Although currency bulls thought that the worst is behind them, their opponents attacked, invalidating yesterday’s breakout above the first resistance earlier today. Will this show of weakness take the exchange rate to the recent lows once again?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.2568; the initial downside target at 1.2173)

- GBP/USD: short (a stop-loss order at 1.4480; the initial downside target at 1.3851)

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.2985; the next downside target at 1.2710)

- USD/CHF: long (a stop-loss order at 0.9329; the initial upside target at 0.9736)

- AUD/USD: none

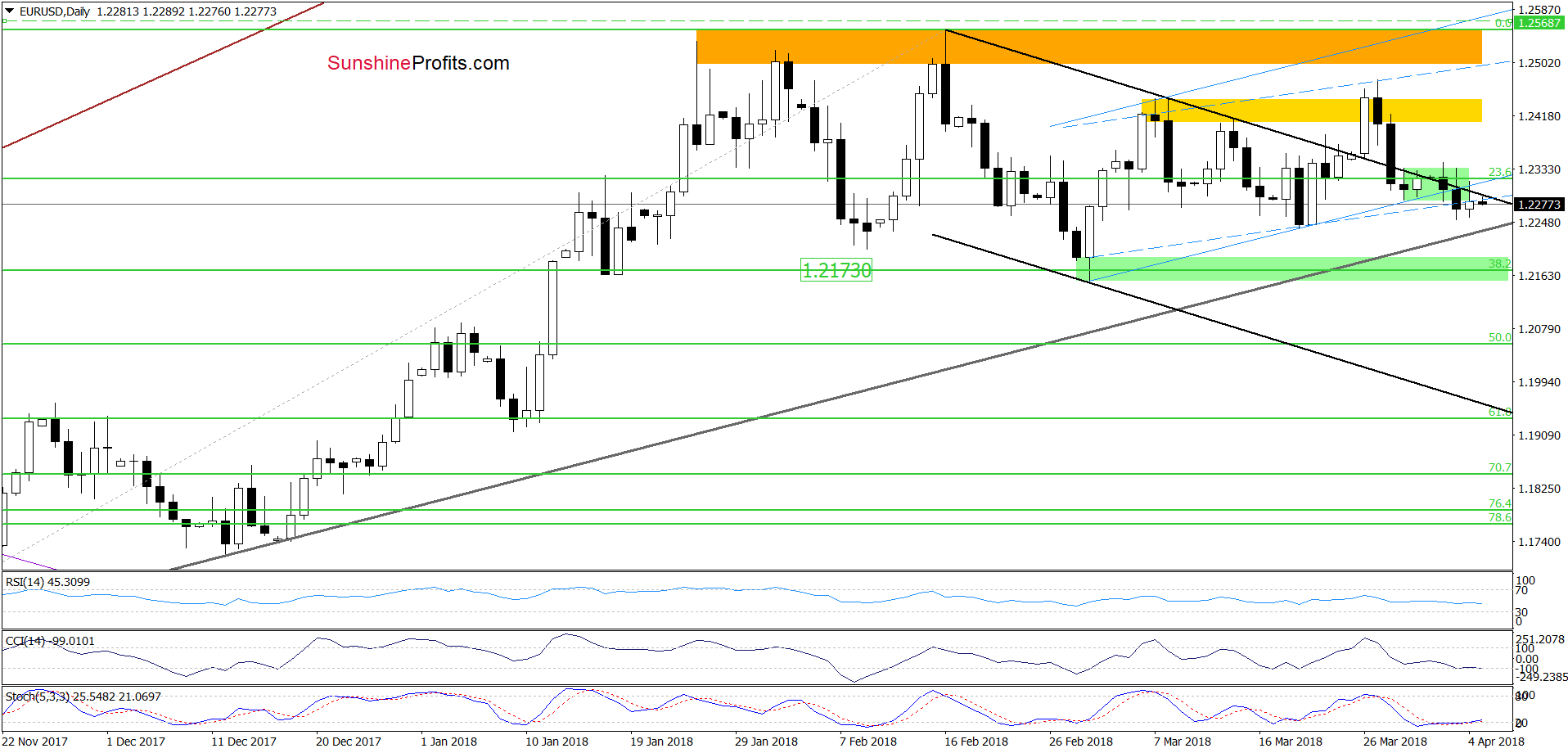

EUR/USD

Looking at the daily chart, we see that although currency bulls tried to push EUR/USD higher during yesterday’s session their attempts failed. The combination of the nearest resistances (the upper border of the black declining trend channel and the lower line of the blue rising trend channel based on previous intraday lows) stopped them, triggering a pullback.

As a result, the pair closed Wednesday’s session not only under these lines, but also below the lower border of the green consolidation, which suggests further deterioration soon.

Where will the pair head next? We believe that the best answer to this question will be the quote from our last alert:

(…) we think that the pair will test not only the medium-term support line based on the November and December 2017 lows, but also the 38.2% Fibonacci retracement and the green support zone in the coming day(s).

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.2568 and the initial downside target at 1.2173) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

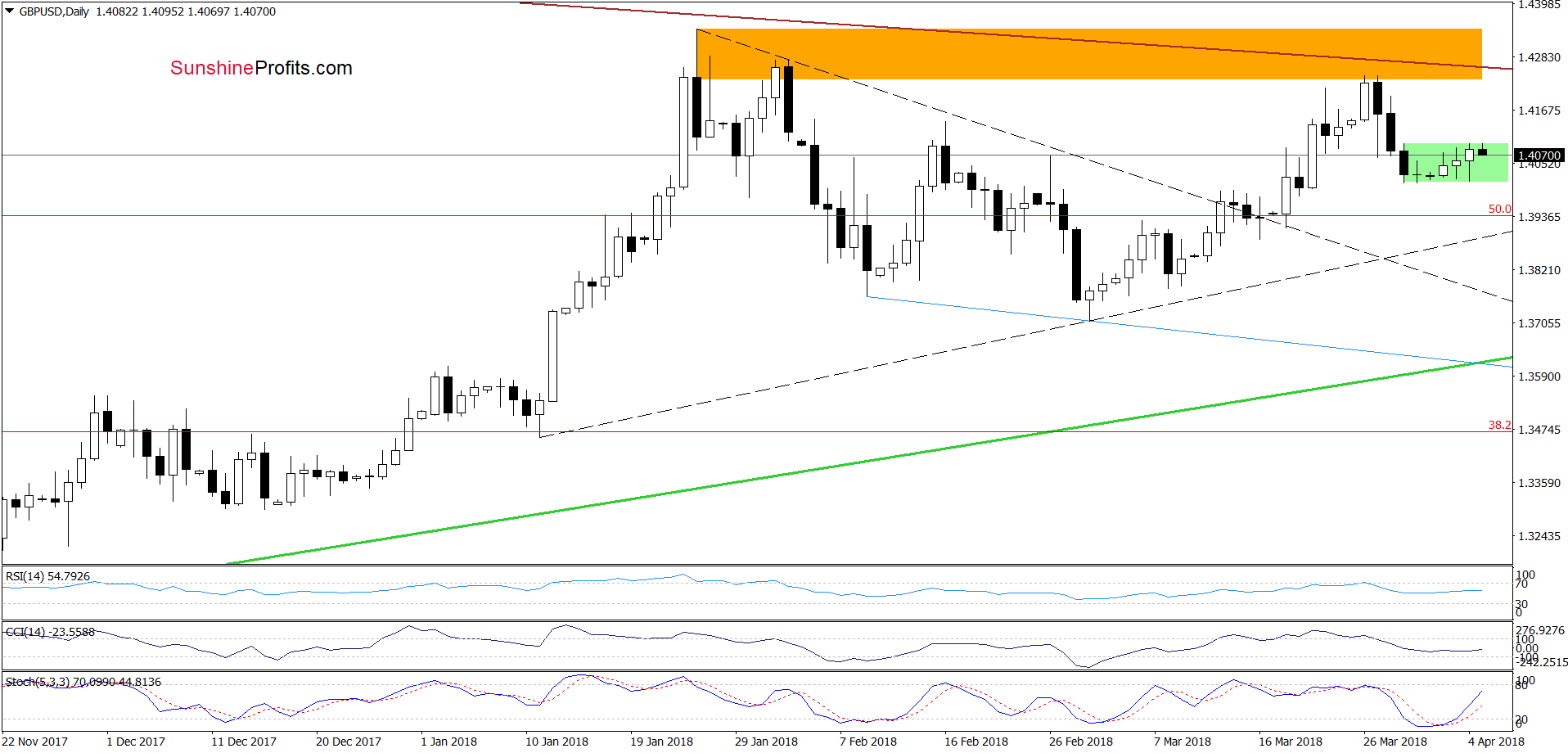

GBP/USD

On the daily chart, we see that the overall situation hasn’t changed much in recent days as GBP/USD is still trading in the green consolidation.

Nevertheless, the size of rebound is quite small compared to the earlier decline, which suggests that another attempt to move lower may be just around the corner.

If this is the case and the exchange rate reverses and declines from here, the pair will test the lower border of the black triangle (marked with dashed lines on the daily chart) in the coming days (currently around 1.3890).

Trading position (short-term; our opinion): Short positions with the stop-loss order at 1.4480 and the initial downside target at 1.3851 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

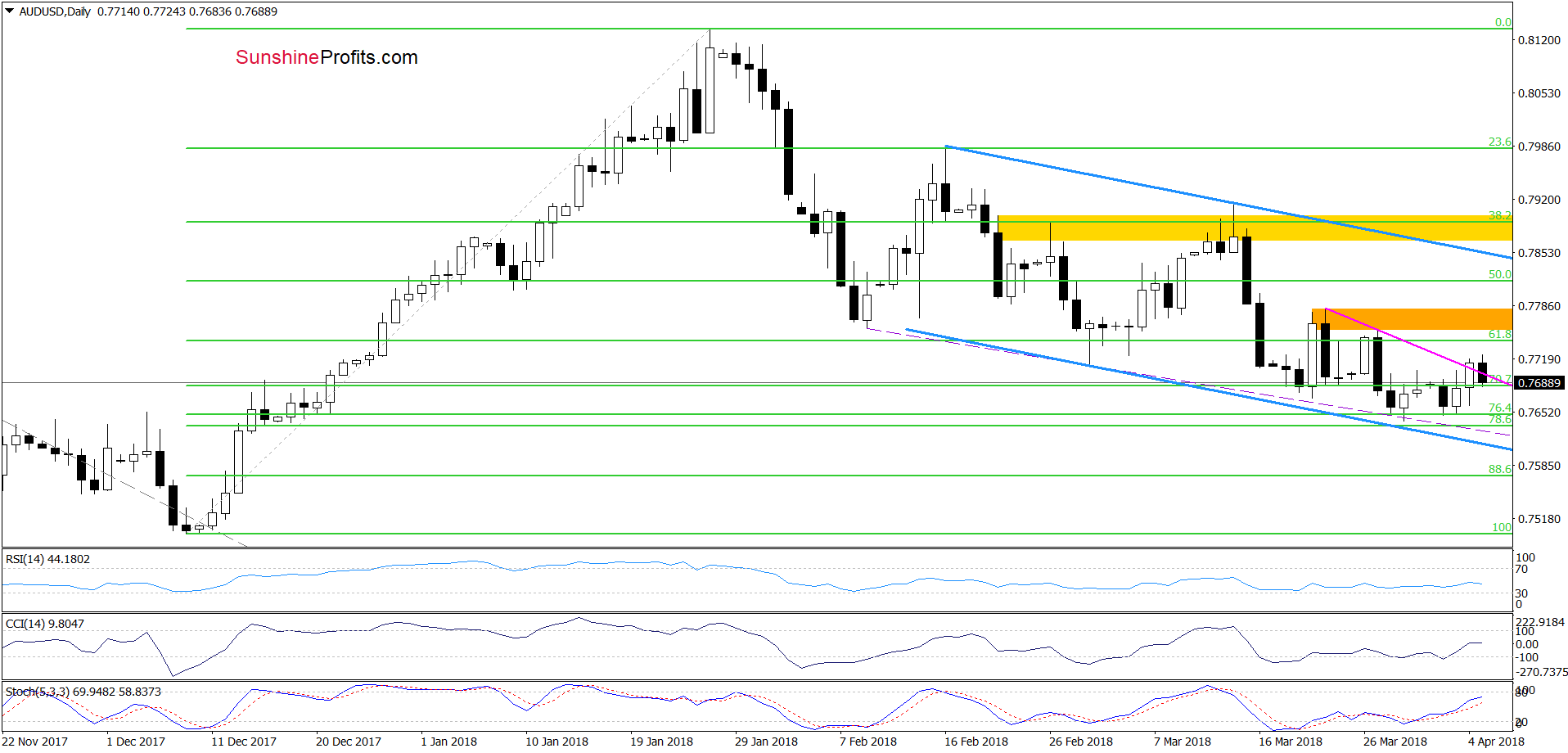

AUD/USD

Yesterday, AUD/USD extended Tuesday’s gains and broke above the pink declining resistance line based on the previous highs. Despite this improvement, currency bears pushed the exchange rate lower earlier today, invalidating yesterday’s breakout, which doesn’t bode well for higher values of the exchange rate in the coming day(s).

In other words, although buy signals generated by the indicators continue to support the buyers, it seems to us that further deterioration and a re-test of the major support zone (created by two Fibonacci retracements, the lower border of the blue declining trend channel and the purple dashed line based on the previous lows) can’t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts