Even though the bulls tried to improve their situation at the end of last week, the previously-broken upper border of the declining trend channel lured the sellers to the trading floor. Earlier today they have settled in for good and the question arises: how it will affect EUR/USD in the coming week.

- EUR/USD: short (a stop-loss order at 1.1878; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3256; the initial downside target at 1.2923)

- USD/JPY: half of the long positions (a stop-loss order at 112.47; the next upside target at 114.03)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

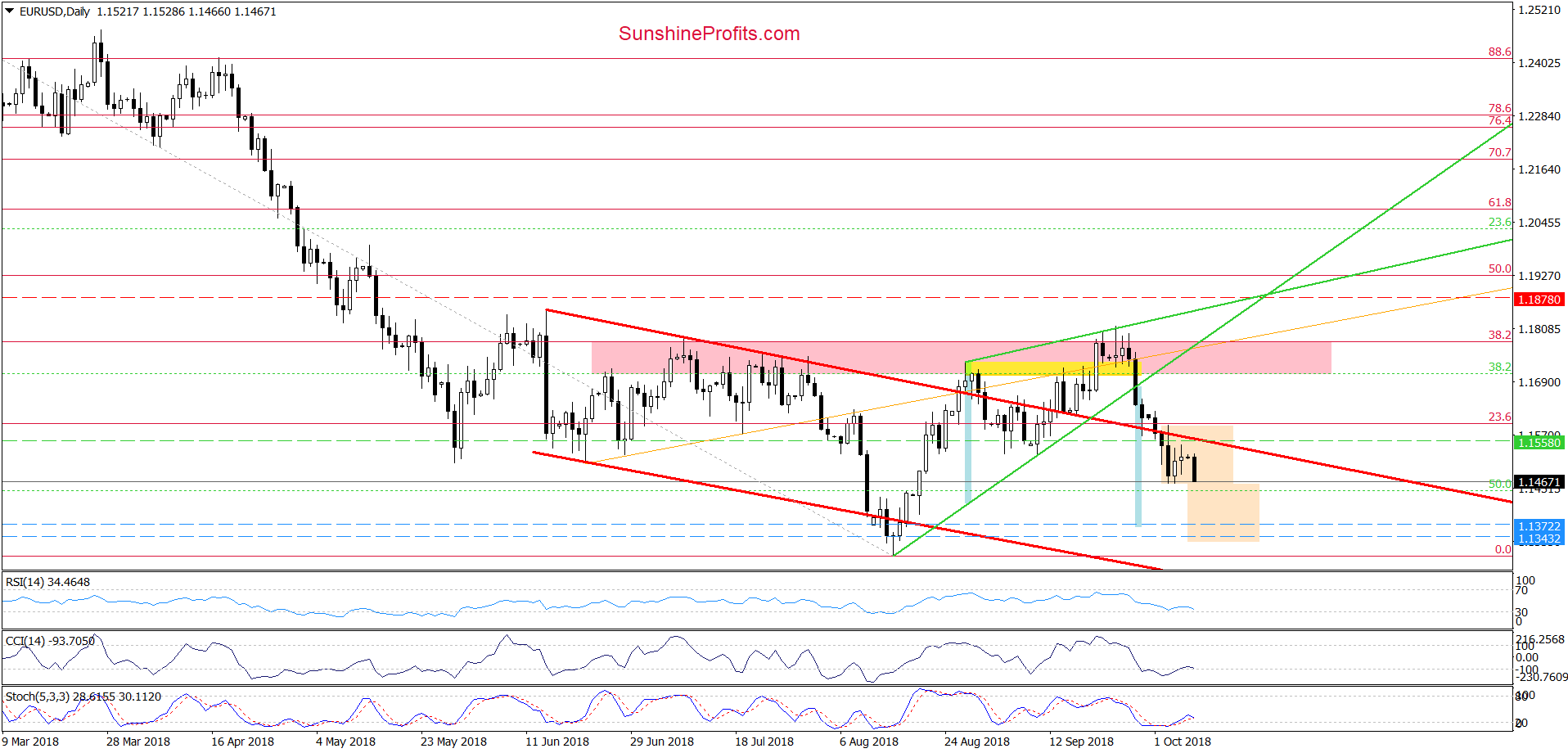

EUR/USD

Looking at the daily chart, we see that although EUR/USD rebounded a bit at the end of last week, the previously-broken upper border of the red declining trend channel encouraged currency bears to act, which resulted in a pullback on Friday.

Earlier today, the sellers extended losses and the exchange rate came back to the last week’s lows, erasing the above-mentioned upswing.

What can we expect next?

Taking into account the last week’s consolidation (between Wednesday high and low), we think that if the pair drops under the lower line of the formation, we’ll see not only a decline to around 1.1372 (where the size of the downward move will correspond to the height of the green triangle), but also a test of our initial downside target and the mid-August lows in the coming days.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1878 and the initial downside target at 1.1343 are justified from the risk/reward perspective.

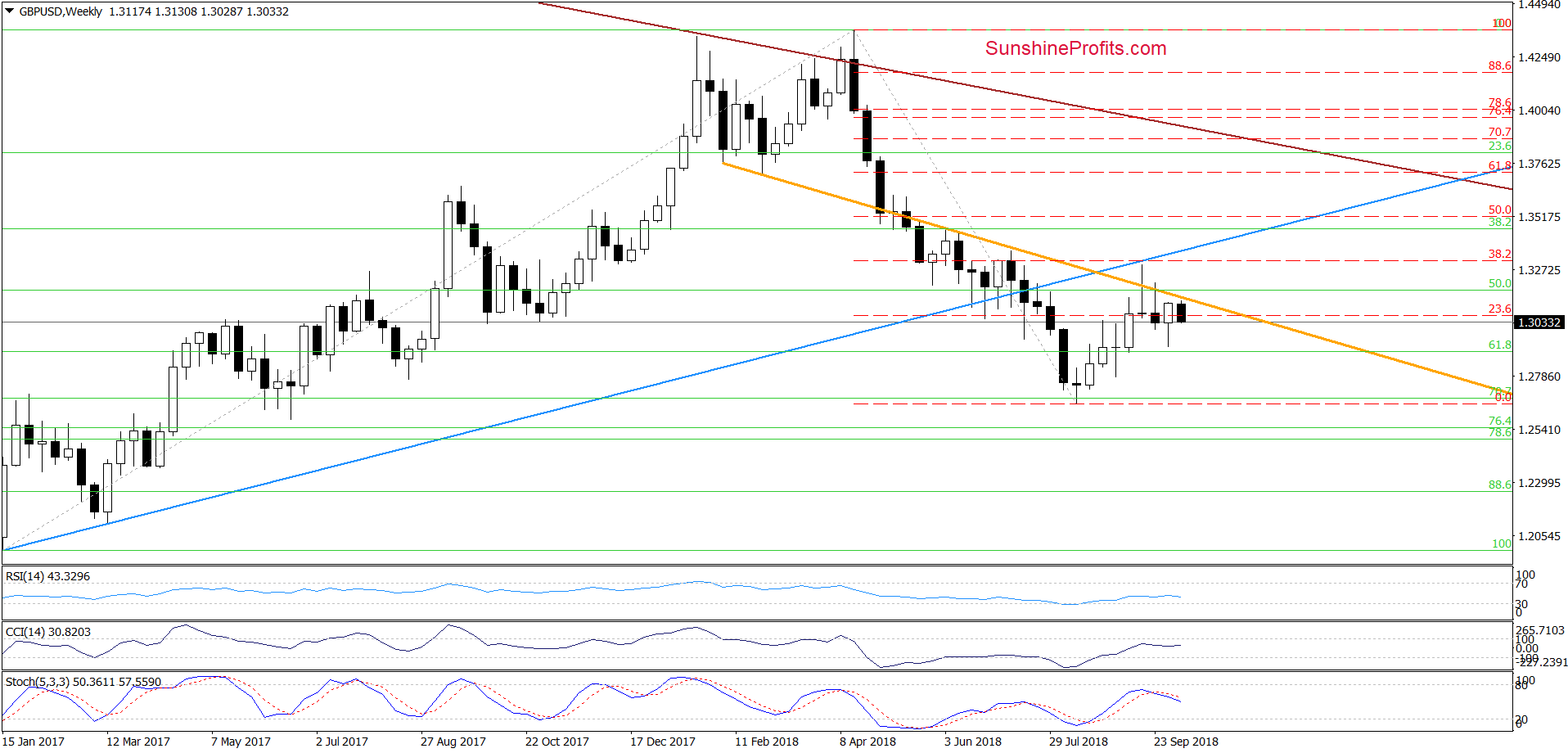

GBP/USD

From the medium-term perspective, we see that although GBP/USD moved higher in the previous week and extended that gain earlier today, the proximity to the orange resistance line (which was strong enough to stop currency bull several times in the past – not only in in May and June, but also two times in September) woke up the currency bears' vigilance, triggering a pullback.

Additionally, the sell signals generated by the weekly indictors continue to support lower values of the exchange rate, increasing the probability of further deterioration in the coming week.

If this is the case and the pair extends losses from current levels, we’ll see a re-test of our initial downside target and the last week low of 1.2919.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3256 and the initial downside target at 1.2923 are justified from the risk/reward perspective.

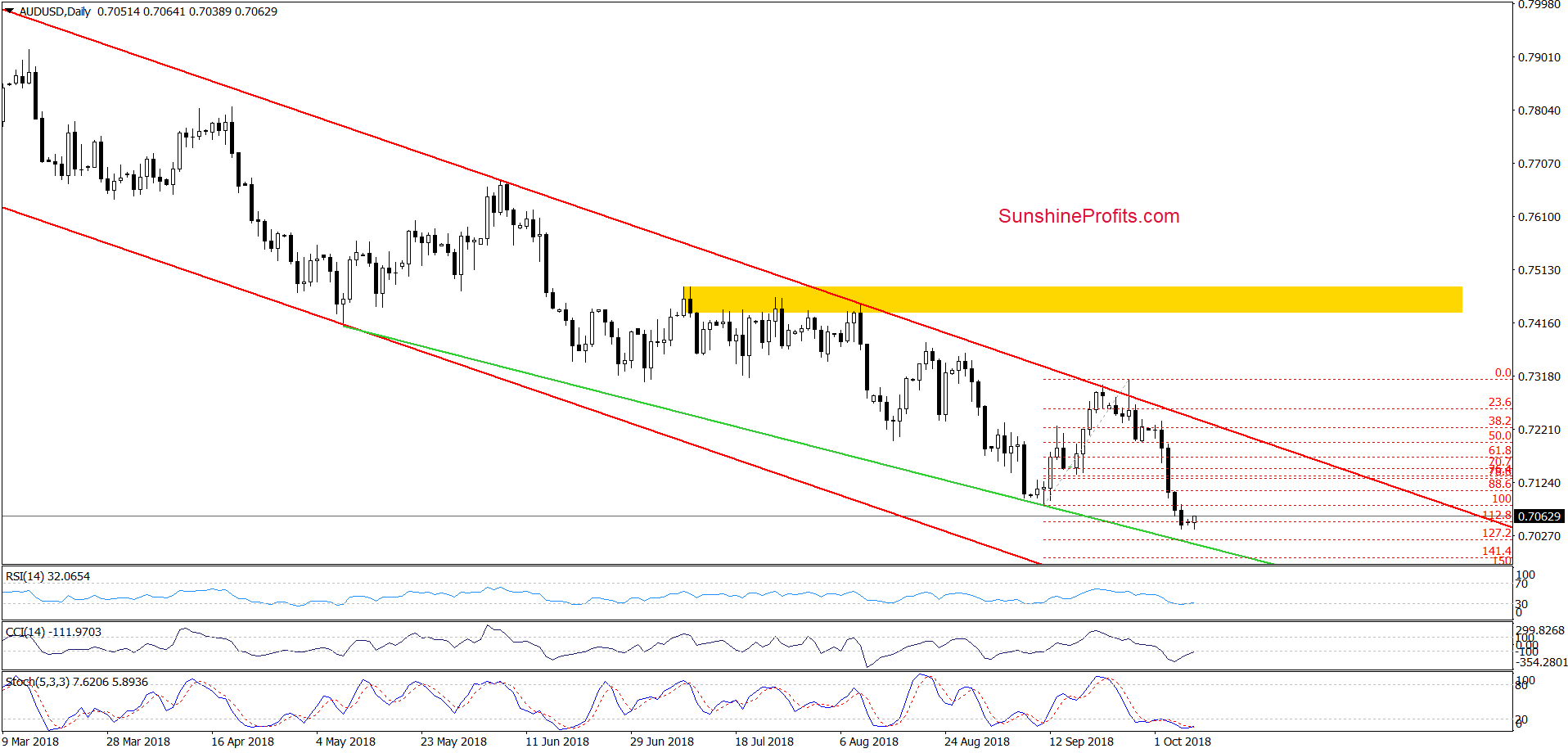

AUD/USD

In our last commentary on this currency pair, we wrote:

(…) we think that the way to lower values of the exchange rate is open and we’ll see a test of September lows in the coming days.

From today’s point of view, we see that currency bears not only tested the last month’s lo, but also pushed AUD/USD below it, closing Friday’s session even under the 112.8% Fibonacci extension.

Earlier today, we saw a rebound, but can we trust it? In our opinion, we can’t. Why? Because it is tiny compared to the size of the recent decline, the exchange rate is still trading under the September low and there are no buy signals, which could encourage currency bulls to act.

Taking all the above into account, it seems that one more downswing and a test of the green support line based on May and September lows is likely (at least as long as we don’t see an invalidation of the breakdown under the September low).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts