Based on the March 30th, 2012 Premium Update. Visit our archives for more gold & silver articles.

This Wednesday Goldman Sachs reiterated its position that investors should buy gold. Goldman Sachs remains bullish on the precious metal, citing the familiar fundamentals-- low interest rates and subdued economic growth as catalysts for gold prices to rise this year.

Goldman economists expect another round of quantitative easing from the Federal Reserve will weigh on the U.S. dollar and push gold higher. From Goldman:

Gold prices remain too low relative to the current level of real rates. Under our gold framework, US real interest rates are the primary driver of US$-denominated gold prices. However, after being remarkably strong in the first half of 2011, this relationship broke down last fall, with gold prices falling sharply in the face of declining US real rates, as tracked by 10-year TIPS yields. While gold prices have returned to trading with a strong inverse correlation to US real rates since late December, at sub-$1,700/toz they remain below the level implied by the current 10-year TIPS yields.

Thegold markets expectation that real rates would be rising along with economic growth may help explain this valuation gap.We believe that despite last falls decline in 10-year TIPS yields, the gold market may have been expecting that real rates would soon be rising along with better economic growth, leading to a sharp decline in net speculative length in gold futures. Accordingly, a simple benchmarking of real rates to US consensus growth expectations suggested a level of +40 bp by year end. Our models suggest this higher level of real rates would be consistent with the current trading range of gold prices. As we look forward, our US economists expect subdued growth and further easing by the Fed in 2012, which should push the markets expectations of real rates back down near 0 bp and gold prices back to our 6-mo forecast of $1,840/toz.

The firm says that strengthening U.S. economic data would represent a growing risk for gold.

We reiterate our view that at current price levels gold remains a compelling trade but not a long-term investment, Goldman says.

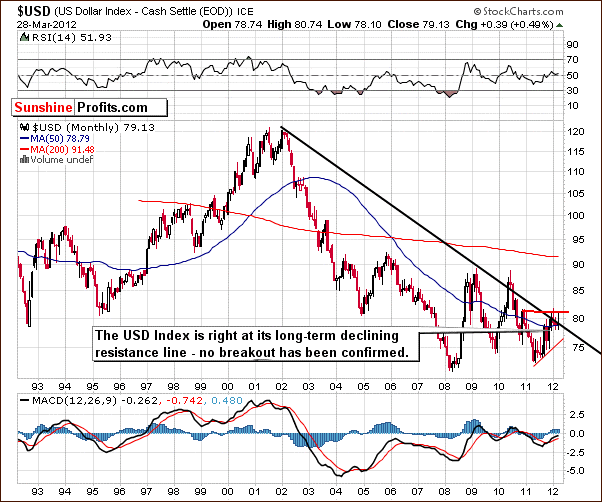

In general, we disagree, as we believe that gold is a very good long-term investment. To see how the USD Index and the general stock market fit into this picture, lets move to the technical part of todays essay. We start with the USD Index chart (charts courtesy by stockcharts.com).

This week the index moved a bit lower, down 1.64 or 2% since last Thursday. It is no longer close to its 2011 high and prices are now visibly below the 80 level and more or less at the long-term resistance line. No breakout has been seen so far.

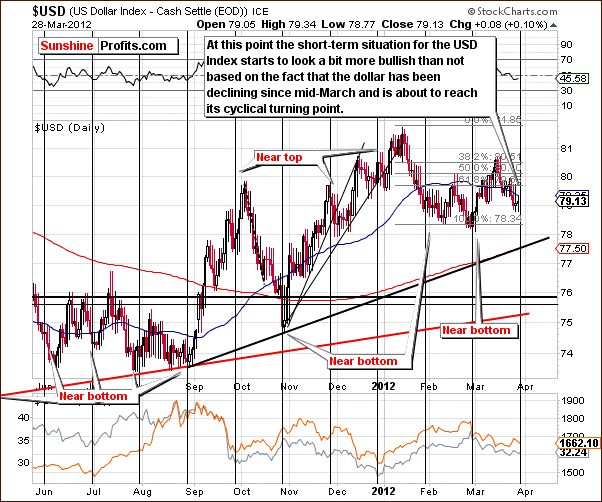

In the short-term USD Index chart, it appears that we may see another small rally in the days ahead. A cyclical turning point is at hand, and with declines having been seen for a couple of weeks now, a local bottom could form followed by a small period of moves to the upside. If it does occur, it will likely be short lived since the main, medium-term trend is now down.

Although the very short term may see some strength here, this does not necessarily translate to weakness in the precious metals sector. A rally in both gold prices and the USD Index would result in gold appreciating from a non-USD perspective. In fact, this is something which appears to be in the cards as well.

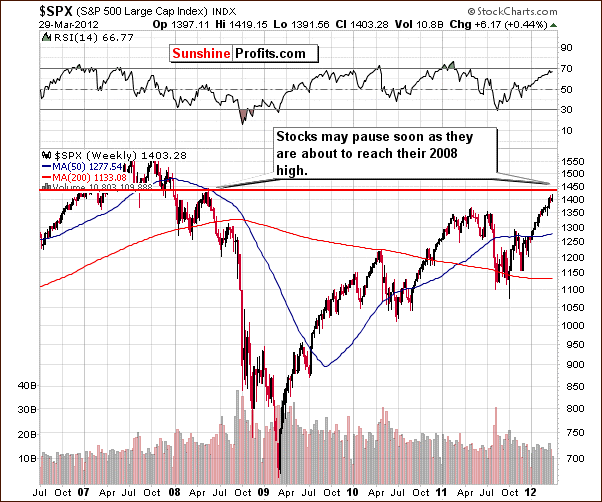

Let us move on to the general stock market now.

In the long-term S&P 500 Index chart, it seems that stocks may pause soon, as theyre about to reach their 2008 highs. Thursdays closing index level was just 2-3% below this resistance line. If prices decline from here, they will likely not go lower than to the level of the 2011 highs. We would then expect the rally to continue in a manner similar to what was seen in late 2010.

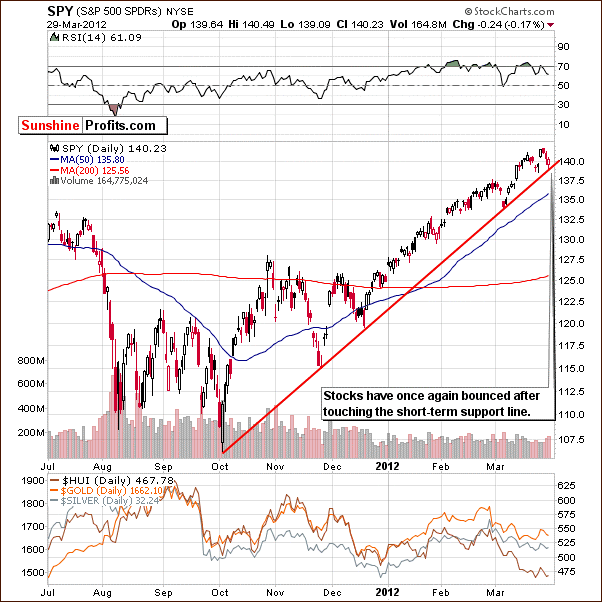

In the short-term SPY ETF (proxy for S&P 500) chart, we see a bit of a different picture. Here, stocks are at a short-term support line, so it seems that the next short-term move will be to the upside. Its likely however that this move will be somewhat short-lived based on the previously discussed situation on the long-term chart.

Can the above situation be bearish for the precious metals market? Lets take a look at the correlation coefficients between stocks and gold, silver and mining stocks.

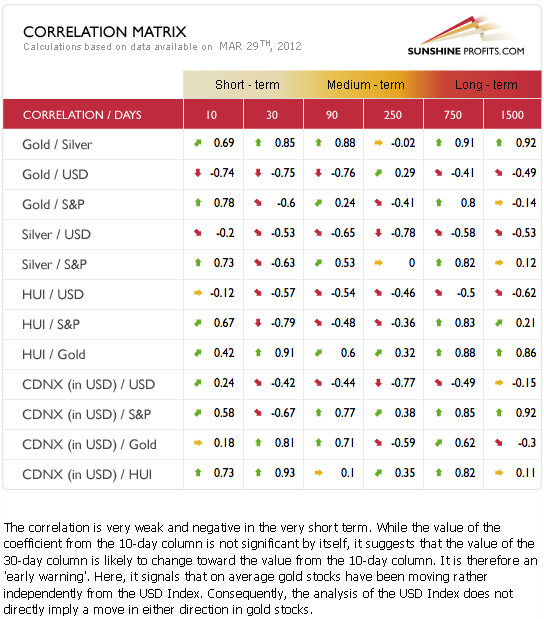

The Correlation Matrix is a tool, which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector.

Two weeks ago we wrote the following on the dependencies between precious metals, currencies and the stock market:

The general stock market simply does not appear too important for gold, silver and the gold and silver mining stocks. (

)

The strong negative correlations between the USD Index and the precious metals continue. The implications appear bullish for the medium term and somewhat unclear for the short term.

The situation changed slightly in the short-term correlations: Gold, Silver and Mining Stocks seem to be correlated moderately strongly with general stock market, whereas the short-term correlations between Silver and USD as well as Mining Stocks and USD seem to have weakened.

In general, the coefficients this week are not very strong with many of them in the range of -0.5. It seems much better to focus on the clearer technical situations in the gold and silver markets as opposed to what we now see in currency and stocks.

Summing up, The situations in the USD Index and the general stock market seem a bit unclear for the upcoming two week period. The USD Index may move a bit higher and a small move to the upside may be seen for stocks as well. Both moves appear to probably be short-lived, however, with stocks likely to soon correct and a subsequent move to the downside seemingly in the cards for the USD Index. This is not expected to have any serious bearish impact on gold, silver or the gold and silver mining stocks.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Gold declined sharply this week, just as it rallied in the previous two days. Meanwhile, gold stocks moved lower, even below their previous lows. Was the self-similar pattern just invalidated? What action should long-term investors and short-term traders take? What are the current price targets? These are the three most important questions that we deal with in today's Premium Update.

Moreover, we discuss the reasoning behind the $5,000 target for gold, mining stocks' performance, gold options, probabilities for gold moving to $1,900 before or after summer, and we comment on the idea of purchasing gold in Japanese yen.

Additionally, today's Premium Update includes up-to-date top gold and silver junior rankings.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.