We explained that the end of QE3 does not imply the abandon of the expansionary market policy, but rather a change of its tools. However, it does not mean that stopping the purchasing program is irrelevant for the economy and, thus, for the gold market. There are three main effects connected with the halt of buying assets by the Fed.

First, it implies the steepening of the yield curve’s shape, because it impacts only its long end, while short-term interest rates are not affected.

Second, it increased the volatility in financial markets. It was not unexpected, because the markets had used the Fed’s stimulus safety net, and wobbled both after the end of QE1 and QE2.This turmoil was also predicted by Bernanke who suggested that ending QE3 with future short-term interest rates being unknown makes bond holders uncertain about the equilibrium long-term interest rates. The rise in the financial market volatility could encourage the risk-averse investors to buy gold as a defensive asset to improve the diversification of their portfolios.

Third, and this is another factor which can raise volatility, the end of QE3 means withdrawal of support for the financial markets. Quantitative easing involved buying particular (also private) assets from the market, increasing the price of these assets, and helping out their sellers. Banks also benefited from QE3, because each time the Fed expanded its balance sheets, it created money, which eventually went to the banking system. We have already mentioned that after QE1 and QE2 there were substantial corrections in stocks. Similarly, the rise in stock prices was accompanied with the rise of the monetary base and reserve balances, with significant correlation coefficients.

Why could such a correlation exist, as the Fed purchases bonds and not stocks? The reason is that QE translates into lower interest rates, which means lower the risk premium, which in turn increases the demand for more risky assets such as stocks. In other words, declining yields on bonds made equities more attractive for the investors. Moreover, QE could also mean lower discount rates, which in turn would be likely to drive up the present value of future cash flows and therefore stock market prices.

This is why some analysts consider the current boom in the stock market to be caused by the QE3 and, consequently, call into question whether the markets are ready to stand on their own without the Fed’s assets-buying program. Others just worry that extremely low interest rates caused too much risk-taking.

Graph 1: U.S. federal funds rate from 1999 to 2014

Economists from the International Monetary Fund and the Fed’s officials are very concerned about the crash of the stock market due to the end of QE. How else to explain the creation of the Committee on Financial Stability in September, 2014 in order to watch for asset-price bubbles? It’s a bit funny that after promoting QE for years, IMF is now warning us of the risks involved. Theoretically, better late than never, but their alert is a bit late because we are already witnessing a bubble in the stock market which is going to burst. We can mention the high stock price to replacement costs ratio (Tobin’s q), the high stock price to earnings ratio, the low dividend yield or the low financial stress index. However, we will focus on the three most important indicators.

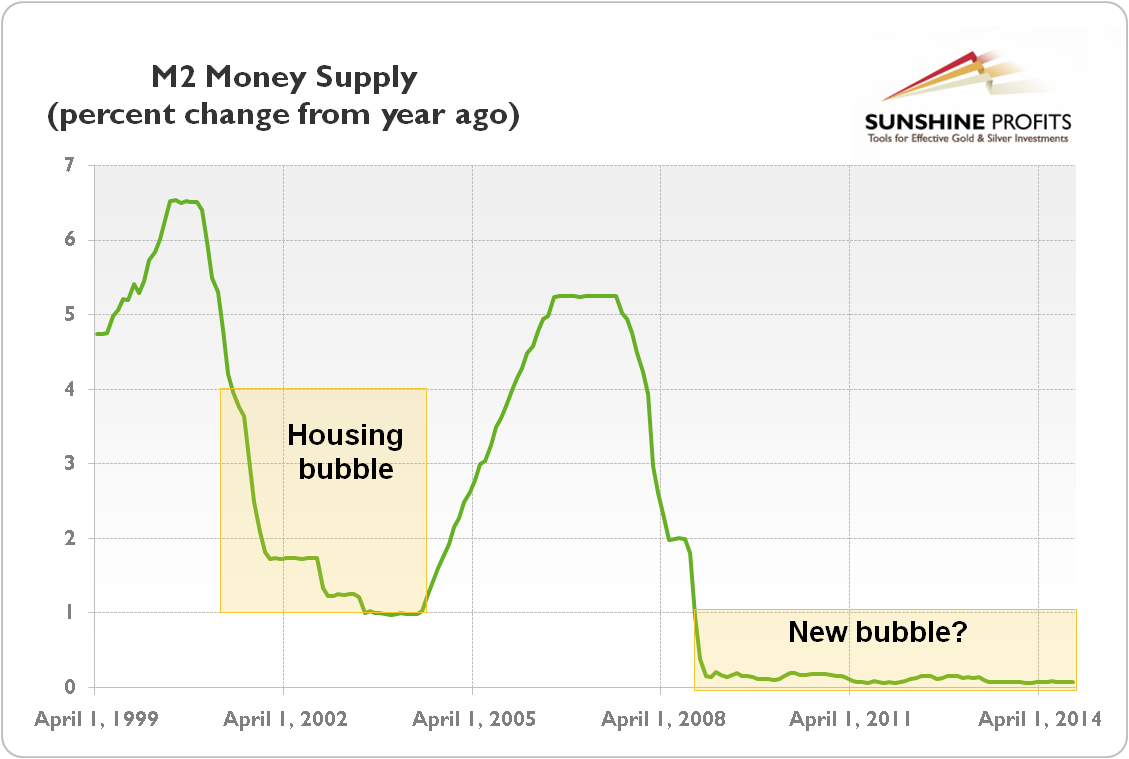

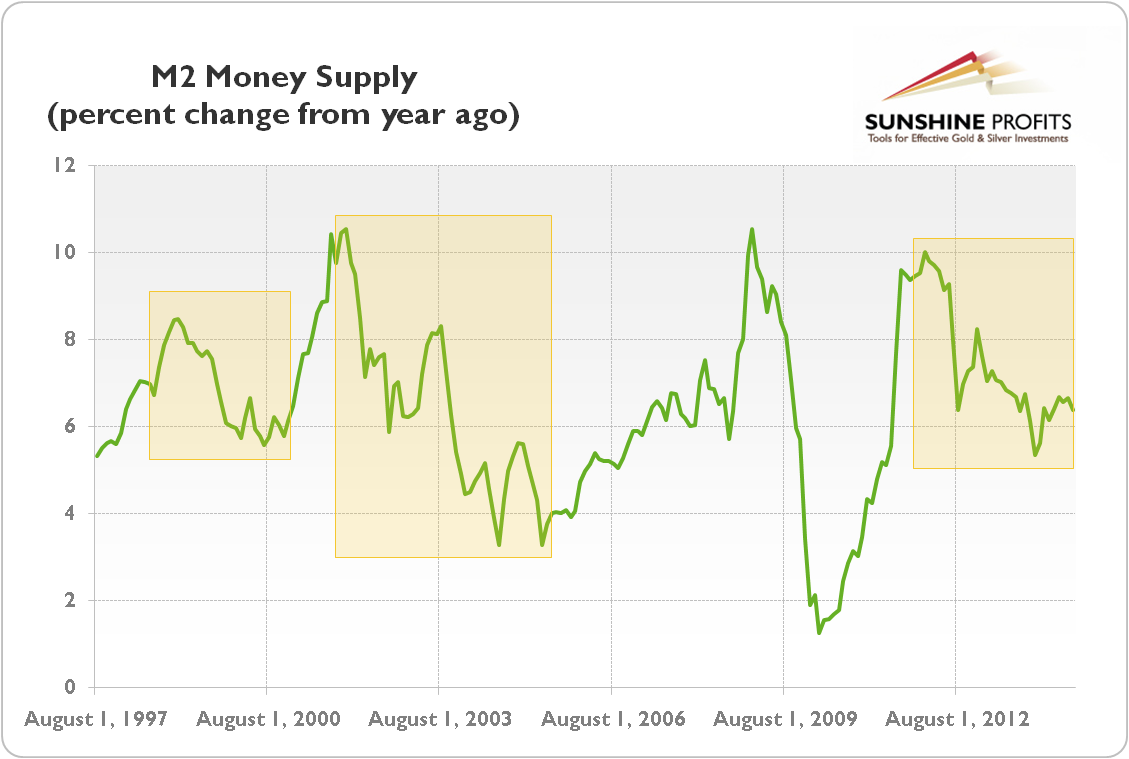

First, the pace of the U.S. money supply has been decelerating for some time. The end of QE3 could reinforce this trend, which increases the risks of a deflationary bust. This is because the unsustainable, artificial economic boom can last as long as the banking system is throwing larger and larger doses of money into the economy. The continuation of this policy could result in high inflation; therefore the central bank voluntarily pulls back at some point, but risks a bust.

Graph 2: U.S. money supply (the percent change of M2 from year ago) from 1997 to 2014

Second, asset prices continue to climb to new highs. For example, the stock market has tripled in value since the current bull market started in early-2009, greatly exceeding the pre-Lehman peak. The high level of total market capitalization to GDP ratio also indicates that stocks are in bubble territory. Consequently, total U.S. household net worth reached a record high of $81.5 trillion in the second quarter of the 2014, over $10 trillion higher than the level at the peak of the asset bubble in 2007. The household net worth to GDP ratio is also at an all-time high. It seems that the increase in assets price and household wealth has been driven mainly by the Fed's zero interest rate policy and quantitative easing programs.

Third, extremely low borrowing costs and the booming stock market has encouraged traders to extensively use margins to finance their stock purchases, which resembles the previous U.S. bubbles. Corporate borrowing is also at a level comparable to the peaks of the last few bubbles.

Therefore, the end of QE may contribute to bursting of the asset price bubble. The bubble may even burst not because of some real consequences of the halt of the bonds-buying program, like the lower pace of the monetary expansion, but just due to expectations of hiking the federal funds rates, which could increase the long-term interest rates after remaining at record lows since the financial crisis. Any such change would be detrimental to the asset markets. Do not forget that rising interest rates are what burst the 2003-2007 bubble, which led to the Great Recession. The question now is what are the prospects of the gold in the post-QE world.

We analyze this issue in our last Market Overview report and we invite you to read it. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term implications of the relationship between Fed’s policy and gold. If you’re not ready to subscribe now, we still encourage you to sign up for our gold newsletter and stay up-to-date. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor