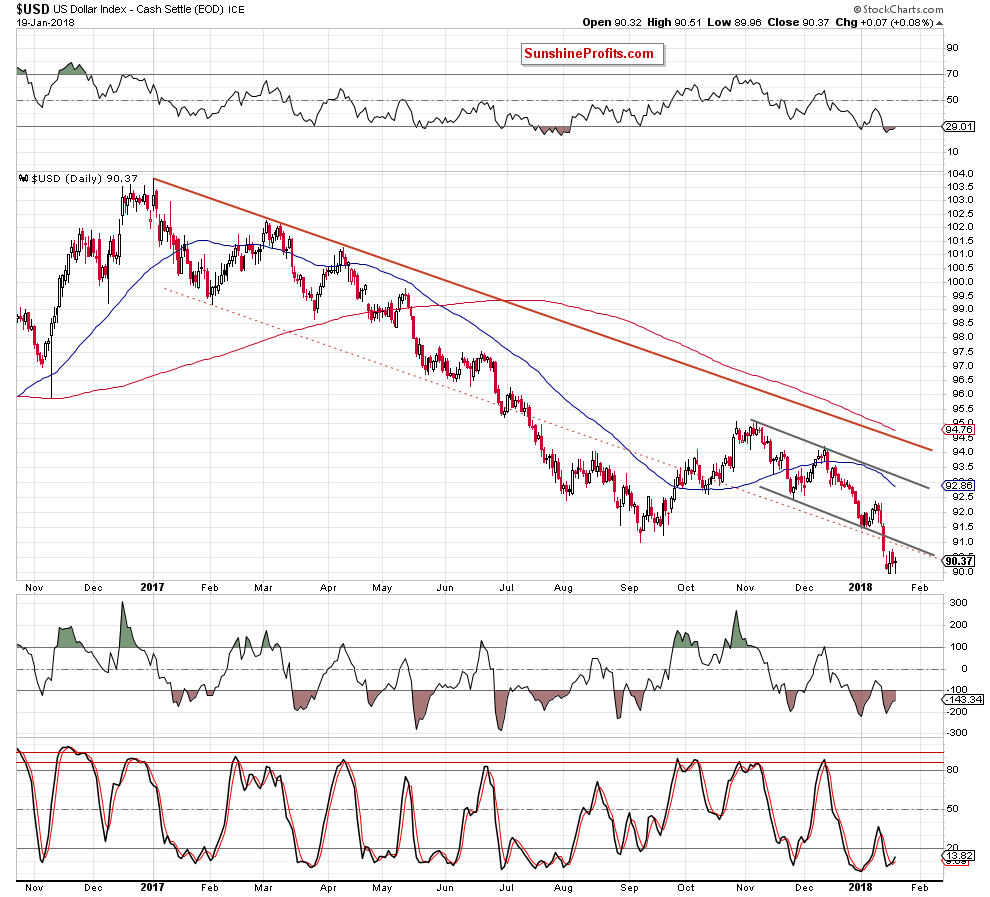

Although the USD Index extended losses on Friday, the Wednesday low stopped the sellers, triggering a rebound. Will the double bottom formation withstand the selling pressure and trigger a rally in the greenback in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.8138; the initial downside target at 0.7730)

EUR/USD

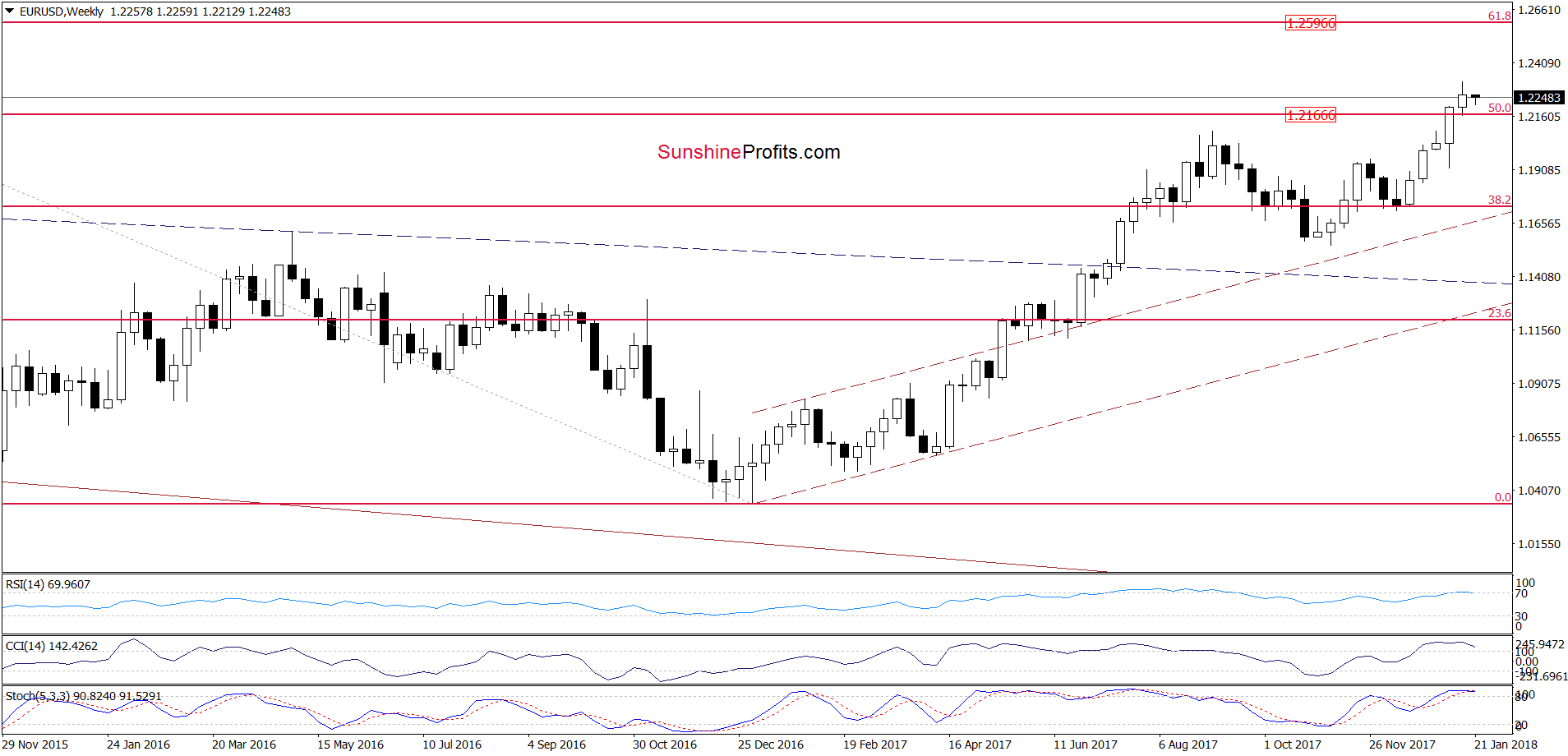

From the medium-term perspective, we see that the previously-broken 50% Fibonacci retracement withstood the selling pressure in the previous week and continues to serve as the nearest support.

Having said the above, let’s check what we can infer from the daily chart.

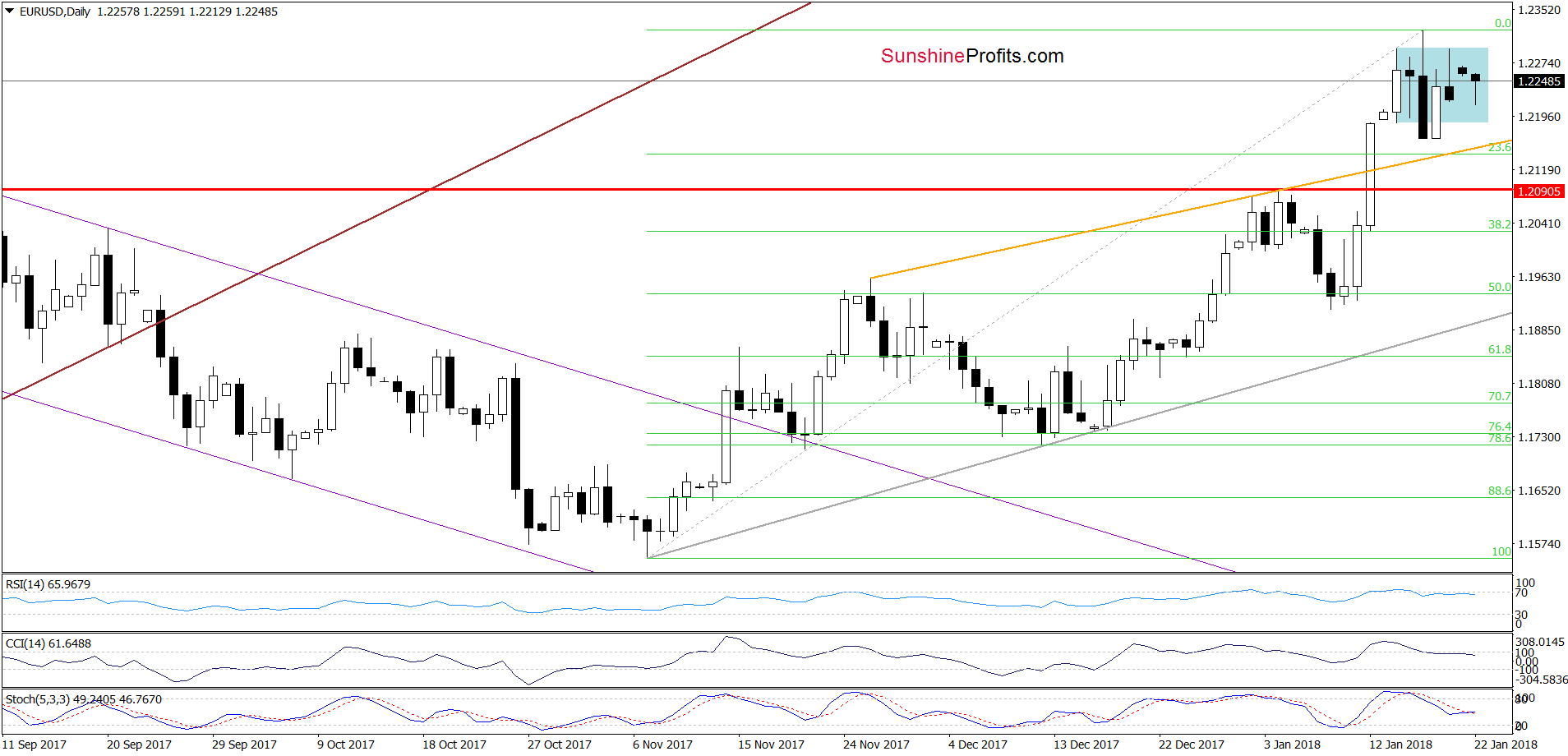

Looking at the daily chart, we see that not much happened since our previous alert was posted. On Friday, EUR/USD climbed to the upper border of the blue consolidation, approaching the Wednesday peak (and the highest level in 2018), but then reversed and declined. Earlier today, the pair is still trading in a narrow range, which means that as long as there is no breakout above the last week’s highs or a breakdown under recent lows a bigger move to the upside or downside is not likely to be seen.

Nevertheless, taking into account the fact that the USD Index hit a double bottom on Friday (you can see it more clearly on the chart below) and the Stochastic Oscillator generated the buy signal (while the RSI is very close to doing the same), it seems that higher values of the greenback are ahead of us.

This scenario is also reinforced by the sell signals generated by the daily indicators marked on the daily chart of EURUSD.

Nevertheless, we still think that a bigger move to the downside in EUR/USD will be more likely and reliable only if we see an invalidation of the breakout above the 50% Fibonacci retracement (marked on the weekly chart) and the January peak. Until this time, a downswing and a verification of the breakout above the September and January 2018 highs seems to be a more credible scenario.

Why? Because, we think that the USD Index will verify the breakdown under the lower border of the red declining trend channel at the same time. Therefore, in our opinion, as long as there is no invalidation of the breakdown under this line opening full short positions in EUR/USD is not justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, however, if we see an invalidation of the breakout above the above-mentioned 50% Fibonacci retracement and the January peak, we’ll likely open short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

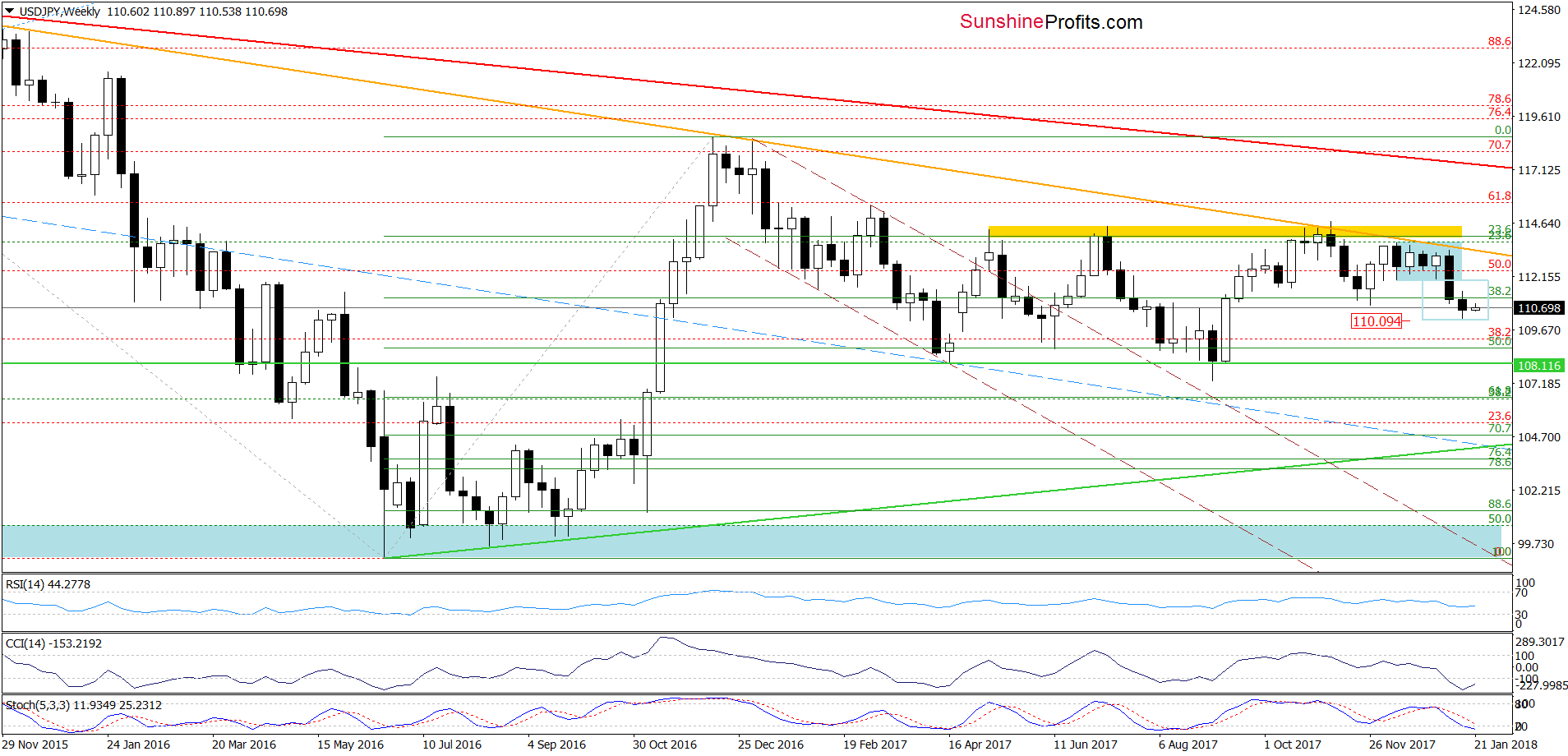

From today’s point of view, we see that AUD/USD pulled back on Friday, which resulted in a comeback to the zone created by the 76.4% and 78.6% Fibonacci retracements. Although the pair moved a bit higher earlier today, the sell signals generated by the daily indicators and the current situation in the USD Index suggest that reversal and lower values of the exchange rate are ahead of us.

Therefore, if AUD/USD moves lower in the following days, we’ll likely see a decline to at least 0.7880-0.7895, where the October highs are.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 0.8138 and the downside target at 0.7730) are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts