Although AUD/USD started this week well above Friday’s closure, the combination of August peaks encouraged currency bears to act in the following days. Earlier today, they managed to erase the biggest ally of their rivals. What can be the consequences of this event?

- EUR/USD: none

- GBP/USD: long (a stop-loss order at 1.2642; the upside target at 1.3050)

- USD/JPY: short (a stop-loss order at 114.68; the initial downside target at 112.34)

- USD/CAD: none

- USD/CHF: short (a stop loss order at 1.0192; the initial downside target at 0.9881)

- AUD/USD: none

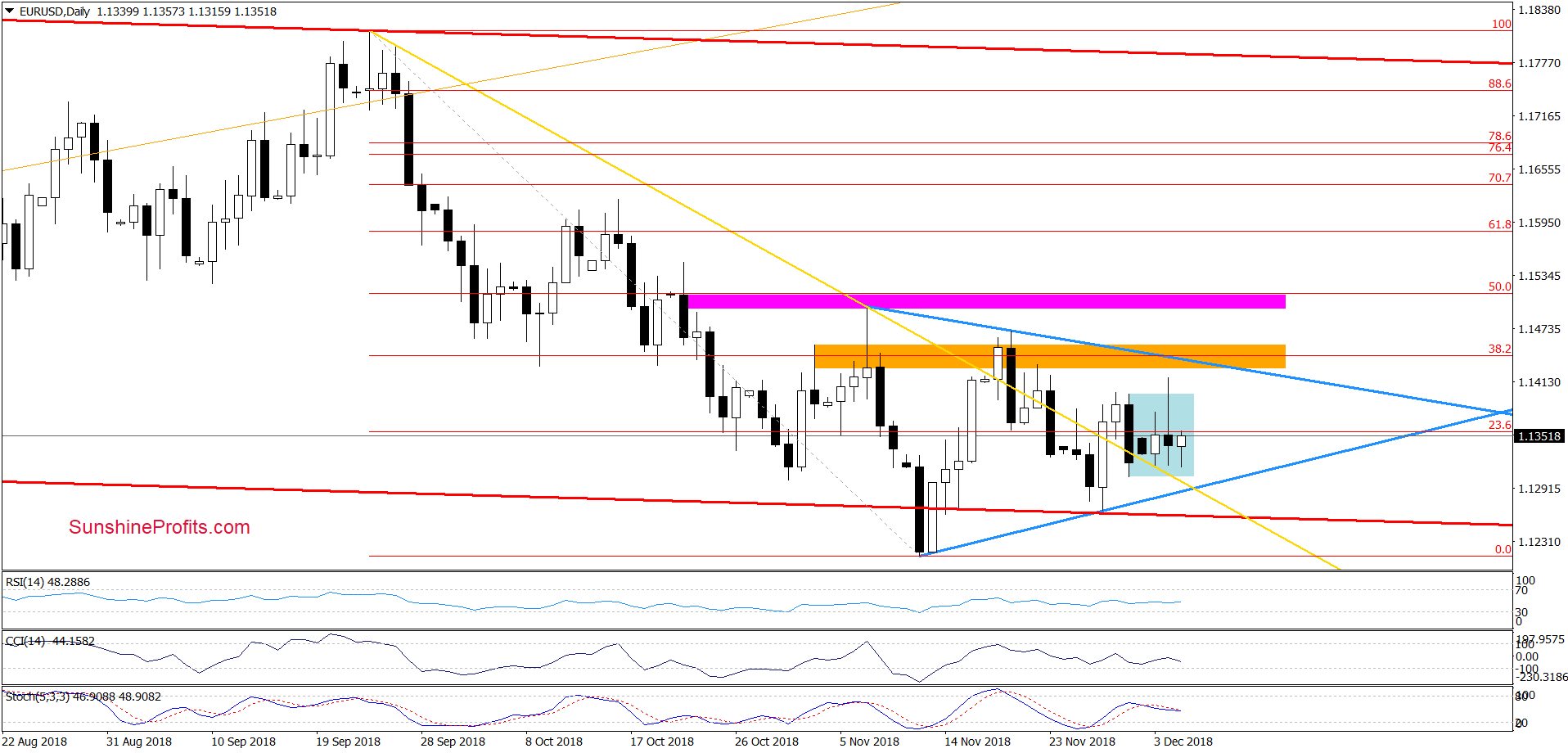

EUR/USD

Looking at the daily chart, we see that the situation in the very short term remains almost unchanged, which means that our yesterday’s comments on this currency pair are valid also today:

(…) we continue to believe that as long as there is no breakout above the upper border of the triangle (or a breakdown under the lower line) another bigger move is not likely to be seen and short-lived moves in both directions should not surprise us in the coming days.

Nevertheless, if currency bulls show strength and manage to take the exchange rate above the nearest resistances, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

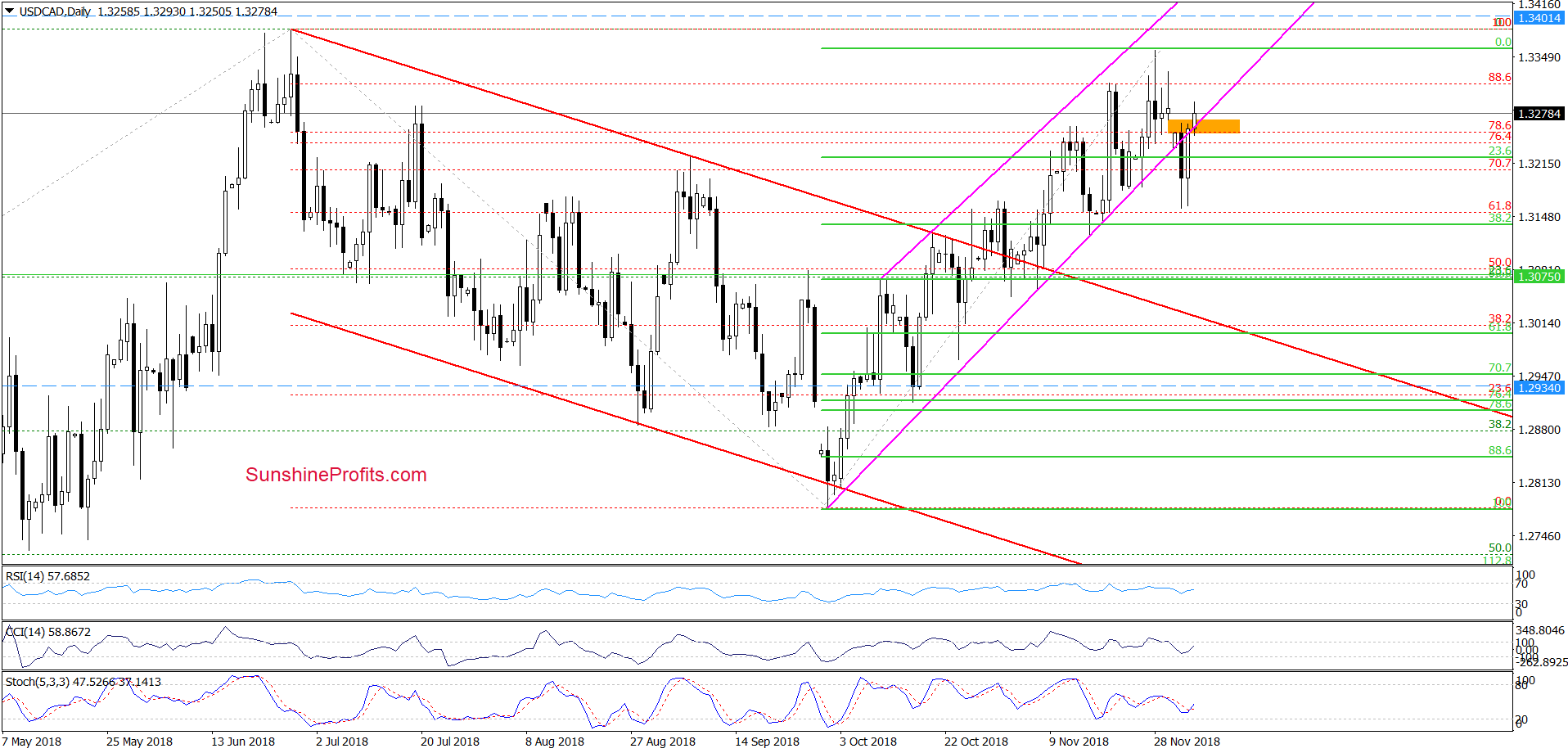

USD/CAD

From today’s point of view, we see that although USD/CAD moved sharply lower and dropped below the pink trend channel on Monday, currency bulls managed to trigger an equally fast rebound, which not only erased the earlier drop, but also caused an invalidation of the breakdown under the channel.

This positive development encouraged the bulls to take the pair even higher earlier today, which resulted in a climb above the upper border of the gap created between Friday’s closure and this week’s open (we marked it with green). Additionally, the Stochastic Oscillator generated a buy signal, increasing the probability of further improvement in the coming days.

Taking all the above into account, we think that closing short positions to avoid further losses is justified from the risk/reward perspective at the moment of writing this alert. Nevertheless, if the bulls show weakness in the following days, we’ll likely re-open our positions at better prices. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

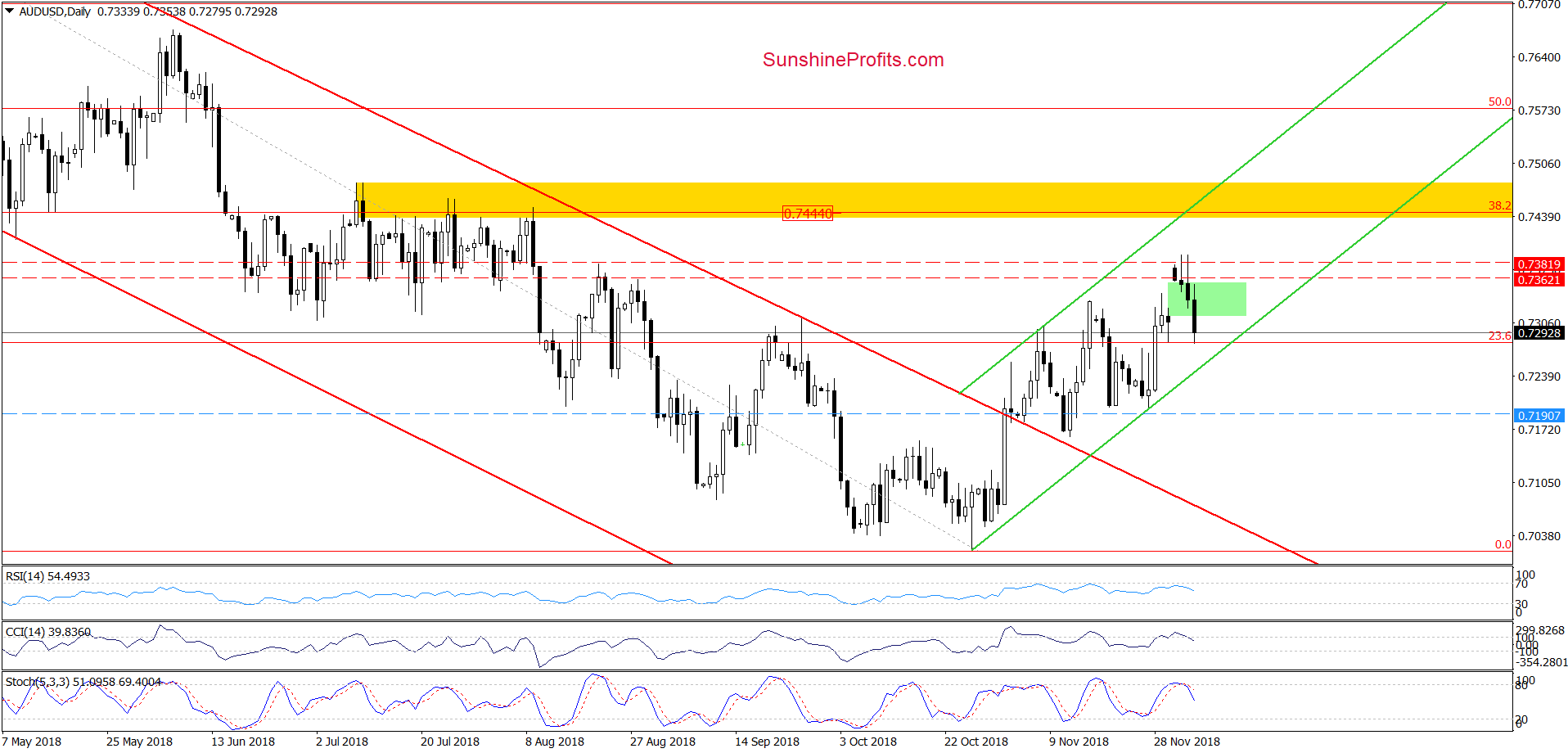

AUD/USD

The first thing that catches the eye on the daily chart is invalidation of the earlier tiny breakouts above the red horizontal resistance lines based on late-August highs. This negative development encouraged the sellers to act, which resulted in a sharp downswing earlier today. On top of that, the CCI and the Stochastic Oscillator generated sell signals, suggesting that lower values of AUD/USD might be just around the corner.

Thanks to these circumstances, the exchange rate slipped under the lower border of the green gap, which is an additional bearish development that justifies the closure of existing long positions.

How low can the pair go in the coming days? In our opinion, the first downside target will be the lower border of the green rising trend channel (currently at around 0.7247).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts