On Friday, the Australian dollar moved sharply higher against its U.S. counterpart, which took AUD/USD to its first important resistance zone. Will currency bears be active here once again?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1833; the initial downside target at 1.1588)

- GBP/USD: none

- USD/JPY: long (a stop-loss order at 110.21; the initial upside target at 113.50)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7510; the initial downside target at 0.7315)

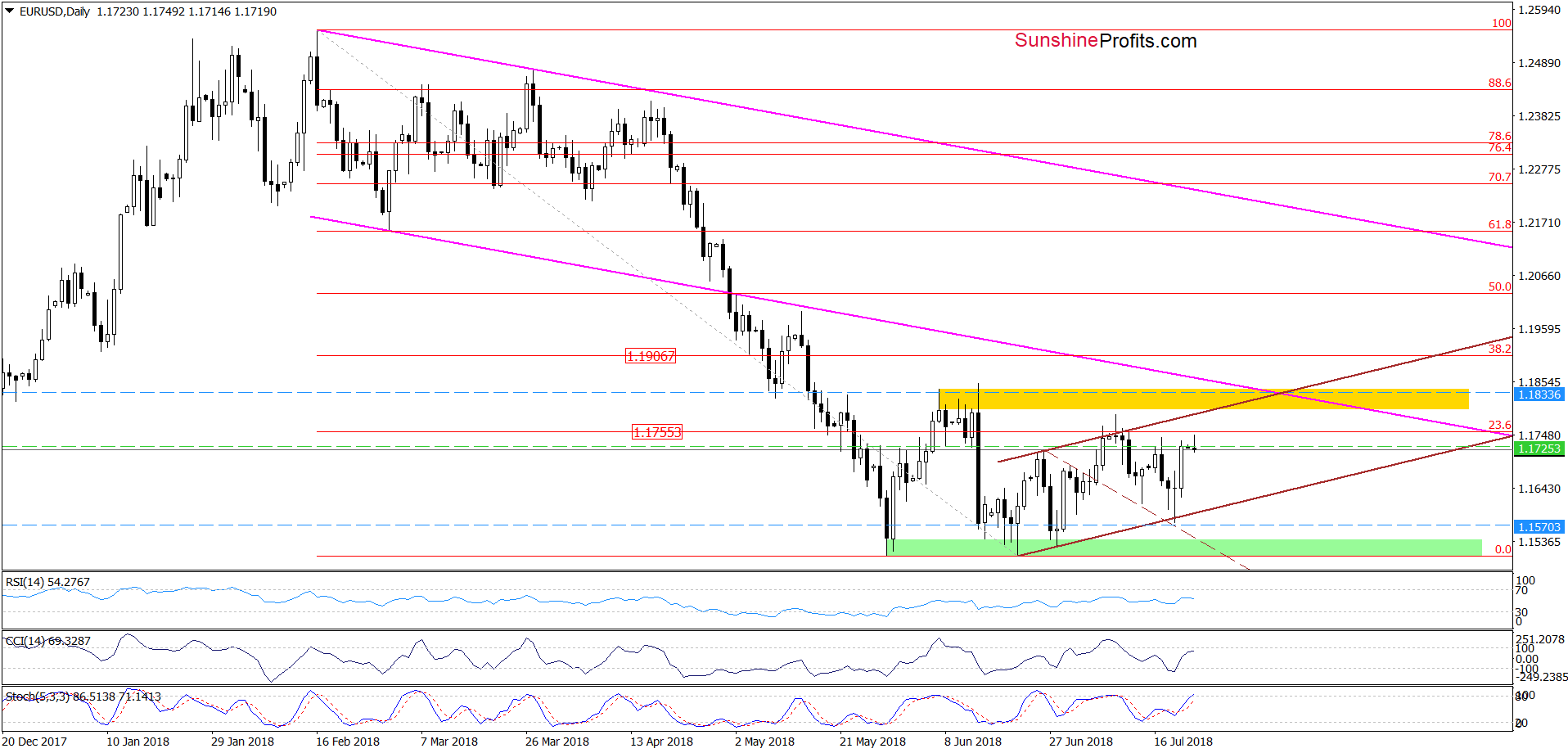

EUR/USD

Earlier today, EUR/USD moved a bit higher, but the proximity to the 23.6% Fibonacci retracement triggered a pullback – similarly to what we saw last Tuesday. Additionally, the pair is trading inside the short-term brown rising trend channel, which means that the overall situation in the short term hasn’t changed much and another move to the downside is just around the corner.

If this is the case and the exchange rate moves south of current levels, we’ll see at least a re-test of the lower border of the brown rising trend channel in the coming week.

Trading position (short-term; our opinion): short positions with a stop-loss order at 1.1833 and the initial downside target at 1.1588 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

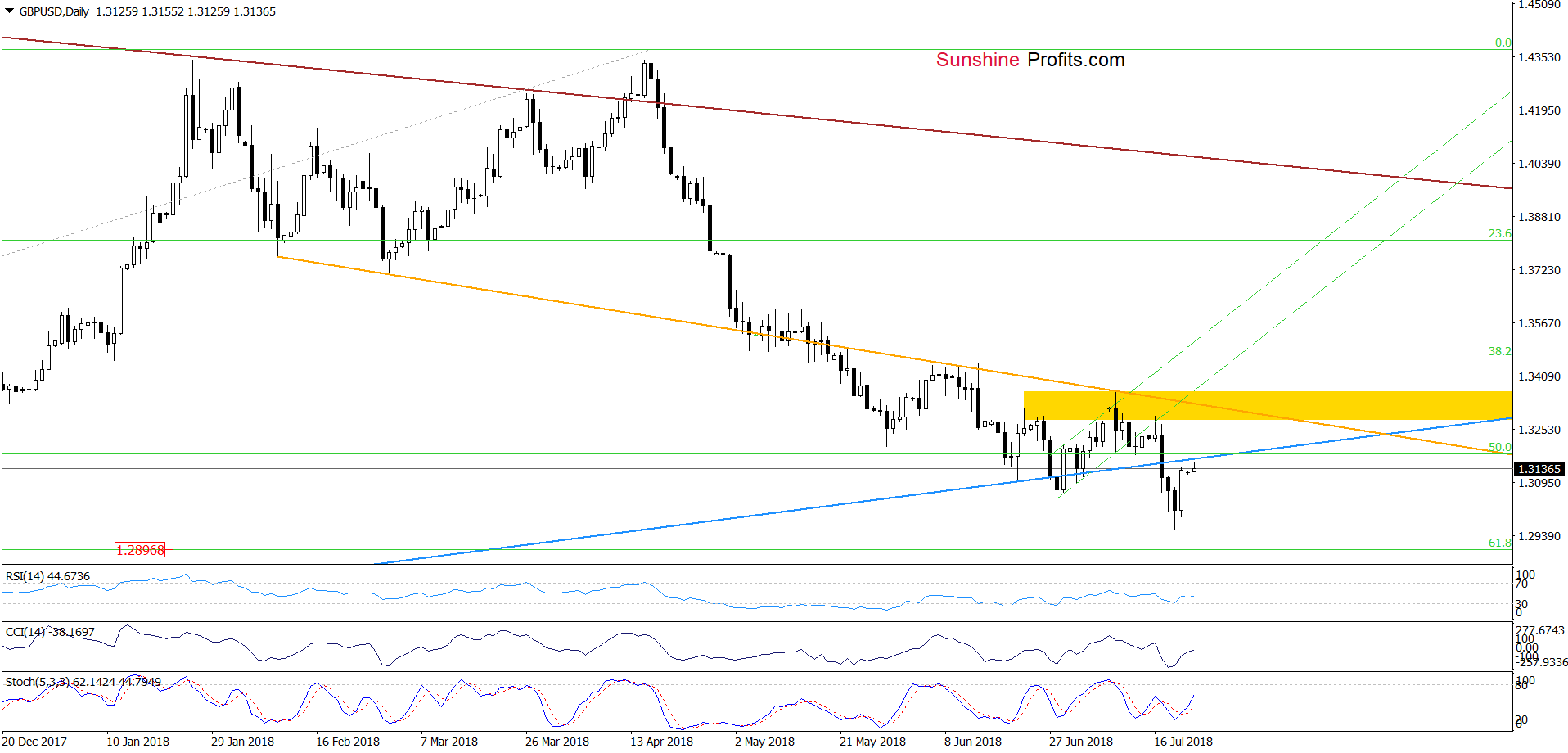

GBP/USD

From today’s point of view, we see that GBP/USD rebounded sharply on Friday, approaching the previously-broken blue support line. Earlier today, the pair moved even a bit higher, which looks like a verification of the last week’s breakdown under this important line.

If the situation develops in line with the above assumption, currency bears will likely show their claws in this area, which should push the pair lower in the very near future.

How low could GBP/USD go after their attack? In our opinion, we’ll likely see not only a test of the recent lows, but also a drop to around 1.2896, where the 61.8% Fibonacci retracement (based on the entire January 2017 – March 2018 upward move) is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

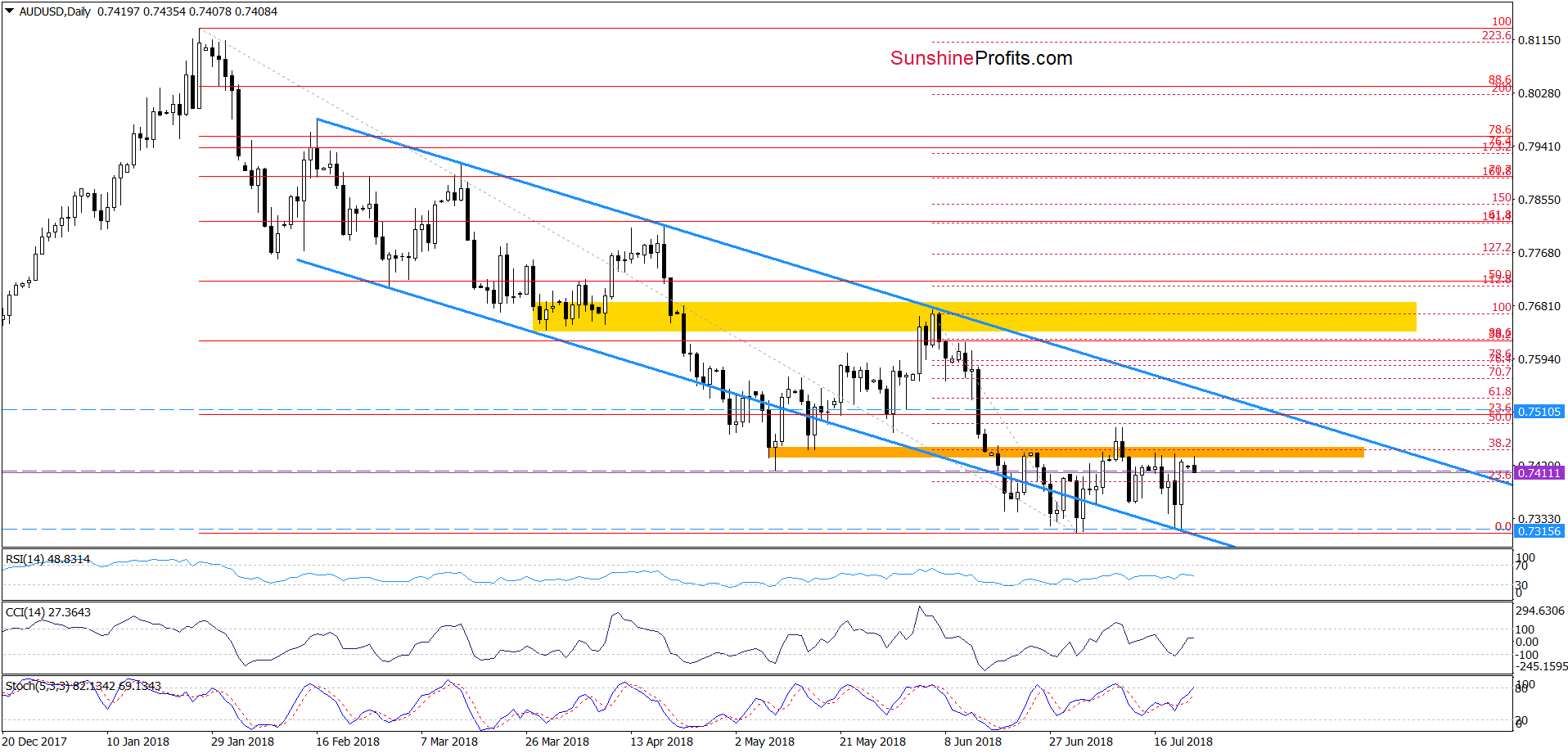

AUD/USD

Although AUD/USD rebounded sharply on Friday, the orange resistance zone managed to stop currency bulls once again, showing their weakness and encouraging their opponents to act.

Earlier today, thanks to the sellers’ determination, AUD/USD erased some part of the recent move to the upside, which suggests that further deterioration and (at least) a decline to the lower border of the blue declining trend channel is very likely in the coming week.

Trading position (short-term; our opinion): short positions with a stop-loss order at 0.7510 and the initial downside target at 0.7315 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts