In our opinion, the following forex trading positions are justified - summary:

EUR/USD

In our yesterday's commentary on this currency pair, we wrote that EUR/USD climbed slightly above the late August peak and the 50% Fibonacci retracement, but then the bulls lost strength. This translated into a pullback at the beginning of this week.

Additionally, we assumed that if the bears take over the market, the exchange rate could test the previously-broken green horizontal line based on the last month's peak.

What happened after our Alert was posted? Let's check.

From today's point of view, we see that the pair extended losses and reached our first downside target. The sell signal generated by the Stochastic Oscillator remains on the cards, giving support to the bears.

Nevertheless, we think that as long as there is no daily close below the above-mentioned line, a reversal from here and a test of the 50% Fibonacci retracement or even the recent high can't be ruled out. Therefore, we decided to keep our cool and refrain from opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, we will carefully observe the actions of both the bulls and bears, in the areas discussed today, waiting for more clear clues as to the direction of the next bigger move.

GBP/USD

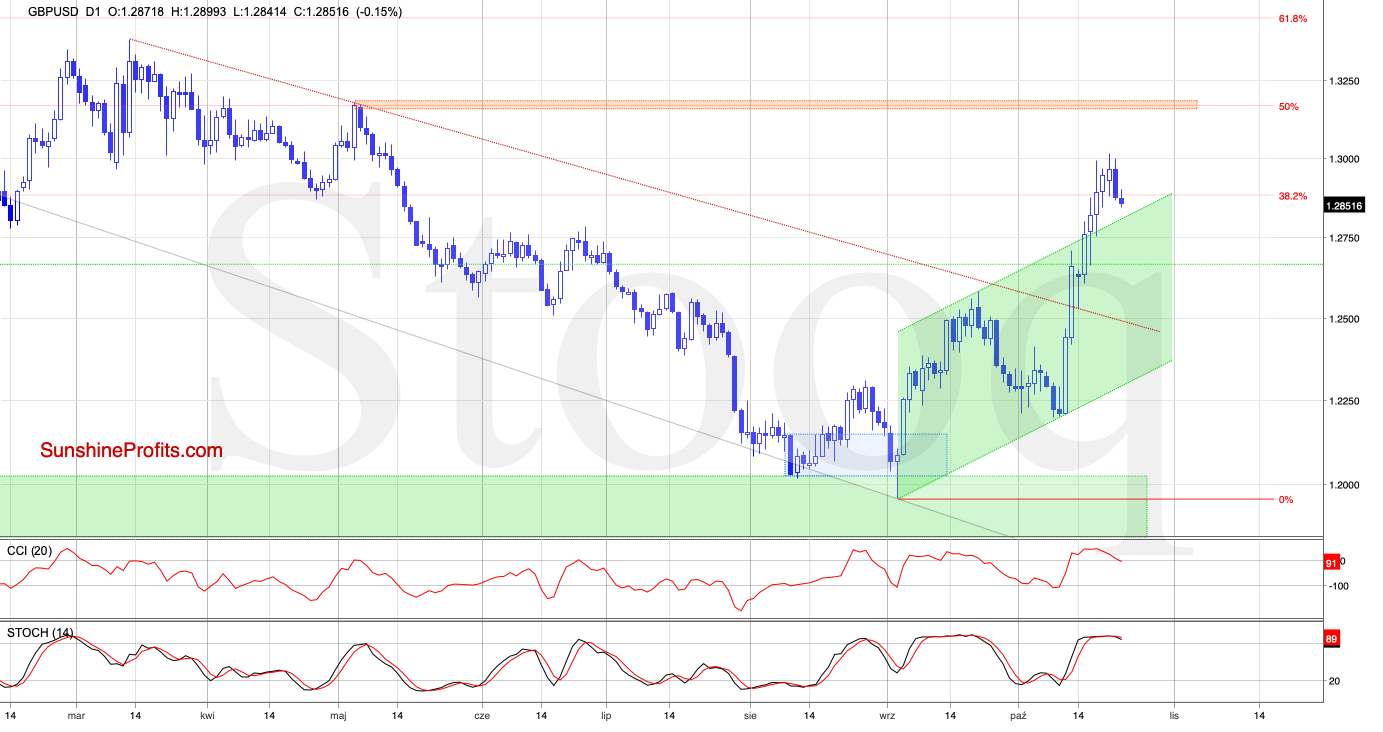

As you see, on the daily chart, the bulls failed during yesterday's session and didn't manage to break above the barrier of 1.3000, which translated into a pullback and a daily close below the previously-broken 38.2% Fibonacci retracement.

Earlier today, the pair moved a bit higher, but then reversed and declined, which suggests that we could see verification of yesterday's breakdown.

Although it may look quite bleak from the perspective of buyers, we should keep in mind that they have not (yet) lost their most important ally - the nearest support based on the previously-broken upper border of the green rising trend channel.

Therefore, we think that as long as there is no drop below this line, the bulls can count on rebound in this area and verification of the mid-October breakout. Nevertheless, just as we wrote yesterday, if the bears manage to push the exchange rate down, we could see a drop to around 1.2500 or even lower. That is where the previously-broken red declining line currently is, serving as additional support.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. However, if the situation develops in tune with the bearish scenario, we'll consider opening short positions.

USD/CHF

The first things that catches the eye on the above chart are: yesterday's daily close above the lower border of the declining red trend channel and the breakout above the upper border of the blue consolidation.

Thanks to this price action, the bulls are positioned favorably to push for higher values - especially when we factor in the buy signals generated by the daily indicators.

However, before deciding to go long, we want to see how the buyers deal with the nearest resistance based on the October 8 low. If they manage to break above it, thus invalidating the breakdown below it, then the chance of the move continuing higher will increase, in our opinion.

Connecting the dots, we are refraining from opening the long position and see how today's session plays out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist