Crude oil bounced from its yesterday's lows, and the oil bulls rebuffed another attempt to move lower earlier today. Does that mean that the upswing can continue now, or a cautious approach would win the day?

In yesterday's Alert, we wrote the following:

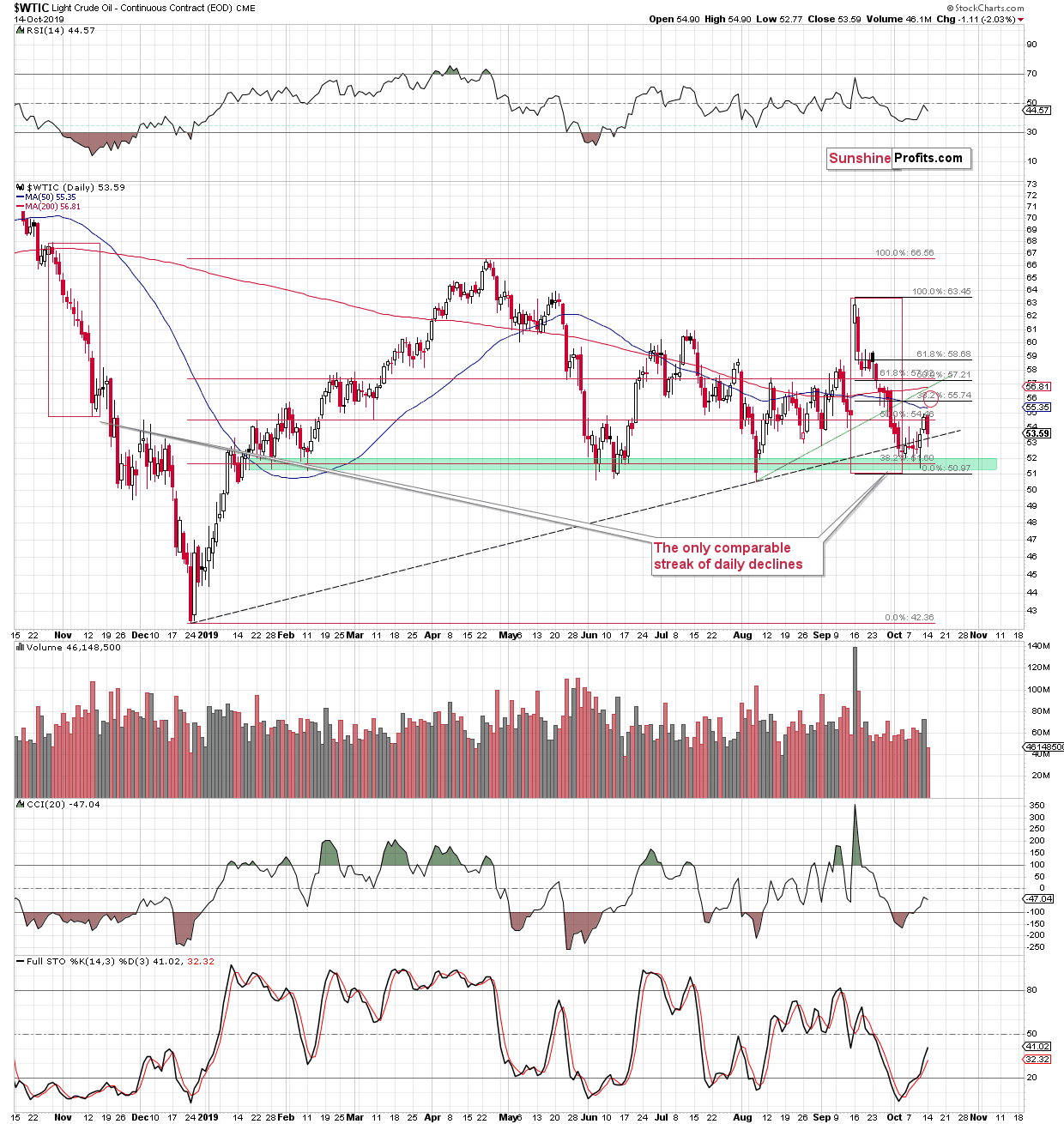

Crude oil moved higher last week, especially on Thursday and Friday. This rally was in tune with the clear buy signals from the CCI and Stochastic indicators. While crude oil pulled back in today's pre-market upswing, it's unlikely that the rally is completely over at this time. Why? Because of two factors: one that we covered previously, and one that we didn't cover so far.

The thing that we already discussed is the upside target based on the 38.2% Fibonacci retracement. It was not reached yet. Consequently, the price most likely has further to run.

The thing that we didn't mention previously is the fact that crude oil just invalidated the breakdown below the rising dashed support line that's based on the December 2018 and the August 2019 lows. Invalidations of breakdowns are bullish on their own. That's yet another reason to expect the profits on the current crude oil long position to increase further.

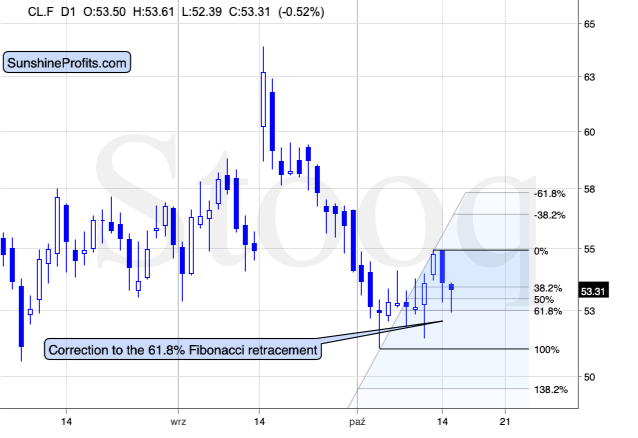

The above generally remains up-to-date. The price of crude oil declined today and then rose back up and at the moment, our long positions are about $1.50 in the black. The question is whether we run for the hills because of this week's decline, or do we wait for the price target to be reached.

The latter still appears to be the better idea. Applying the Fibonacci retracements to the October rally shows that today's low formed almost exactly at the 61.8% Fibonacci retracement level. That's the classic way for any asset to correct its preceding move and then to resume the trend. The short-term trend remains up, which means that the odds are that our target area will be reached.

One concerning matter is the situation in the USD Index. In the very recent past - the last several days - the USD Index and crude oil moved in the opposite ways. Thursday's and Friday's upswing in crude oil corresponded to declining USD. And the USD Index seems to be bottoming.

Then again, the relationship may be very short-lived and crude oil might be able to rally despite USD's rally for a few days, anyway. After all, the USD Index is up at the moment of writing these words, and crude oil is almost done correcting its initial downswing.

Consequently, in our view, the current long position is justified from the risk-reward point of view.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts to also benefit from the trading action we describe - the moment it happens. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care