The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold articles.

The dollar is on the defensive again as the payroll report showed that the US will have a hard time recouping jobs lost during the recession. As the greenback dropped against the euro, investors have turned to an alternative asset: gold. The precious metal reached a three-week high; it has once again breached the $1,200 an ounce barrier (as we had suggested two weeks earlier). Gold has already advanced 10% this year, even climbing a record high of $1,266.50 an ounce on June 21.

Franc McGhee of Integrated Brokerage Services LLC in Chicago said that, "The dollar is getting odious compared to the euro". The euro is on a three-month high against the dollar. It gained 1.8% this week after three weeks of sliding against the greenback. Giving his prediction on gold, he added, "If the Fed has to do something more accommodative to spur the economy, you're going to see an explosive rally in gold".

Payroll figures excluding government agencies grew by 71,000 in July. It fell below economists' expectations of 90,000 job increase. Overall though, the jobless rate remained at 9.5% as employment fell by 131,000.

Effects of Consumer Spending

The United States is known for its consumerism. The good thing about this is that consumer spending accounts for about 70% of the US economy. But relying too much on spending has its bad sides as well. Any dip in consumer confidence can hurt the economy as a whole. In the recession of 2001, American consumers spent their way out of a recession. At least that is what the official saying goes. Generally, they only way one can spent their way out of recession is to delay it and at the same time make it even bigger.

After the September 11 attacks, people became frightened to go out. But President Bush appealed to American citizens to go out of their homes and spend. Spending was supposed to show that the terrorists "cannot destroy the US economy". The simple appeal worked wonders. Aside from people's willingness to spend, consumers were also provided with bonuses and tax rebates. Low interest rates also encouraged them to borrow.

Consumers pulled the country out of the recession (or pushed the recession into the future). Continued spending also ensured that businesses will be provided with ample demand for products and services. Unfortunately, good intensions resulted to reckless spending. It produced record high credit card debt and the financing bubble. The euphoria during the good times led to the eventual financial meltdown that is still being experienced today.

Even if having an economy that is primarily driven by spending was a good thing before (which we double), it isn't the case today. With fearful consumers comprising 70% of the economy, recovery will take time. It is a vicious cycle of unemployment, low consumer confidence, and debt. People also need to pay down their debt before it becomes possible for them to spend more.

There are companies that are doing quite well despite these challenges. For example, both Starbucks and McDonalds provided better-than-expected earnings. However, companies like Unilever and Proctor & Gamble, both consumer goods producers, tell the real picture. Any gain was the result of cost-cutting and lay-offs.

Another important development that should be noted is that many companies that have reported big gains last month generated most of their sales from overseas. In the United States, losers outnumber of the winners. Costco Wholesale (COST), Limited Brands (TD), and Macy's all beat estimates. The performance of both Aeropostale (ARO) and American Eagle (AEO) were a disappointment as the former only posted a 1% gain in July while the latter's sales figure was flat. Companies that missed their earnings forecast include Dillard's (DDS), JC Penny (JCP), Target (TGT), and BJ Wholesale (BJ).

The economy needs consumers to start spending (however it still needs savings in order to finance the growth). With things the way they are, however, it is unlikely that consumers have the capacity to spend even if they wanted to. We don't think we need to comment on how big the savings of the average U.S. Citizen are.

Flee the Dollar?

Since December 2008, the Fed has kept its benchmark interest rate at 0 to 0.25% to counter recession. But this doesn't seem sufficient. According to Peter Schiff of the Euro Pacific Capital based in Darien, Connecticut, "It is now widely accepted that the continued domestic weakness will case the Fed to significantly expand stimulus efforts through so-called quantitative easing." This sends a signal to investors to drop the dollar.

The Federal Reserve's next decision regarding interest rates is due on Aug. 10 Meanwhile, the European Central Bank kept its rate at 1%.

Gold, Euro, and Copper

Gold price has reached a record amid Europe's sovereign-debt crisis last June. The metal historically moved in conjunction with the euro against the dollar. Deutsche Back AG reported that "The positive correlation of gold prices to the euro is re-establishing itself." The bank projects that gold price will average $1,275 during the third quarter given bearish views on the dollar. In our view - it might be the case, but as far as this summer is concerned - we doubt that the final bottom has been formed.

On the other hand, payroll data unveiled the underlying weakness in the US economy. At the same time, copper fell for the second straight day since the US is the world's second-biggest user of metal. According to David Thurtell of Citigroup Inc. based in London, "Metal demand should continue to disappoint". He added that the payroll report just means that the recovery is a weak one.

The International Copper Study Group also revealed that demand for refined copper fell by 3.2 percent in April. Phil Streible of Lind-Waldock, a broker based in Chicago, specifically cited private payroll. He said this is leading to a slower recovery. Joblessness remains a problem on the whole. Based on his study, he commented that he's not expecting significant growth in Europe either.

While China's demand for copper remains strong, copper may still fall to $3 in September. Already, copper futures for the September delivery fell 0.3 percent. It fell by 1.05 cents to close at $3.343 as of Aug. 7, 2010. This is after falling 1.5 percent just the day before after reaching a three-month high of $3.4105 on Aug. 4.

While the decline in copper prices may be worrying to some, it is good news for others. It has already increased by 21% in the past year. On the London Metal Exchange, the copper delivery in three months slipped by 0.4% to $3.34 a pound. Other metals that declined include lead and aluminum. Meanwhile, nickel, zinc, and tin climbed.

Silver futures for September rose by 0.8% or by 15.1 cents to $18.472 an ounce on Comex. Platinum futures for September fell by 1.7% or by $8.45.

Hoping for the Best, Expecting the Worst

Friday's report fell short of economists' expectations. Aside from the worse than expected outcome on the job market, there was also a revision on the June figure. This resulted to 100,000 jobs lost. But in a market that's anticipating a pullback at the very least, bulls didn't flinch. You would think that investors would be selling like crazy in this market but they didn't. While there was early selling, the bulls were once again in control by the end of the day.

At the surface, the reaction on Friday couldn't have been more surprising. After all, what could have been more worrying that lower-than-expected job figures in a vulnerable market with revisions to boot? It is clear though that it would now take more than that to frighten the bulls.

There are several technical issues that need to be looked into. Both appeared last April, which led to massive selloff. The financial industry basically caused the market to bottom in February up until the early part of April. But as the market tried to rally in the latter part of the month, the relative support from financials had already reversed.

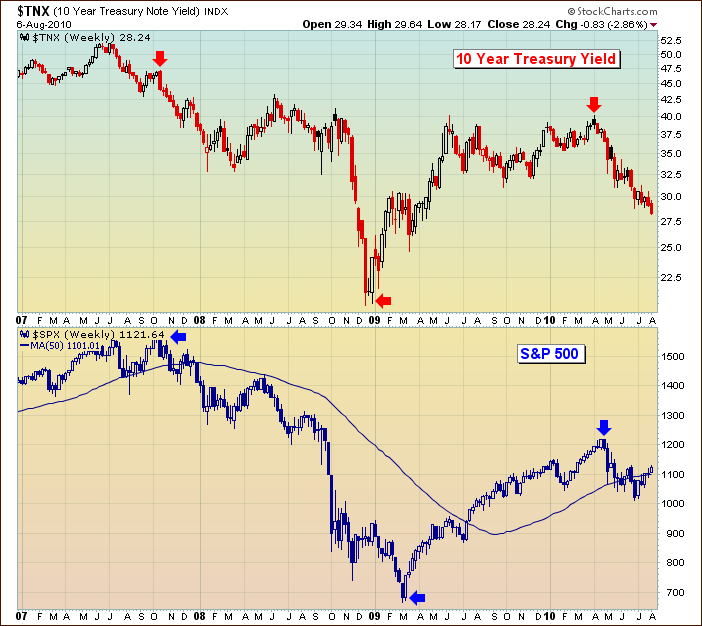

The second technical issue involves the 10-year treasury yield. Equity prices and the treasury yield typically move in tandem with each other, with the yield moving first. It may seem that the yield drags equity prices along but there are also instances when the two diverged. Later, it becomes clear that the same correlation still applies. There are two instances we can cite. One occurred in January 2009; 10-year treasury yield bottomed just before S&P 500 did in March 2009. Just this year, the yield topped 4% in the early part of April; a few weeks later, the same thing happened in the S&P 500.

Take note of the chart provided above (source: http://blogs.stockcharts.com/chartwatchers/2010/08/making-cents-in-a-wacky-market.html).

Significant changes in the treasury yield have a big impact on the S&P 500 because it basically follows its direction. It would seem that the bond market is more responsive to economic changes compared to the stock market. During an uptrend though, the bond market seems to lead the treasury yield. When you study the movement of each chart individually, there will be times when the S&P 500 will set the direction of the bond yields. But the bond market seems to be ahead during major chances. Still - as P. Radomski points out in his latest essay - we will need to wait for a breakout or breakdown from the current mini-flag pattern,

It is important to keep in mind that bond yields move inversely to bond prices. Falling yield means that more investors are putting money into bonds. Treasuries are seen as secure investments; it is safe the say that when you yields falls, it is a signal that investors are searching for safety nets. High risks are avoided and this should be seen as a red flag for the equity market.

Thank you for reading.

Rosanne Lim

Sunshine Profits Contributing Author

--

In this week's Premium Update we once again provide an extensive explanation behind signals from today's Market Alert. While last trades have been completed with a significant profit, we already provide you with an early indication of what the next profitable trade may be.

We begin the report with our comments regarding the "Welcome to the Recovery" essay by Timothy F. Geithner, Secretary of the Treasury. We continue with our regular technical analysis, and end the essay with replies to several questions from our Subscribers i.a. Is money flowing out of gold and mining stocks?

We have analyzed the Euro and USD Indices, the general stock market (and the M3 money supply chart), our correlation matrix, gold (also from the non-USD perspective), silver, HUI Index, and GDX ETF charts. Additionally, we cover the Gold Miners Bullish Percent Index and our unique SP Long-Term Junior Indicator. Speaking of juniors, this week's Premium Update includes our rankings of top gold and silver juniors.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.