Thursday’ session showed that currency bulls have had serious problems with the nearest resistance once again in a row. In response to their weakness, the sellers came in off the fence and triggered a sharp decline. Thanks to their attack, the chance for THIS pro-bearish formation is growing.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1833; the initial downside target at 1.1588)

- GBP/USD: short (a stop-loss order at 1.3301; the initial downside target at 1.2913)

- USD/JPY: long (a stop-loss order at 110.21; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

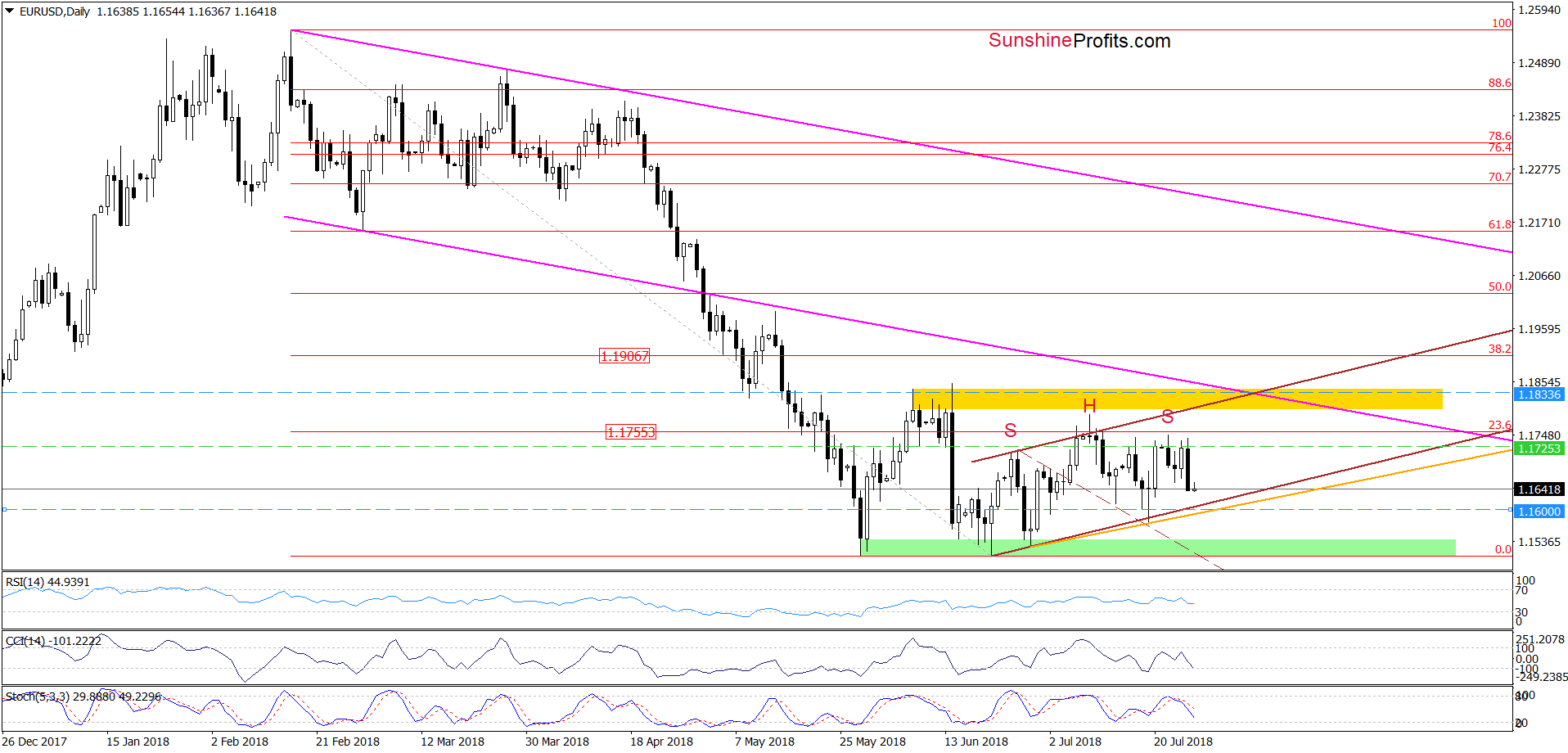

EUR/USD

From today’s point of view, we see that EUR/USD moved sharply lower during yesterday’s session, which together with the sell signal generated by the Stochastic Oscillator increases the probability that we’ll see a realization of the pro-bearish scenario about which we wrote on Tuesday:

(…), we can observe a potential pro-bearish head and shoulders formation. If this is the case, currency bears are just forming the right arm of the pattern, which will likely take EUR/USD to (at least) the neck line marked with orange (and based on the previous lows) in the following days.

Trading position (short-term; our opinion): short positions with a stop-loss order at 1.1833 and the initial downside target at 1.1588 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

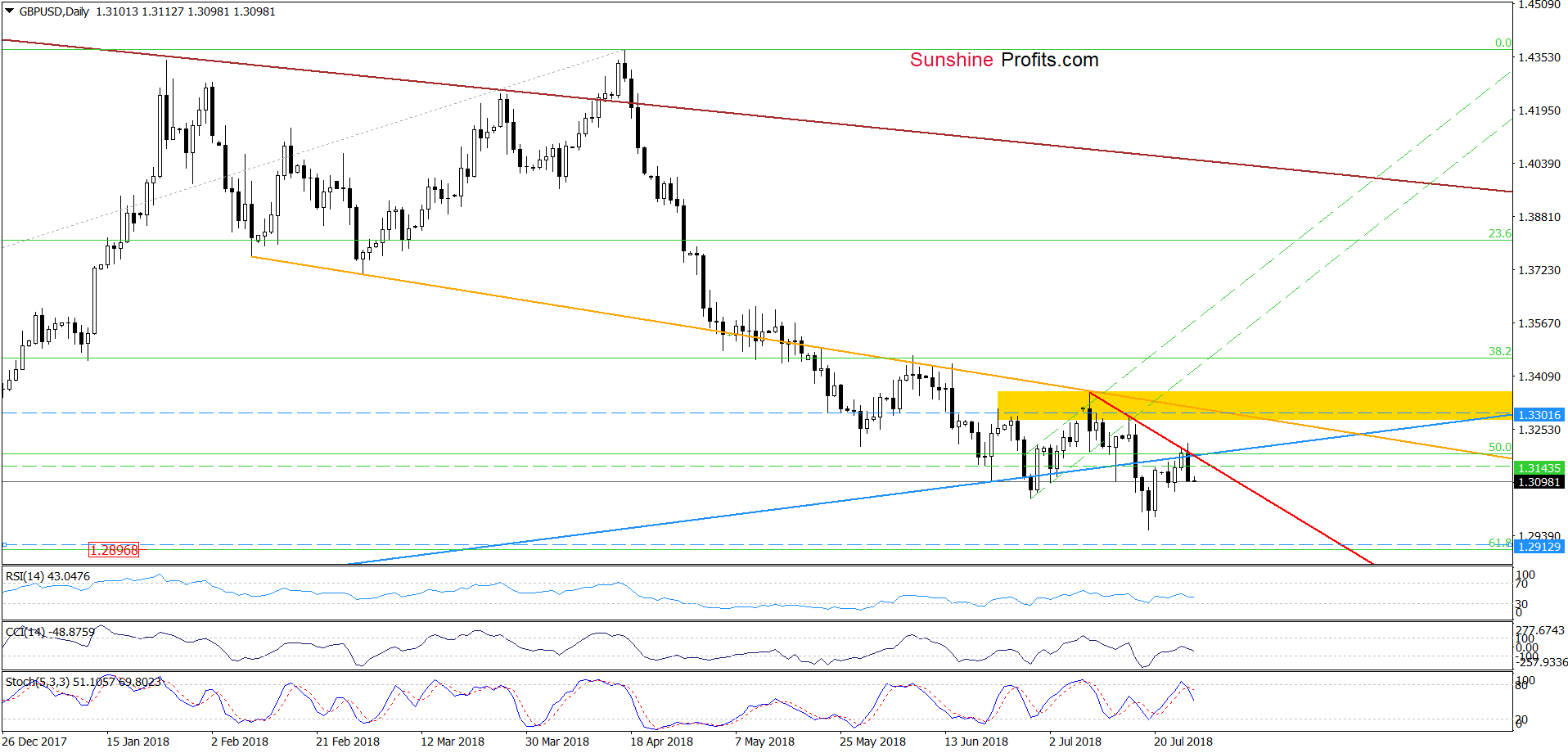

GBP/USD

Quoting our last commentary on this currency pair:

(…) the pair not only invalidated the earlier tiny breakout above the blue line, but also slipped under the very short-term red declining resistance line based on the previous highs, which in combination with the current position of the Stochastic Oscillator (we’ll likely see a sell signal tomorrow or even later in the day) increases the probability of further deterioration in the very near future.

As you see on the daily chart, currency bears took the exchange rate lower yesterday (as we had expected), making our short positions profitable. Additionally, the Stochastic Oscillator generated the sell signal, giving the sellers one more reason to act.

Taking all the above into account, we believe that our downside target from Wednesday remains up-to-date also today:

(…) In our opinion, we’ll likely see not only a test of the recent lows, but also a drop to around 1.2896, where the 61.8% Fibonacci retracement (based on the entire January 2017 – March 2018 upward move) is.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.3301 and the initial downside target at 1.2913 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

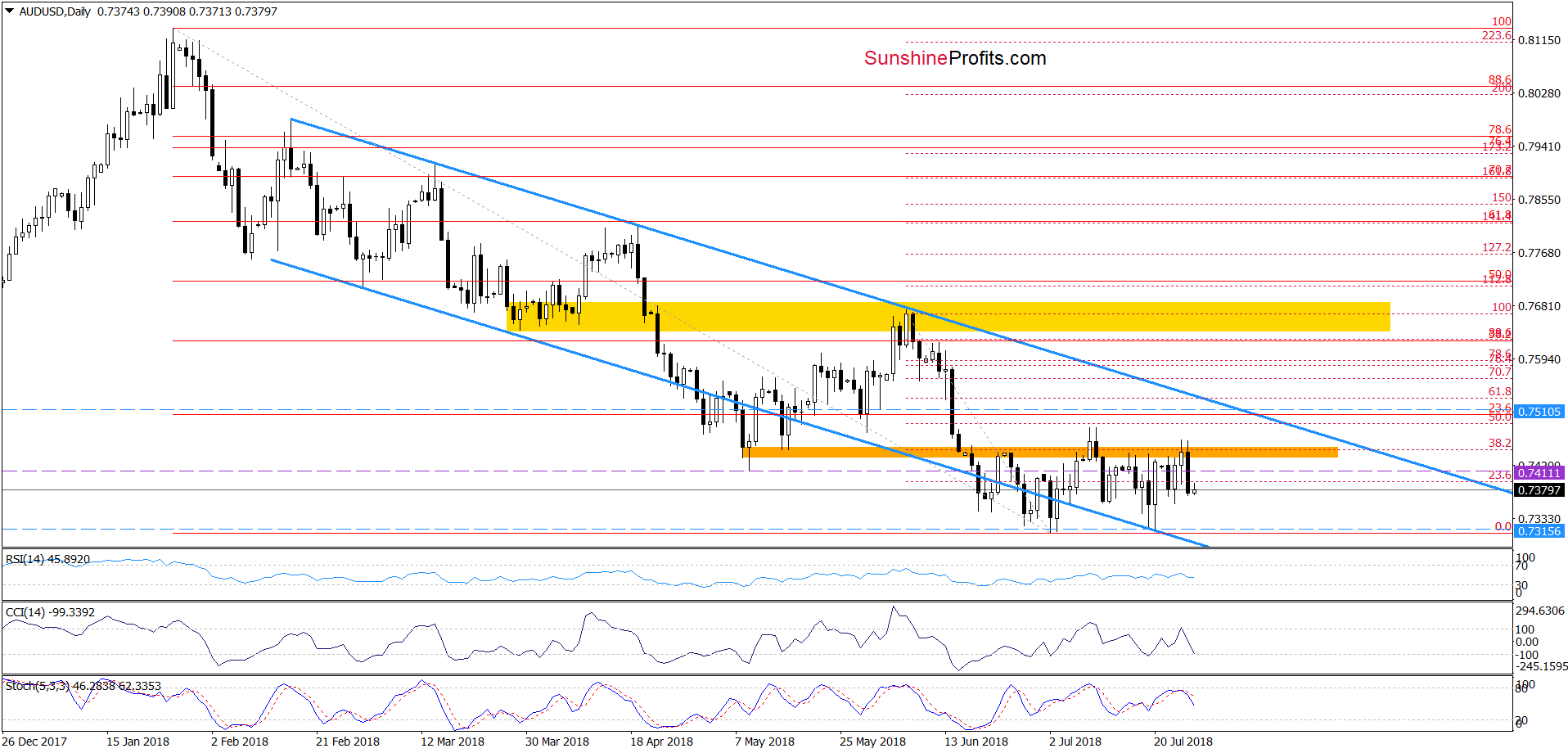

AUD/USD

The highlight of yesterday’s session was another invalidation of the tiny breakout above the orange resistance zone, which triggered a sharp decline in the following hours.

On top of that, the CCI and the Stochastic Oscillator generated sell signals, suggesting that further deterioration is just around the corner. If this is the case and AUD/USD extends losses from current levels, the exchange rate will (at least) decline to the lower border of the blue declining trend channel in the coming week.

Additionally, it is also worth keep in mind that as long as there is no successful breakout above the orange resistance zone a bigger move to the north is not likely to be seen and short-lived moves in both directions should not surprise us.

Trading position (short-term; our opinion): short positions with a stop-loss order at 0.7510 and the initial downside target at 0.7315 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts