Based on the October 26th, 2012 Premium Update. Visit our archives for more gold & silver articles.

With the US presidential election drawing near, it is beginning to look like Mitt Romney may actually have a shot at the white House. This prompts gold investors to wonder how such an outcome might affect financial markets and especially gold. What if Mitt Romney wins? The election may impact everything from mortgage costs to the cost of financing the U.S. debt. Trillions are at stake.

The theory goes that Romney will replace Fed Chairman Ben Bernanke whose current term will expire in any case on January 2014. He has said as much. This might slow down the perpetual money printing machine, which would be a bearish signal for gold. It would add uncertainty to monetary policy and increase market volatility.

If Romney were to be elected, a front-runner for the Fed Chairman post is Glenn Hubbard, Dean of Columbia Business School and Romney’s top economic adviser. Hubbard is not enamored with Bernanke’s methods.

A new Fed Chairman might raise interest rates which would lead to a short-term economic contraction and increase the government’s cost to service its debt. Only last month the Federal Reserve unveiled a program to keep interest rates at or near zero until 2015. If a new Fed chairman raises interest rates that would be a bearish signal for gold since it would make bonds more attractive to investors. Bernanke believes that rates should not be raised before the recovery is firmly “entrenched.” He says that removing the stimulus too early would tilt the economy back into recession. A more conservative Fed Chair appointed by Romney may think that recession is an acceptable cost for getting off the perpetual money printing train.

Both candidates talk about reducing the deficit, both want to extend tax cuts to avoid the upcoming fiscal cliff. Romney may talk about reducing spending by $5 trillion but has also called for a whopping $2 trillion increase in military spending. We better not hold our collective breaths for any debt reduction. If Romney were to actually follow through, this could be seen as a temporary negative signal for gold since it would make the dollar look more trustworthy.

Romney has stated that if elected president, he would label China a currency manipulator, which could lead to a trade war with the dollar being devalued versus the yuan. Romney believes that China’s currency is being kept artificially low, to the detriment of U.S. manufacturers. “The president has a regular opportunity to label them as a currency manipulator but refuses to do so,” he said during the last debate, and repeated his pledge to do just that if he’s elected.(Coincidence or not, China’s yuan hit a multi-year high Wednesday against the dollar.) Any currency war, a decline in the dollar and a further discrediting of fiat currencies would be bullish for the price of gold.

Romney has talked about establishing a gold standard commission, which if put into effect, would be incredibly bullish for gold.

It is interesting to note that Romney owns gold, between $250,000 and $500,000 according to his disclosure.

No matter who wins the election, we believe that gold and other precious metals should be a part of any gold & silver investor’s portfolio. The US economy is in trouble and there are no quick fixes. If spending levels are cut and the quantitative easing program derailed, the economy would contract bringing the U.S. to center stage in a Greek style tragedy. If, on the other hand, the U.S. continues its Keynesian policies, the country could face serious inflation. So it won’t matter much to the price of gold if it is Obama or Romney who occupy the White House this January. Deficit spending and money printing will ultimately continue like there is no tomorrow even though gold could dip if Romney does indeed win. If Obama wins, we will likely see a quick rally in the precious metals in the short term. The long-term picture will remain bullish in either case.

To see what we can expect on the precious metals market in the short term, let's move on to today’s technical part. This time we will focus on markets that can impact the precious metals market in the following days and then we will move to the strength and direction of this impact. We’ll begin with the analysis of the US Dollar Index (charts courtesy by http://stockcharts.com.)

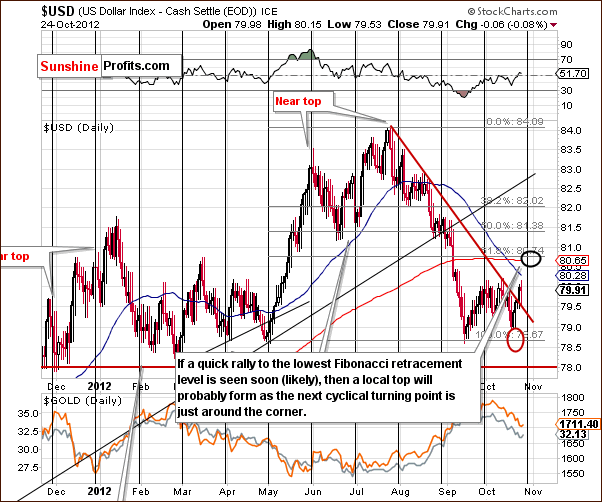

In the medium-term USD Index chart, we see a small possibility of another retest of the declining support line. While lower index values are still possible here, it already seems that the consolidation period has ended and the USD Index is ready to move higher. Moves to the upside appear to be more likely than not. These implications are based on this chart alone however.

Turning now to the short-term USD Index chart, this is where we find the key details concerning the USD Index this week. We have seen a breakout here and it has been verified by three consecutive daily closes above the declining resistance line. The index now appears likely to move higher. Please keep in mind, however, that the cyclical turning point will soon be reached.

Since the USD Index has been moving higher of late, the cyclical turning point will likely coincide with a local top. It seems this will be fairly soon, likely at the end of October or early in November. There appears to be a good chance that the Index could move to the lowest Fibonacci retracement level (80.74), which is slightly above Thursday’s close. While a move a bit higher to the 50% retracement level (81.38) would not surprise us, a move above this next level is unlikely. This is because it would invalidate the very long-term declining resistance line, something which is highly unlikely.

Consequently, the very short-term picture remains bullish here but beyond that the situation is rather unclear. A local top will likely form within the next two weeks (more likely next week), but it is too early to discuss the next moves for the dollar. How soon the top is formed as well as how high the index goes before reversing are both critical pieces of information which are missing at this time. What we have now, however, seems enough to form a strategy for precious metals, because their charts provide other important pieces for this puzzle.

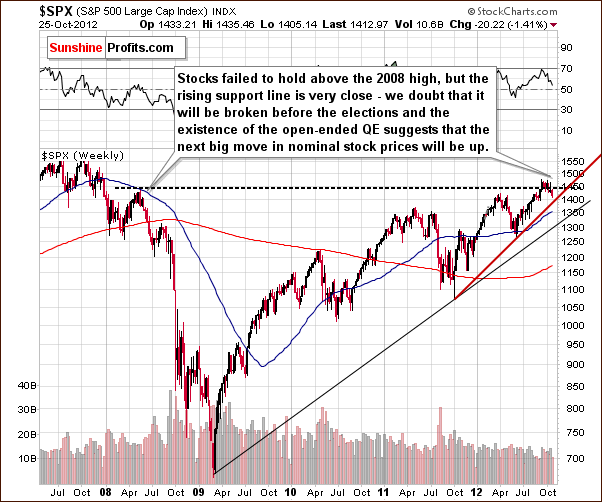

Now, let us have a look at the general stock market’s long-term picture.

While stocks have failed to hold above their 2008 highs, they have not declined below the rising support line (shown in red). It was created by the 2011 and 2012 lows, which means that it is a fairly strong support line and likely to hold at least until Election Day. In short, the short-term downside potential appears very limited.

What happens to the stock market after the elections will to a considerable extent depend on who wins.

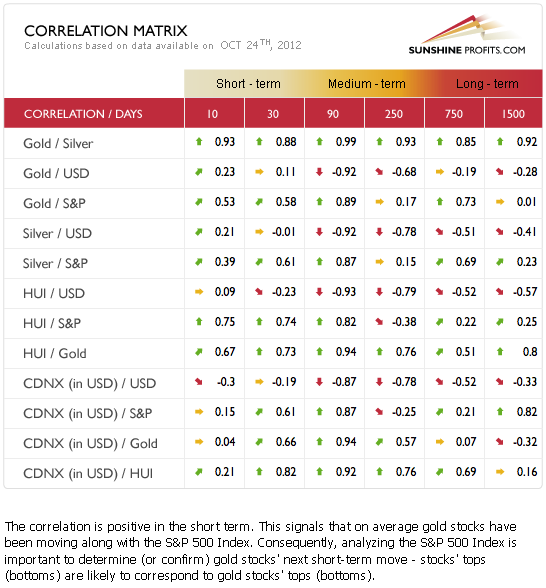

Let’s move on to Correlation Matrix to see whether the situation on the currency and the general stock market will influence gold and other precious metals.

The Correlation Matrix is a tool which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector. It’s interesting to note this week that the recent short-term correlations between the precious metals and the USD Index have been almost non-existent. The previous significant relationship is now neutral as the precious metals’ prices actually declined recently without a rally in the USD Index.

This is not a sign of strength but rather a sign of weakness in the precious metals themselves. Their correlation with the general stock market is still fairly strong, so it seems that the limited downside potential in the stock market likely applies to the metals as well.

Summing up, the short-term outlook for the USD Index is for a rally but likely not a big one. The opposite outlook holds for the general stock market. Although the short-term trend is down, the medium-term support line is close, so significant declines are not likely, especially just before the elections. The decline in gold is likely not over but relatively close to being over.

Please keep in mind that the situation on the precious metals market may change quickly and what you read above may become outdated before you read our next free essay. That's why our premium subscribers receive Market Alerts as soon as anything important takes place - they remain covered at all times. Moreover, our subscribers read full versions of our articles that we callPremium Updates - they are much more in-depth and thorough than free commentaries posted in this section, so by reading them you are better and earlier prepared when major changes regarding gold and silver occur. For instance, today's Premium Update includes the analysis of silver stocks, comments on the decline in gold's 300-day moving average and updated price targets for the current decline.

Our subscribers also enjoy up-to-date and tailor-made (!) gold stocks ranking, silver stock ranking and more. Traders particularly value the ability to track the accurate SP Indicators dedicated to the precious metals market without the weekly lag. We encourage you to join our subscribers and also enjoy all of the above-mentioned benefits.

Thank you for reading. Have a great weekend and profitable week!

Przemyslaw Radomski, CFA

Back