Yesterday, EUR/USD broke above the upper border of the short-term declining trend channel. Earlier today, currency bulls extended gains. But is the situation as optimistic for the bulls as it might seem at first glance?

- EUR/USD: short (a stop-loss order at 1.1807; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3220; the initial downside target at 1.2848)

- USD/JPY: long (a stop-loss order at 110.80; the initial upside target at 112.88)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

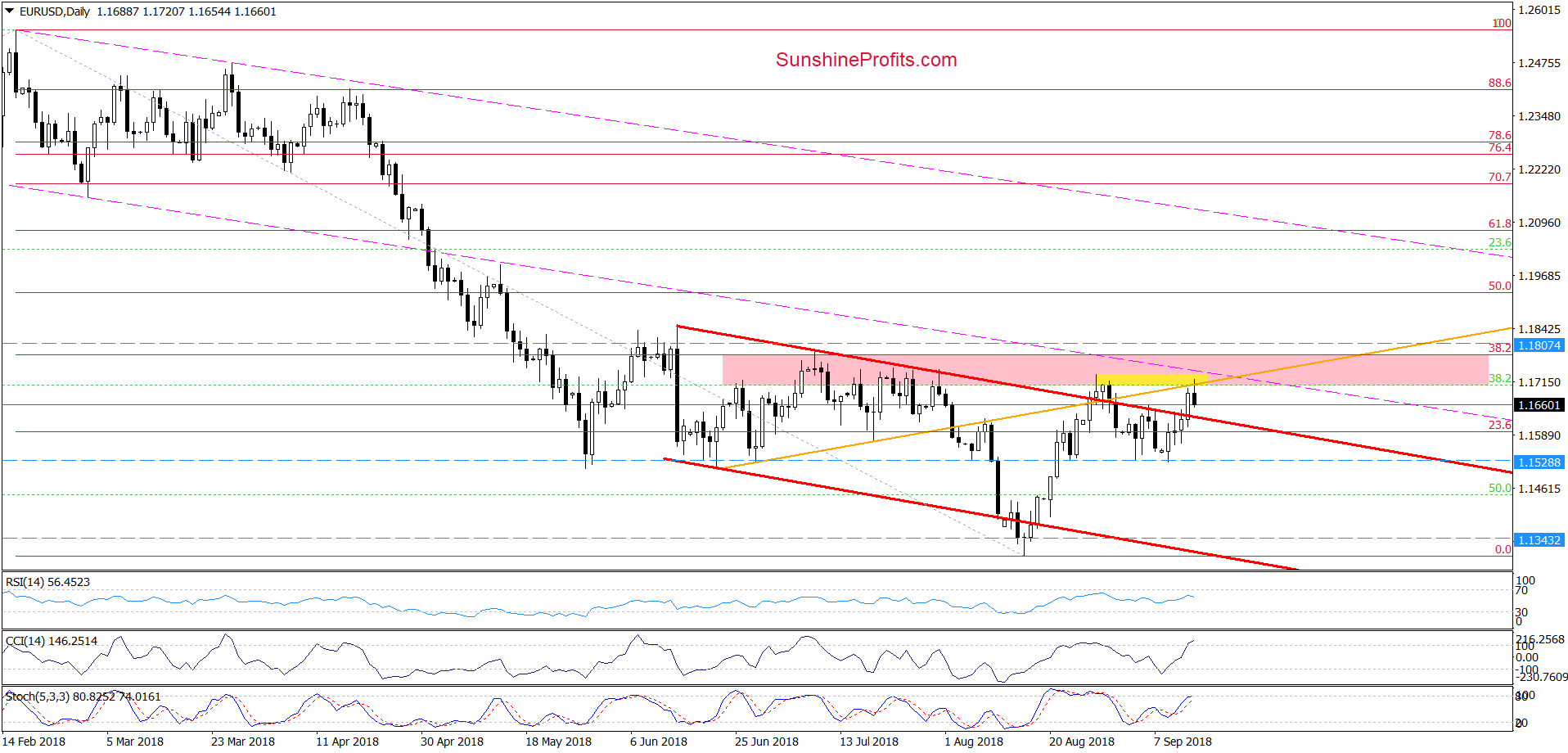

EUR/USD

The first thing that catches the eye on the daily chart is a breakout above the upper border of the red declining trend channel. Is this a bullish development? Yes, but in our opinion, only at the first sight. Why?

First, we should keep in mind that the pink resistance zone continues to keep gains in check. As a reminder, it was strong enough to stop the buyers several times in July and also at the and of August, which means that as long as there is no breakout above it higher values of EUR/USD are questionable, and another reversal is very likely.

Second, earlier today, currency bulls approached the exchange rate to the late-August, but there was no breakout above it. Instead, the pair pulled back, which shows that their opponent are active in this area and they will fight to stop further improvement.

Third, today’s upswing took the pair to the previously-broken orange resistance line, which looks like another verification of the early-August breakdown. At this point, it is worth noting that similar price action at the beginning of he previous month preceded a bigger move to the downside, which increases the probability that the history will repeat itself once again in the very near future.

In our opinion, the pro-bearish scenario will be even more likely and reliable if EUR/USD invalidates yesterday’s breakout above the upper line of the red trend channel. If we see such price action, we’ll consider increasing short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Finishing today’s commentary on this currency pair, please note that we decided to move our stop-loss order a bit higher in case if the bulls decide to fight for higher levels once again (however, this is a pretty dubious scenario at the moment of writing these words).

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1807 and the initial downside target at 1.1343 are justified from the risk/reward perspective.

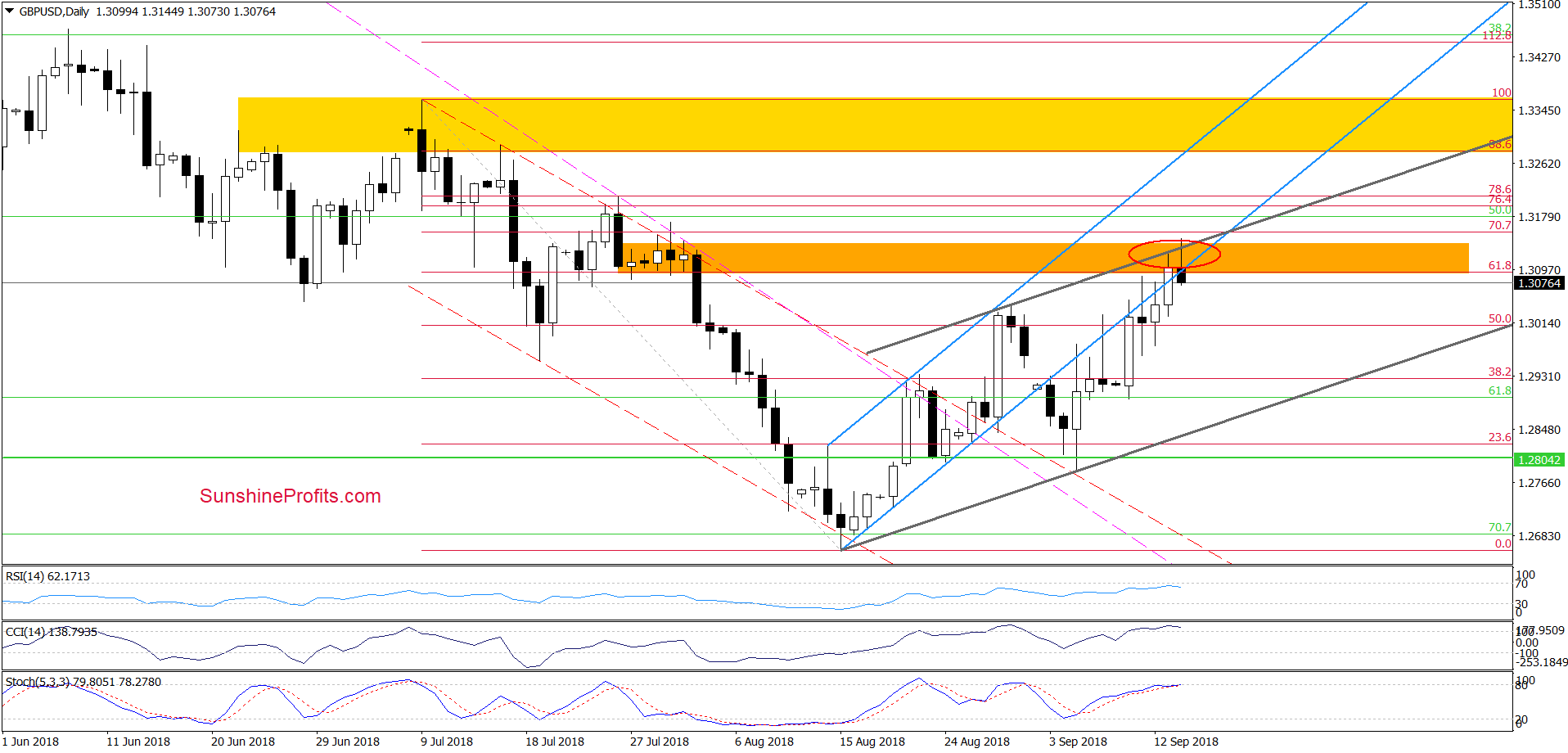

GBP/USD

In our Wednesday’s alert, we wrote the following:

(…) the buyers didn’t give up and pushed the pair higher earlier today, which suggests that GBP/USD will test the orange resistance zone (created by the late July and early highs, the 61.8% Fibonacci retracement, the lower border of the blue rising trend channel and the upper line of the grey rinsing trend channel based on the August-September upward move) in the very near future.

Nevertheless, the current position of the daily indicators shows that the CCI is overbought, while the Stochastic Oscillator approached the barrier of 80, which could translate into sell signals in the coming days.

Therefore, if we see currency bulls’ weakness in the orange resistance area and the above-mentioned indicators generate sell signals, we’ll consider opening short positions.

Looking at the above chart, we see that the situation developed in line with the above scenario and GBP/USD reached our upside target earlier today. Despite this improvement the combination of the above-mentioned resistances triggered a decline, which took the pair under the previously-broken levels, invalidating the earlier breakouts.

Taking this fact into account and combining it with the current position of the daily indicators, we think that further deterioration is very likely in the coming week. Therefore, in our opinion, opening short positions is justified from the risk/reward perspective. All needed details you will find below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3220 and the initial downside target at 1.2848 are justified from the risk/reward perspective.

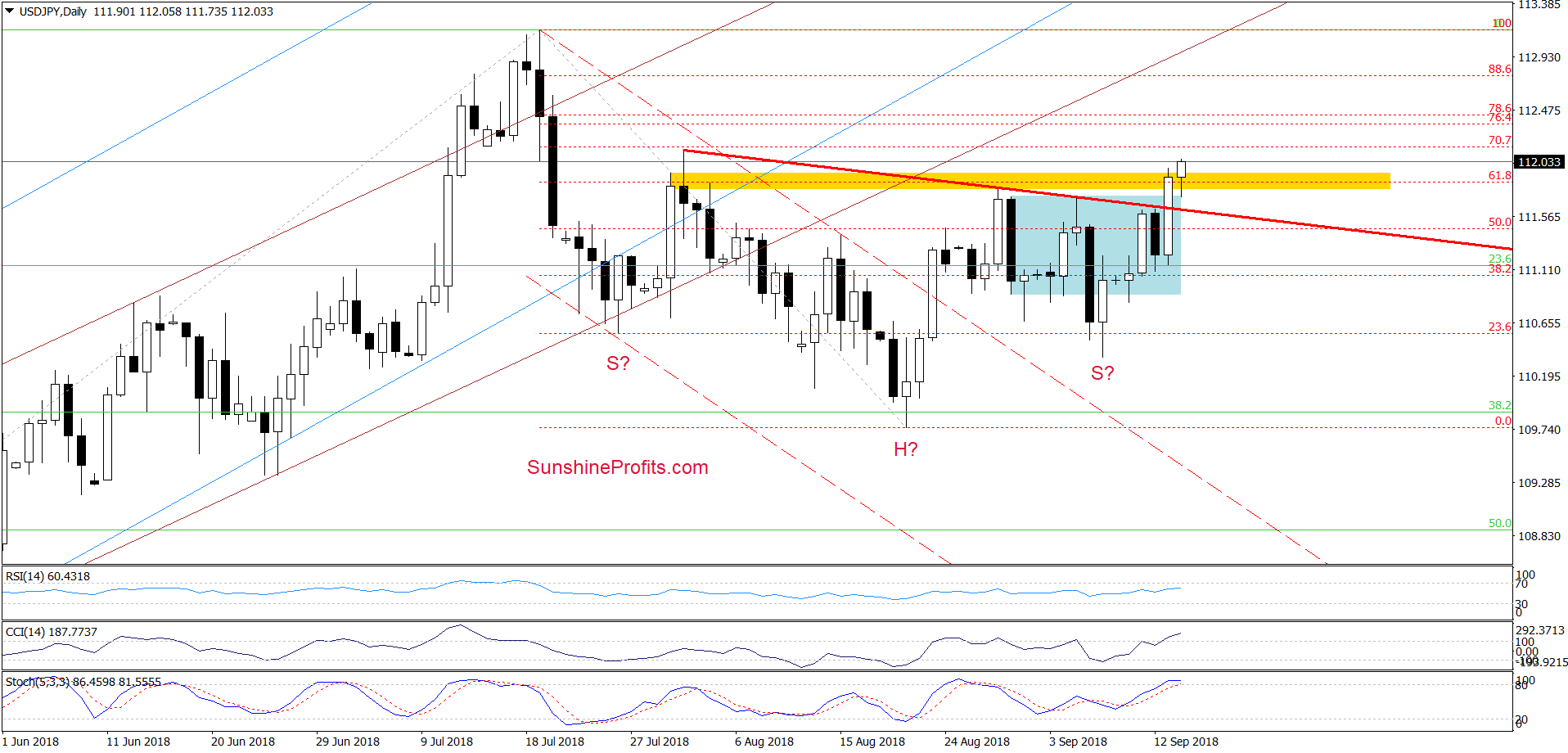

USD/JPY

On Tuesday, we wrote the following:

(…) the buyers will have to break above the red declining resistance line based on August peaks.

How important could this line be for the future of the bulls?

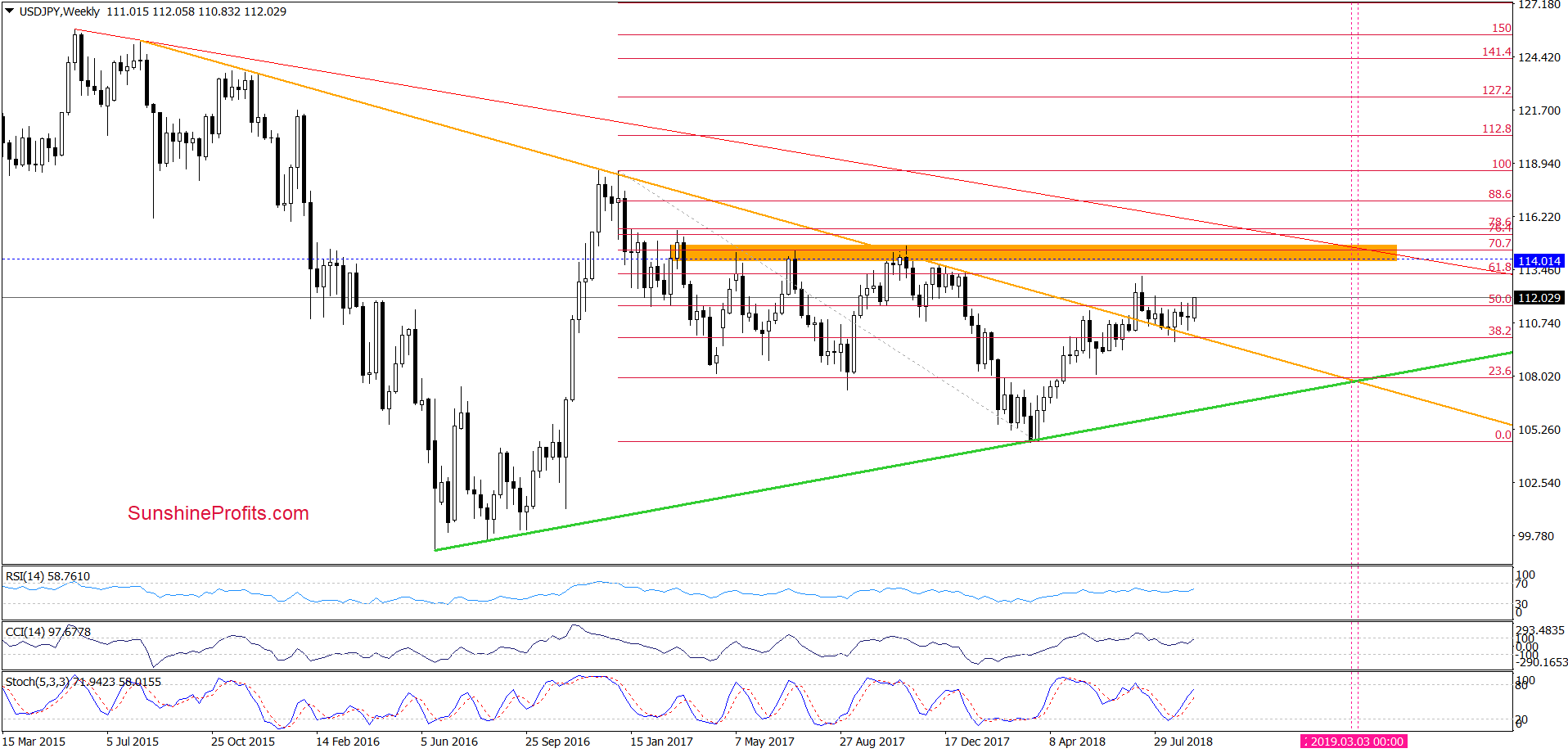

(…) it could be the neck line of a potential reverse head and shoulders formation. Therefore, if currency bulls manage to break above it, we could see an upward move not only above the yellow resistance zone (created by the 61.8% Fibonacci retracement and the highs that we saw at the turn of July and August), but also a test of the July peaks or even a rally to around 114, where the size of the increases will correspond to the height of the above-mentioned formation.

What’s interesting, in this area is also the lower border of the orange resistance zone (seen on the weekly chart below), which stopped the buyers several times in the past.

Therefore, if we see a confirmed breakout above the red resistance line and the upper line of the blue consolidation, we’ll likely open long positions (of course, if there are no other technical contraindications to this).

From today’s point of view, we see that USD/JPY extended gains in tune with our assumptions, which increases the likelihood that we’ll also see a realization of the bullish scenario in the coming week.

Connecting the dots, we think that opening long positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 110.80 and the initial upside target at 112.88 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts