Visit our archives for more gold & silver articles.

Right now all currencies on the planet are backed by debt. If you need a refresher course in why fiat money can become toast, here are some wordspublished this weekon the website of Texas Congressman Ron Paul about fiat money andgold standard:

Fiat money is not good money because it can be issued without limit and therefore cannot act as a stable store of value. A fiat monetary system gives complete discretion to those who run the printing press, allowing governments to spend money without having to suffer the political consequences of raising taxes. Fiat money benefitsthose who create it and receive it first, enriching government and its cronies. And the negative effects of fiat money are disguised so that people do not realize that money the Fed creates today is the reason for the busts, rising prices and unemployment, and diminished standard of living tomorrow.

This is why it is so important to allow people the freedom to choose stable money. Earlier this Congress I introduced the Free Competition in Currency Act (H.R. 1098) to permit people to usegold as moneyagain. By eliminating taxes on gold and other precious metals and repealing legal tender laws, people are given the option between using good money or fiat money. If the government persists in debasing the dollar - as money monopolists have always done - then the people would be able to protect themselves by using alternatives such as gold that are both sound and stable.

As the fiat money pyramid crumbles, gold retains its luster. Rather than being the barbarous relic Keynesians have tried to lead us to believe it is, gold is, as the Bundesbank president put it, "a timeless classic." The defamation of gold wrought by central banks and governments is because gold exposes the devaluation of fiat currencies and the flawed policies of government. Governments hate gold because the people cannot be fooled by it.

We all know that gold has gone up spectacularly in the last decade. If you want to look at the numbers just for the sheer pleasure of it, here is a list. (The ones, who will get the most enjoyment from this list, are those that got into the gold trade in its earlier stages.)

2000 — $273.60

2001 — $279.00

2002 — $348.20

2003 — $416.10

2004 — $438.40

2005 — $518.90

2006 — $638.00

2007 — $838.00

2008 — $889.00

2009 — $1096.50

2010 — $1421.40

2011 — $1566.80

2012 — $???

While nobody can tell now high will gold go in 2012, the odds are that it will end up much higher than it did last year.

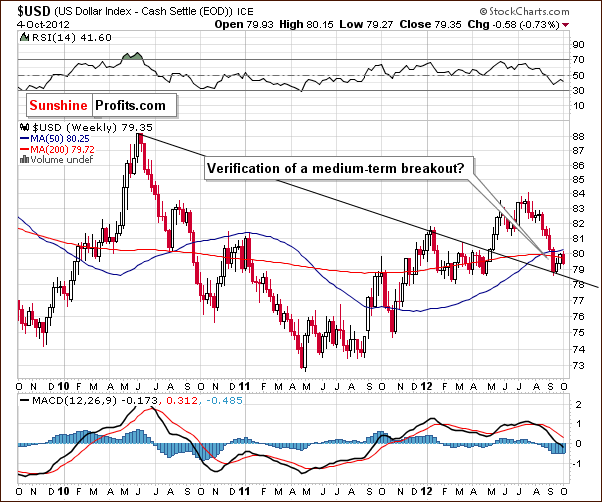

In the following part of the essay we will see if the short-term picture is as positive as the long-term one. As indicated in the title of this essay, we will focus on the situation in the currency markets in order to estimate the most likely outcome from here. We will start with the USD Index long-term chart (charts courtesy byhttp://stockcharts.com.)

There were no long-term changes this week and the picture remains bearish because of the invalidation of the previous breakout (…) This is an important bearish phenomenon for the medium term, and the implications for the months ahead are quite bearish.

The USD long-term bearish outlookremains in place.

However, the above medium-term chart that can tell us some interesting things about the US currency’s near future. This chart allows us to use two important local tops (from 2010 and 2012) to create a support line. Adding this support line to our chart adds value because clearly this support line has stopped the decline seen recently in the USD Index and therefore improves the bullish outlook.

In fact, taking into account this perspective alone, the outlook is bullish. While a major rally does not appear likely based on the long-term picture, a smaller upswing appears quite possible from a medium-term outlook. Combining the implications and signals of the two, it seems that another attempt to move above the declining resistance line (seen on the previous, long-term chart) is a good possibility in the near term.

Summing up, we could still see another small decline in the USD Index followed by a bigger rally and then a continuation of the decline. There appears to be a good possibility for a correction in the precious metals sector when the USD moves higher again.

There were some technical issues regarding Friday's free essay that might have caused the charts not to be visible for you - if that was the case, please note that they are visible now, and that the essay (and points made in it regarding the junior sector) are very much up-to-date. You can read it here:Junior Mining Stocks Could Soon Outstrip the Senior Ones.

Please keep in mind that the situation on the precious metals market may change quickly and what you read above may become outdated before you read our next free essay. That's why our premium subscribers receive Market Alerts as soon as anything important takes place - they remain covered at all times. For instance, the volume in GLD, SLV and GDX was exceptionally low yesterday when prices declined which is generally a non-confirmation and such action used to mean that a rally is to be expected, not a decline. Then again, yesterday was the Columbus Day, so maybe the volume was normal? Today's Market Alert discusses this in detail and it clarifies our views on the short-term picture (plus and update on the currently open speculative position). We encourage you tojoin our subscribers and also read today's Market Alert.

Thank you for reading. Have a great and profitable week!

Przemyslaw Radomski, CFA

Back