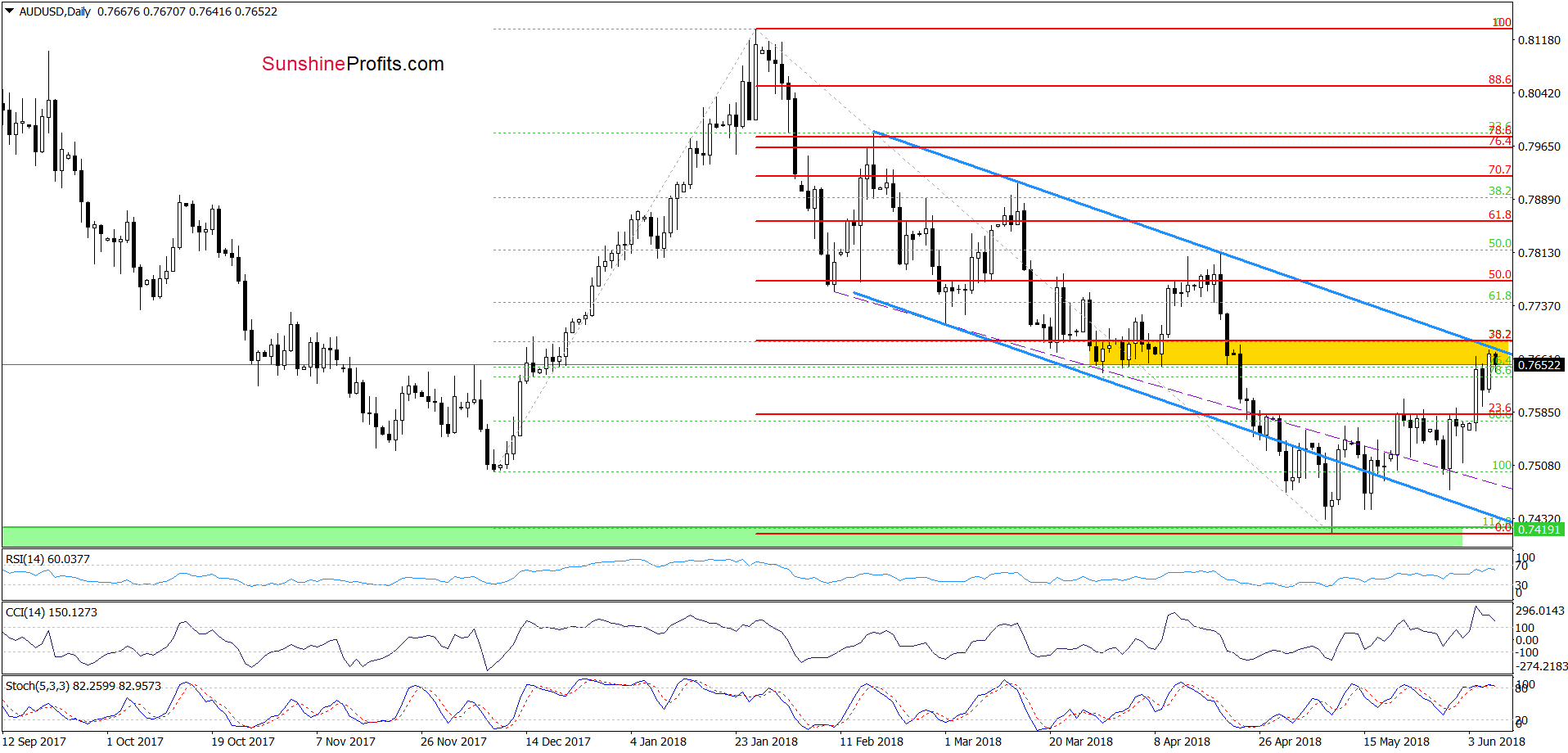

Recent days were quite good for currency bulls as they manage to break above the consolidation and climb to the previously-broken late March and early April lows. Will there be bears willing to fight for lower values of AUD/USD?

In our opinion the following forex trading positions are justified - summary:

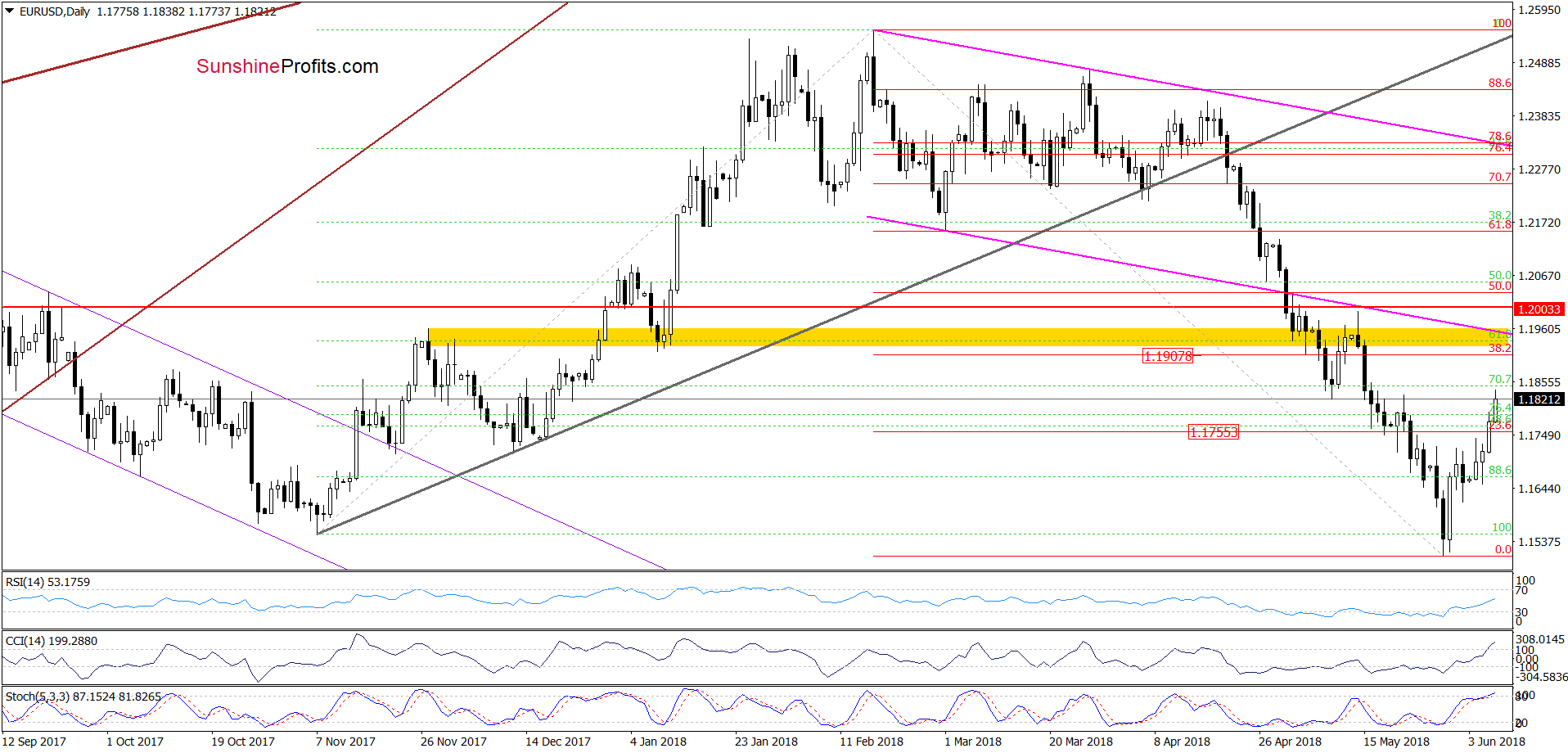

EUR/USD

Yesterday, we wrote the following:

(…) despite Monday’s downswing, the situation developed in line with the above scenario and the exchange rate broke above our firth upside target earlier today. Taking this fact into account and the lack of the sell signals, we think that further improvement and a test of the May 22 high (or even our next upside target from Thursday’s alert) is very likely.

From today’s point of view, we see that the situation developed in line with the above scenario as EUR/USD extended gains and climbed to our next downside target earlier today. Although the CCI and the Stochastic Oscillator are overbought, there are no sell signals, which suggests that test of the next upside target is likely. Nevertheless, if we see any sign of the bulls’ weakness around the 38.2% Fibonacci retracement, we’ll consider opening short positions. Stay tuned.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

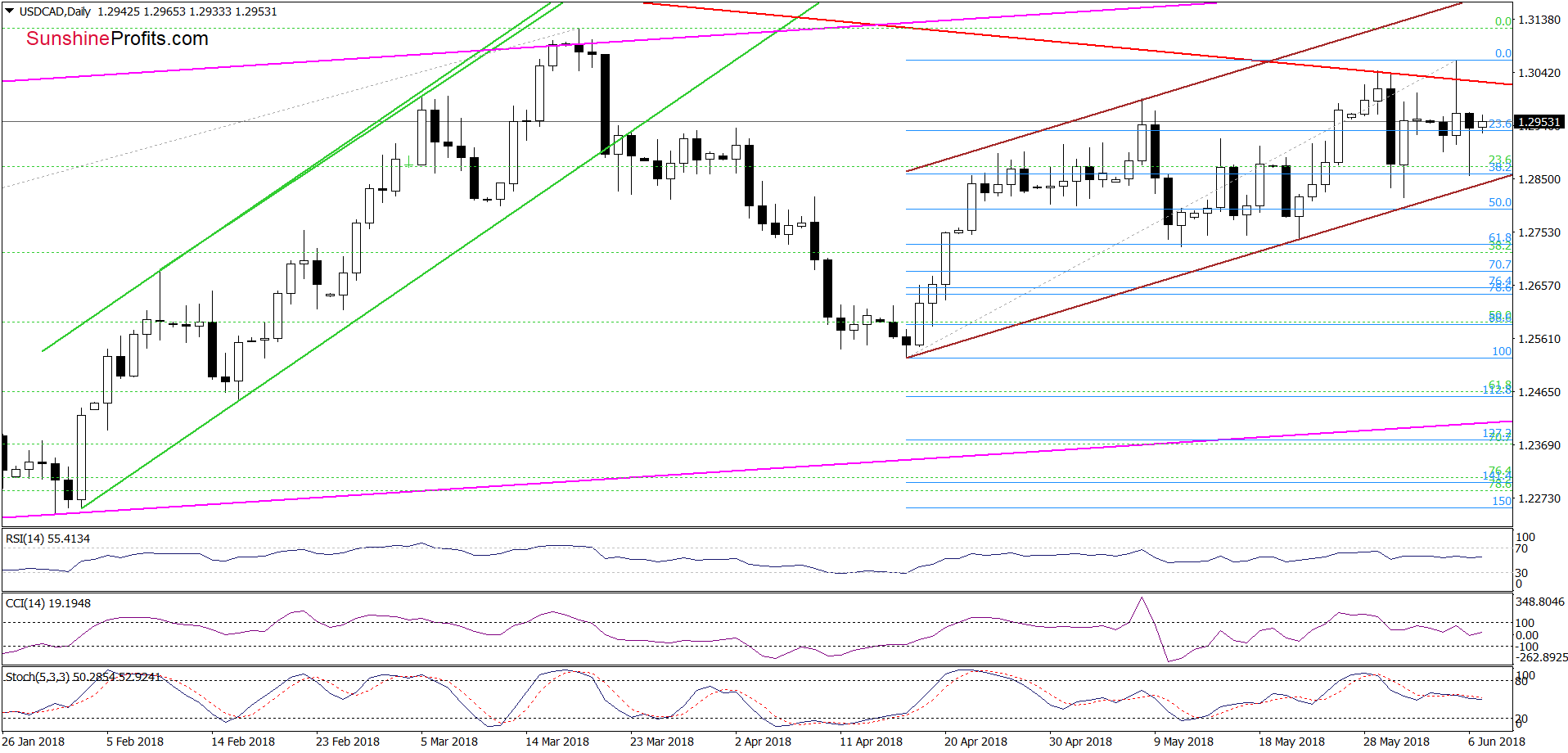

USD/CAD

Looking at the medium-term chart, we see that USD/CAD re-tested the upper border of the long-term red declining trend channel and the 38.2% Fibonacci retracement based on the entire 2016-2017 downward move earlier this week.

Despite this increase, currency bulls didn’t manage to break above these strong resistances, which resulted in another pullback. How did this price action affect the daily chart? Let’s check.

From this perspective, we see that although USD/CAD broke above the previous highs on Tuesday, the above-mentioned resistances triggered a decline, which took the exchange rate to the 38.2% Fibonacci retracement on the following day.

As you see on the chart, the pair bounced off this support, but the sell signals generated by the daily indicators continue to support the sellers (at least at the moment of writing this alert), which suggests that one more test of the above-mentioned retracement or even the lower border of the brown rising trend channel is likely in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

Looking at the daily chart, we see that AUD/USD extended gains and reached the yellow resistance zone created by the late March, early Aril lows and the upper border of the blue declining trend channel.

Thanks to this move, the pair also approached the 38.2% Fibonacci retracement, which together with the current position of the daily indicators (the CCI and the Stochastic Oscillator are overbought and very close to generating sell signals) suggests that reversal and lower values of AUD/USD are just around the corner.

Taking all the above into account, we think that we’ll consider opening short positions in the very near future. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts