On Thursday, the Australian dollar extended losses against its U.S. counterpart and closed the day at the lowest level for over two weeks. Despite this deterioration, currency bulls triggered a rebound earlier today. What’s next for AUD/USD?

- EUR/USD: half of the recent short positions (a stop-loss order at 1.1417; the exit downside target at 1.1300)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7180; the exit downside target at 0.7064)

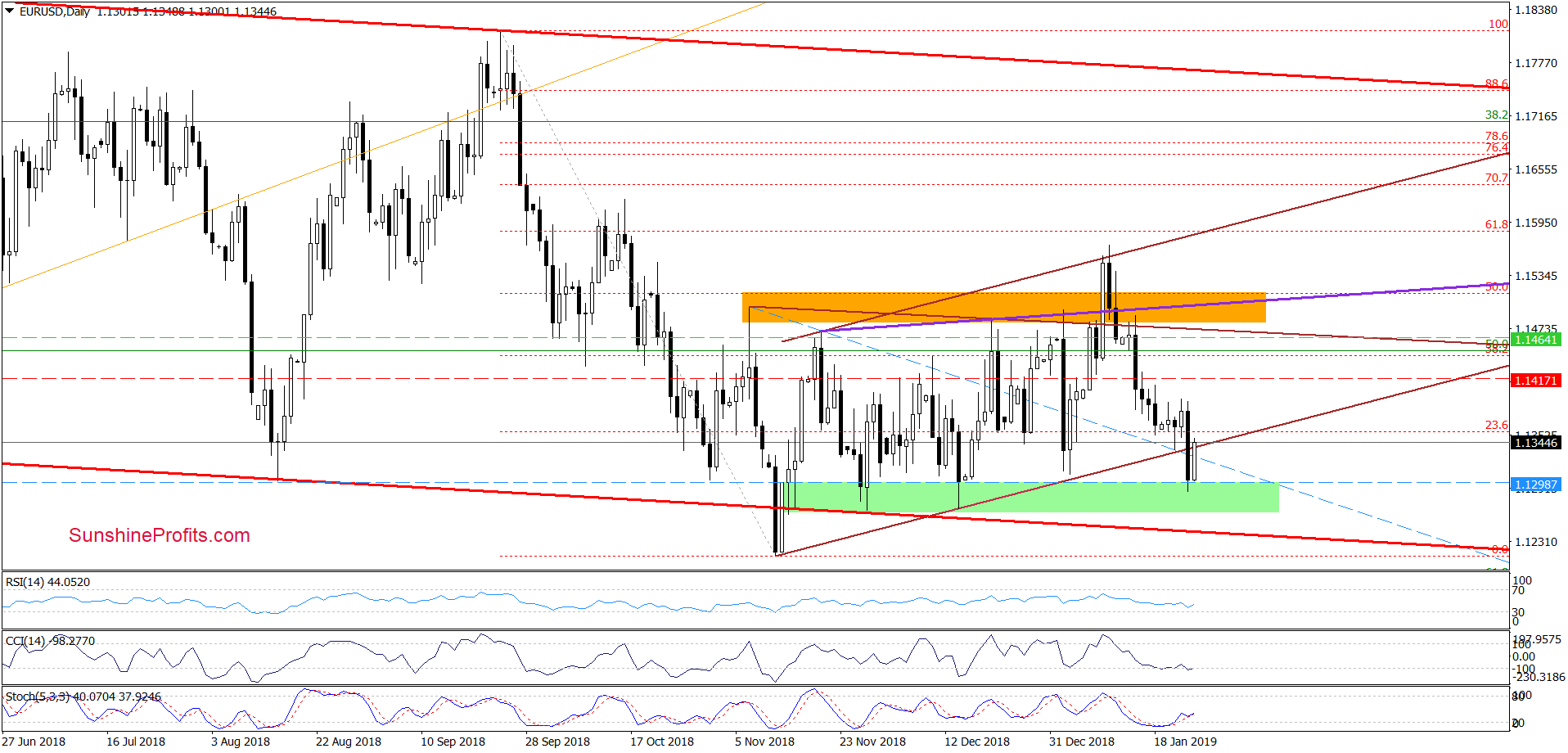

EUR/USD

Yesterday, EUR/USD extended losses and dropped under the lower border of the brown rising trend channel, reaching our next downside target and the green support zone. Although the exchange rate closed the day below the channel, the above-mentioned support area encouraged the bulls to act, which translated into rebound earlier today.

Thanks to today’s increase, the pair came back above the lower border of the formation, which looks like an invalidation of yesterday’s breakdown (at least at the moment of writing these words). Nevertheless, as long as there is no daily closure inside the formation one more downswing can’t be ruled out.

Taking all the above into account, we think that the closure of today's session will probably decide the fate of our short positions. What does this mean in practice? If the bulls keep gained levels and EUR/USD closes the day inside the channel, we’ll probably close them and consider an opening of long positions on Monday. However, if the buyers show weakness and the currency pair ends the day under the channel, the bears will likely test the green support zone once again. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Half of recent profitable short positions with a stop-loss order at 1.1417 and the exit downside target at 1.1300 are justified from the risk/reward perspective.

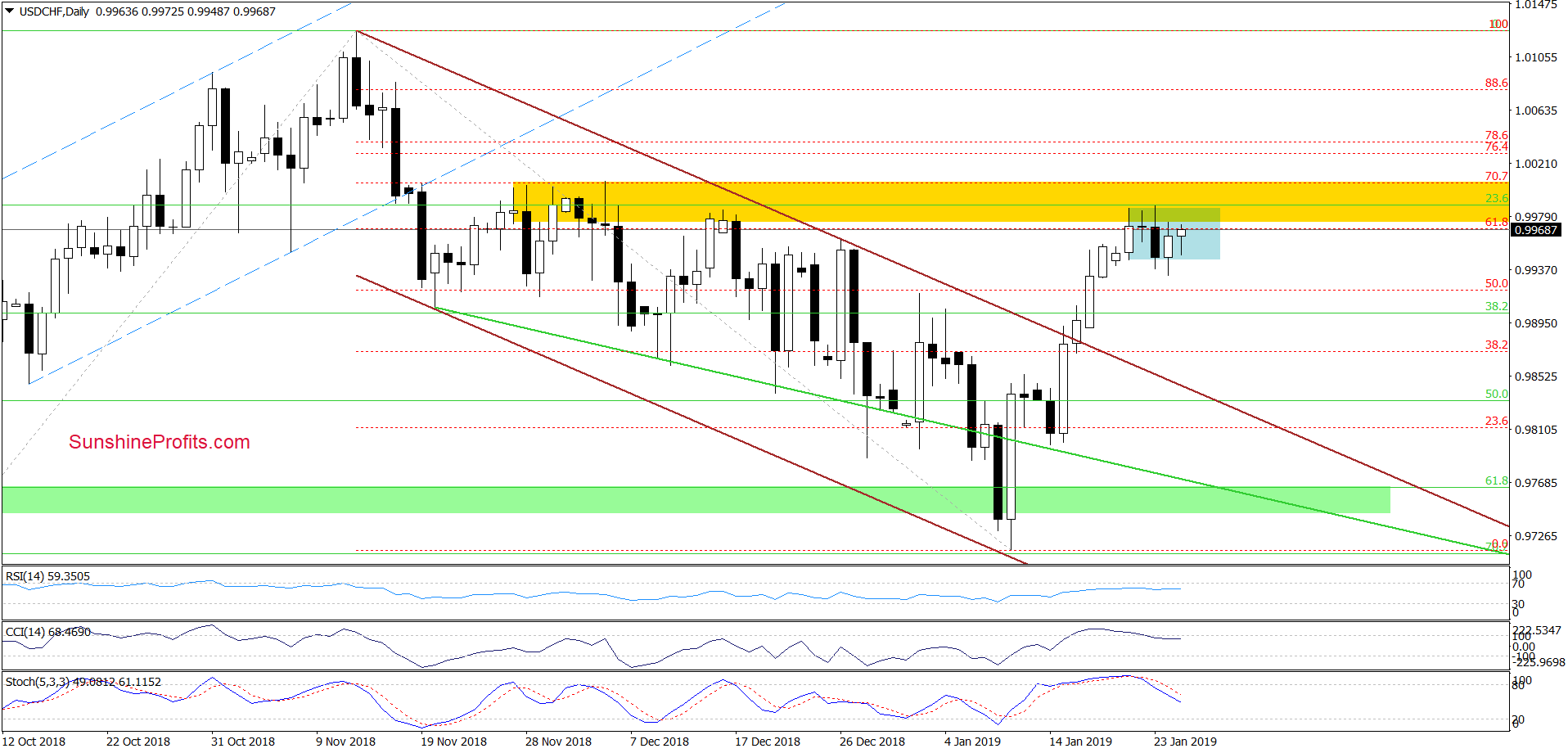

USD/CHF

From today’s point of view, we see that although the sellers tried to go south in recent days, their attempts failed, and USD/CHF came back into the blue consolidation. Although this is a positive sign, we should keep in mind that the exchange rate is still trading under the yellow resistance zone and the sell signals generated by the indicators continue to support the sellers and lower values of the pair.

Therefore, if the bulls do not manage to push the pair higher and we’ll see a drop below the lower border of the blue consolidation we’ll consider opening short positions.

What could happen if the bulls fail? In our opinion, USD/CHF will likely decline and test the previously-broken upper border of the brown declining trend channel in the following days. Therefore, we believe that it is worth carefully observing the behavior of this currency pair in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

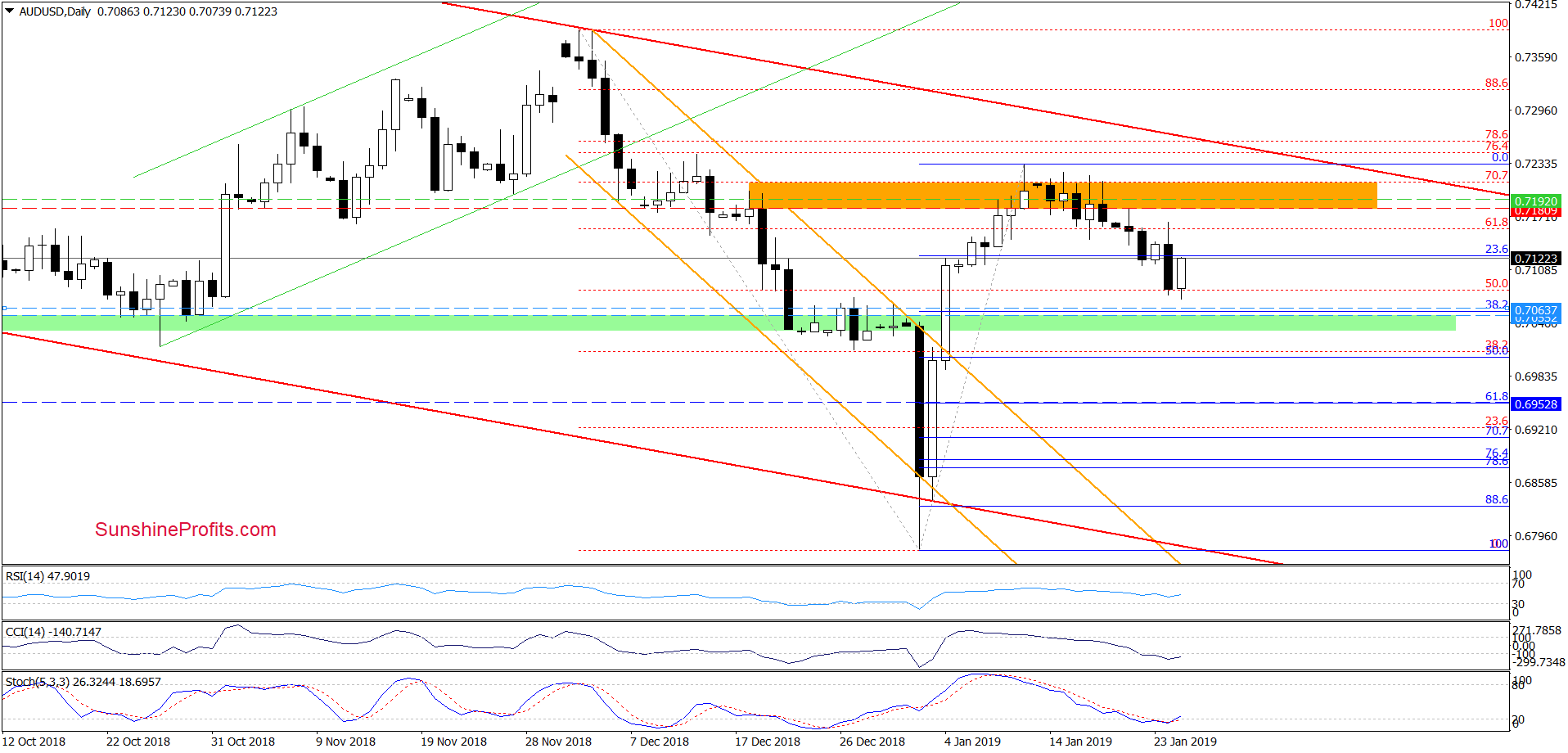

AUD/USD

Looking at the daily chart, we see that currency bulls took AUD/USD a bit higher yesterday, but as it turned out it was a very short-lived improvement. As you see, the exchange rate reversed and slipped not only under the 23.6% Fibonacci retracement, but also below the earlier lows.

Although the pair closed the day under the retracement, the proximity to the 38.2% Fibonacci retracement encouraged the bulls to act. As a result, they triggered a rebound and the pair headed north (similarly to wat we saw in the case of EUR/USD). Taking this fact into account and combining it with the current position of the indicators, it seems that further improvement is just around the corner.

Nevertheless, as long as there is no daily closure above yesterday’s high one more downswing and test of the 38.2% retracement can’t be ruled out.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 0.7180 and the exit downside target at 0.7064 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager