The currencies look to be playing tricks on our attention. Setting up for a move and then... doing next to nothing to support us in taking a new position with confidence. But still, the technical picture remains and the sky is brightening with regard to the following tradable move. It's our job to identify it and act on the opportunity while it's hot. Here you go.

In our opinion, the following forex trading positions are justified - summary:

EUR/USD: none

GBP/USD: none

USD/JPY: none

USD/CAD: none

USD/CHF: none

AUD/USD: none

EUR/USD

It's a rare occasion that any yesterday's commentary would be up-to-date also today, and in full. Yet, today is one of those days:

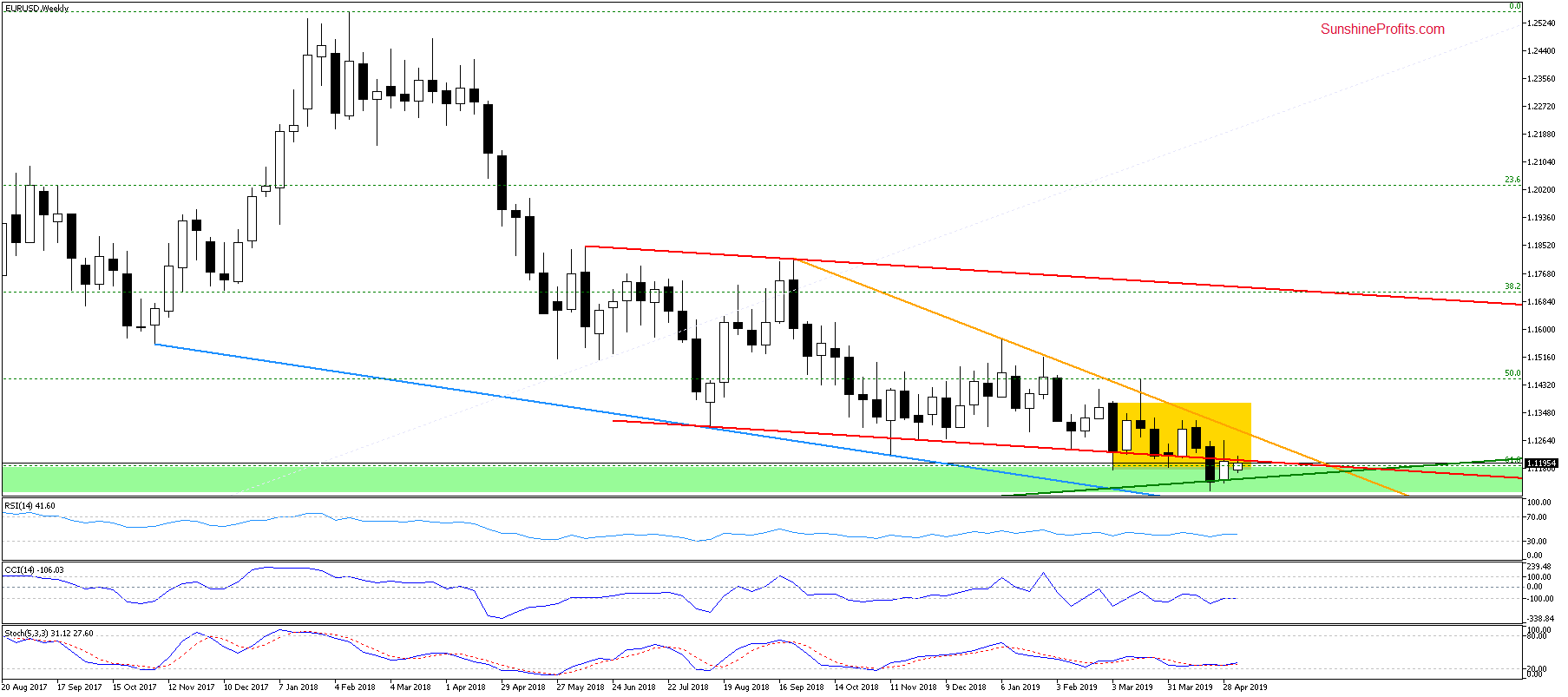

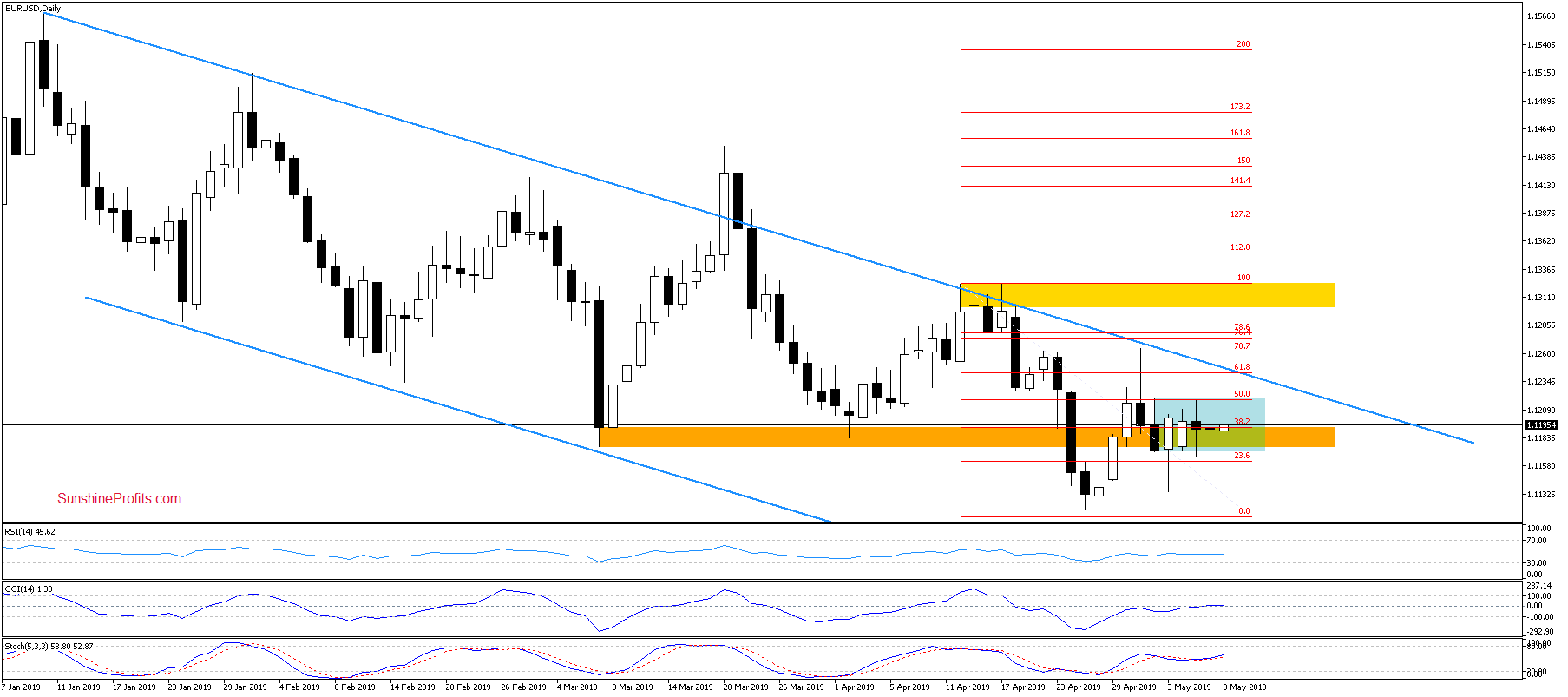

(...) Looking at both the weekly and daily chart, we see that the EUR/USD situation hasn't changed much. The pair is still trading in the narrow blue consolidation that is located between the orange support zone and the strong resistance area created by the 50% Fibonacci retracement (as seen on the daily chart) and the lower border of the red declining trend channel (as seen on the weekly chart).

As long as there is no successful breakout above them that would invalidate the previous breakdown below, higher values of the exchange rate are not likely to be seen. Another downward reversal in the coming days should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

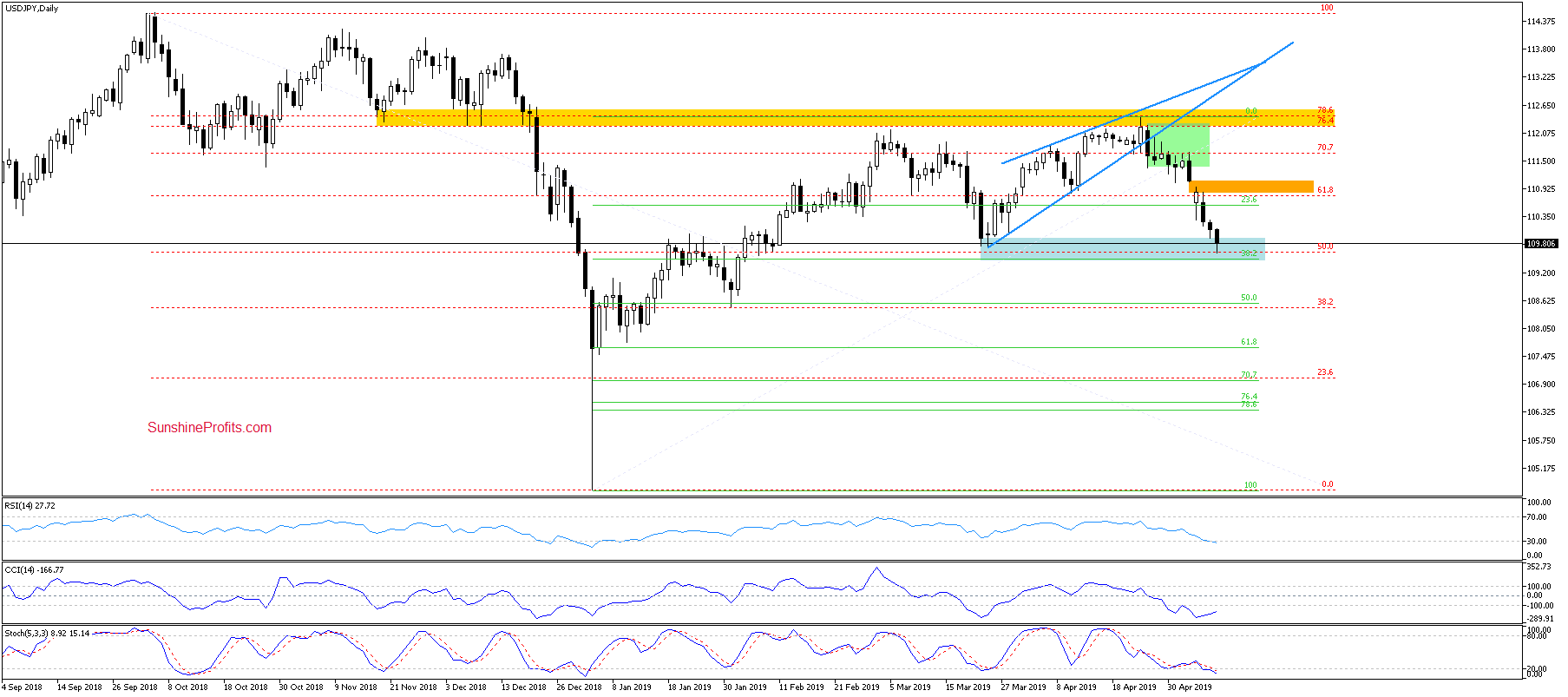

USD/JPY has been slowly adding to its losses in recent days. These are our Tuesday's words:

(...) the pair opened this week with an orange gap. As long as it is open, lower values of USD/JPY are more likely than a move to the upside. If the pair extends losses from here, we could see a test of the late-March lows or even the 38.2% Fibonacci retracement in the following days.

The blue support zone marking late-March lows has been reached. The question is what is likely to come next.

All daily indicators are in their oversold areas, which increases the likelihood of reversal in the near future. Should we see such a bullish turn of events, the first upside target for the buyers will be the orange gap. That would be the bulls' first resistance to overcome.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

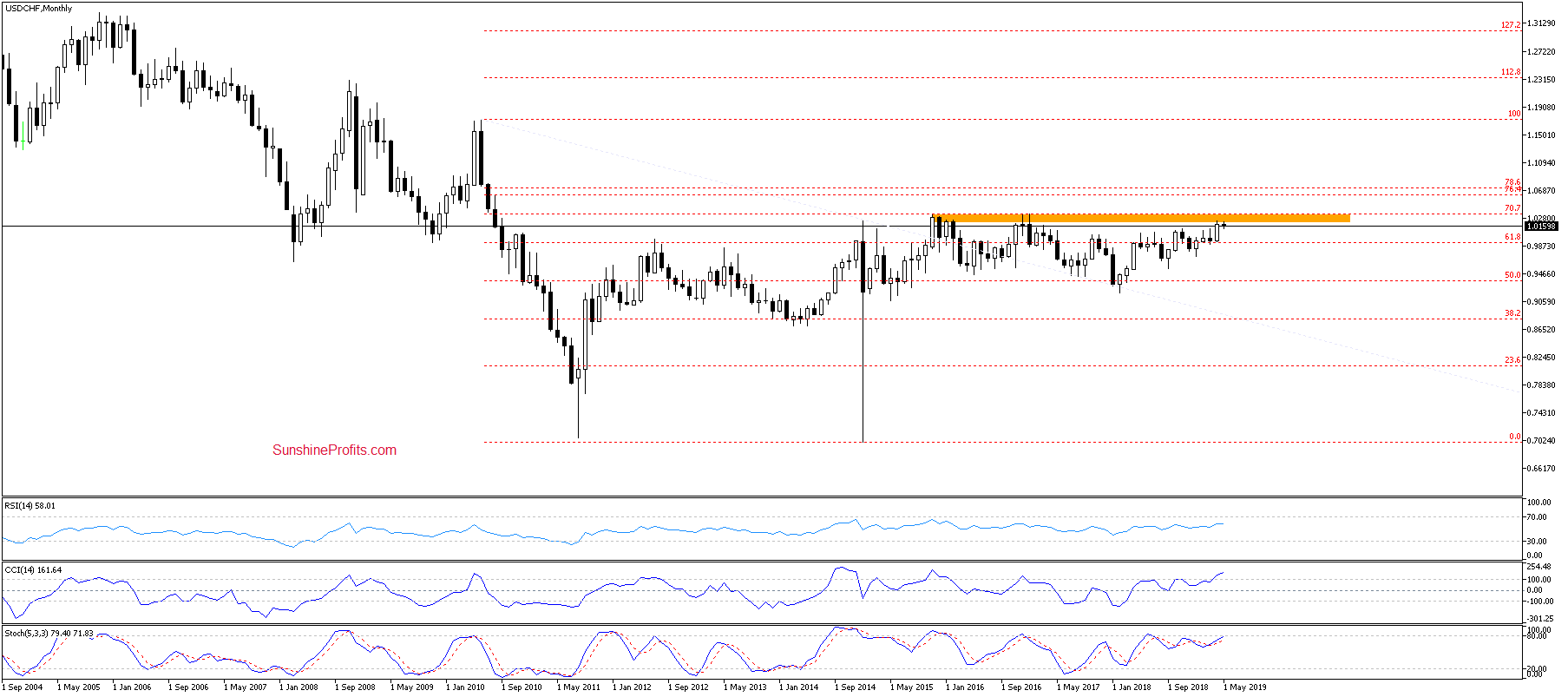

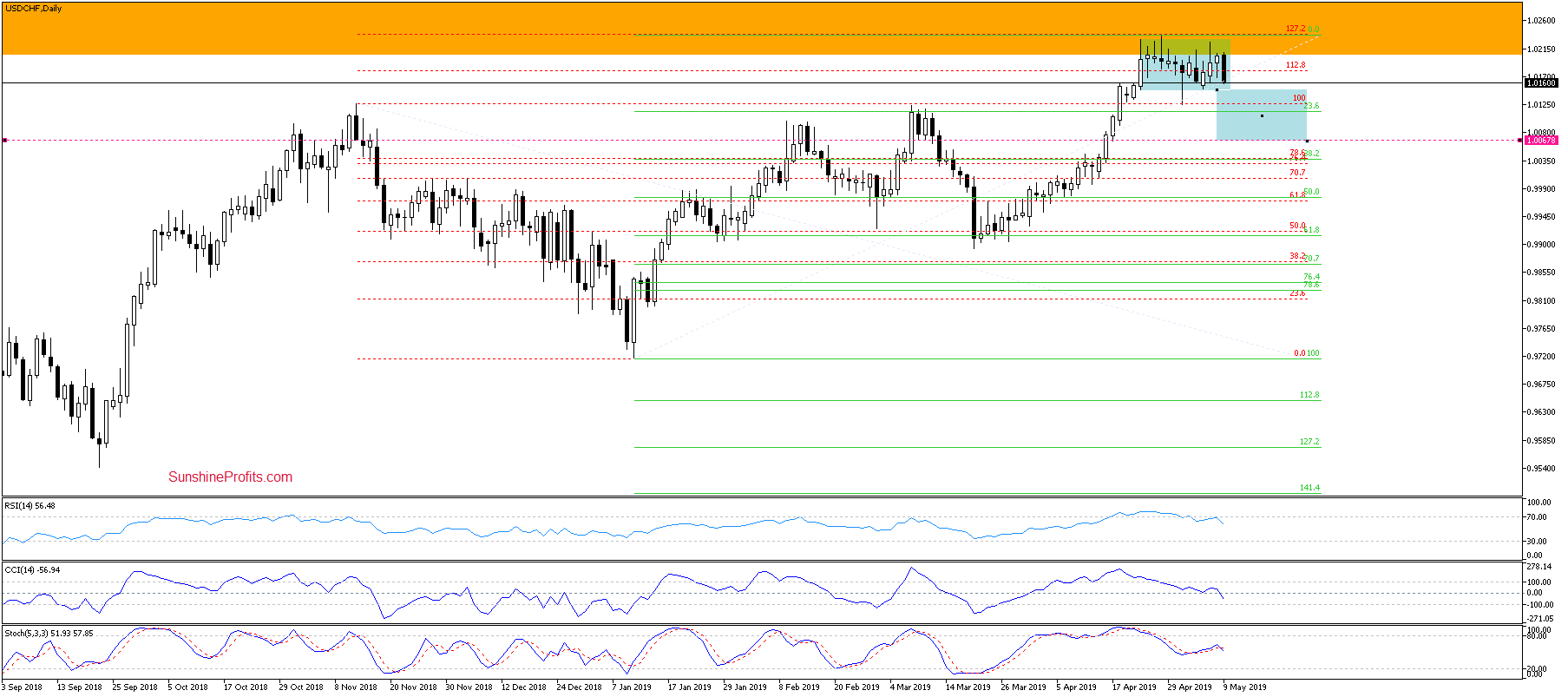

The bulls are still struggling with the major orange resistance zone and the price looks to getting ready for a downswing as seen on the monthly chart.

As the daily chart shows, another approach towards the orange resistance zone encouraged the sellers to act. The rate however still remains inside the blue consolidation. Lower values will be more likely only if we see a breakdown below its lower border.

Should we see such a price action, the first downside target for the bears will be the lower border of the blue consolidation on the right (at around 1.0067). There, the size of the downward move would correspond to the height of the preceding consolidation. The daily indicators also support such an outcome.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, neither the EUR/USD, USD/CAD or AUD/USD warrant opening new positions yet. We remain keenly watching and as always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist