Earlier today, the greenback extended losses against the yen, which took USDJPY below the lower border of the rising trend channel. Sounds pretty gloomy for fans of further increases of this currency pair, right? Don't worry, there is something technical that gives hope to currency bulls.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1833; the initial downside target at 1.1588)

- GBP/USD: short (a stop-loss order at 1.3301; the initial downside target at 1.2913)

- USD/JPY: long (a stop-loss order at 110.21; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

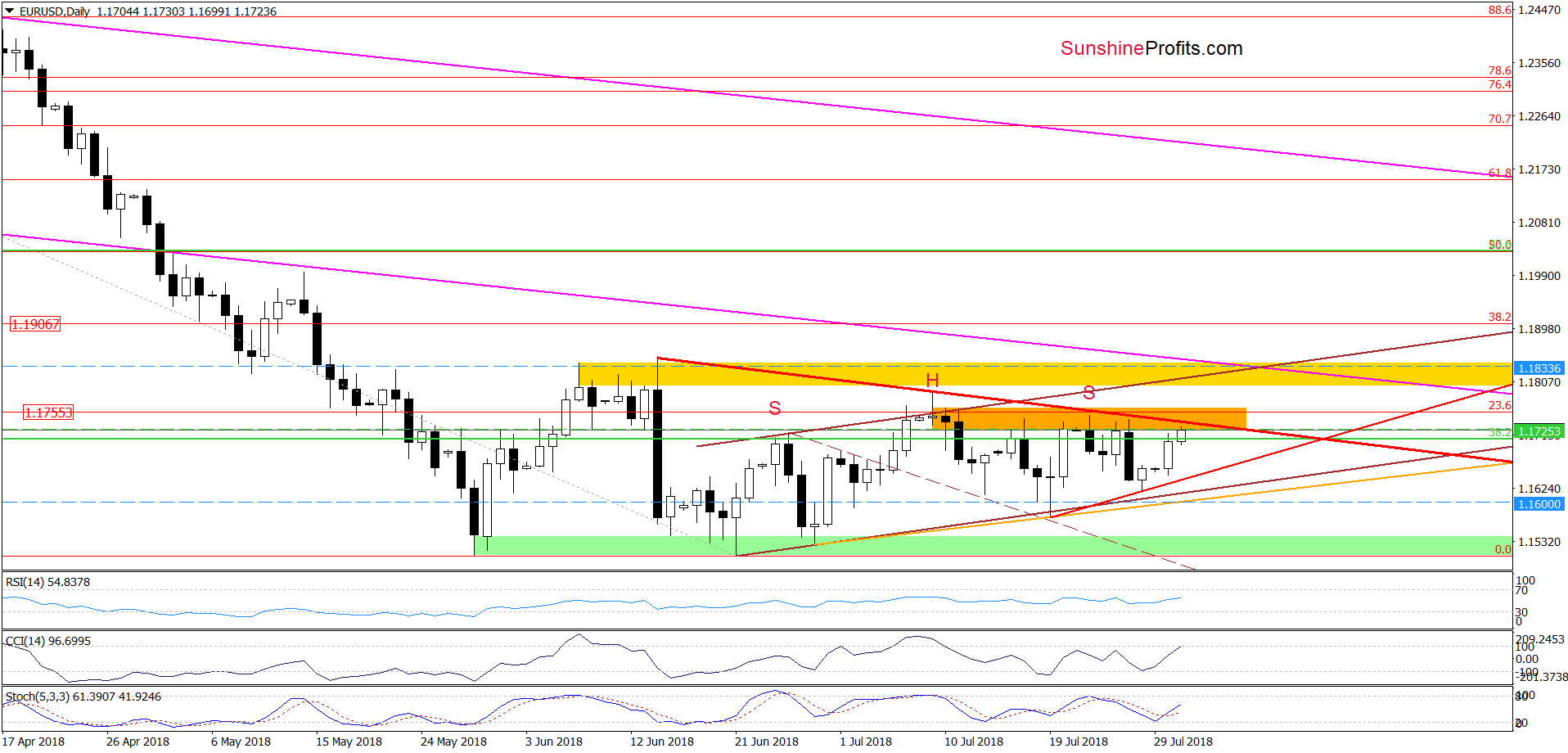

EUR/USD

EUR/USD came back to the orange resistance zone created by the previous highs and approached the red declining line based on the mid-June and July peaks.

This is a repeat of what we already saw several times in the past, therefore, we believe that as long as there is no breakout above these resistances higher values of the exchange rate are not likely to be seen and another reversal should not surprise us.

Trading position (short-term; our opinion): short positions with a stop-loss order at 1.1833 and the initial downside target at 1.1588 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

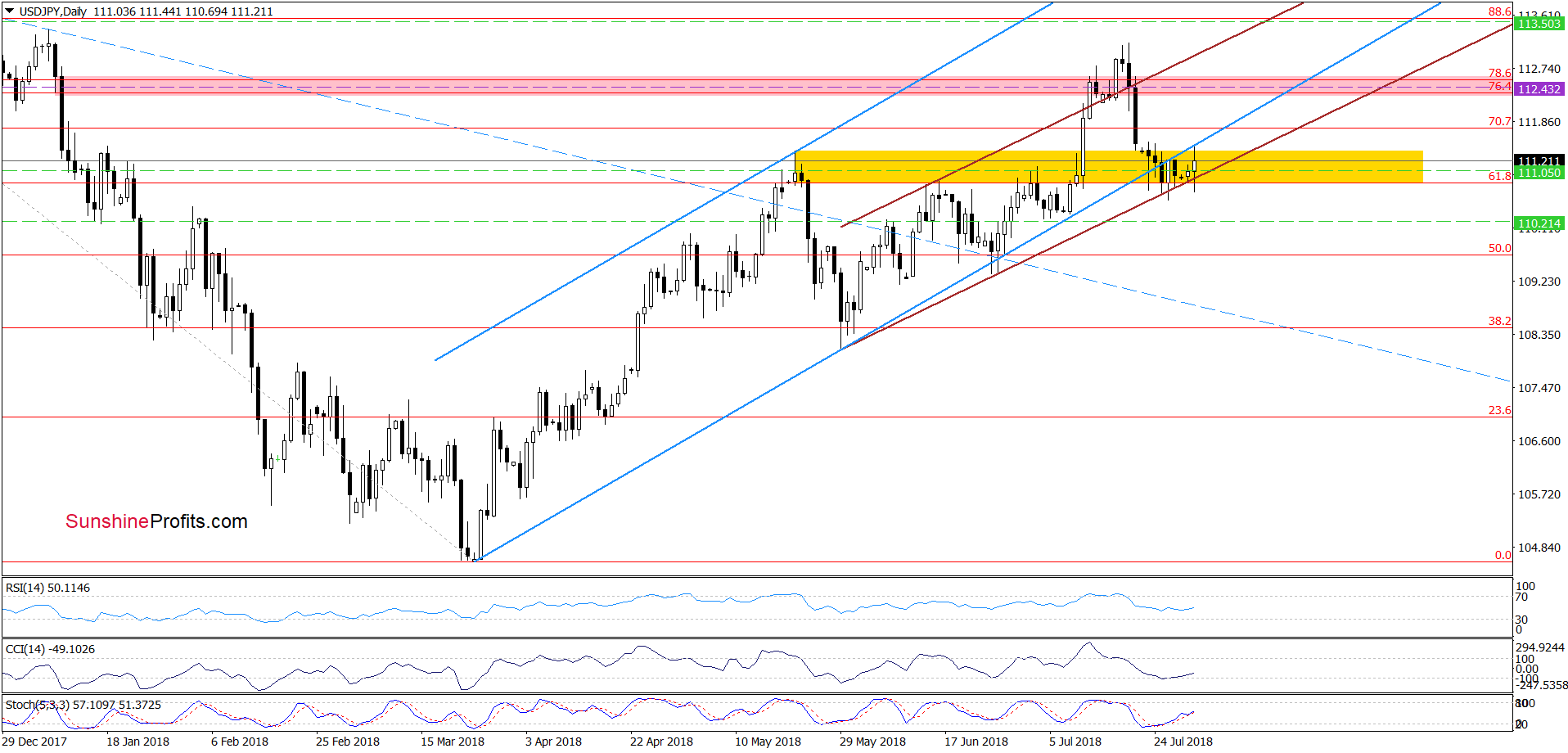

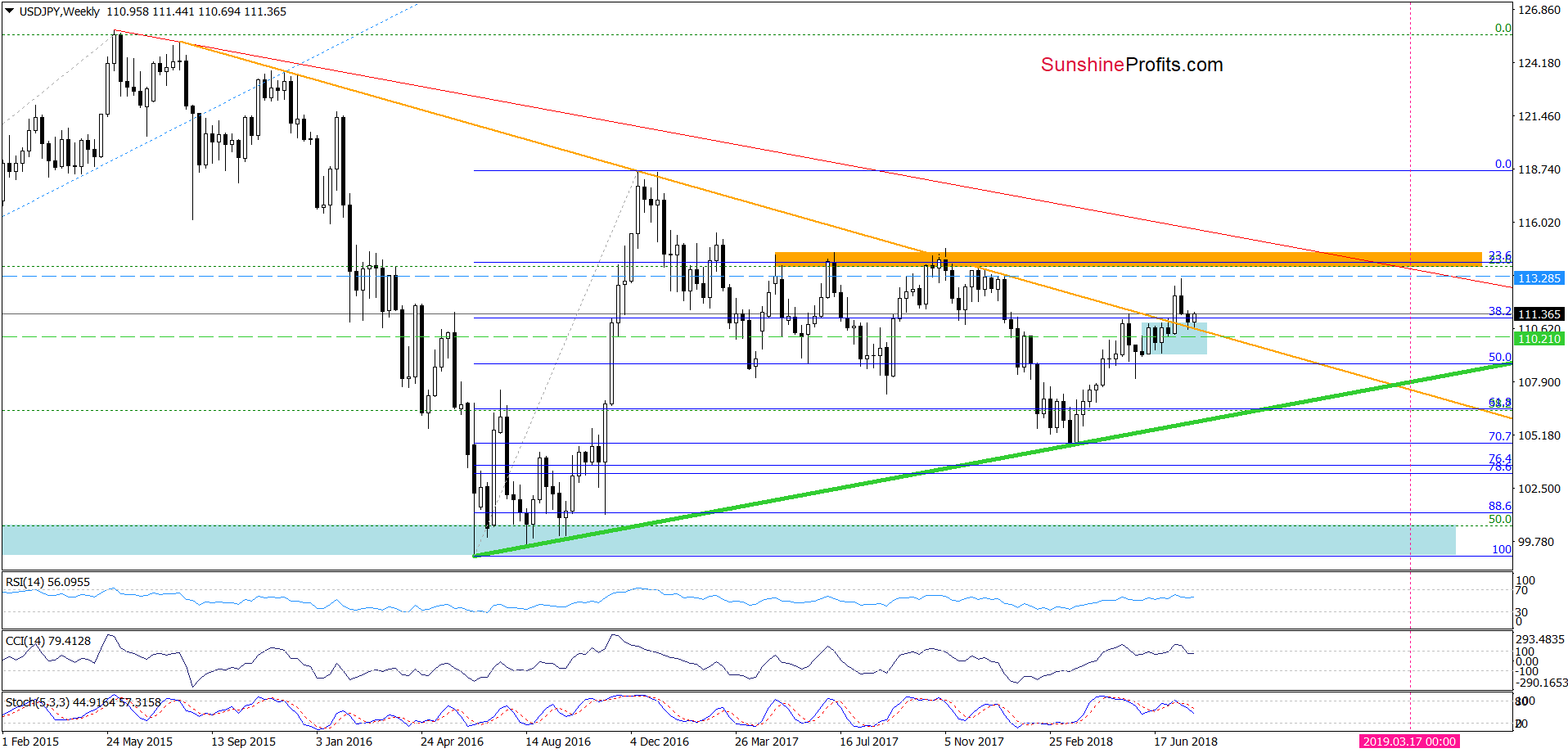

USD/JPY

Earlier today, USD/JPY moved lower once again, but the lower border of the brown rising trend channel stopped the sellers similarly to what we saw in the previous week.

Such price action suggests that currency bulls are active in this area and they will not surrender too easily without a fight. Additionally, the CCI and the Stochastic Oscillator generated the buy signals, suggesting that another bigger move to the upside is just around the corner – especially when we factor in the medium-term picture of the exchange rate.

From the broader perspective, we see that USD/JPY tested the previously-broken long-term orange declining line (which serves as the nearest very important support) last week, but currency bears didn’t manage to close the week below it, which resulted in an invalidation of the tiny breakdown.

Earlier this week (more precisely speaking earlier today), we saw another attempt to move lower, but this solid support withstood the selling pressure once again, triggering a rebound. Such price action looks like a verification of the breakout above this line, which increases the probability of further improvement in the coming week(s).

If this is the case and currency bulls use all these positive signs to push the pair higher, we’ll see (at least) a test of the recent highs in the following days.

Trading position (short-term; our opinion): long positions with a stop-loss order at 110.21 and the initial upside target at 113.50 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

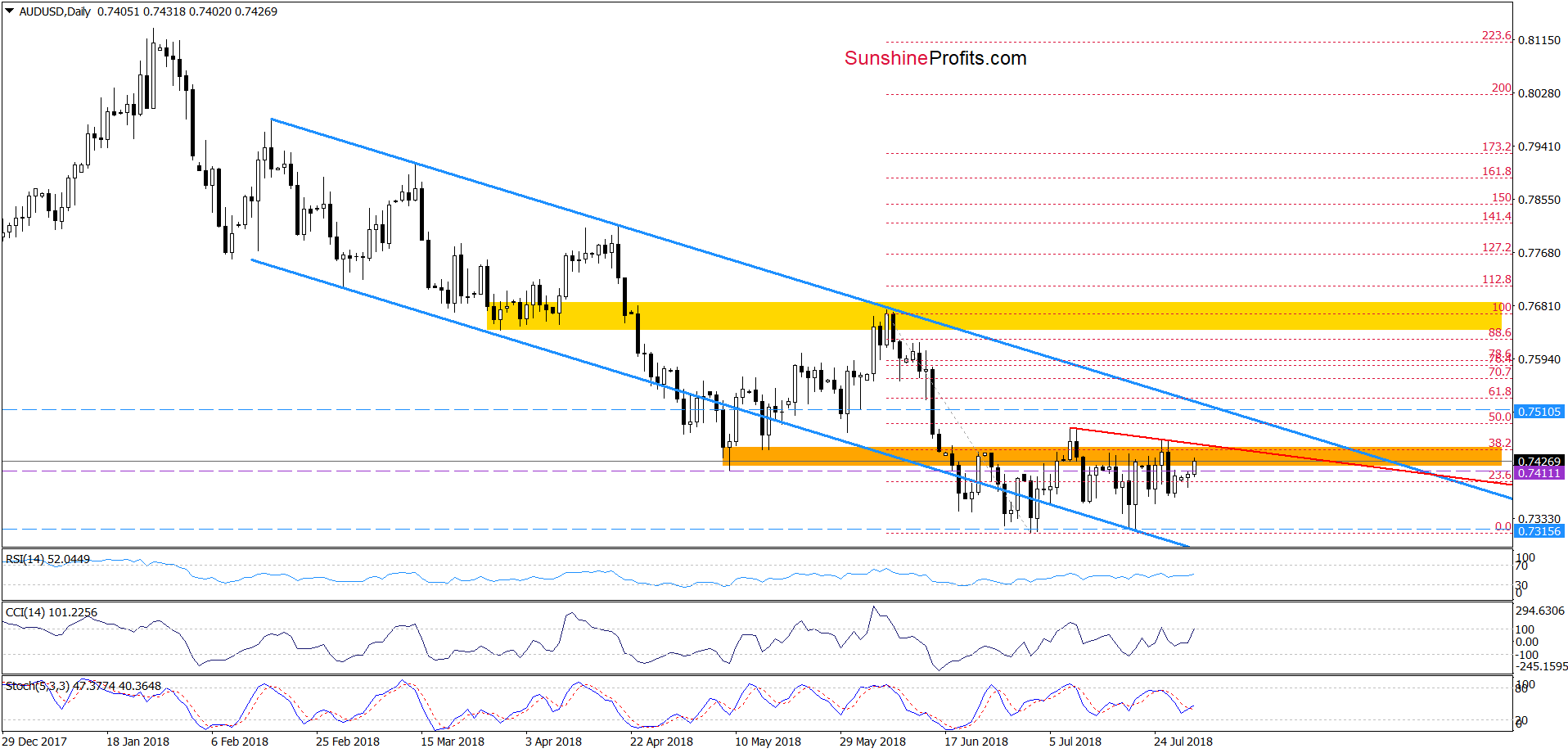

AUD/USD

On the daily chart, we see that AUD/USD increased once again earlier today. But did this move change anything? Not really, because the orange resistance zone continues to keep gains in check.

Additionally, the pair is still trading under the red declining resistance line based on the previous highs (similar to EUR/USD), which means that higher values of the exchange rate will be seen only if we see a breakout above it.

Until this time, another reversal and decline should not surprise us. How low could the pair go if the situation develops in line with our assumptions?

In our opinion, if AUD/USD extends losses from current levels, the exchange rate will (at least) decline to the earlier July lows or even test the lower border of the blue declining trend channel in the coming week.

Trading position (short-term; our opinion): short positions with a stop-loss order at 0.7510 and the initial downside target at 0.7315 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts