Although currency bulls closed the gap created at the beginning of the week, their weakness in the following days encouraged the sellers to fight. As a result, the pair declined sharply earlier today, hitting a fresh December low. What can we expect in the coming week?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 114.68; the exit target at 112.34)

- USD/CAD:none

- USD/CHF: short (a stop loss order at 1.0192; the exit target at 0.9850)

- AUD/USD:none

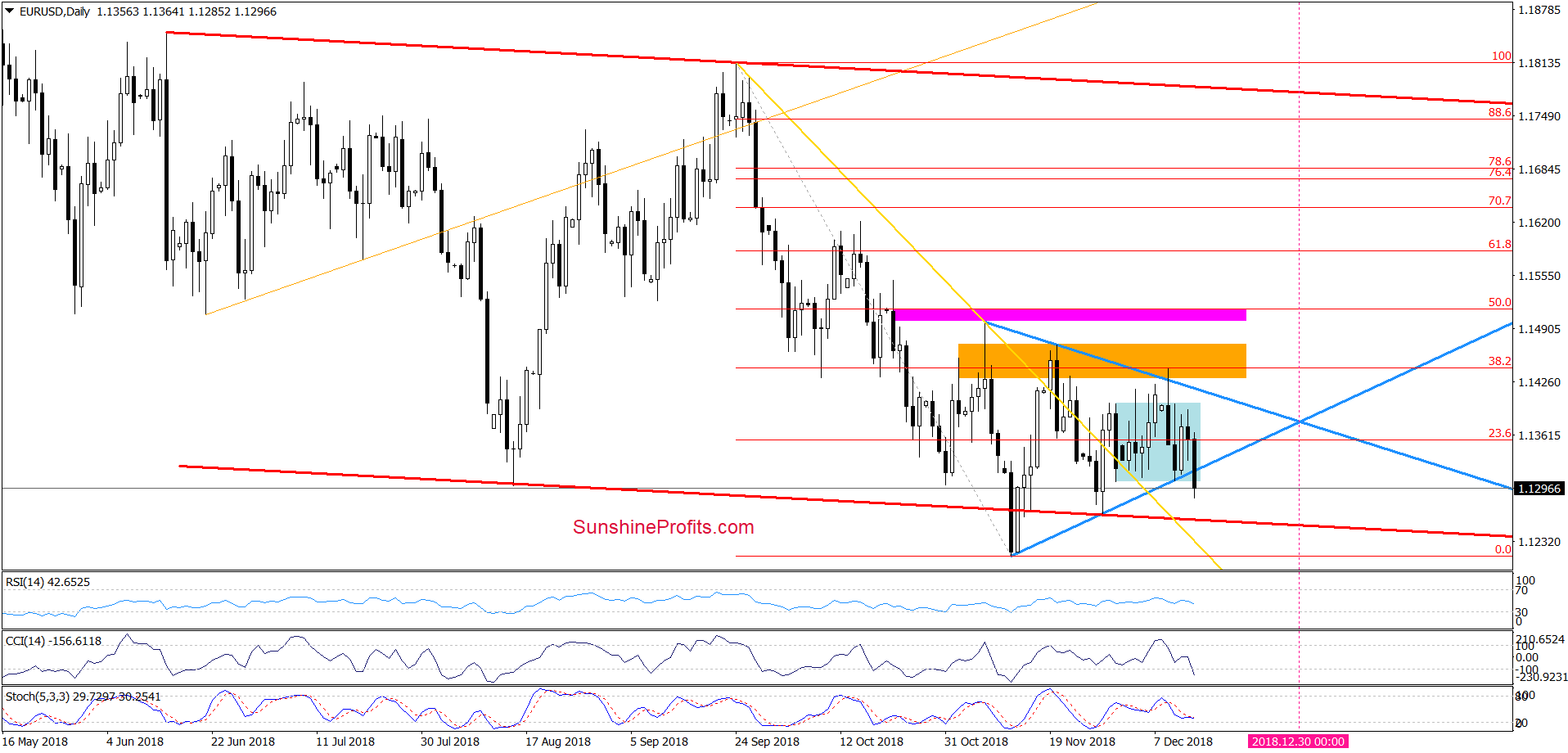

EUR/USD

The first thing that catches the eye on the daily chart is a breakdown not only below the lower border of the blue consolidation, but also below the lower line of the blue triangle. This is a negative development, which will turn into bearish if the exchange rate closes today’s session under these lines.

What could happen if the sellers win? In our opinion, if the pair finishes today’s session at current levels (or lower), we’ll see a test of the lower border of the red declining trend channel or even the mid-November lows at the beginning of the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

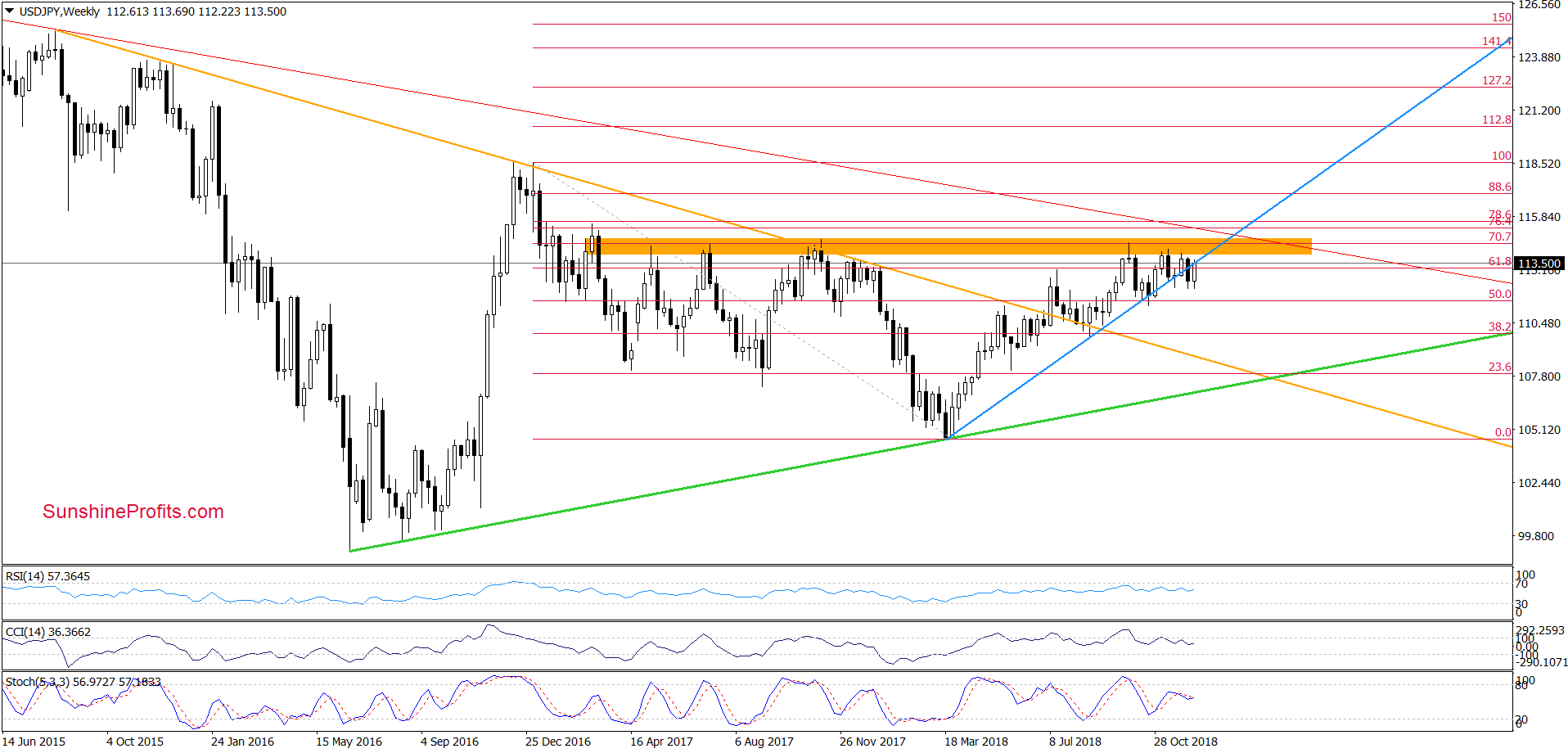

USD/JPY

Looking at the medium-term chart, we see that although USD/JPY moved a bit higher earlier this week, the overall situation in the broader perspective hasn’t changed much as the exchange rate is still trading under the previously-broken long-term blue line.

Taking this fact into account, we continue to believe that this week’s price action is nothing more than a verification of the earlier breakdown and suggests that reversal and lower values of the exchange rate might be just around the corner.

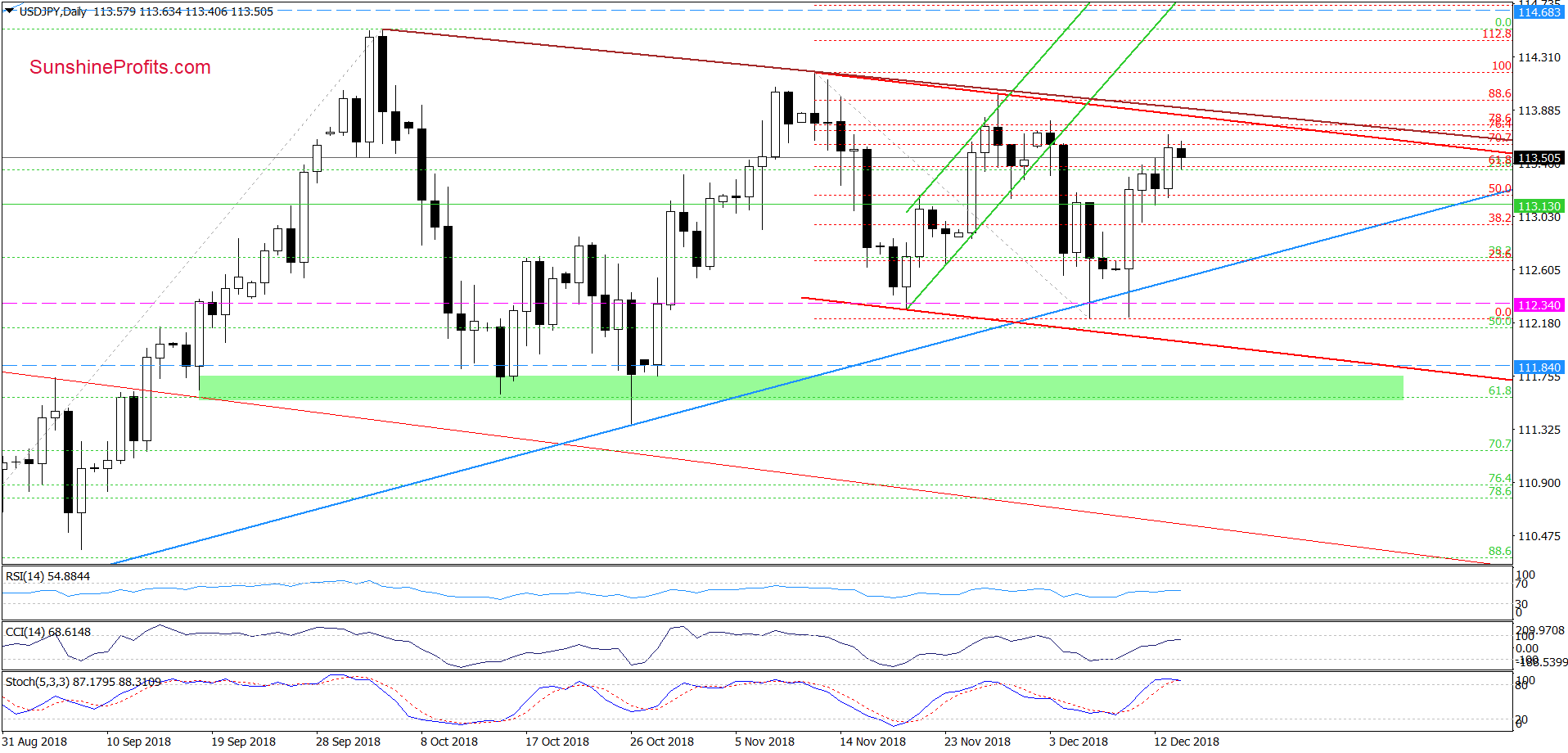

This scenario is also reinforced by the short-term picture. Why?

Because the pair is trading not only below the 76.4% and 78.6% Fibonacci retracements, but also below the brown declining resistance line (based on the October and mid-November highs) and the upper border of the red declining tend channel.

Additionally, the current position of the daily indicators suggests that the space for gains is limited and reversal is just a matter of time (a very short time).

How low could the pair go if currency bears show their claws?

In our opinion, the first downside target will be around 112.54, where the blue support line (marked on the daily chart) currently is.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at 114.68 and the exit target at 112.34 are justified from the risk/reward perspective.

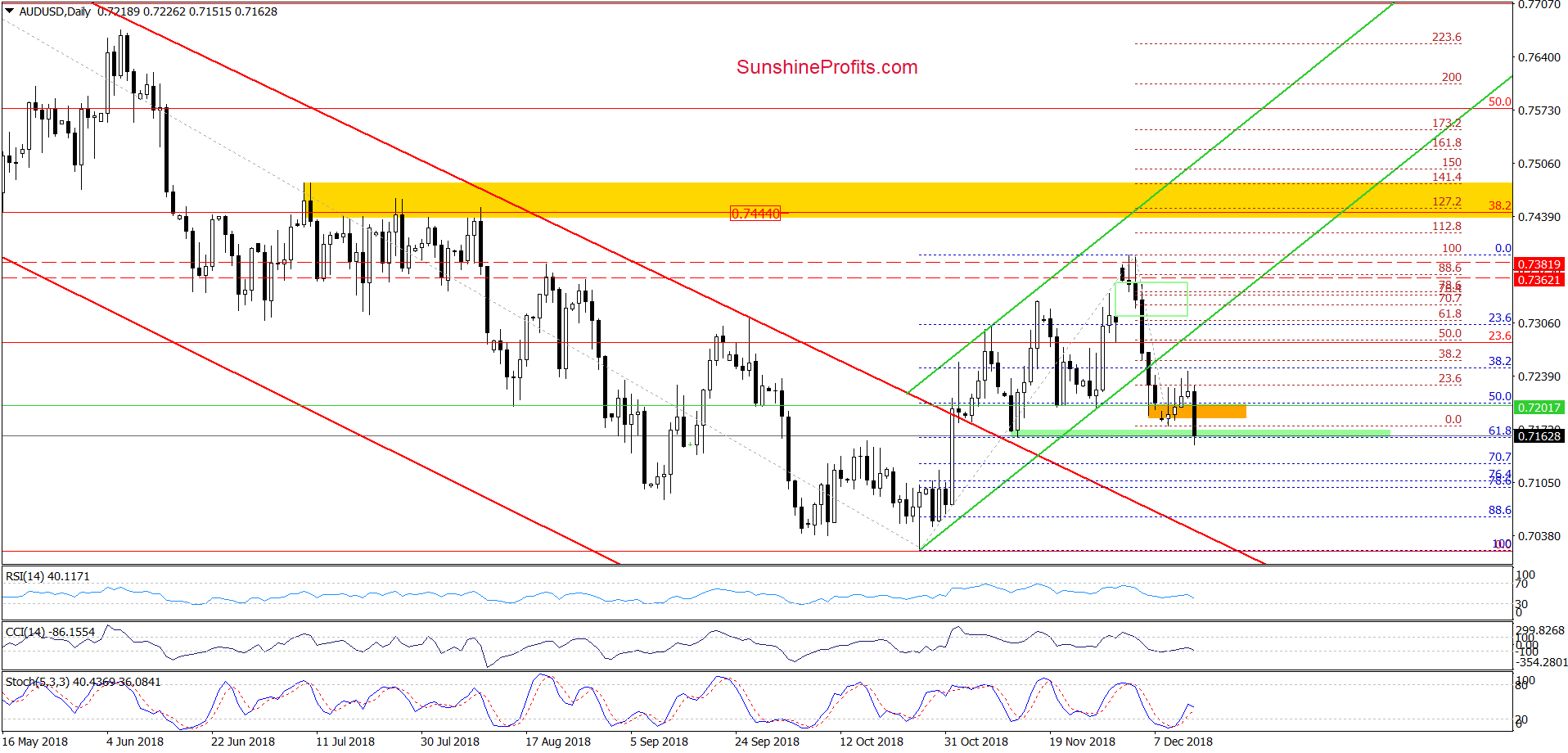

AUD/USD

Quoting our last commentary on this currency pair:

(…) AUD/USD came back to the previously-broken 50% Fibonacci retracement and the upper border of the gap, but in our opinion, as long as there is no daily closure above these resistances all upswings could be nothing more than a verification of the earlier breakdown.

Therefore, we think that one more downswing and a test of the above-mentioned green zone is very likely in the coming days.

As you see on the daily chart although the exchange rate closed the small gap (marked with orange) in recent days, currency bulls didn’t even manage to push the pair to the 38.2% Fibonacci retracement.

This show of weakness encouraged their opponents to act, which resulted in a sharp decline to our downside target earlier today.

What’s next for AUD/USD?

Taking into account the importance of the green zone (it is based not only on the mid-November low, but also on the 61.8% Fibonacci retracement), we think that the closure of today’s session will determine the fate of the currency pair.

If the buyers manage to hold it, we’ll see a rebound at the beginning of next week and the first upside target will be around yesterday’s peak. However, if the pair finishes Friday’s session below these supports, the way to the area marked with the red ellipse (created by the 76.4% and 78.6% Fibonacci retracements) will likely be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts