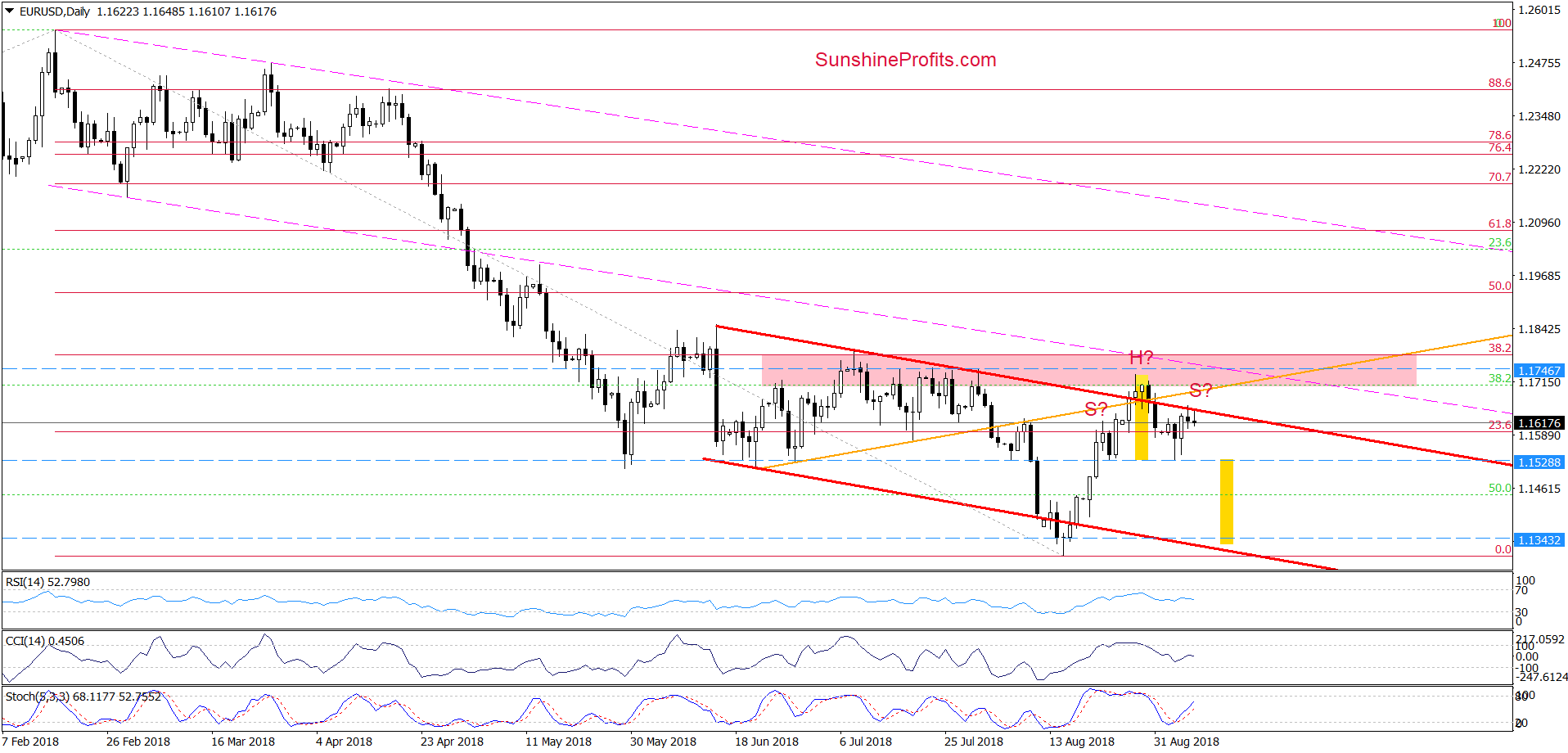

EUR/USD

From today’s point of view, we see that although EUR/USD re-tested the previously-broken upper border of the red declining trend channel earlier today, currency bulls didn’t manage to break above this resistance, which resulted in another pullback.

Taking this fact into account, we believe that our last commentary on this currency pair is up-to-date also today:

(…) the pair invalidated the earlier tiny breakout, which suggests that currency bears will likely create the right shoulder of the potential head and shoulders top formation in the coming days. If this is the case, EUR/USD will come back to the neck line of the pattern in the very near future.

What could happen if we see a breakdown under this support (marked with the blue dashed horizontal line)? In our opinion, the exchange rate will drop not only to our initial downside target, but also test the recent lows (in terms of daily closures) and the lower line of the red declining trend channel.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1746 and the initial downside target at 1.1343 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

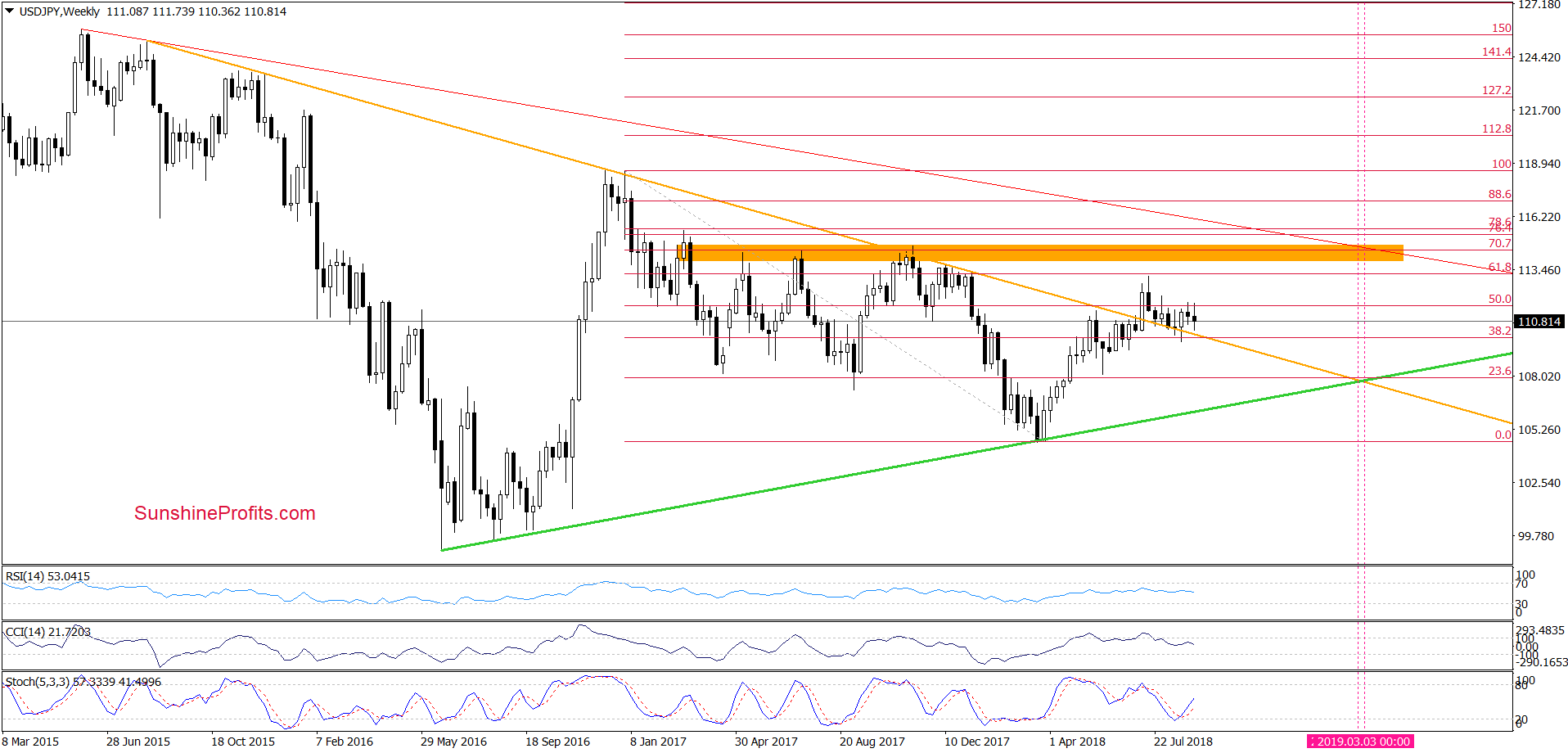

USD/JPY

Earlier this week currency bears took USD/JPY lower once again, which approached the exchange rate to the previously-broken long-term orange declining line. Nevertheless, there was no breakdown below it, which means that the medium-term picture remains unchanged and the above-mentioned orange line continues to serve as the major support.

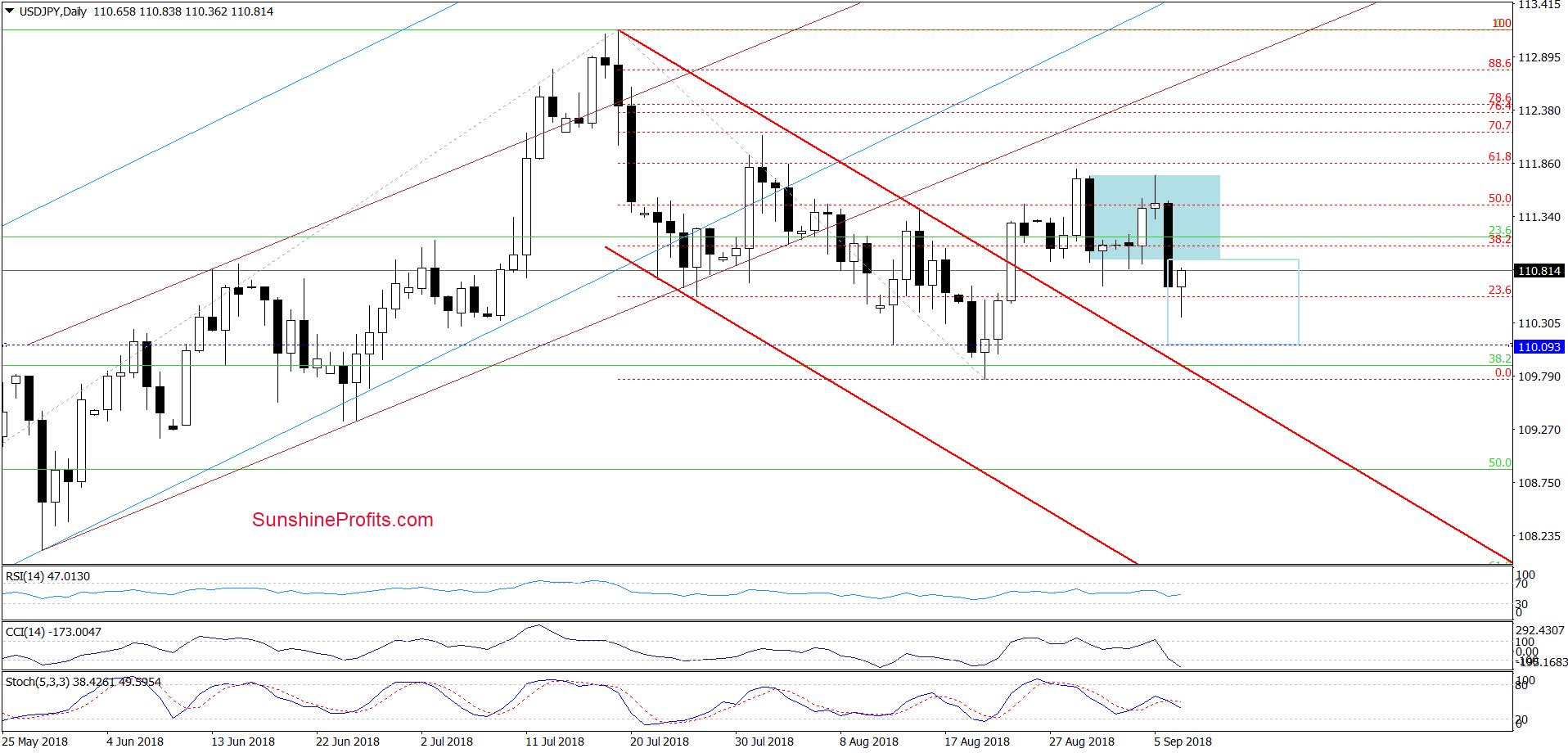

How the recent price action affected the short-term chart? Let’s examine the chart below.

From the daily perspective, we see that the upper border of the blue consolidation stopped the buyers on Wednesday. On the following day, this show of weakness encouraged their opponents t act and the exchange rate moved sharply lower, closing yesterday’s session below the lower line of the formation.

This bearish development triggered one more downswing earlier today, but the proximity to the above-mentioned orange support line motivated currency bulls to act. As a result, the pair rebounded slightly, but in our opinion, as long as there is no invalidation of yesterday’s breakdown all upswings will be nothing more than verifications of this event (in this case, one more downswing and a re-test of the long-term orange support line should not surprise us).

However, if the buyers show strength and manage to close today’s session (or one of the following) inside consolidation, we’ll see (at least) a test of the upper border of the formation in the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

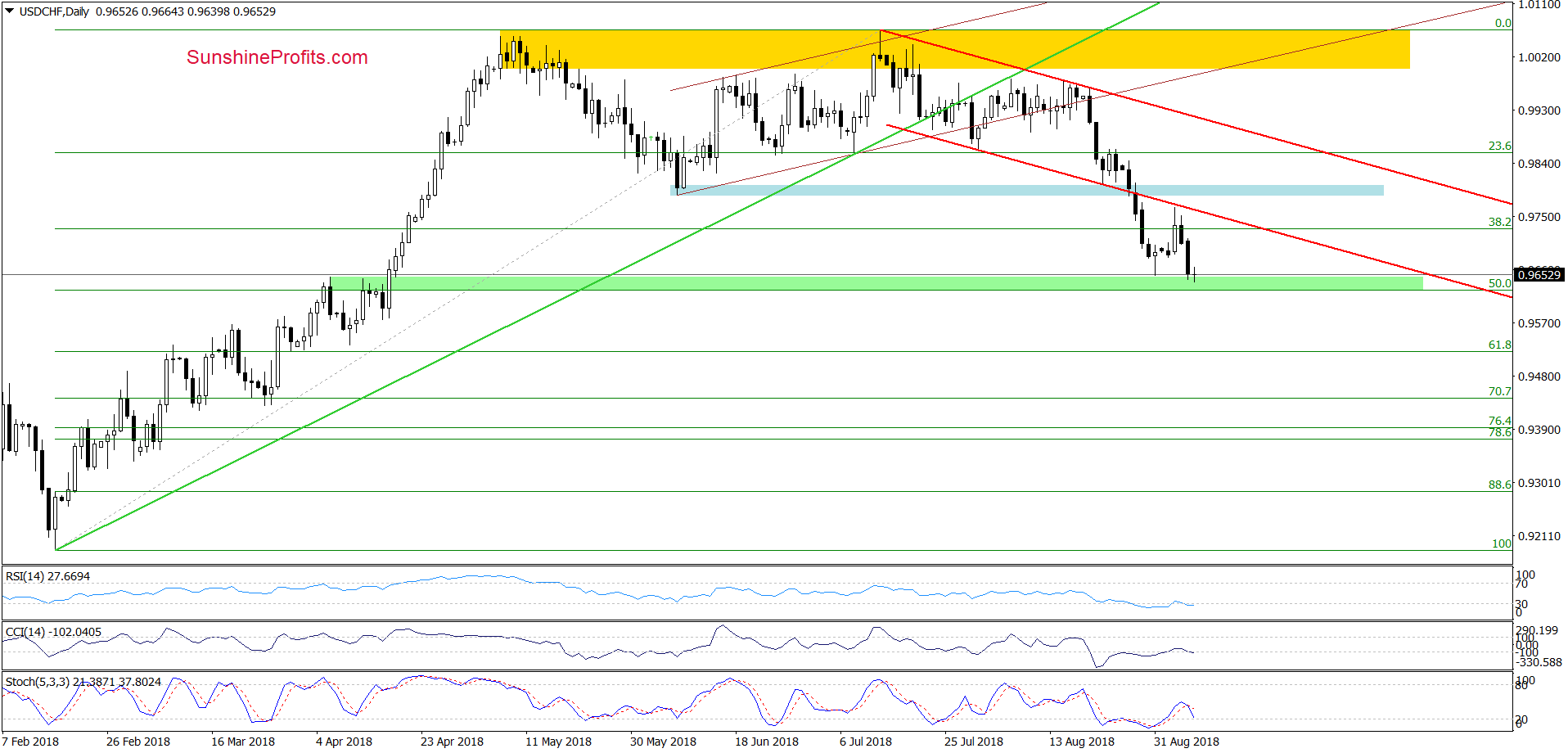

USD/CHF

In our Forex Trading Alert posted on Wednesday, we wrote:

(…) Yesterday, the pair moved quite sharply higher, but there was no comeback above the previously-broken lower border of the red declining trend channel, which suggests that we could observe a verification of the breakdown under this line (…) and USD/CHF will re-test the recent lows and the green support zone. (…)

On the daily chart, we see that currency bears showed their strength in recent days, which resulted in a test of our first downside target yesterday. Earlier today, the situation remains almost unchanged as USD/CHF is still trading slightly above the green support zone.

What’s next for the exchange rate?

Taking into account, the above-mentioned support area, it seems to us that even if the pair slips a bit lower (to the 50% Fibonacci retracement at 0.9626), the space for declines is limited and we’ll see a reversal and rebound at the beginning of the upcoming week.

If the situation develops in line with this assumption, USD/CHF will climb to the first upside target and re-test the strength of the lower border of the red declining trend channel in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts