Demand for gold declined 7 percent in Q1 2018 while gold supply increased. But the price did not fall. What does it all mean for the gold market?

Gold Demand Dwindles in Q1 2018

We are always ahead of other analysts. Last week, the World Gold Council released a new edition of its quarterly report on gold demand. At the same time, we published a summary of the developments in the gold market in the first four months of 2018. But let’s analyze the WGC report.

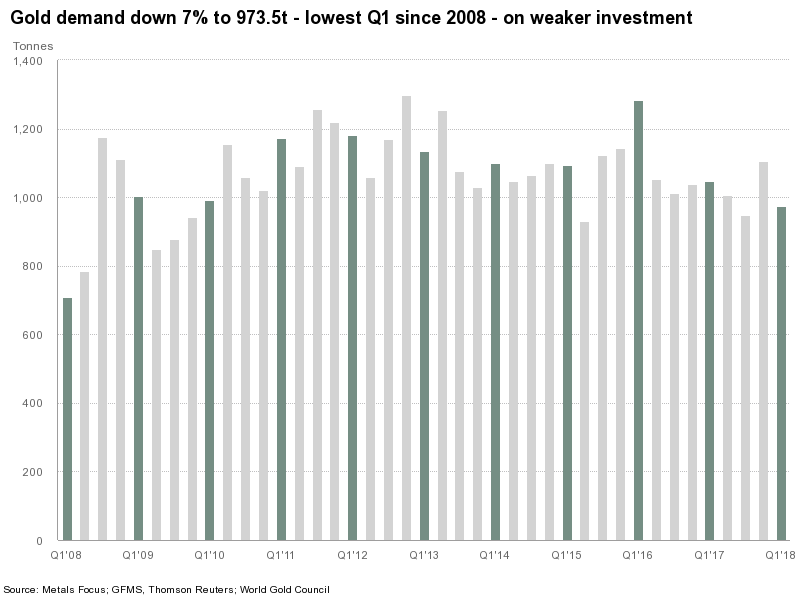

The crucial finding is that gold demand plunged 12 percent from 1,105.9 tons in the preceding quarter to 973.5 tons in the first quarter of 2018. Compared to Q1 2017, the demand for gold dropped 7 percent, the lowest Q1 since 2008, as one can see in the chart below.

Chart 1: Gold demand over the last ten years (source: WGC).

The decline was mainly caused by a fall in investment demand. Indeed, ETF inflows of 32.4 tons were down 66 percent from Q1 2017. It shouldn’t be surprising given that Q1 2018 was a period of relatively stable gold prices and rising interest rates, while the beginning of 2017 was a time when negative German yields reached a record low.

However, the inflows into gold ETFs gathered some pace compared with the second half of 2017 (13.2 tons in Q3 and 28.9 tons in Q4). It indicates that the geopolitical concerns and the sudden return of volatility to global financial markets encouraged U.S. investors to seek refuge in gold. But investors should be aware that the recent tensions between U.S. and Iran failed to boost the price of gold.

WGC’s Flawed Analysis

You can learn some interesting things from the WGC report. There is no doubt about it. You can find out that global jewelry demand was roughly flat, central bank demand surged 42 percent year-over-year, and technology demand continued to improve (thanks to the increased use of gold in electronics). Fair enough. But the whole analysis is fundamentally flawed. Why? Well, the fatal error is that the WGC treats gold as commodity. It meticulously calculates the quarterly demand and supply, to determine the “balance” and to predict the future price movements.

But the problem is that, as we showed in the May edition of the Market Overview, gold behaves like a currency rather than a commodity. Commodities are produced and then they disappear in the process of consumption. Gold does not disappear, it is accumulated. Just look at the numbers: there is more than 180,000 tons of gold above ground. Meanwhile, the annual mining output of bullion is only about 3,300 tons. So it should be clear that the changes in the annual supply – and how it is used – have limited impact on the price of gold.

If you don’t believe us, just analyze WGC’s own numbers. Gold demand fell 7 percent, while the supply increased 3 percent. But the price of gold increased 9 percent, according to the “global authority on gold.” Incredible! The demand decreased and the supply rose – and the price also jumped! The law of demand and supply has to be reformulated! A Nobel Prize in Economics guaranteed.

Implications for Gold

Another weakness of the WGC report is that it does not pay enough attention to true drivers of gold – such as the U.S. dollar or real interest rates – and it does not draw conclusions for the future of the gold market. We do. We don’t want to spoil the joy of reading, but in our recent Market Overview, in which we thoroughly analyzed the gold market in the first tertile of 2018, we focused on really important developments, such as the collapse of the standard relationship between real interest rates and gold prices. The significant implication is that if the old relationship comes back again – and it seems that it’s happening right now – the price of gold may go south. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview