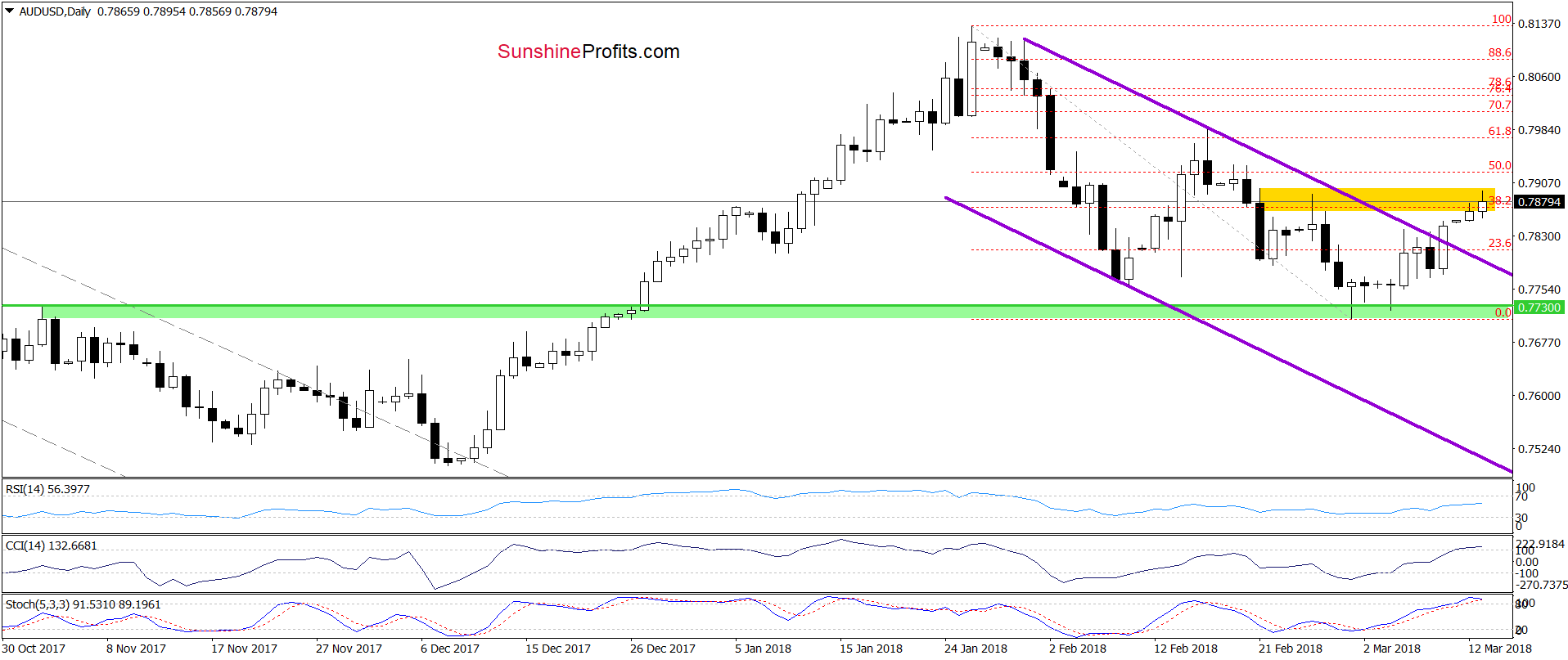

On Friday, the Australian dollar moved sharply higher against its U.S. counterpart, which resulted in a breakout above the upper border of the short-term declining trend channel. But can we trust this development?

In our opinion the following forex trading positions are justified - summary:

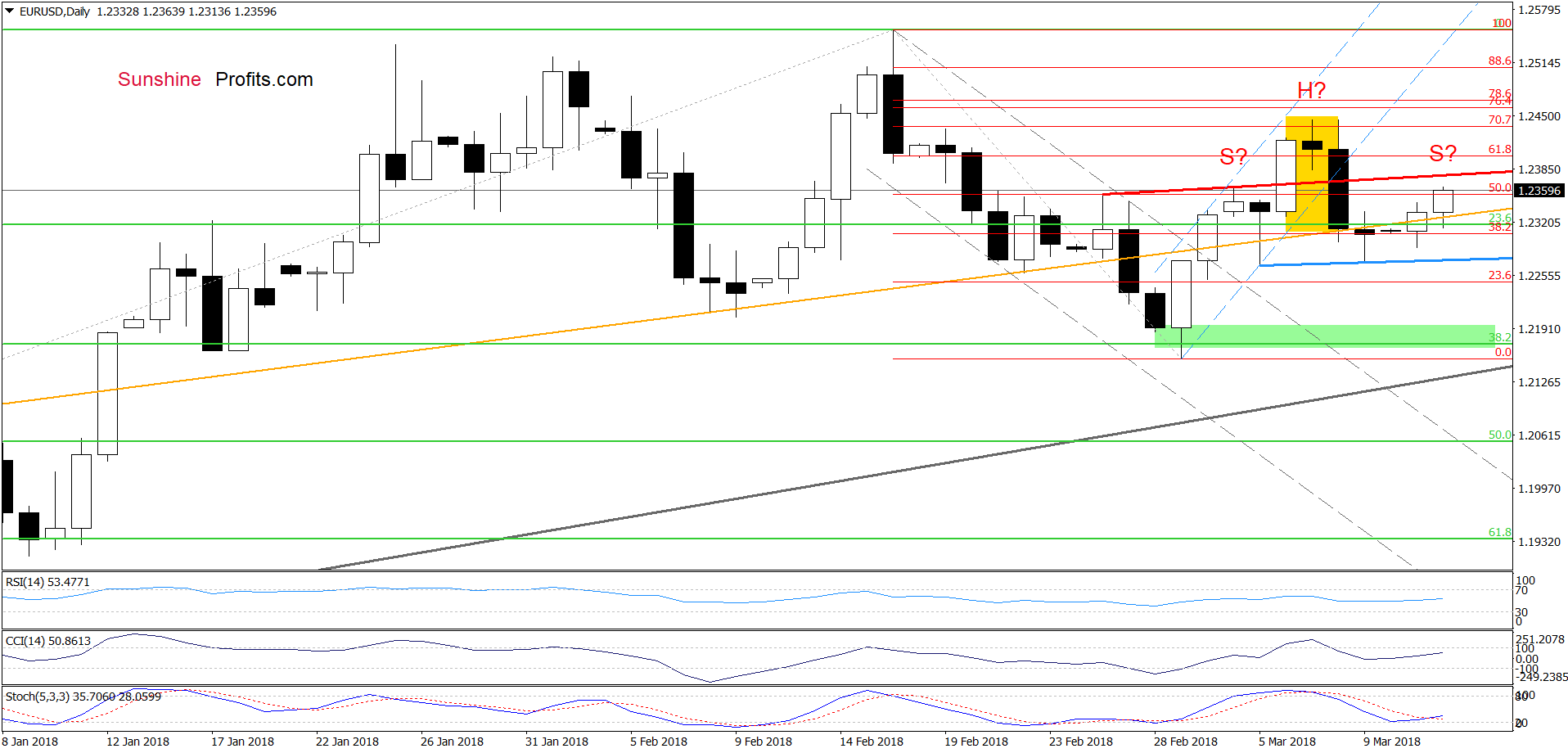

EUR/USD

Quoting our Friday’s Forex Trading Alert:

(…) the euro’s reaction to today's positive U.S. data is surprisingly weak, which raises some doubts about the legitimacy of opening short positions. Therefore, we decided to wait at the sidelines (…), because it seems to us that we could see (…) move to the upside first and an attempt to create the right shoulder of the pro-bearish formation.

Looking at the daily chart, we see that the situation developed in line with the above scenario and EUR/USD extended gains earlier today. Additionally, the Stochastic Oscillator generated a buy signal, which suggests further improvement.

If currency bulls push the exchange rate higher and climb above the red resistance line, we’ll likely see not only a test of the previous highs, but also the resistance zone created by the 76.4% and 78.6% Fibonacci retracements.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective now. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

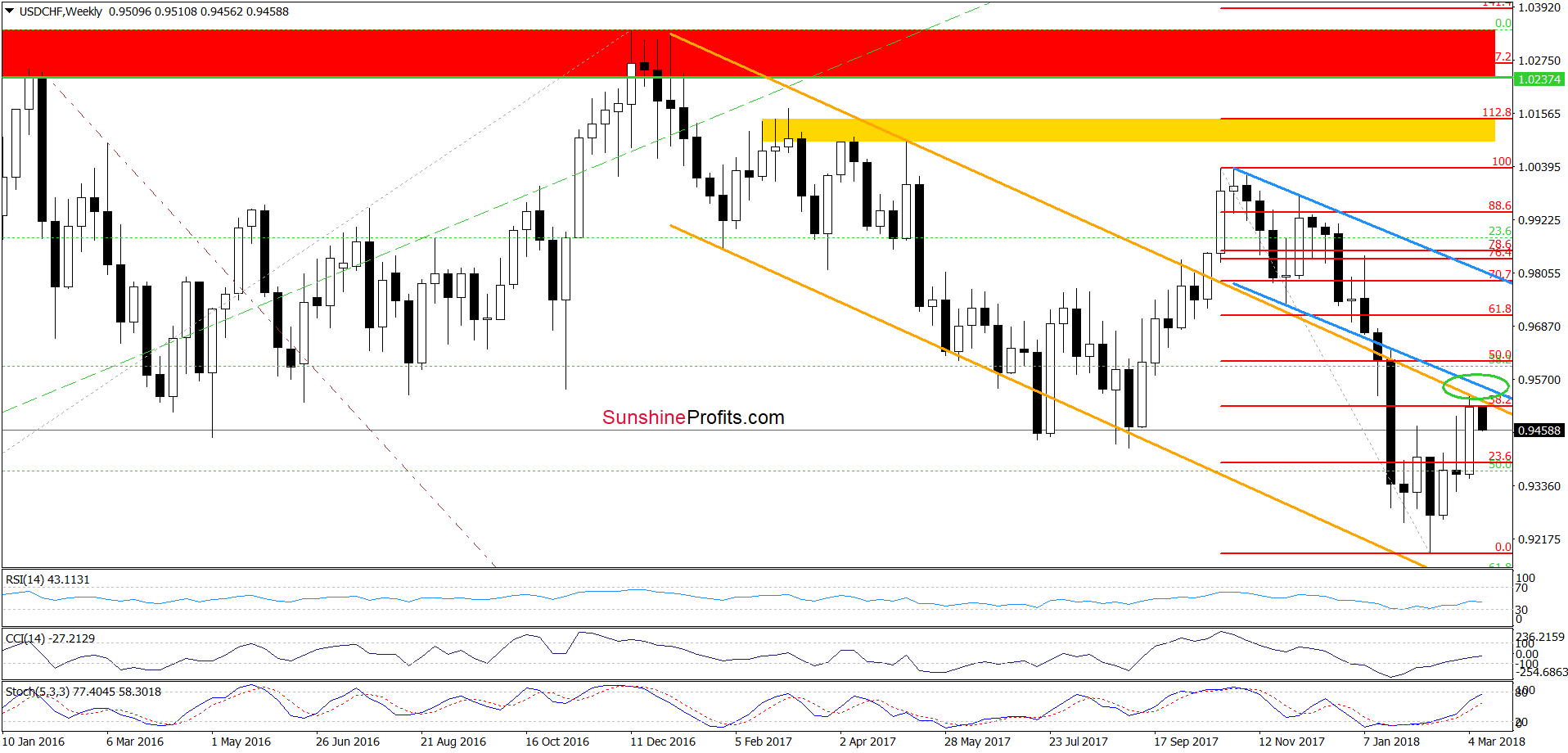

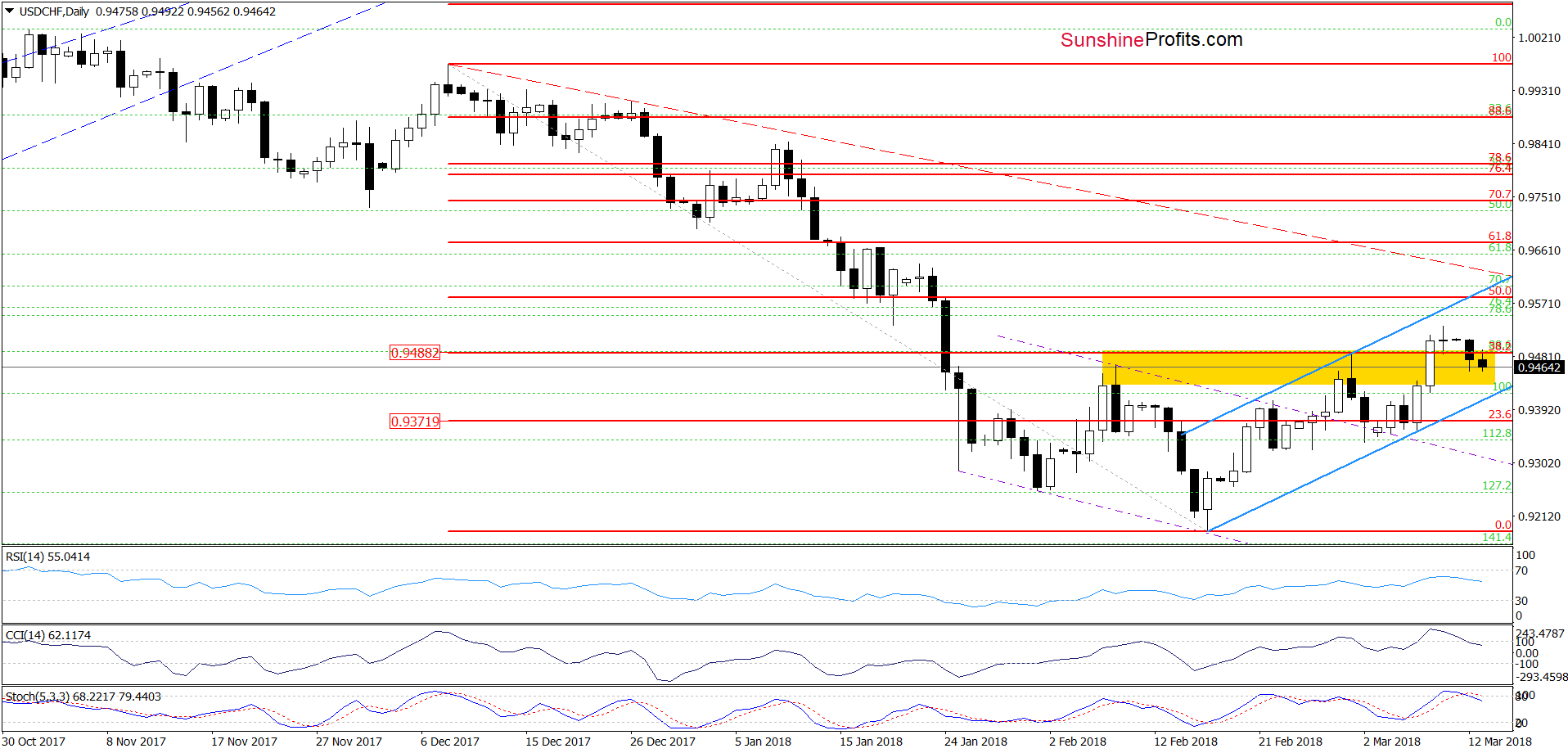

USD/CHF

On Friday, we wrote the following:

(…) on the medium-term chart, we (…) see some negative factors, which could thwart the pro-growth currency bulls’ plans.

(…) USD/CHF climbed not only to the 38.2% Fibonacci retracement, but also to the upper line of the orange declining trend channel and approached the previously-broken lower line of the blue declining trend channel (we marked this resistance area with the green ellipse), which could pause or even stop further improvement.

From today’s point of view, we see that currency bears pushed the exchange rate lower as we had expected. How did this price action affect the short-term picture of USD/CHF? Let’s examine the daily chart to find out.

The first thing that catches the eye on the above chart is an invalidation of the earlier breakout above the 38.2% Fibonacci retracement and the yellow resistance zone. This negative development together with the sell signals generated by the indicators suggest further deterioration in the coming days.

How low could USD/CHF go?

In our opinion, the first downside target will be around 0.9413, where the lower border of the blue rising trend channel currently is. If this support is broken, the next target for the bears will be around 0.9336-0.9370, where the early March lows are.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

Looking at the daily chart, we see that although AUD/USD broke above the upper border of the purple declining trend channel on Friday, we didn’t see a sharp or significant upward move, which raises doubts about currency bulls’ strength.

Additionally, the exchange rate climbed to the yellow resistance area, which together with the current position of the daily indicators suggests that reversal may be just around the corner.

If this is the case and the pair declines from here, the first downside target for currency bears will be around 0.7793, where the previously-broken upper purple line currently is.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts