The long weekend is over and so are the European Parliament elections. Meanwhile, U.S. - China trade concerns persist. In such an environment, one might have expected a more vigorous return to the trading desks than the charts show. Not to despair, they go on highlighting recent price developments and subtly point in a certain direction. This is especially the case of two currencies where we're on the verge of opening new positions once we see...

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3545; the initial downside target at 1.3360)

- USD/CHF: none

- AUD/USD: none

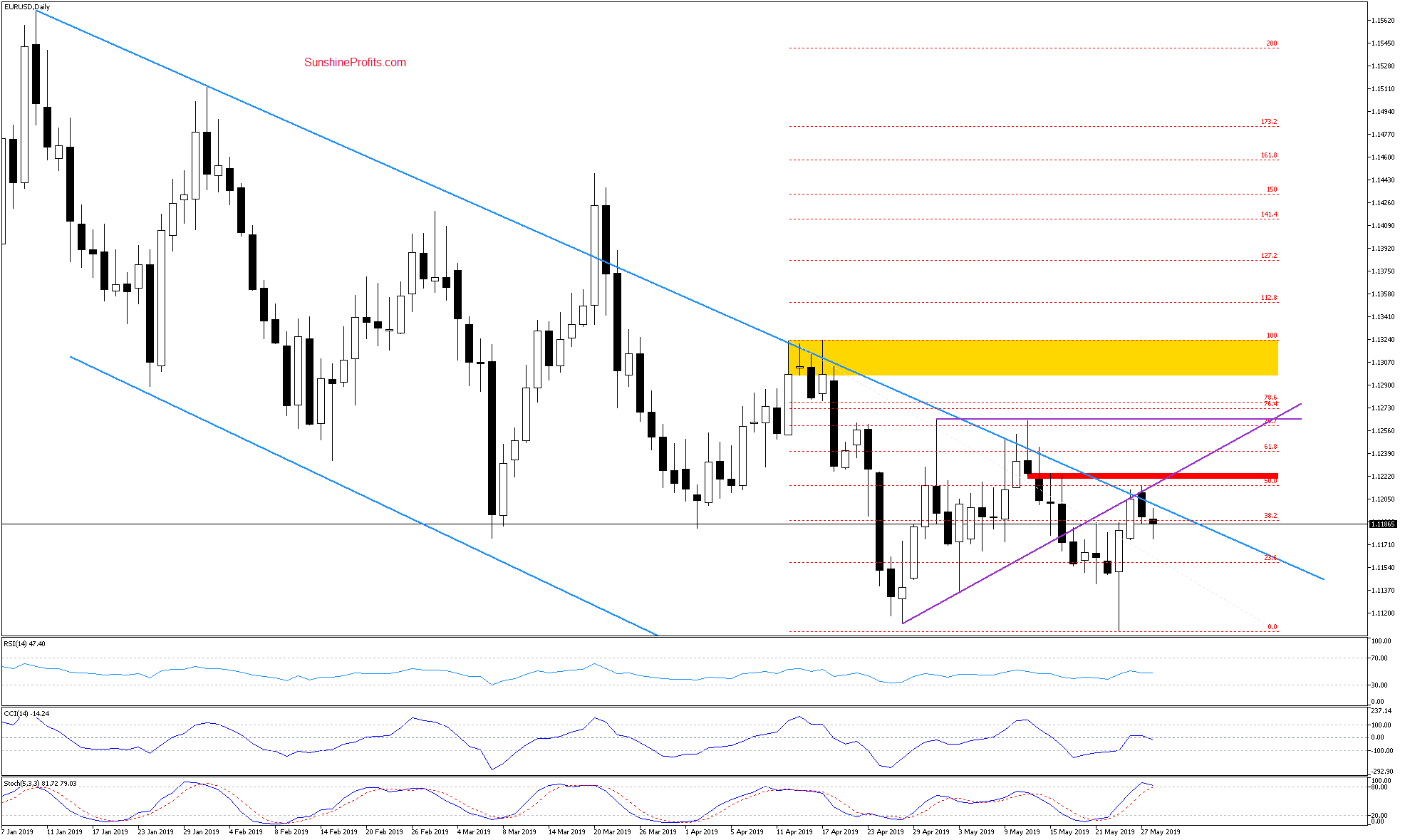

EUR/USD

Yesterday, the euro bulls repeated their Friday's test of the previously-broken lower border of the purple triangle and the 50% Fibonacci retracement (based on the recent entire decline). They haven't managed to hold on to their gains and the rate has pulled back since.

As a result, the pair has invalidated the earlier tiny breakout above the purple line and also a small move above the upper border of the blue declining trend channel. This doesn't bode well for higher EUR/USD values ahead.

Earlier today, the rate revisited Friday's lows and we also see the Stochastic Oscillator in its overbought area and close to generating a sell signal.

Connecting the dots, further deterioration seems to be just around the corner. This will be more likely and reliable only if the pair makes a daily close below Friday's lows and the Stochastic Oscillator generates its sell signal too.

Should we see such a development, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

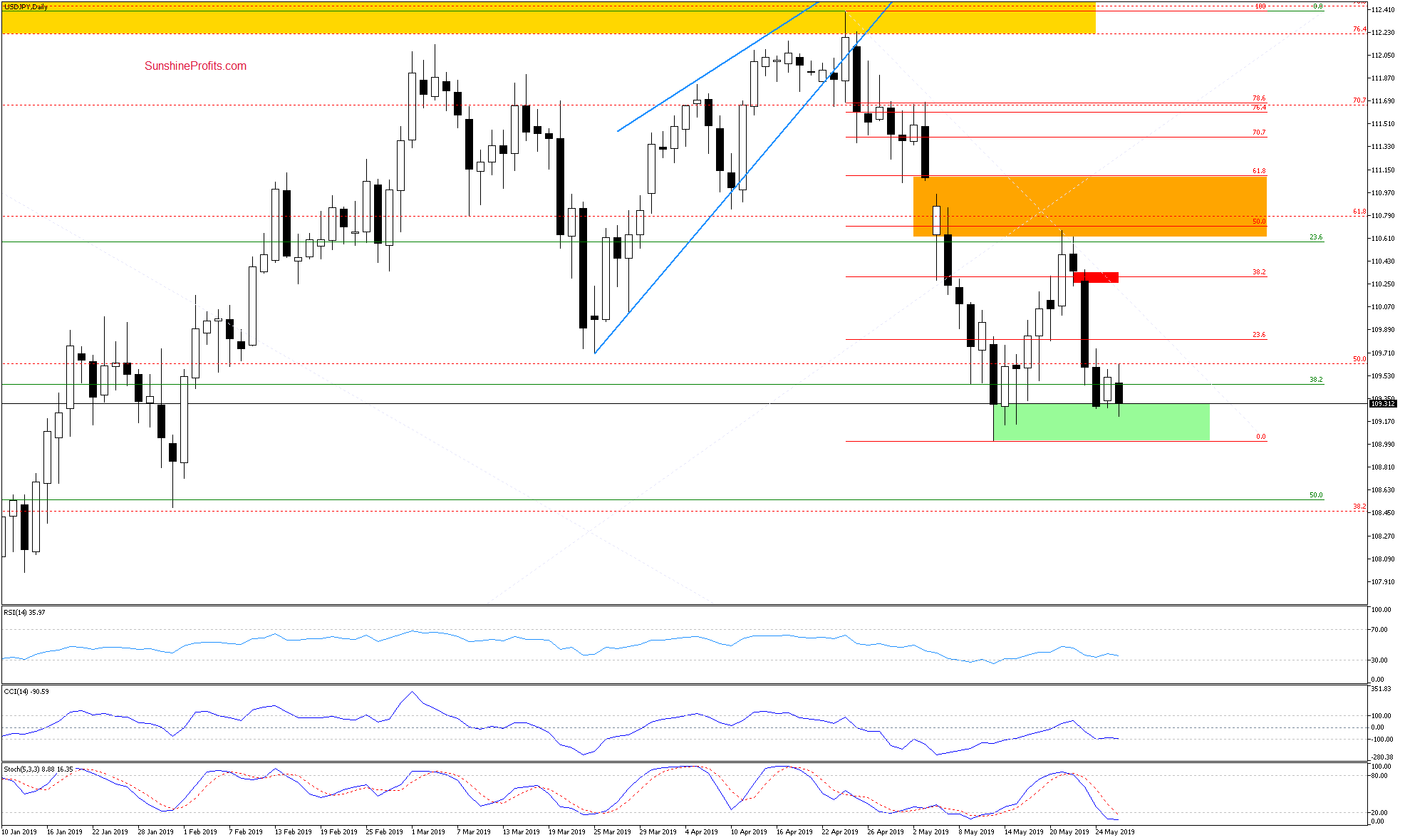

USD/JPY

Let's start by quoting our Thursday's alert:

(...) Today's opening gap suggests that further deterioration is just around the corner. (...).

Looking at the current position of the Stochastic Oscillator, we see it has ample room to decrease before reaching its oversold area. Considering that, the pair could move even lower and retest the 38.2% Fibonacci retracement (at around 109.46) in the following days.

Our downside target has been reached on Friday. Monday's session brought a modest price recovery though the rate hasn't bested Friday's highs. It suggests that one more downswing and a test of the mid-May lows is just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

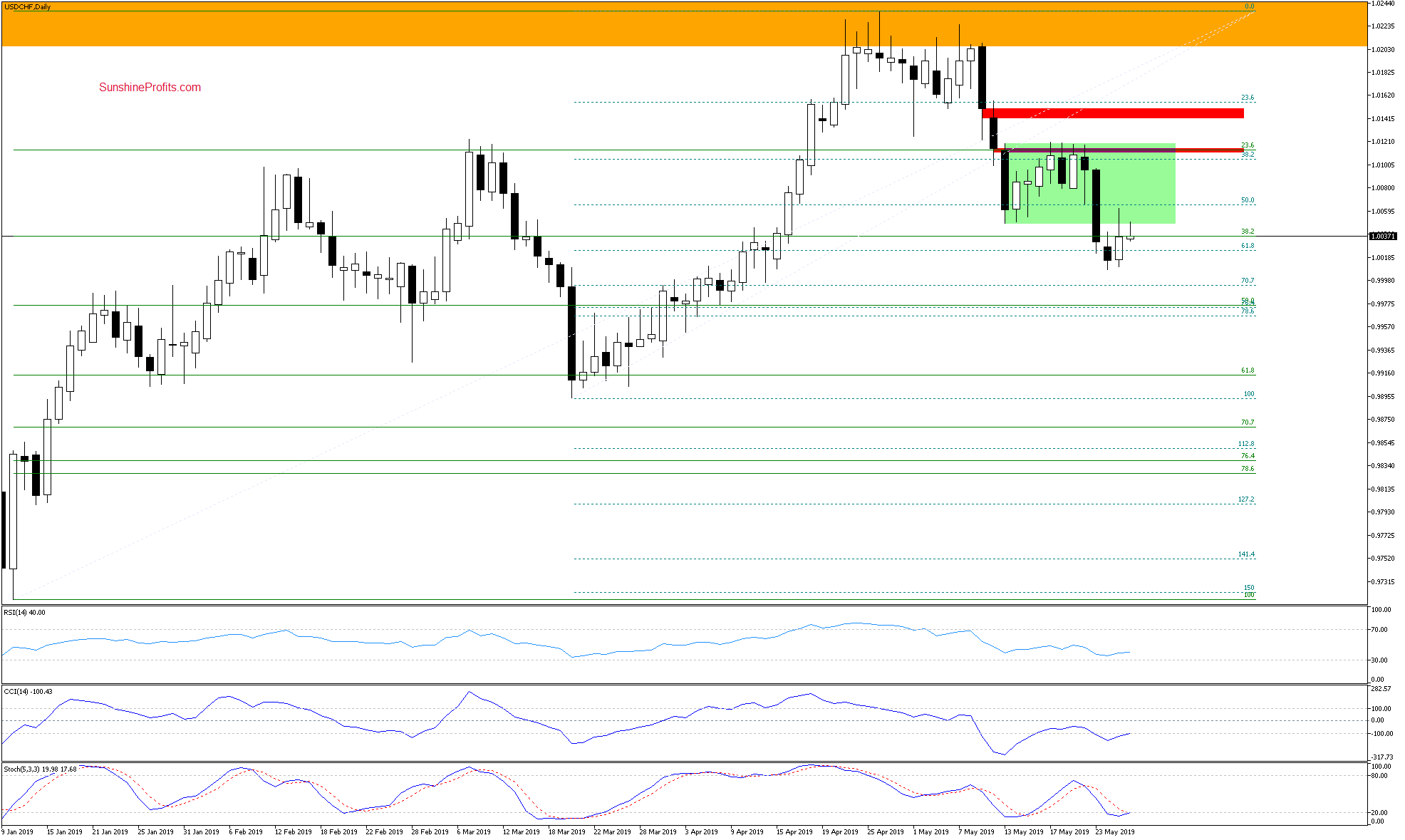

USD/CHF

We wrote these words in our Tuesday's Alert:

(...) If USD/CHF extends losses from here, we could see it drop to the lower border of the green consolidation that marks recent lows. Even a test of the 38.2% Fibonacci retracement in the coming week isn't out of the question.

The pair kept falling on Thursday and Friday to slip below the 38.2% Fibonacci retracement. It had however rebounded yesterday. Does it bode well for the bulls going forward?

The previously-broken lower border of the green consolidation stopped the buyers , and we saw similar price action earlier today, too. This hints at one more downswing in the coming day(s).

Should we see such a development, the pair could drop to around 0.9976, where the 50% Fibonacci retracement is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, EUR/USD upswing looks to be over and the rate had moved lower again. Should wee see it breaking below Friday's lows and the daily Stochastic Oscillator generate its sell signal, we'll consider opening short positions. USD/CAD looks again to be approaching the strong combination of resistances that have sent it lower many times earlier already. Our short position remains justified as there hasn't been any breakout, let alone a verified one. AUD/USD is making tentative gains but unless we see the bulls in strength and overcoming both nearest resistances, opening a long position isn't the right call. We'll continue being picky and act on the strongest setups only, as that is the right call. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist