Gregory Bergman

Editor-in-chief, CapitalWatch

It's all over.

Maybe not quite yet - and maybe not for some countries. But for this one? Absolutely.

Socially, politically, economically, racially, medically - the nation is unraveling at the seams. To use a timely metaphor, America's mask is slipping, revealing a bruised and battered face for all the world to see.

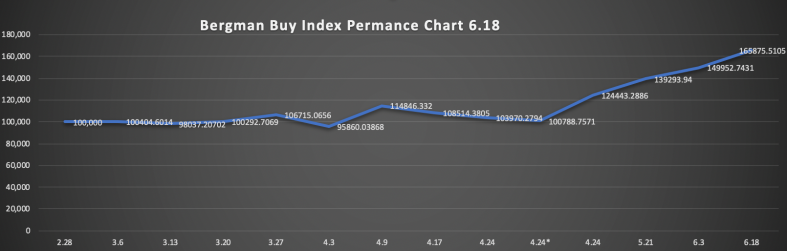

Trump's election was proof that the American collective was in a far worse place psychologically than some expected, a widespread madness bubbling up from its bowels. But it was his actual tenure (I am speaking in the past-tense hopeful for a change in November), that broke this nation beyond repair. Whether stocks or up and down is almost entirely meaningless at this point. And even then, one can trade the Bergman Buy Index from anywhere (now up over 65% since we started it,15% in two weeks while the S&P fell about 90 points).

So, where should I go? Denmark? Iceland? The fjords of Norway?

Do they still hunt whales in Norway? More importantly, how tall is the average man there? At five-foot-nine and a half (five-eight and a half, but I wear inch-high inserts in my shoes) I have to consider that; the whaling, grotesque as it is, I can live with.

Greenland is the place to be in 100 years, climate scientists say. But 100 years? I'm patient, and don't expect much in the way of amenities but do they at least have decent Thai food in the meantime?

Access to fresh water and a currently cold climate soon to turn more temperate are the main factors to consider, they say.

What about New Zealand? They seem normal and competent enough, and technically, they speak English. But will I be subjected to incessant references to The Lord of the Rings trilogy? That would be a dealbreaker.

How about a lake in Italy? Sure, the boot's a mess, but isn't it always a mess? The mayor of Ollolai in Sardinia is offering 200 homes with prices starting at 1 euro ($1.17). Does Sardinia have a lake?

Germany? Can that nation benefit as the lead broker between a rising China and the sinking United States, or will economic failure in Southern and Eastern Europe weigh it down even more in the future? What about Switzerland? In that little alpine oasis, the government pays you when you go to jail. That said, the Swiss jail easily; I was almost arrested for yelling in a Starbucks after spilling coffee on myself.

Canada? No way. Never. To me, that's cheating.

I don't know. I just do not know. What I do know is that America is not a place to build a future long-term - not anymore.

Of course, I could be wrong. America could emerge stronger than ever post-virus, entering a new era of small business entrepreneurship generated by the trillions of dollars spent in stimulus - or so say some Pollyannaish market commentators on CNBC.

If the country does have a promising future, things like universal basic income, as stunningly promoted albeit only temporarily by Jerome Powell, might need to remain permanent, as the prescient former presidential candidate Andrew Yang championed during his bid for the White House.

But it is not our economy so much as our democracy that worries me.

Oh, Henry!

The decision to relinquish citizenship and renounce any further participation in the American experiment may be moot. Wherever I go, it seems, catastrophe is likely to greet me according to a report from Deutsche Bank which revealed some harrowing prognostications.

Analysts led by Henry Allen say there is a one-in-three chance that at least one of four major "tail risks" will occur in the next 10 years. Here are some of the fun possibilities:

1) A major influenza pandemic killing more than 2 million people (Covid-19 has already killed roughly 450,000)

2) A globally catastrophic volcanic eruption

3) A major solar flare

4) A global war

So, there is a one-in-three chance another Covid-19 level nightmare strikes in a decade. Now, if you give it two decades, then there is a 56% chance of such a worldwide nightmare. (Earthquakes are not included since the fallout is too localized.)

I know, solar flare? This obscure nightmare hasn't been on the radar since the last severe one in 1859. Turns out, however, we are due for another. Analysts list this event as more likely than a global war. The recent violent skirmish between India and China might change that calculus a bit, a border conflict whose exacerbation could ignite WWIII.

Finland?

Nah, seems too depressing. Plus, I am not sure they let Jews live where they have reindeer (but don't quote me on that).

Again, wherever I go or don't go, access to water will be a must. The United Nations World Water Development report for 2020 says that water shortages and contamination of crops from bad water are increasing rapidly, while a National Resource Defense Council report says that from 2015 and 2018, nearly 30 million Americans were drinking water "from community systems that violated the EPA's Lead and Copper Rule."

Add to that a 2012 American Water Works Association (AWWA) report which puts the cost of repairing existing water infrastructure at $1 trillion over the next quarter-century, and it is clear that the water crisis is deeper than you may think.

Investors can play the water crisis a few ways - from companies focusing on improving infrastructure to companies who bottle clean drinking water to buying real estate in future desirable locations (2.2 billion people do not have access to fresh, safe drinking water).

A complex market space, one stock to start with is Xylem Inc. (NYSE: XYL), a global player involved in many facets of the industry. Treatment, dewatering, transport, applied water systems, analytics - Xylem is a one-stop water stock involved in every stage of the water cycle. The stock has been crushed by Covid-19, falling from $73 to $64 per share just this month. Long-term, however (as in 18 months or more), if you are betting on the end of water and the end of the world, this is a good place to begin.

Teetering on the Tipping Point?

Despite the current horrors the imminent ones that await, I would be remiss if in this week's lugubrious lamentations, I didn't mention what is some very good news.

As the murder of George Floyd gruesomely illustrated, the police in the U.S. are in serious need of reform. And the tide on this front is turning, and fast.

Malcolm Gladwell, the bestselling author of "The Tipping Point," says that it only takes 30% of the population to embrace an idea or a product before it spreads like wildfire. This phenomenon he calls the tipping point, is "the moment of critical mass, the threshold, the boiling point."

In a nation so split along partisan lines (what else could possibly explain more than 100,000 people expected to attend a Trump rally in the middle of a pandemic?), a recent poll showed that the majority of both Democrats and Republicans support sweeping police reform. More specifically, 82% of Americans support the banning of police from using chokeholds, 83% support banning racial profiling, and 92% want federal police to be required to wear body cameras. These numbers reflect a dramatic shift in popular opinion in a matter of weeks.

Is that a Non-Lethal Weapon in Your Pants or Are You Just Happy to See Me?

If police in the U.S. and around the world decide to stop killing suspects with such frequency (police killings in the U.S. are actually way from decades past, evidence of just how bad the problem is), the market for non-lethal weapons will expand even more dramatically than current figures suggest.

Non-lethal ammunition includes rubber bullets, wax rubber plastic bullets, bean bag rounds, and sponge grenades. The term "non-lethal," however, should be taken with a grain of salt.

Take rubber bullets, for example, which have been widely used over the last few weeks on protestors. A study published in 2017 in the BMJ Open found that 3% of people hit by rubber bullets died of the injury, while 15% of the 1,984 people studied were permanently injured. Rubber bullets are called "kinetic impact projectiles" in law enforcement lingo.

The market for these and other non-lethal weapons is projected to grow from $5.65 billion in 2015 to $8.37 billion by 2020. Driving this demand is not an increased desire on the part of police to limit fatalities, but the desire for as many tools as possible to curb increased civil unrest - and just wait until the world's coastal cities are submerged by rising seas.

Lethal and non-lethal weaponry go hand-in-hand in the militarization of law enforcement agencies around the world. However, in the U.S., where police are armed to the teeth with assault weapons and even tanks, the demand for non-lethal alternatives is, by contrast, a good thing.

Between tasing George Floyd and kneeling on his neck, the former is preferred alternative (not that tasing seemed a necessary use of force for one guy surrounded by four cops). Yes, he was a big guy and may have been high on methamphetamine, a drug found in his system according to the autopsy report. But meth only makes you feel like Bruce Lee, not actually become him. What happened was murder, period.

With significant police reform on the near horizon, some smaller stocks in this space have taken center stage. Three stocks that stand to benefit from the new landscape of increased police accountability include Axon Enterprise (Nasdaq: AAXN) and Shotspotter (Nasdaq: SSTI), and Byrna (CSE: BYRN; OTCQB: BYRN).

Axon, once called TASER, is best known for manufacturing stun guns or TASERs. Today, however, it is also the market leader in police body cameras and dashboard cameras. Evidence.com, its software database, enables data collected from the cameras to be stored, shared, and analyzed.

Protests and looting have been good for the company. And increased civil unrest coupled with increased emphasis on police accountability will only make its products more attractive.

"We have a big role to play in providing the tools and technology backbone for much of police training," CEO Rick Smith told Yahoo! Finance. "And we think there's a huge role for us to play in helping introduce new ways to train police to really squash out some of the behaviors that we saw that I think everybody agrees are unacceptable."

The stock just hit an all-time high.

Long-term, I am bullish on Axon. Short term, I would wait until it falls back under $85 per share (the stock trades at $94 per share now up from $75 last month) and/or it completes its planned secondary offering before adding it to your portfolio.

Shotspotter does just what the name suggests - it alerts first responders and law enforcement when a gun goes off, improving response time which serves both the victim and the police called to investigate. The company's mission is to assist police and end gun violence. The technology it employs to accomplish this goal is unique.

Revenue growth has slowed since 2018, however, and Covid-19 has made things worse. But this kind of environment that will bode well for the company, which only serves three of the 10 largest U.S. cities as its customers. With increased attention on policing and crime, Shotspotter might be able to land a few more big municipalities to its customer base.

Short term, this stock might see a big boost, but nothing like what happened this week to Byrna Technologies.

Byrna's stock skyrocketed this week after "newsman" and devil incarnate Sean Hannity featured it on his strangely popular Fox News program, suggesting that the company's personal security device might be part of the solution to curb the unrest through non-lethal means. Byrna's flagship product, Byrna HD (Home Defense) is a compact non-lethal personal security device the company insists is the safest and most effective non-lethal self-defense weapon on the market today. It shoots .68 caliber projectiles filled with a powerful chemical irritant. Unlike pepper spray and stun guns or tasers, it provides a safety zone of 60 feet and comes with multiple easily reloadable magazines. Basically, an almost lethal amount of non-lethality at your hip.

After the Fox News bump, online orders exploded, exceeding $2.4 million worth in 24 hours. The company is racing to hire new workers and boost capacity to fulfill the overnight rise in demand.

The morning after Hannity's segment aired, Byrna CEO Bryan Ganz commented: "Last night reinforced our strong conviction that people on all sides of the gun debate can agree on one thing - there is a need for a truly effective personal security device that can stop a would-be attacker without the risk of permanent injury or death."

While the product can be used by police, it was designed primarily as a civilian tool to be used by homeowners looking to dissuade unwanted houseguests.

The stock is trading at $1.37 per share as of Thursday, up from 62 cents per share on June 9. If you missed the bump, wait until it falls closer to a dollar or $1.10 per share. Let momentum players cash out before you buy.

As for the product itself, it looks like one worth buying. Anyone can get it, as no gun license is required.

The only question is: Can I bring it to Copenhagen?

Bergman Buy Index Up Over 65%!

Beginning Sum: 100k in Hypothetical Capital - Current Capital: $165,875.51

(A more than 15% increase in the last two weeks. To compare, the S&P is down more than 90 points for the same period. Percentages are based on closing prices for stocks as of Thursday's close)

Symbol Current Price Change Open High Low Purchase Price

DOCU 162.88 0.58000183 163.07 164.3543 161.67 162.3

PINS 23.53 0.47000122 23.37 24.34 23.28 23.36

BYD 21.41 -0.2800007 22.13 22.3 21.32 21.69

CMG 1029.805 -0.19494629 1040 1041.98 1020.4508 820.27

ACB 13.3263 0.31629944 13.18 13.89 12.97 9.61

CGC 17.255 0.074998856 17.86 17.82 17.121 13.25

REGN 609.36 12.01001 602.31 609.58 598.71 493.32

NVAX 63.59 4.3199997 63.28 63.76 61.75 15.61

INO 14.5799 0.23989964 14.43 14.74 14.12 7.74

SQ 99.29 1.0200043 100.1 102.26 98.43 53.43

WYNN 86.96 -1.4100037 90.35 90.96 86.6538 63.31

SEDG 155.2 4.199997 152.27 156.24 151.31 82.37

FSLR 50.84 0.36999893 51.28 51.56 50.55 35.63

BBY 81.21 -1.090004 83.84 83.91 80.72 62.47

HD 247.51 -1.7000122 249.36 254.3 246.38 190.55

GM 26.535 -0.5550003 27.74 27.77 26.5 18.14

F 6.3042 -0.025799751 6.64 6.69 6.28 4.33

PFE 33.2482 0.008197784 33.69 33.74 33.12 29.01

RHHBY 44.89 0.5099983 45 45.21 44.72 36.09

JNJ 143.705 0.29499817 145.79 145.88 143.26 119.89

WMT 118.93 0.94000244 118.89 119.34 117.75 113.97

QSR 55.39 -0.61999893 56.65 56.9662 55.31 32.02

DPZ 377.51 1.960022 380.81 380.96 373.59 299.95

DNKN 64.3 -0.20999908 65.13 65.3365 63.99 39.68

WEN 21.87 -0.1799984 22.32 22.45 21.7605 10.94

HES 52.19 0.5399971 49.87 53.55 51.94 34.92

MCD 187.59 -1.9000092 192.29 192.3565 187.13 148.49

RCL 56.32 -3.0299988 60.96 61.105 56.12 32.33

CLX 218.17 3.5800018 218.17 219.38 215.8453 173.26

MRNA 64.9369 -0.01309967 64.99 65.14 64.01 25.93

CODX 16.9499 1.0198994 15.95 16.97 15.82 13.23

AMZN 2672.904 18.924072 2678.08 2688 2659 1883.75

DG 189.65 -1.6700134 193.08 193.72 188.27 142.12

Gregory Bergman

Editor-in-chief, CapitalWatch

(The opinions expressed in this article do not reflect the position of CapitalWatch or its journalists. The analyst has no business relationship with any company whose stock is mentioned in this article. Information provided is for educational purposes only and does not constitute financial, legal, or investment advice)

Back