The euro bulls keep fighting for higher values. The USD just had a three-day losing streak and today so far, it's almost flat. The question on everybody's mind is... Has the USD stabilized today? Sure, you expect us to have the answer... And apart from that, we have one brand new candidate for opening a position to tell you about!

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (50% of already existing positions) (a new stop-loss order at 0.7074; the next downside target at).

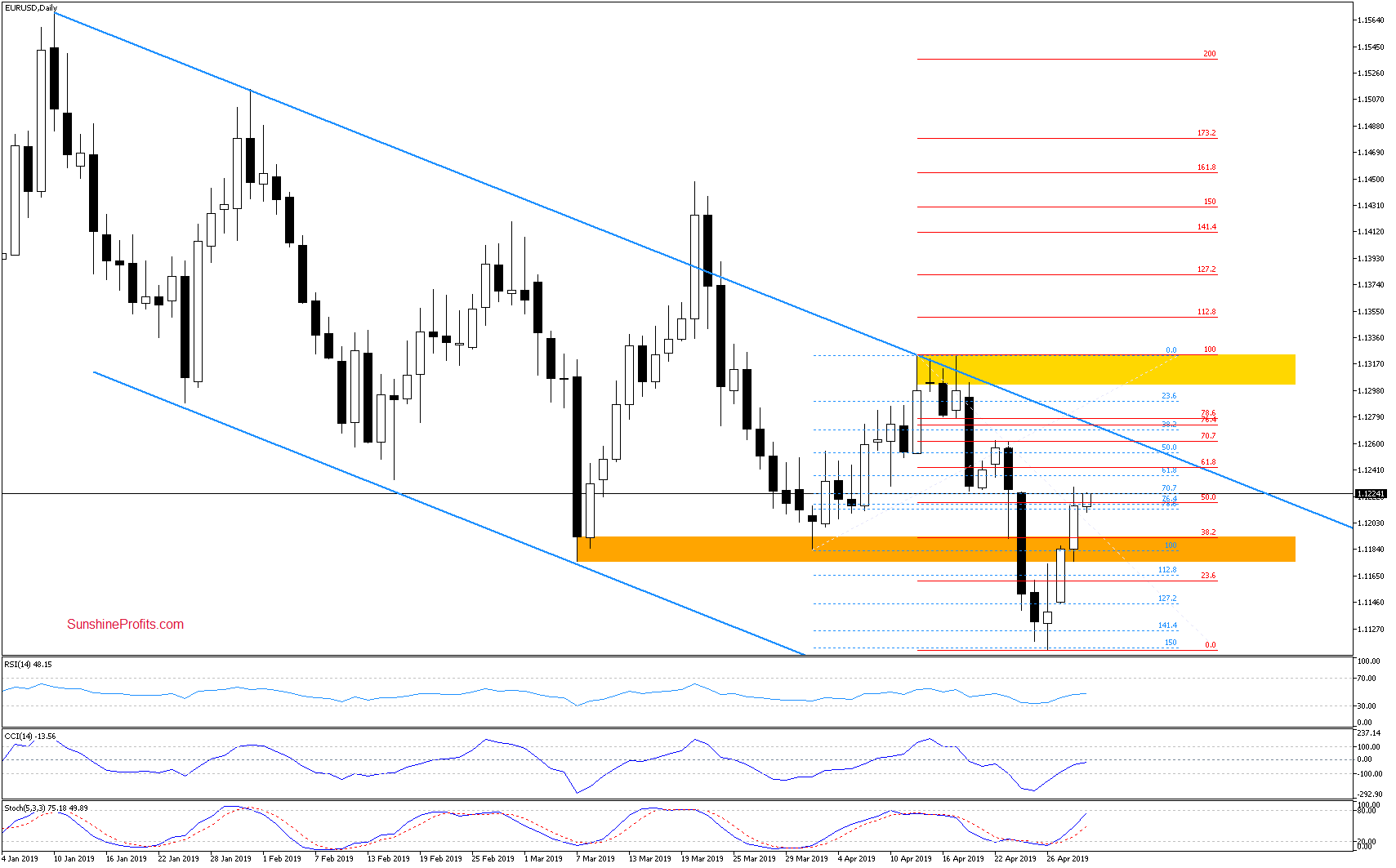

EUR/USD

Yesterday, the bulls made an attempt to overcome the 50% Fibonacci retracement, however they were unable to hold on to all of their gains. The resulting pullback means a close below this resistance level and an invalidation of the intraday breakout above it.

Earlier today, the bulls are attempting another breakthrough and have made it to yesterday's highs already (the rate trades at around 1.1235 currently). Combined with the buy signals of the daily indicators, it suggests that we may see a test of the 61.8% Fibonacci retracement in the near future, just like we've told you yesterday.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

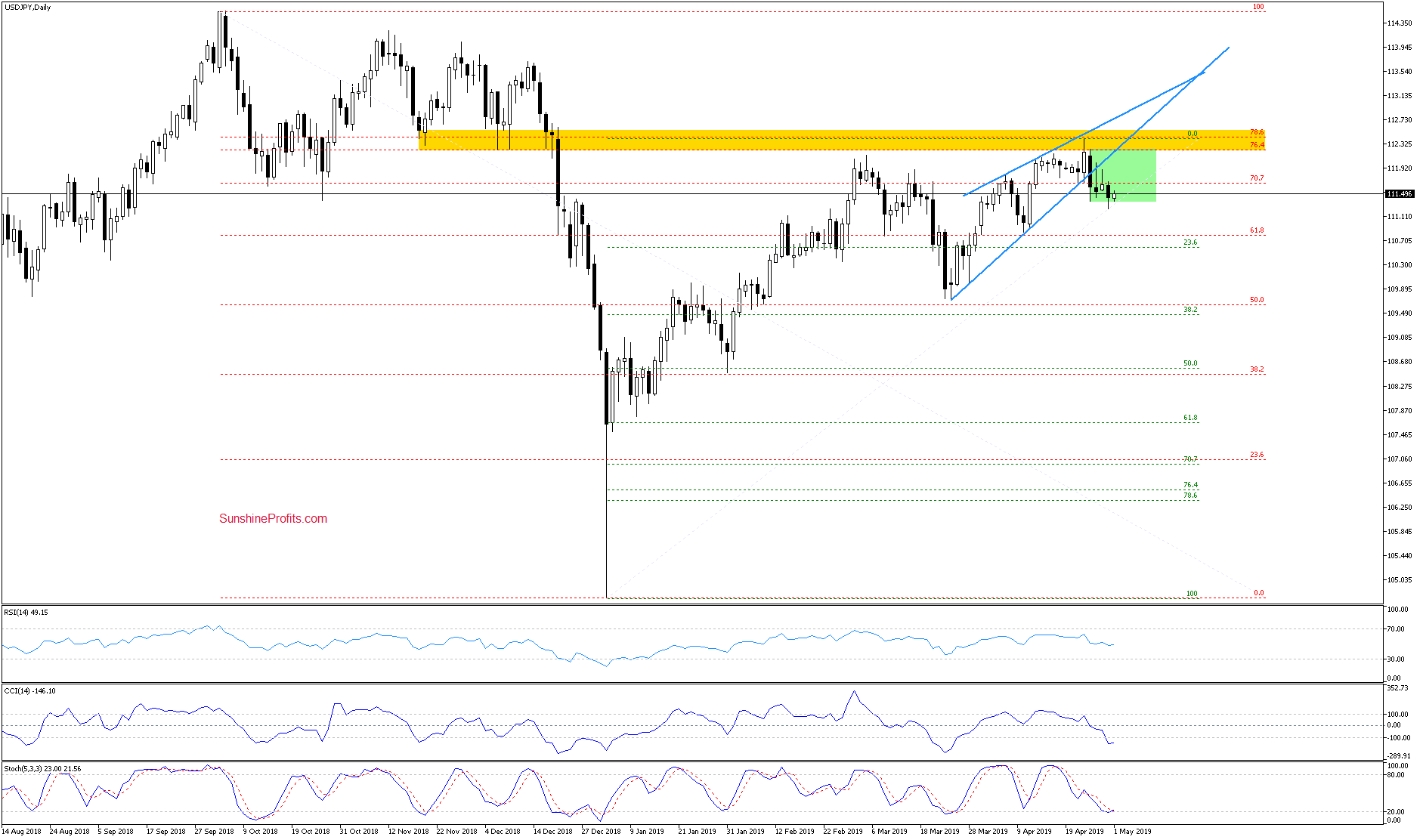

USD/JPY

Yesterday, we've seen a tiny breakdown below the lower border of the green consolidation that ended up invalidated. This is a positive sign for the bulls.

Earlier today, they've tried to take the rate higher but at the moment of writing these words, it looks like they've failed. The price action again broke down from the green consolidation and the pair changes hands at around 111.30 currently but the session is far from over.

The Stochastic Oscillator generated a buy signal. If the rate closes today's session inside the consolidation for the second time in a row, we'll likely see further improvement in the coming days.

That could be followed by a test of the upper border of the consolidation, just where the lower border of the blue rising wedge is (112.25). Should we see signs of a lasting improvement, we'll consider opening long positions.

However, please remember that the Japanese Golden Week's implications for volatility are far from being over. We've described the details in our Monday's alert.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

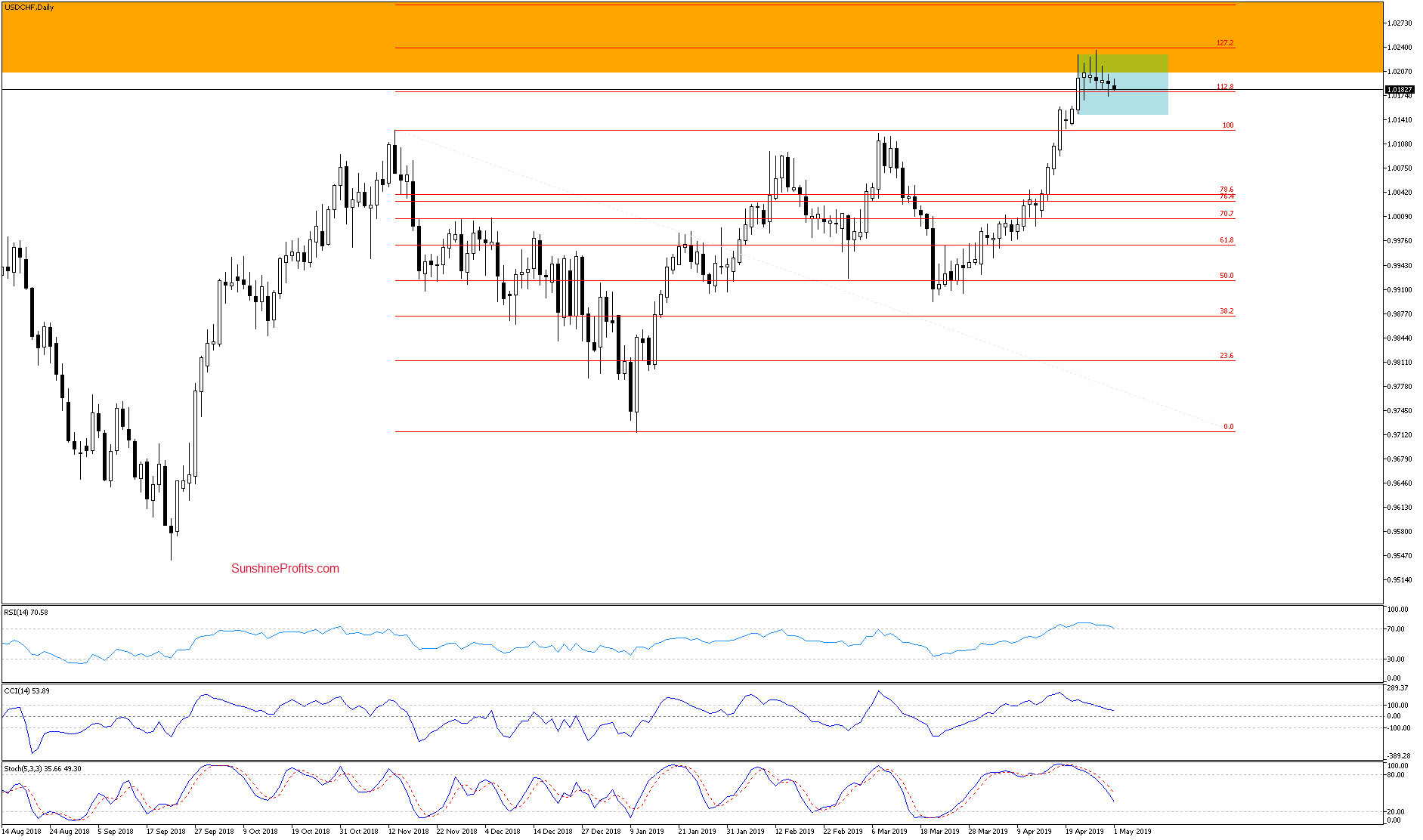

USD/CHF

The monthly chart shows that the pair has finished April below the orange resistance zone. It means that the bulls lacked the power to take the rate above this major resistance.

How does the short-term situation look like?

The daily perspective reveals that the exchange rate still trades inside the blue consolidation. Combined with the orange resistance zone, the proximity to the 127.2% Fibonacci retracement and the sell signals generated by the daily indicators, it increases the probability of further deterioration. Should we see a breakdown below the blue consolidation, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the remainder of our profitable short position in AUD/USD continues to be justified. The rate appears to be rolling over and yesterday's downswing appears to be the starting point. This is further supported by the failed upswing earlier today and the pair trading at around 0.7045 currently. As for USD/JPY, today's close will provide a hint whether the rate has stabilized. Should we see signs of USD/JPY strength, we'll consider going long. USD/CAD technical posture looks deteriorating and should the price break down from the green consolidation on the daily chart, we' ll consider opening short positions. The same for USD/CHF should it break down from its blue consolidation. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist