Gregory Bergman

Editor-in-chief, CapitalWatch

I have debt.

Student loans, mostly, that I have never paid. And by "paid," I don't mean "paid off." I mean that I have not made one payment on these decades-old loans. Not one. (There is a reason this column focuses on equities and macro trends, not personal finance.)

In my defense, I always meant to do so at some point, but every time I am about to make a payment, another presidential candidate offers to wipe my slate clean. And thus, I will table this once again until November 10. What about my credit? I'll fix that later and just put all the assets in my girlfriend's name as I did with my ex-wife. I mean, what could go wrong?

Oh, right.

With the pandemic still in full swing and a contested election on the horizon, I'd rather upgrade that RV I have mentioned in past articles by another $100,000 or so and await the apocalypse. Interest rates on bad credit? What do you think the girlfriend is for? Not for her driving skills, I can assure you.

But no one cares about my debt. And for years now, no one has cared about America's debt either.

Just google "Why no one cares about the debt" and hundreds of articles appear. The first one is from TheHill.com dated April 2019 in which the writer, Sheila Weinberg, points out that Trump first campaigned on the importance of paying off debt for which he blamed Obama, only to add trillions in deficits once elected--the bulk of which came from tax cuts for the wealthy.

Deficit Versus Debt

In the simplest terms, a budget deficit constitutes the difference between what the federal government spends and what it takes in, while the national debt is the result of the federal government borrowing money to cover years (and decades) of deficits.

The federal budget deficit for 2020, in part exacerbated by a history of borrowing, is expected to hit $3.3 trillion this year, according to the nonpartisan Congressional Budget Office (CBO).

Of course, there is no such thing as a nonpartisan entity in the minds of an overly partisan public. Once cited by legislators as an objective overseer, both parties have called CBO's validity into question, depending on which piece of legislation their respective party is pushing. So, that's the projected deficit.

As for the debt, it is expected to hit $20.3 trillion. Compare this to the total GDP for 2020 projected to reach $20.6 trillion, and you only have a $300 billion difference--barely enough for Jeff Bezos, Bill Gates, Warren Buffet, and Larry Ellison to live on.

Not Like a Profligate Parent

The debt isn't money we owe to our children, which is why familial analogies pushed by familiarly partisan panderers are so misleading. This isn't at all like profligate parents squandering their children's college money on more facelifts and tummy tucks.

As renowned economist Paul Krugman explains: "Debt is money we owe to ourselves -- that is, for the most part it obliges one group of Americans, taxpayers, to make payments to another group of Americans, bondholders."

There are also some foreign holders, but a negligible amount. So, debt doesn't directly impoverish the nation, but, indirectly, it can if we have to result to higher taxes or less investment (spending) to pay down interest. The absolute debt no one cares about, it is the amount of debt ratio of debt to the base of debt-owners (i.e. taxpayers).

Now Is Not the Time for This Talk

Not since World War II has the nation faced such debt. As noted earlier, the nation would require nearly an entire year's GDP to pay off its debt. (The record was set during World War II in 1946, at 106.1% of GDP). At around 18% of GDP, the federal deficit for this year will be nearly twice what it was compared the Great Recession of 2009.

Just as it took borrowing money to defeat Nazi Germany and Imperial Japan, defeating Covid-19 won't be cheap. That's why even so-called fiscal conservatives were on board with the first few trillion in stimulus back in March. Everyone agrees that now is not the time to stop borrowing and spending.

"This isn't the time to have that conversation," said Loretta Mester, the president of the Federal Reserve Bank of Cleveland and longtime debt worrier, according to The New York Times.

Of course, she's right. While Democrats and Republicans are arguing over $300 extra per week versus $600 extra per week for the unemployed or state government bailouts, no one is arguing that trillions will be needed to save us from the coronavirus' wrath. The coronavirus, like the Nazis, won't last forever, and the nation's credit rating isn't in any danger of being lowered on account of a worldwide one-off.

But what about after the pandemic?

If Trump wins, likely no one will make mention of the debt even once the coronavirus subsides. While he campaigned to end the debt in eight years, instead he will add $8.3 trillion to itduring the same time. But at least he got the "eight" right.

On the other hand, if Biden wins, expect Fox News, whose propagandists are already returning to their "debt crisis" narrative in order to push back against the Dems' demand for a larger stimulus. This is of course after having totally ignored Trump's post-inaugurate four-year spending spree.

But obvious hypocrisy and the current crisis aside, the question is should we worry about the debt post-Covid-19, or shouldn't we?

How Much Is Too Much?

That's the thing, no one really knows. We know that while Brunei has the lowest debt in the world, with no external debt and national debt of 2.46% among a population of 439,000 people (2017). The small nation run by a socialist-minded Sultan gets 90% of its revenue from oil. And what could possibly go wrong there?

The United States once was totally debt-free. On January 8, 1835, President Andrew Jackson achieved his goal of entirely paying off the country's debt, the only time it stood at zero. The bad news was this led to one of the nation's worst financial crises. A real-estate bubble caused by federal land sales and reckless spending and borrowing after the destruction of the national bank caused a depression. Soon, the government was borrowing again. Yet another reason to topple statues of "Old Hickory."

Unlike you or me individually, there is no time constraint to borrowing. All the country has to do is balance its books eventually, and so long as bond market participants do not fear a default on the debt (this is why the debt ceiling annual government shutdown standoff is so perilous), then the U.S. can theoretically owe more money every year in perpetuity. Low interest rates in the bond market support the view that all is well with the U.S. and its debt. Luckily, these interest rates were low before the crisis and have stayed low. The Fed has taken advantage of low rates, buying tons of U.S. Treasury debt in the secondary market. (The Fed has been unable to buy from the Treasury directly since 1935).

Buying in the secondary market, the Treasury can up its borrowing without upping rates.

Still, borrowing trillions of dollars is nothing to cheer about; the government spent about $260 billion just on interest in the first eight months of the fiscal year. And when the low-rate party is over (not expected for some time), the cost of borrowing will go up.

It is true that countries who print their own money will never default on their own debt, but printing money to pay debt is what drove many a nation into hyperinflationary chaos; think 1920s Germany or contemporary Venezuela. A few million Weimar Papiermarks for a pretzel is a surefway to make people hungry for Nazism.

As for those who argue that America's leading geopolitical position, economic strength, and world currency reserve status insulate it from debt-related doom, a walk down debt-laden history lane tells us otherwise. From Rome in the third century to Spain in the 16th century to France in the 18th century, tremendous borrowing can trigger tremendously bad economic outcomes, usually in the form of runaway inflation.

More Debt Than Meets the Eye

The real worry for many economists isn't the debt on the books, which as discussed isn't a problem so long as payments are manageable, but the "off-balance sheet liabilities," which are spending commitments that fall outside of the promise to pay back borrowed money. The bulk of these commitments are Social Security, pension guarantees, Medicare, and Medicaid.

So how much are we talking about? $70 trillion according to economist Jim Hamilton, or thrice the amount of the debt that sparked Tea Party "revolutionaries," many of whom were Social Security recipients, to grab a musket (or an AR-15), don a tricorn hat, and head to the town hall to rant and rave about President Obama's efforts to stimulate the economy post the housing bubble meltdown.

Like today, the Tea Party era was certainly not the time to worry about the debt. But as the population ages and baby boomers go from investing and producing to withdrawing investments, the tax base will shrink, and suddenly the ratio of debt to GDP won't be so pretty. A new study cited in The New York Times yesterday shows that America is 28th worldwide (down from 19th in 2011) in the Social Progress Index (SPI). This index is based on 50 metrics--including health, safety, nutrition, freedom--collected by Nobel-winning economists.

"It's like we are a developing country," Michael Porter, Harvard professor and chair of the advisory panel for the SPI, told Times columnist, Nicholas Kristof: "We are no longer the country we like to think we are."

We most certainly are not. So, if we need to spend money to get there, now is the time to borrow to do that. That means fewer trillions spent on wars and tax cuts for the wealthy, and more money spent on a Marshall Plan for these United States. Paying people directly as we have in this Covid-19 temporary UBI is a start. The fact that most Americans can't afford an unforeseen $500 expense is more worrying than any collective public debt. Time to invest in the right things again. Like our investments in post-Nazi Germany and post-Imperial Japan, which paid those nation dividends. As of 2019, those nations ranked eighth and 10th, respectively in the aforementioned index. Either that, or we invade No.1-ranked Norway and force them to be all be U.S. bondholders.

On second thought, let's make them pay off our school loans instead. And by us, I mean me.

Low-Debt Stock Picks

While the amount of national debt may not matter to many, during uncertain times like these--and as the tech exuberance dies down a bit--investors would be wise to at least consider stocks based on their exposure to debt. I know it sounds old-fashioned, but these debt-free stocks should be on every investors' radar. Of course, some big tech like Facebook and Alphabet (Google) have extremely low debt-to-equity ratios--but everyone knows to buy them.

Kirkland Lake Gold (NYSE: KL)

I have recommended this gold stock for months. As of June 2020, the company reported $537 million in cash and zero debt. For the same quarter, the company reported free cash flow of $191.4 million. Its strong balance sheet will enable it to aggressively pursue capital investments.

Moderna (Nasdaq: MRNA)

Here's another one already in my index that I have long recommended. We all know about Moderna's vaccine play, and we all know the competition is fierce. But it is worth reminding investors (especially as the stock has fallen) that the company's partly government-funded debt-free balance sheet will enable it to invest in R&D to bring its products to market and develop others.

CoStar Group, Inc. (Nasdaq: CSGP)

According to Insider Money, CoStar Group was in 50 hedge funds' portfolios at the end of the second quarter of 2020.

Hedge funds are not always right; we all know that a simple investment in the S&P index would beat just about every hedge fund over the last 10 years. But CoStar, which makes its money in providing real-estate data, has seen traffic soar to its Apartments.com and Loopnet.com sites during the pandemic. The company's stock also soared but has come down significantly in the last month.

The stock is a hold now, and a buy if it drops another 10% or so (shares are expensive at $790 apiece). A split would encourage more retail investors.

Skyworks Solutions (Nasdaq: SWKS)

The semiconductor player was up and down before fears of the China trade war and the coronavirus heated up. The company's chips are in just about everything, and as the 5G race speeds up, so will the company's opportunities. Compared to its peers, the company can survive the supply chain disruptions and other economic woes.

It's not only the company's technology that makes it a buy, it's the company's ironclad balance sheet with no long-term debt on the books that sets Skyworks apart.

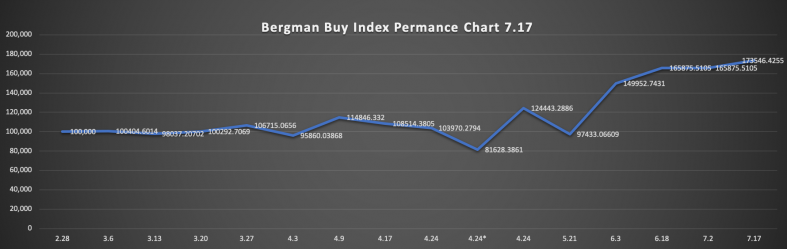

Bergman Buy Index:

(Performance since Feb. 28. Stocks sold and profit put into cash.)

Bergman Buy Index 1: Started Feb. 28 with $100k hypothetical capital

Ending Capital: $173,546.

$100k back in New Index; $73,546k held in Cash.

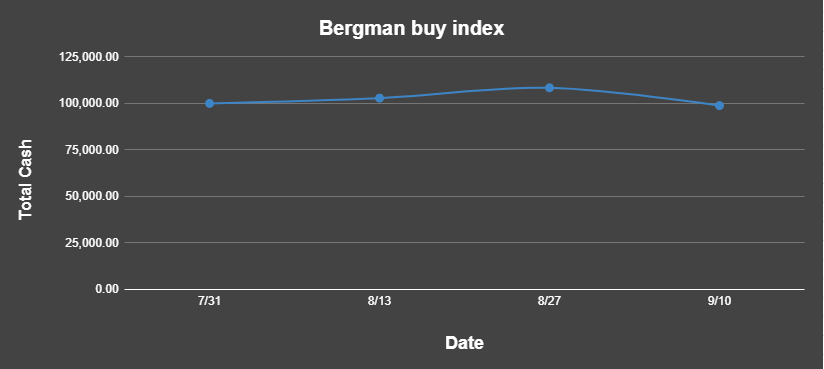

Bergman Buy Index 2

(Two Week Performance Bergman Buy Index 2: Negative 4.2%

Compared to: Nasdaq --Negative 7.57% and S&P--Negative 6.87%

For more information on buy and sell signals in options and momentum plays on small-cap equities email me at [email protected].

Full List of Equities in Buy Index 2

Long-term Movers, Undervalued (12-24 months)

Intel

IBM

Boeing

Raytheon

General Dynamics

Mid-Term Movers (6-12 months)

Big Lots, Inc.

Apple Inc.

General Electric Company

NVIDIA Corporation

Sony Corporation

Netflix, Inc.

Tesla, Inc.

Amazon.com, Inc.

Canopy Growth Corporation

Best Buy Co., Inc.

Dollar General Corporation

Activision Blizzard, Inc.

Fortinet, Inc.

Aphria Inc.

Uber Technologies, Inc.

Bank of America Corporation

Regeneron Pharmaceuticals, Inc.

Walmart Inc.

Target Corporation

Pfizer Inc.

Johnson & Johnson

Canon Inc.

Kirkland Lake Gold Ltd

Shorter-Term (3-6 months)

Advanced Micro Devices, Inc.

AMD

Zoom Video Communications, Inc. (ZM)

Square, Inc.

PayPal Holdings, Inc.

Moderna, Inc.

United Parcel Service, Inc.

FedEx Corporation

HUYA Inc.

Baozun Inc.

Alibaba Group Holding Limited

JD.com, Inc.

Tencent Holdings Limited

Gregory Bergman

Editor-in-chief, CapitalWatch

(The opinions expressed in this article do not reflect the position of CapitalWatch or its journalists. The analyst has no business relationship with any company whose stock is mentioned in this article. Information provided is for educational purposes only and does not constitute financial, legal, or investment advice)

Back