Gregory Bergman

Editor-in-chief, CapitalWatch

As the Editor-in-Chief of CapitalWatch, a site mainly focused on Chinese U.S.-listed stocks, I have covered my share of Chinese frauds. Luckin Coffee was the most bitter, whose accounting antics drove disillusioned investors to dump shares in a caffeinated frenzy. Covering China, I have written the word "fraud" almost as often as I had written the word "coronavirus."

From lying about the state of containment of the coronavirus or the state of labor camps where a million or more ethnic minorities toil to lying about intellectual property theft, China lies and lies big. And so do its companies. But not like they used to. The frauds of the early 2000s were both the biggest and the most colorful.

My favorite fraud is when Chinese travel services provider Universal Travel Group gave auditors an address for one of the company's supposed hotel customers that turned out to be a public restroom, according to regulators. Then the proverbial sh@!t hit the fan. The company, once trading on the NYSE under "UTA", decided to "voluntarily" delist in 2012. The sheer number of frauds shipped across the seas from the Middle Kingdom to the U.S. during this period was stunning. (Interestingly, Germany has the most recorded cases of fraud annually per capita and in absolute terms more than any nation, which attributed, in part, to better law enforcement).

But as Nikola reminds us, there is still fraud in America. This should come as no surprise. After all, fraud and scandal are grotesquely personified at the very top of the nation's government. And while the veracity of the accusations levied in Hindenburg Research's bombshell short-seller report is still in question, it is nice to know that, if all or even partly true, America and its companies are still masters at fraud.

As I covered last week, we are now ranked 28th in the world (down from 19th in 2011) in the Social Progress Index based on 50 metrics--including health, safety, nutrition, freedom--collected by Nobel-winning economists. Slipping from prestige, at least we can still at least lie with the best of them.

Trust is indeed a rare commodity these days. Even Tom Hanks, the most trusted person in America according to several polls, is now maligned by a growing number of conspiracy theorists who think the actor is a satanic pedophile at the center of a worldwide child sex-trafficking ring. Makes you wonder: What Walter Cronkite was really doing in Vietnam?

Fraud and mistrust go hand in hand. In fact, it was arguably the mistrust Americans had in their institutions that motivated so many to vote for an obvious grifter. Only a conman who knows the game can rework it so it ain't rigged, the strange reasoning goes. Yes, he is a conman and a liar, they say. But he is our conman; he is our liar.

From the president to Enron to Charles Ponzi, America is no stranger to fraud and fraudsters. The question is: Has Nikola joined this great all-American tradition?

Nikola: All Downhill From Here?

Let's start with what we know for certain. We know for certain that Nikola's video demo of its EV truck driving video was a sham. In the video titled "Nikola One Semi Truck in Motion" the company's electric Semi is seemingly scooting along by its own propulsion. I mean, that's what the viewer assumes. When you see a car commercial, you figure the car is driving itself and isn't just a box with wheels being pushed down an incline. But that's exactly what Nikola's Semi, as seen in the three-year-old video, was: A box with wheels.

Nikola responded in carefully worded, lawyerly rebuttal claiming it had "never stated its truck was driving under its own propulsion in the video, although the truck was designed to do just that." Right. Well, my football coach Pop Warner designed me to be an NFL slot receiver but turns out I'm not quite there yet.

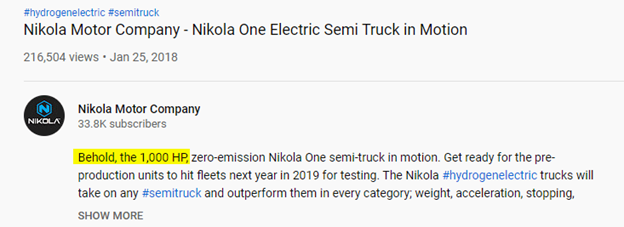

With no disclaimers in the video, the intention to deceive or mislead is obvious. Add to that former public statements (subsequently recanted to Bloomberg) about how the truck is "a real truck--not a pusher" and what you have here in an open and shut case of false advertising. Nikola even tweeted about the video:

1000 Horse Power. Well, not exactly. They were talking about the future truck when fully functional, not the truck in the video. Oh, you mean that by saying "in motion" in the same line as 1000 HP that we meant the truck in the commercial was driving itself and not just being propelled by gravity? Such was the semantics game Nikola tried to play this week, saying: "It was never described as 'under its own propulsion' or 'powertrain driven."

Hindenburg wasn't buying it.

"Nikola's response has holes big enough to roll a truck through," the short seller said in a new report Tuesday. "Obviously, the truck can't have 1,000 horsepower or even one horsepower if it doesn't power itself."

But that was three years ago so it doesn't really matter, right? Nikola's response included this gem: "This three-year-old video of a Nikola prototype is irrelevant except for the fact that the short seller is trying to use it for its main thesis."

The crux of Nikola's response is that it doesn't matter what the Nikola One could do since it now has a functioning prototype, the Nikola Two. Never mind the fact that Nikola raised millions of dollars from the hype surrounding the inoperable Nikola One. What difference would that possibly make?

American corporate chutzpah at its finest.

Stock Up and Down but Appears Stabilized

While the prototype in the much-maligned video didn't really move, Nikola's stock sure has in the past few weeks. On the $2 billion deal with General Motors, the stock shot up. Then, on the Hindenburg report, the stock went down. After Nikola responded to the allegations, the stock creeped back up a bit. This followed by news of the Justice Department's inquiry, which sent the electric vehicle maker's stock down once again.

GM Has No Reason to Back Out

In the midst of this fiasco, chief executive officer of General Motors, Mary Barra, reiterated that the deal was on, and that the company had done the "appropriate amount of due diligence" on Nikola. Whether behind closed doors she sings a different tune, the fact is that the deal as structured is one-sided in GM's favor. The money is coming from Nikola to GM, not the other way around.

Under the deal, Nikola will pay $700 million in cash to cover the cost of erecting manufacturing capacity to make Nikola's Badger truck, and then more cash to make each truck on a cost-plus basis. Oh, and then there's the $2 billion in Nikola stock GM will get and sell after lockup period in tranches over the course of the agreement, ending sometime around 2025. Even if the stock is worthless, GM gets paid. A small price to pay for a little bad PR. In return, Nikola will come to market faster and it will get access to GM's battery technology; the battery-electric version of the Badger will be based on GM's Ultium battery platform which--you guessed it--GM will sell to Nikola likely at a profit.

Whether Nikola will be a success in the end remains to be seen, but chances are its co-founder, Trevor Milton, will end up behind bars. A fitting end to a great American fraud.

So, avoid Nikola, right?

Not necessarily. Some analysts are less bearish than you might think. JPMorgan still rates Nikola at "overweight" with a $45 price target; the stock is now trading around $33 per share. At this price, you could buy if you have money to burn and want a take a shot. But better to bet on Nikola more safely by buying GM despite the reputational hit it may take from this deal. GM is a buy.

If You Want Fraud Protection, Look at These Most Trusted Companies

In a survey published by morningconsult.com, respondents were asked "How much do you trust each brand to do what is right?" Optional responses were: 1) A lot. 2) Some. 3) Not at all. 4) I don't know. The ranking below is ordered based on the percentage of respondents who said "a lot."

USPS

(Not a public company, but surprisingly rated to anyone who has, you know, ever mailed a letter)

Amazon (Nasdaq: AMZN)

(Bezos might be an evil emperor, but customers do trust the service)

Google (Nasdaq: GOOGL)

(Again, it is all about customer's faith in the products here)

PayPal (Nasdaq: PYPL)

I am long on PayPal and Square (NYSE: SQ). These stocks (and GM) are buys.

The Weather Channel

(It is hard to lie about the weather, I suppose)

Chick-Fil-A

The chicken sandwiches (and the fundamentalist Christian messaging) are consistent.

The Hershey Company (NYSE: HSY)

Despite a sweet 2.03% dividend, the price-to-earnings ratio is 25.6, compared with the sector average of 26.2. The stock is overvalued and is only $15 or so per share from its high. Zacks Investmetn Reasearch just lowered the stock to a "hold." Not a buy.

United Parcel Service (NYSE: UPS)

I reccomended this stock months ago. The stock has popped $40 bucks or so per share since the end of July, but has traded sideways recently. You could buy at this level; UPS will continue to rise over the course of the pandemic and beyond.

Cheerios- General Mills (NYSE: GIS)

I never bought the hype. Never loved Cheerios, and never loved the stock. Despite excitement surrounding the rediscovery of its all-American brands in the pandemic, the stock, while it rose, didn't become the sizzling stock story many believed it would. Sales are up, however, and you can think to buy before upcoming earnings. But this is a safe stock, not an explosive one. When the market finally prices in the economic peril in whcih we find outselves this stock, like many General Mills products, will offer comfort on a rainy day.

M&M's

Privately-held, but decidedly delicious. M&M's are a definite buy.

Gregory Bergman

Editor-in-chief, CapitalWatch

(The opinions expressed in this article do not reflect the position of CapitalWatch or its journalists. The analyst has no business relationship with any company whose stock is mentioned in this article. Information provided is for educational purposes only and does not constitute financial, legal, or investment advice)

Back