In our opinion, the following forex trading positions are justified - summary:

EUR/USD

In our Friday's EUR/USD commentary, we highlighted the bulls' problems with breaking the 50% Fibonacci retracement. What happened with EUR/USD in the hours following the Alert's publication? Let's check the chart below.

On Friday, we also wrote that even if the exchange rate manages to move lower from current levels, the bears would have to overcome two supports: the lower border of the potential purple trend channel and the previously-broken orange area that serves as support now.

Today's chart reveals that the sellers pushed the exchange rate below the green horizontal support line during Friday's session. This is certainly a bearish development. It triggered further deterioration, translating into the breakdown below the lower line of the declining purple trend channel.

Additionally, the pair closed the day below both supports, and both the CCI and Stochastic Oscillator generated their sell signals. EUR/USD slipped to the orange support zone, which encouraged the bulls to fight for higher values earlier today.

The pair rebounded and came back into the purple channel, which suggests that we could see an invalidation of Friday's breakdown in the following hours. If it happens, we could also see an attempt to move above the green line or even higher.

Regardless of the many bearish omens, it is therefore not justified from the risk/reward perspective to open short positions at the moment of writing these words.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, we will carefully observe the actions of both, bulls and bears, in the areas discussed today, waiting for more clear clues as to the direction of the next bigger move.

USD/JPY

USD/JPY

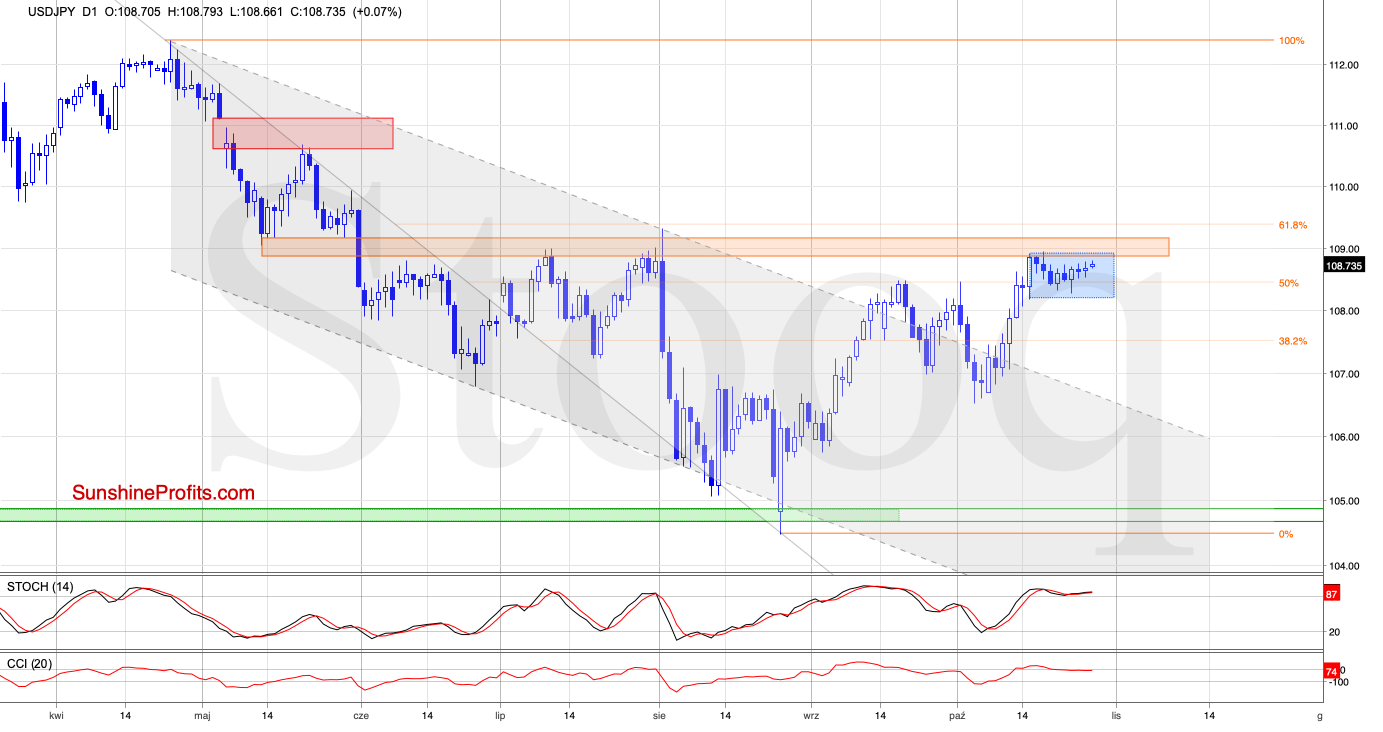

Although USD/JPY moved a little higher during recent sessions, the overall situation in the short term remains almost unchanged - the exchange rate is still trading inside the blue consolidation.

Therefore, what we wrote on Tuesday is up-to-date also today:

(...) Thanks to this increase, USD/JPY moved to the orange resistance area, which was strong enough to stop the bulls several times in the past (especially in June and July). As you see, the resistance zone is also supported by the 61.8% Fibonacci retracement, which is slightly above it.

Therefore it is our opinion that as long as they remain on the cards, the way to higher levels is blocked and reversal in the very near future should not surprise us - especially when we factor in the current position of the daily indicators: they both rose to their overbought areas and the Stochastic Oscillator even generated a sell signal.

On top of that, the pair started consolidation, which suggests that the bulls could have lost their strength and their rivals may take over in the very near future.

What about opening positions?

If the bulls break above the nearest resistances (which looks quite doubtful at the moment) we'll consider going long. On the other hand, if the bears push the pair below the lower border of the formation, we'll likely open short positions.

We will keep an eye on the market and let you know when signs strong enough to justify opening positions emerge.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

On Thursday, we wrote the following:

(...) USD/CAD slipped below the declining red trend channel, invalidating the prior positive developments. Earlier today, we noticed one more attempt to move higher, but the bulls disappointed just as previously, and the pair remains trading below the lower border of the formation.

What does it mean for the exchange rate?

If the buyers do not manage to come back into the channel later in the day, we should treat today's upswing as nothing more than verification of yesterday's breakdown. If the situation develops in line with the above, we'll likely see further deterioration and a test of the green support area created by the July lows in the very near future.

The situation developed in tune with the above, and USD/CAD almost touched the green support zone earlier today. Additionally, the CCI and the Stochastic Oscillator are very close to flashing their buy signals.

Combining this fact with the current position of the daily indicators, a reversal and higher values of this currency pair are probably just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. Nevertheless, should we see reliable signs of the bulls' strength (such as an invalidation of the breakdown under the lower border of the red declining trend channel), we'll consider opening long positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist