Although the euro moved sharply higher against the greenback on Wednesday, currency bulls showed their weakness, which resulted in a pullback yesterday. Will they make another attempt to attack the upper line of the trend channel? What pro-bearish formation can thwart their plans?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2250; the initial downside target at 1.1510)

- GBP/USD: short (a stop-loss order at 1.3773; the next downside target at 1.3000)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: long (a stop-loss order at 0.7410; the initial upside target at 0.7725)

EUR/USD

Yesterday, we wrote the following:

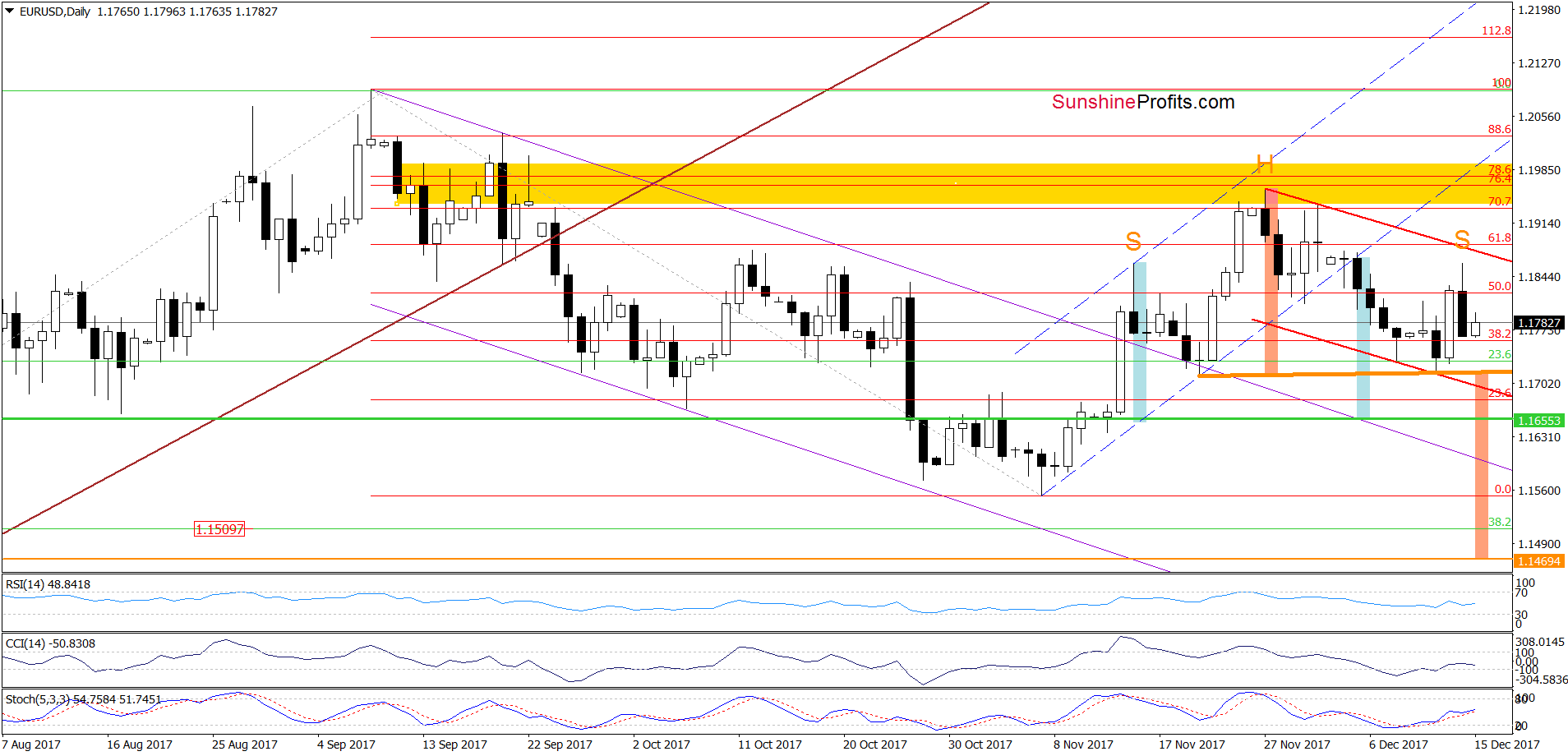

(….) the exchange rate wavered between small gains and losses, but considering the buy signals, we think that the pair will test the upper border of the red declining trend channel in the coming day(s).

From today’s point of view, we see that although currency bulls tried to push the pair higher and reach the above-mentioned target they failed. This show of weakness encouraged their opponents to act, which resulted in a quite sharp decline (it erased over 70% of the Wednesday upswing).

Earlier today, currency bulls took another attempt to push the exchange rate higher, but even if they succeed, we believe that the upper border of the red declining trend channel will stop then and trigger a bigger move to the downside.

This pro bearish scenario is also reinforced by the potential head and shoulders formation seen on the above chart (we marked it with orange).

When we go back in time to the turn of August and September, we will notice a similar pattern. Back then, the breakdown under the neck line of the formation triggered a bigger move to the downside, which suggests that if we see similar breakdown in the coming week, EUR/USD will likely not only test the November lows, but also hit a fresh multi-month low.

How low could the exchange rate go if currency bears push the pair under the orange support line? In our opinion, the first downside target will be the above-mentioned November low of 1.1553. But if it is broken, we may see a decline even to around 1.1469, where the size of the downward move will correspond to the height of the head and shoulders formation.

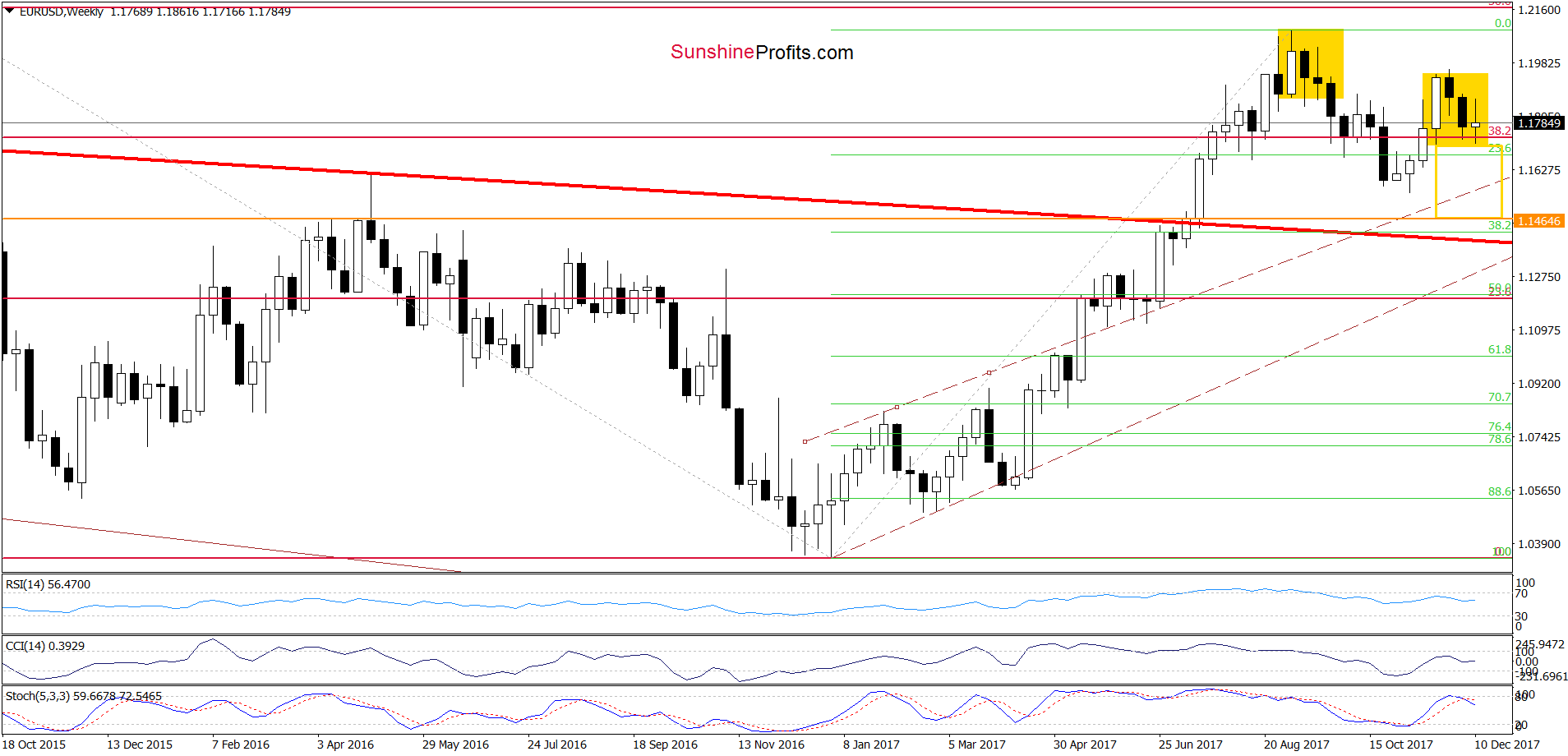

At this point it is also worth noting that in this area the downswing will be equal to one more formation – the yellow consolidation marked on the weekly chart below.

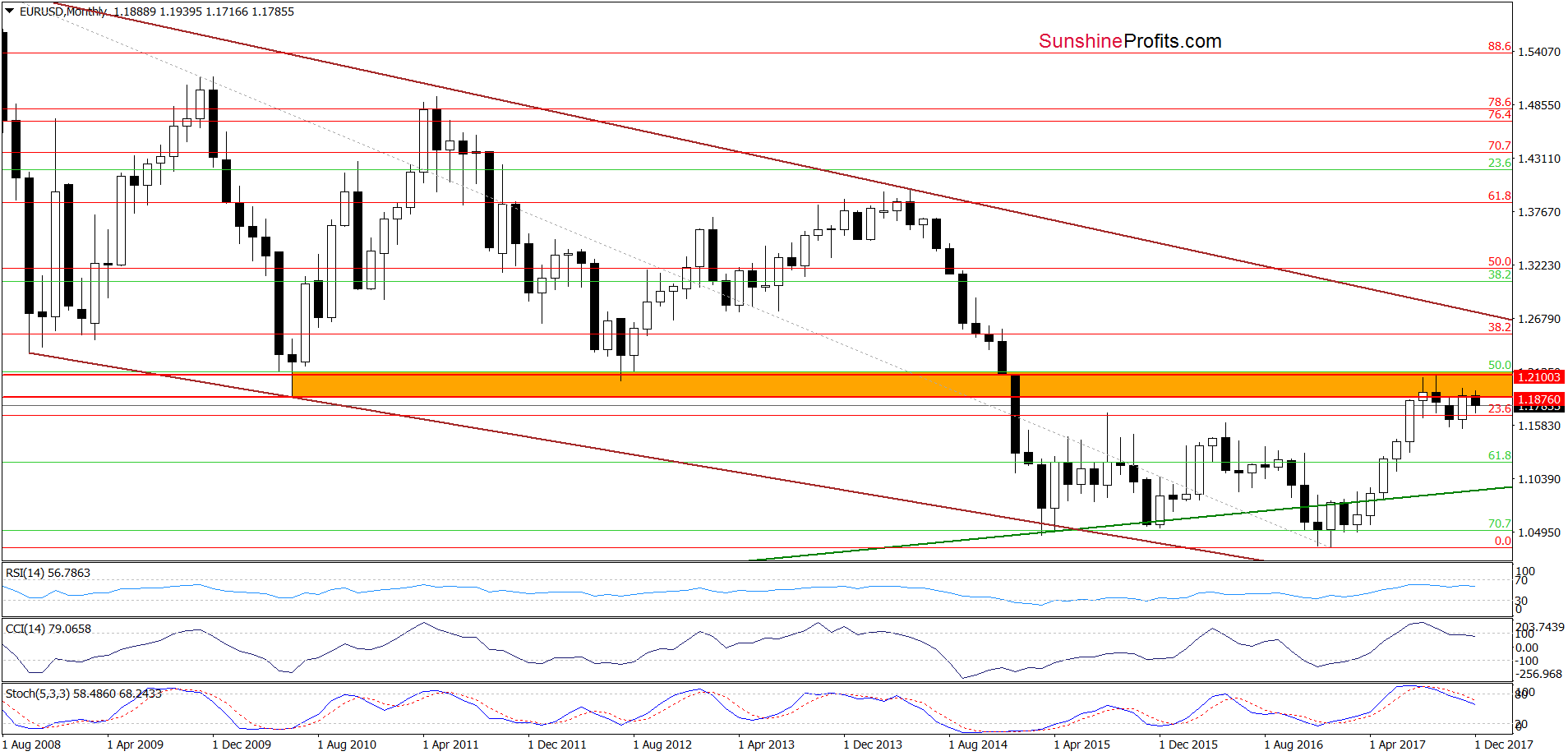

From this perspective, we see that EUR/USD is consolidating – similarly to what we saw at the beginning of September. Taking this fact and the sell signals generated by the medium-term indicators into account, we believe that if the pair declines under the lower border of the consolidation, we’ll see a decline to around 1.1464 (only several pips below our above-mentioned target). This means that even if we see a very short-term upswing, another bigger move should be to the downside. This scenario is also reinforced by the orange resistance zone marked on the monthly chart and the sell signals generated by the long-term indicators.

Trading position (short-term; our opinion): short positions (with a stop-loss order at 1.2250 and the initial downside target at 1.1510) continue to be justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

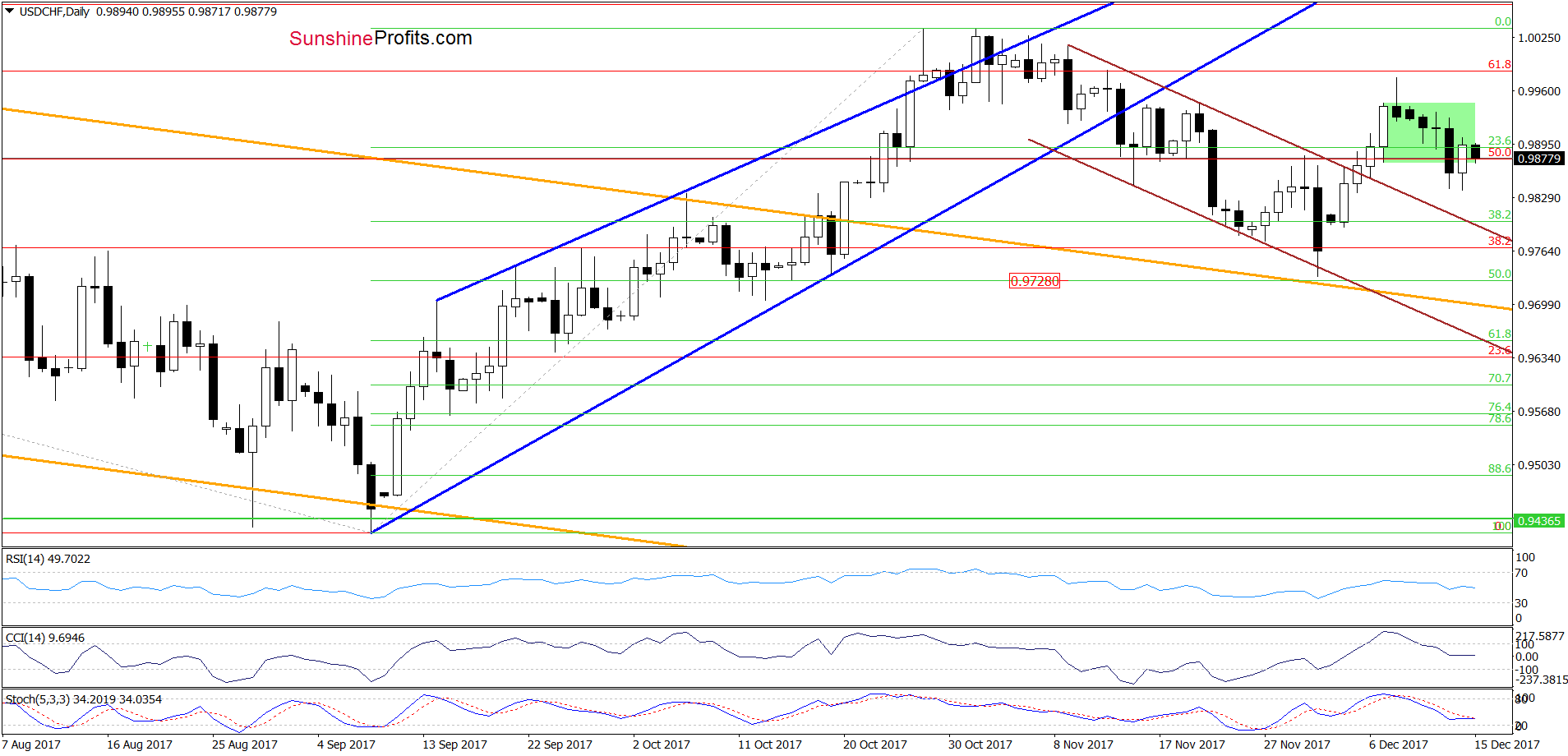

USD/CHF

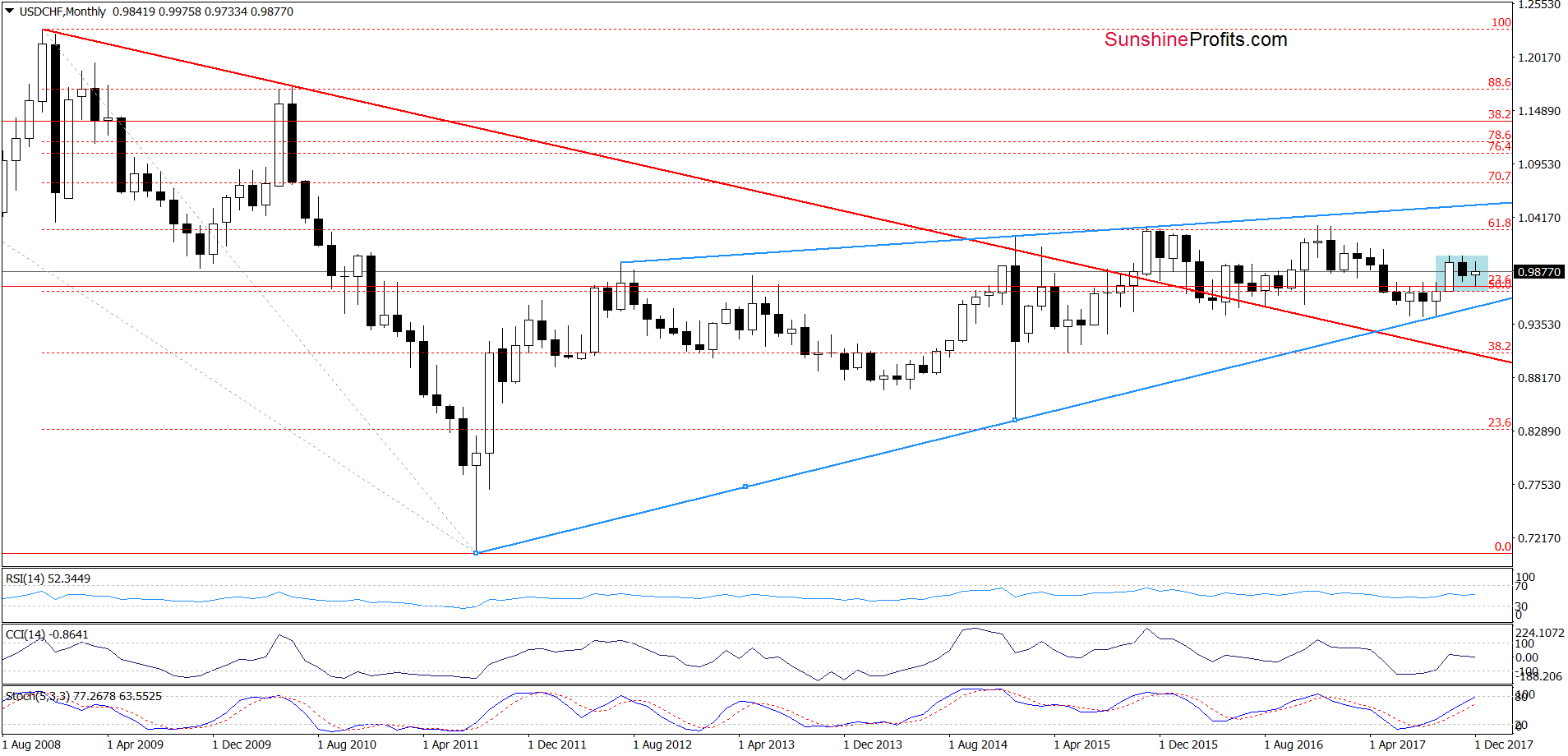

The long-term perspective hasn’t changed much as USD/CHF remains in the blue consilidation from one and a half month, which makes the long-term perspective a bit unclear.

Will the short-term picture give us moe clues about future moves? Let’s check.

From today’s point of view, we see that although USD/CHF broke below the lower line of the green consolidation on Wednesday, currency bulls erased most of this decline on the following day. As a result, the exchange rate came back to the green consolidation, invalidating the earlier breakdown, which is a positive development.

Nevertheless, the pair moved a bit lower once again earlier today, which together with the sell signals generated by the daily indicators suggests that a re-test of this week low (or even the previously-broken upper line of the brown declining trend channel) can’t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

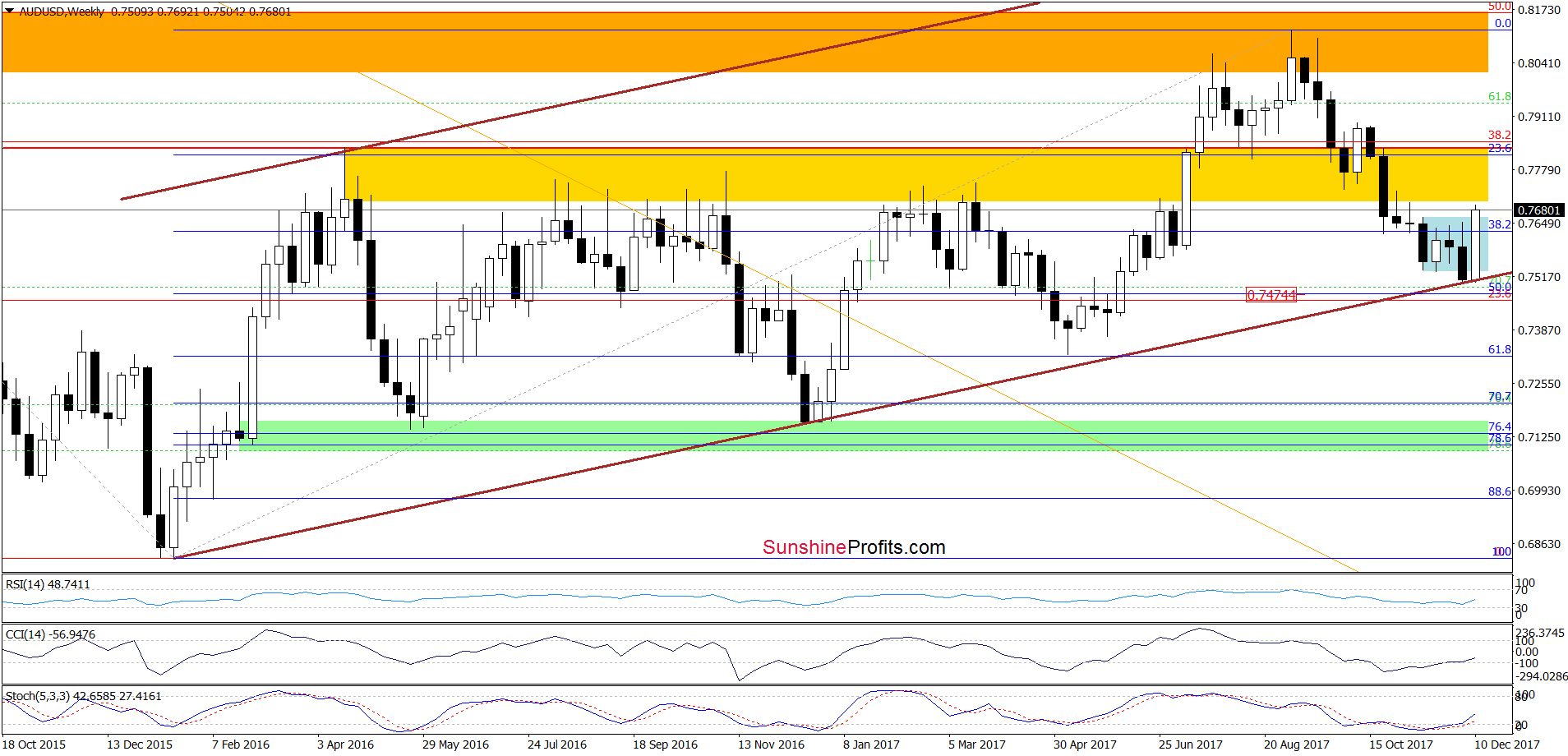

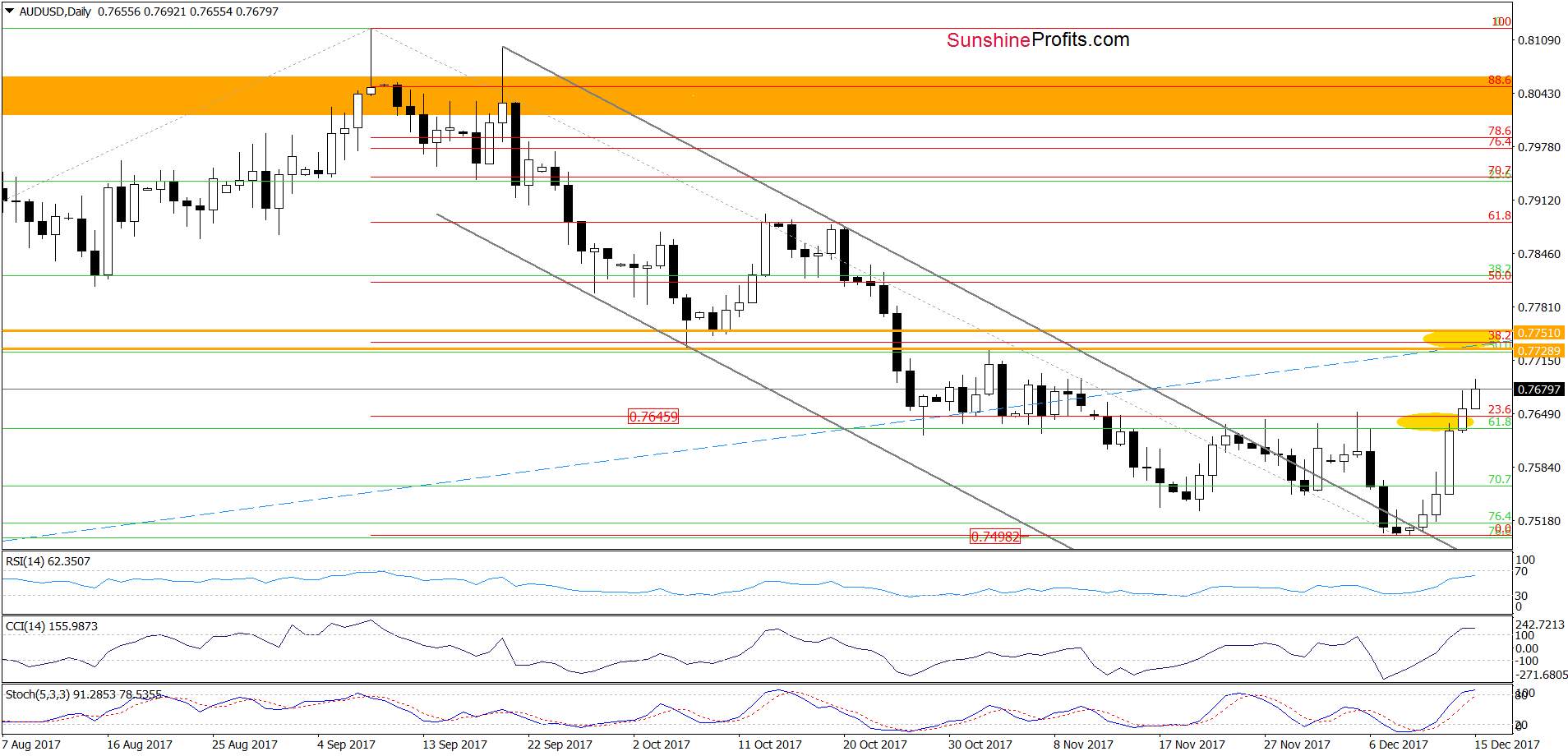

AUD/USD

Quoting our last commentary on this currency pair:

(…) How high could the exchange rate go in the coming days? In our opinion, the first upside target will be around 0.76.30-0.7651, where the lower yellow ellipse (created by the previous highs) is.

Looking at the charts, we that the situation developed in line with the above scenario as AUD/USD moved sharply higher and broke above the first upside target, making our long positions even more profitable. Although the daily indicators increased to their overbought areas, we believe that as long as there are no sell signals another upswing is more likely than not.

If this is the case, and the exchange rate increases once again, we’ll see a test of the next upside target from our Wednesday alert in the coming week:

(…) If this zone is broken, we’ll likely see an increase even to around 0.7728-0.7751, where the orange horizontal resistance lines and the 38.2% Fibonacci retracement are.

Trading position (short-term; our opinion): Profitable long positions (with the stop-loss order at 0.7410 and the initial upside target at 0.7725) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts