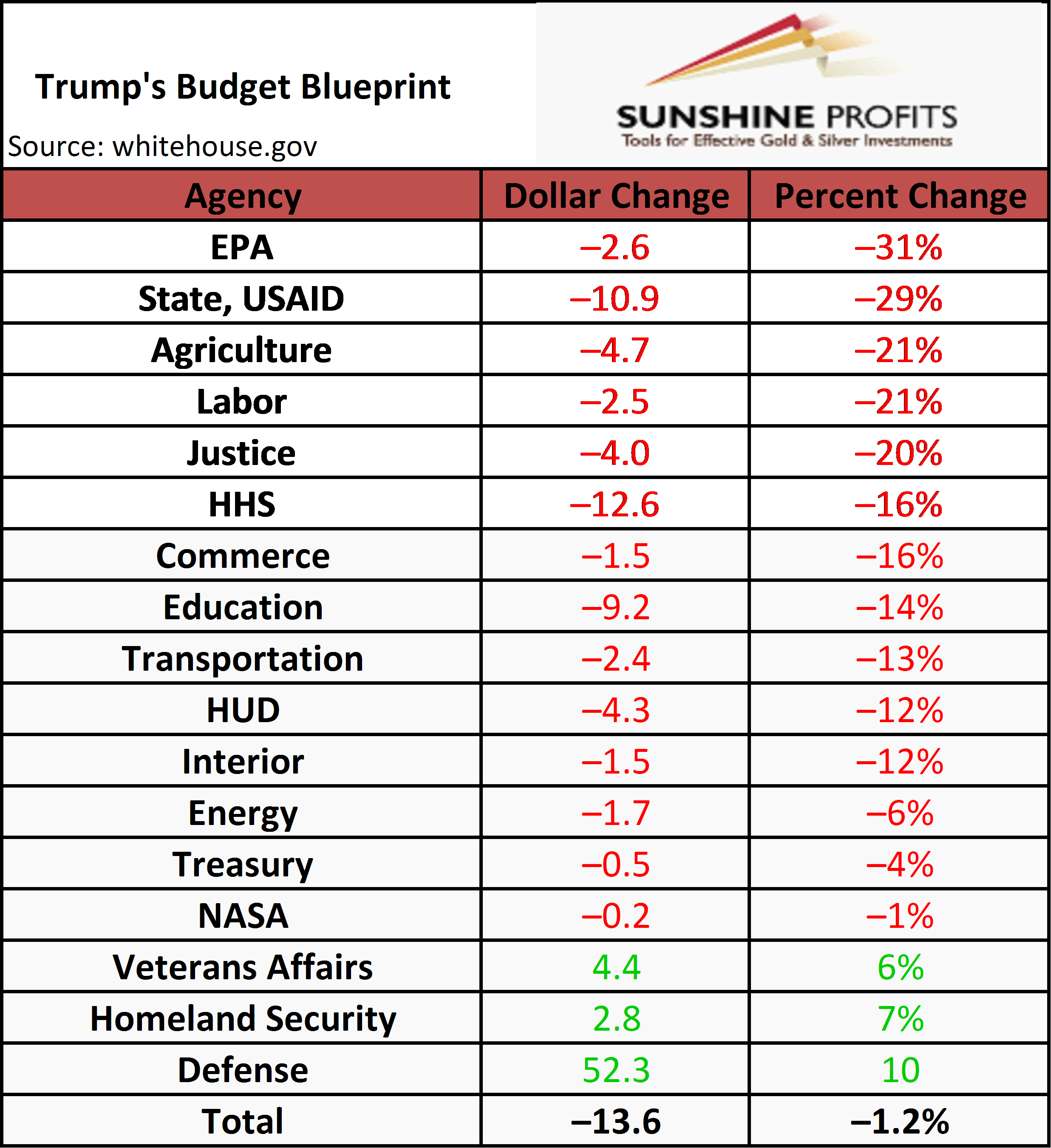

After a long wait, President has finally presented his budget blueprint “to make America great again”. Let’s analyze its possible impact on the gold market. First, we need to praise a 1.2 percent cut in discretionary spending, on balance. In particular, Trump wants to cut the budget of the Environmental Protection Agency by 31 percent, the budget of the Department of State and USAID by 29 percent, and both the budget of the Department of Labor and the Department of Agriculture by 21 percent. The table below summarizes the proposed changes in the allocation of discretionary budget funds.

Table 1: Trump’s Budget Blueprint (in billions of dollars)

Although discretionary spending makes up only about a quarter of all federal spending, it’s a step in the right direction given the American fiscal deficits and indebtedness. As one can see in the chart below, the current ratio of the U.S. public debt to GDP is unprecedented.

Chart 2: Public debt to GDP from 1966 to 2016.

Hence, we agree that it’s time to redefine the proper role of the Federal Government, which should shrink and get out of an area where it doesn’t belong. Defunding cultural programs – such as the Corporation for Public Broadcasting – is a good example. Eliminating programs which do not work – as Essential Air Service, a subsidy program for little-used rural airports – is also a praiseworthy idea. Unfortunately, all these cuts are proposed mainly to fund the 10 percent increase in the budget of Department of Defense, since the goal is to rebuild “our nation’s military without adding to our federal deficit”. Because, you know, U.S. military spending is very modest, it’s just the biggest in the world and higher than the next seven biggest military budgets combined.

What is, however, much more important than our disappointment is that members of Congress express skepticism about the budget plan. Interestingly, there are also Republicans among them, as some of them are defense hawks, who claim that the increase in military spending is not enough, while other see the proposed cuts in non-military spending as too radical. Some of the congressmen even claim that the proposal is dead on arrival. Well, it’s not very surprising given the built-in resistance of members of Congress to cuts, particularly those that affect their districts.

To make matters worse, Trump’s military budget proposal is well above the “sequestration” cap. Hence, it needs to get at least 60 votes in the Senate. Since Republicans have only 52 seats, it means that at least 8 Democrats will have to back the plan. The problem is that they will not approve the increase in military budget financed by cuts in domestic non-military spending. If history is any guide, the most likely way to make Democrats agree to higher defense spending is to assure them that domestic spending also increases. It would water down proposed cuts, which means that the U.S. public debt will not decrease. It might be positive for the gold market, but it should not increase it significantly either, given the Republican budget hawks’ efforts to curb the public debt.

However, another aspect of Trump’s budget plan may be much important for the gold market. The proposal not only covers just discretionary spending, but it does not say anything about tax cuts or infrastructure spending. Actually, the plan includes 13 percent cuts to the Department of Transportation.

The details on the complete budget are supposed to be presented mid-May. It means that the promised fiscal stimulus may arrive later than expected. As a reminder, we write about proposals which aroused the animal spirits on Wall Street and ignited a post-election rally. Therefore, the impatience over Trump’s fiscal stimulus is growing, which may hamper the bullish trend in risky assets and strengthen gold, the ultimate safe haven. Although the reflation trade may stay in place, the enthusiasm about the Trump’s economic agenda should decline. As we wrote in the January edition of the Market Overview, “Trump’s proposals would take a lot of time and political negotiation to be implemented and it would take even more time to influence the U.S. corporations’ profits”. Hence, the bumpy road to the implementation of Trump’s proposal and the related uncertainty are an important upside risk for the gold market. You see, Trump managed to boost confidence in the U.S. economy. However, if he does not translate it into real actions and stronger hard data, the market sentiment may reverse, driving risky asset prices down – while supporting gold.

If you enjoyed the above analysis and would you like to know more about the impact of the current macroeconomic trends and political uncertainty on the gold market, we invite you to read the April Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview