Based on the September 14th, 2012 Premium Update. Visit our archives for more gold & silver articles.

Yesterday gold was little changed before the key Federal Reserve policy decision, a day after a German court ruling in favor of a euro zone rescue fund. The decision centered on challenges to Germany’s participation in the 500 billion euro ($639.3 billion) European Stability Mechanism, or ESM. Critics charged that the treaty behind the ESM robs Germany’s parliament of its constitutional authority over the country’s budget and had asked for an injunction to prevent the country’s president from signing it into law. In other words the Court ruled that it is constitutionally permissible for Germany to finance the debt of other nations.

The decision means the eurozone finally has two robust financial defenses against the debt crisis. The bailout fund will take its place alongside plans by the European Central Bank to buy unlimited amounts of short-term government bonds issued by troubled countries. The ESM can support countries by loaning them money, while the ECB bond purchases could lower the painfully high borrowing costs that are threatening Italy and Spain. Additionally, the ESM is also expected to join in purchasing bonds to support the ECB effort. Yet both the ESM and the ECB bond purchases are only stopgap measures. They can give governments time to reduce their deficits and cut debt long-term by reforming their economies so they can grow faster. One wonders if the countries will bite the bullet or to delay once the pressure is off, as they have during previous lulls in the crisis.

The news of the German court decision Wednesday sent bullion to its highest since the end of February. Also investors were hoping that the Fed will announce another round of quantitative easing, (QE3) at the conclusion yesterday of a two-day policy meeting. Such news would be considered positive for gold, as injections of liquidity into the market tend to benefit the yellow metal.

What investors got from the Fed was something much bigger than QE3. What we got was an open-ended QE. $40 billion will be pumped into the U.S. economy each month until further notice. Just as if the endless QE wasn’t enough, the Federal Reserve has maintained its funds rate at 0.0%-0.25% at least until mid-2015.

The above is not important only per say, but also because it is something that exceeded market’s expectations. Consequently, we didn’t see the buy the rumor, sell the fact type of reaction – what happened was bigger than the rumor, so markets got another positive impact.

This is a major bullish fact for the precious metals market. As Europe and the US continue their inflationary race, precious metals rally – and they should rally much higher – endless QE means that they virtually have to.

At this point, it seems that higher precious metals prices will be seen this fall and winter.

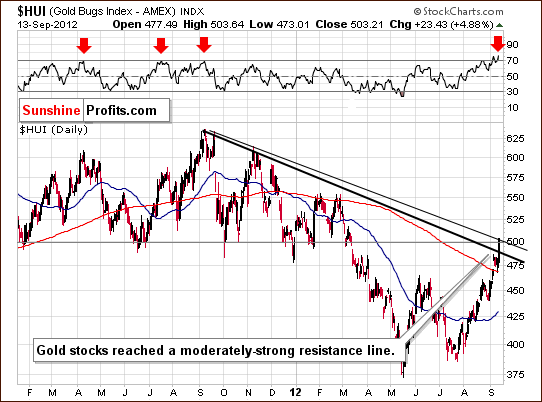

We’ve seen some quite bullish developments in the precious metals this and last week. Let's now turn to mining stocks’ technical picture to see whether they’re in a similarly bullish situation as the metals themselves. We’ll start with short-term HUI Index chart (charts courtesy by http://stockcharts.com.)

In the chart, we have a bit (!) of a bearish situation. With the index reaching the psychologically important 500 level this week, a level which has often provided support in the past, we could very well see it serve as resistance this time.

A moderately strong resistance line is also in place, one which is based on two local tops which were quite close together. The situation would be more bearish if the previous tops were father apart as this would make the resistance line a bit stronger.

At the moment of writing this essay, the HUI Index is at 516, however the breakout is not confirmed and RSI is so extremely overbought that a correction or consolidation is now quite likely.

Let’s now move on to a very interesting chart that will show us the performance of mining stocks relative to gold.

In the miners to gold ratio chart we also see a breakout this week and this is important and encouraging for mining stock investors. The ratio has been struggling for a month to break out and we finally see a convincing move above the resistance line.

If a correction is seen and the ratio does not break below the support line, this will be a strong signal that miners will outperform gold in the month to follow. In exciting related topic, next week a brand new tool (in our new website; actually two tools: one for gold and one for silver) will be at your disposal for selecting mining stocks and rebalancing your mining stock holdings.

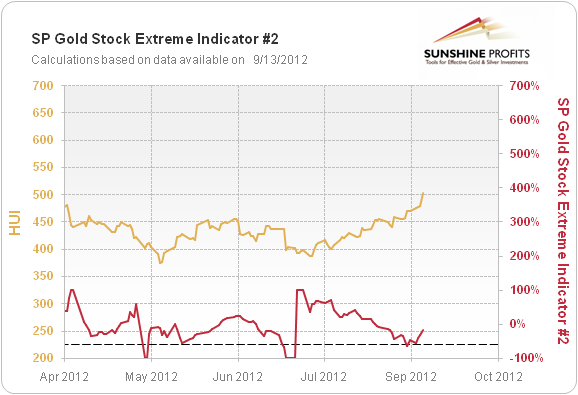

To finish off, let’s have a look at our own in-house developed indicator that serves as yet another confirmation of the recent bullish change in mining stocks.

On September 7th, 2012, one of our indicators flashed a buy signal as it moved to the dashed line.

The medium-term trend is clearly bullish right now. If the correction is seen in the precious metals in the following days, as described earlier, we expect the bottom (and a great buying opportunity) to be confirmed by at least one of our indicators – just as previous important bottoms were (see the above chart for details).

Summing up, the miners are beginning to outperform the underlying metals and this bodes well for the future performance of the mining stock sector in the medium term.However,the following days may not reflect this bullish trend because the HUI Index is extremely overbought on a short-term basis.

In the full version of today's analysis we provide the likely scenario for the following days, weeks, and months for the precious metals market and corresponding price targets (upside and downside price targets for gold). We explain the preferred course of action for investors, who have not yet purchased precious metals and we deal with the will there be another pullback and how low can gold and silver go if it is seen question. Joining our subscribers is a very good idea right now not only because you get immediate access to the full version of the above analysis, but also because we will continue send Market Alerts each day (!) until Wednesday, when the new website is released. The next one will be posted either today or tomorrow. Be sure not to miss them!

Thank you for reading. Have a great weekend and profitable week!

Przemyslaw Radomski, CFA

Back