Although currency bulls managed to invalidate two of the earlier breakdowns, there are some technical factors that raise some doubts about their strength. Is it right?

- EUR/USD: short (a stop-loss order at 1.1878; the initial downside target at 1.1343)

- GBP/USD: short (a stop-loss order at 1.3256; the initial downside target at 1.2923)

- USD/JPY: half of the long positions (a stop-loss order at 112.47; the next upside target at 114.03)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

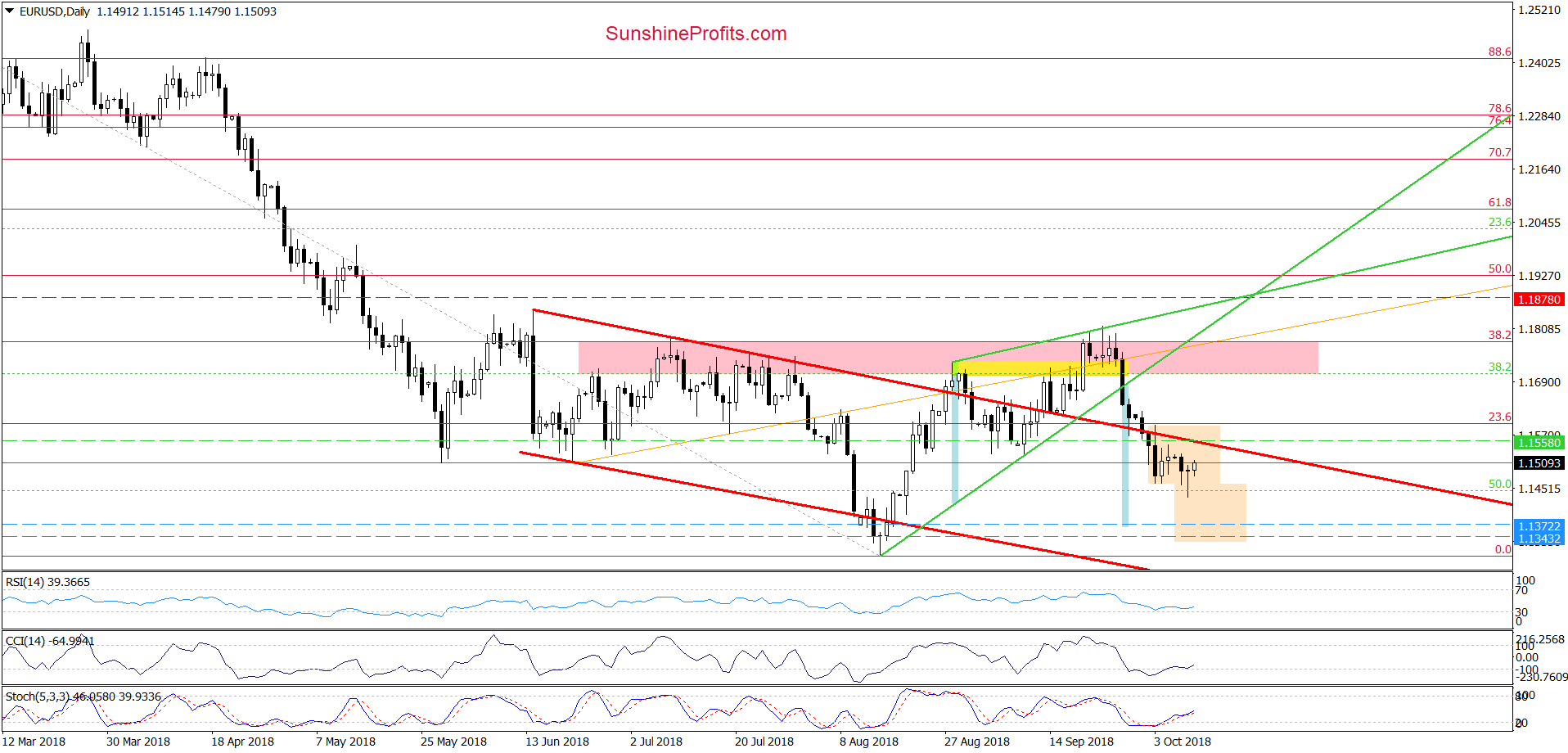

EUR/USD

From today’s point of view, we see that EUR/USD bounced off yesterday’s lows and invalidated the earlier breakdown under the lower line of the consolidation. Additionally, the CCI and the Stochastic Oscillator generated buy signals, which suggests that we’ll see a re-test of the strength of the upper line of the red declining trend channel before another bigger move to the downside appears.

Nevertheless, as long as the pair remains inside the channel lower values of EUR/USD are more likely than not. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1878 and the initial downside target at 1.1343 are justified from the risk/reward perspective.

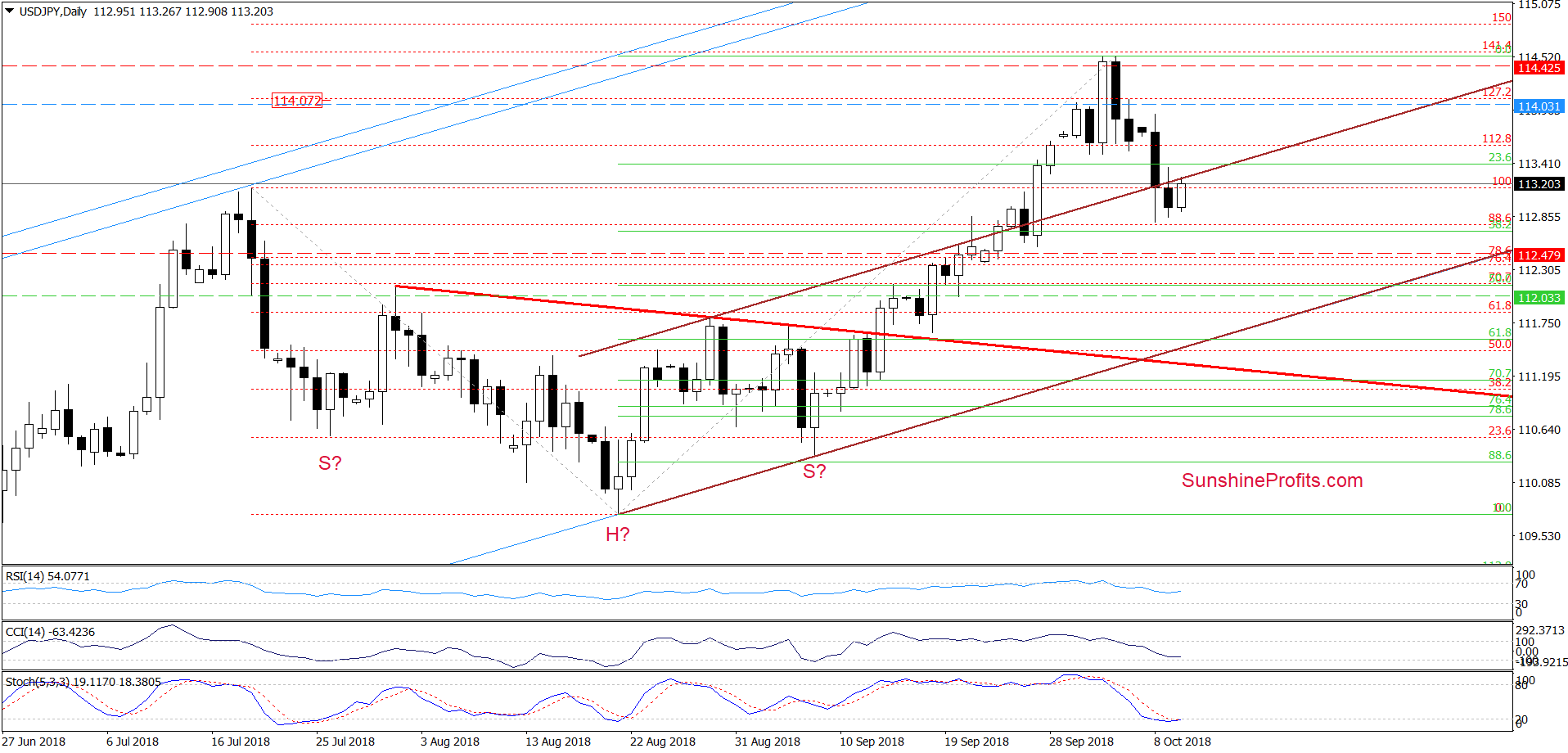

USD/JPY

Looking at the daily chart we see that USD/JPY corrected over a monthly uptrend and dropped below the previously-broken upper line of the brown rising trend channel during yesterday’s session.

Although this price action looks pretty gloomy at the first glance, we should keep in mind that the size of the correction is quite small as it didn’t even reach the 38.2% Fibonacci retracement.

Additionally, the current position of the indicators suggests that further improvement is just around the corner (even if we see a test of the above-mentioned retracement first). Nevertheless, the pro-growth scenario will be more likely and reliable if USD/JPY climbs above the upper border of the brown trend channel and invalidates yesterday breakdown.

What could happen if we see such price action? In our opinion, currency bulls not only climb to our upside target at 114.03, but also re-test the recent highs and the 141.4% Fibonacci extension in the following days.

Trading position (short-term; our opinion): half of already existing profitable long positions (with a stop-loss order at 112.47 and the next upside target at 114.03) are justified from the risk/reward perspective.

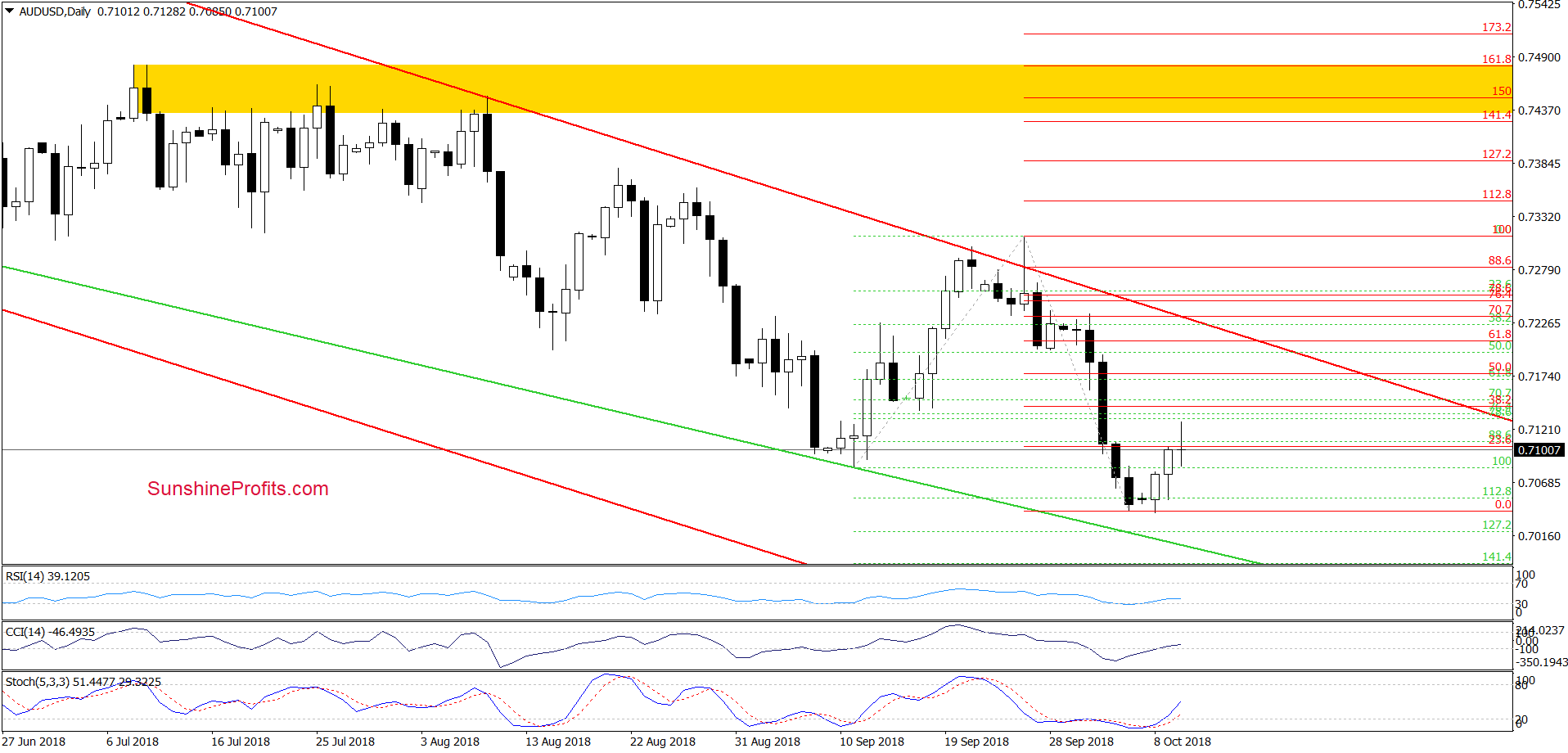

AUD/USD

On the daily chart, we see that Monday’s invalidation of the breakdown under the 112.8% Fibonacci extension encouraged currency bulls to act and triggered further improvement during the following sessions.

Despite this rebound, the buyers didn’t manage to take AUD/USD to the 38.2% Fibonacci retracement, which raises some doubts about their strength (at least at the moment of writing this alert). Nevertheless, the buy signals generated by the daily indicators suggest that they will try to go higher in the very near future.

If this is the case and the pair extends gains from here, we’ll see a test the above-mentioned retracement. However, if the buyers do not show strength in this area, one more downswing and a test of the 127.2% Fibonacci extension should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts