While we regularly cover the individual currency pairs, in today’s alert, we’ll focus on their common denominator – the USD Index. The reason is that whatever happens to it, will have profound implications on what happens in the rest of the forex world. And it seems that quite a lot is going to happen, and it’s not going to be intuitive.

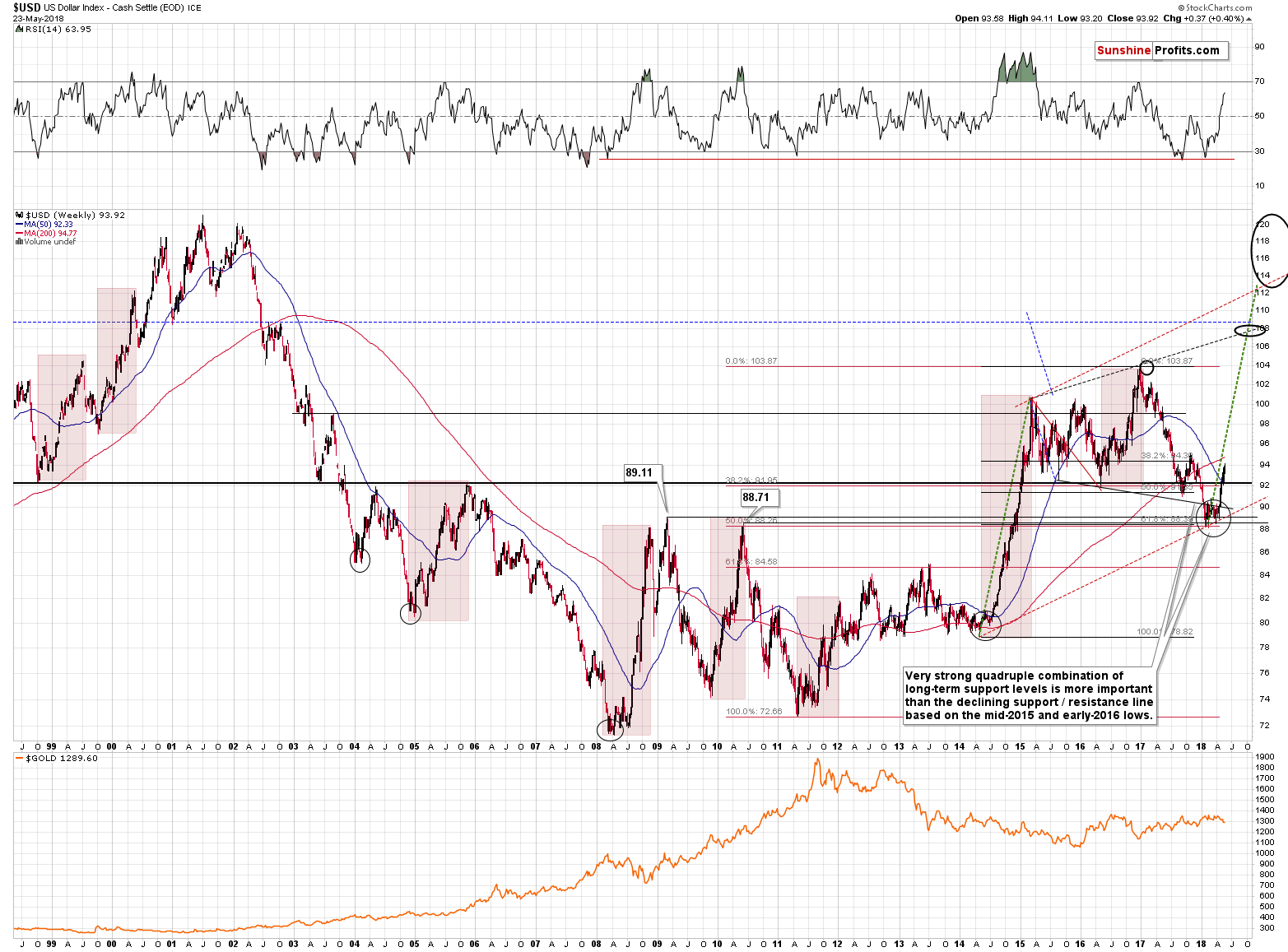

As one can see, there is a general tendency for a given market to move up until it is very overbought and then to correct or decline significantly. At the least - visibly and at the most - extremely and another way of describing the latter is to say that the market is going to become very oversold.

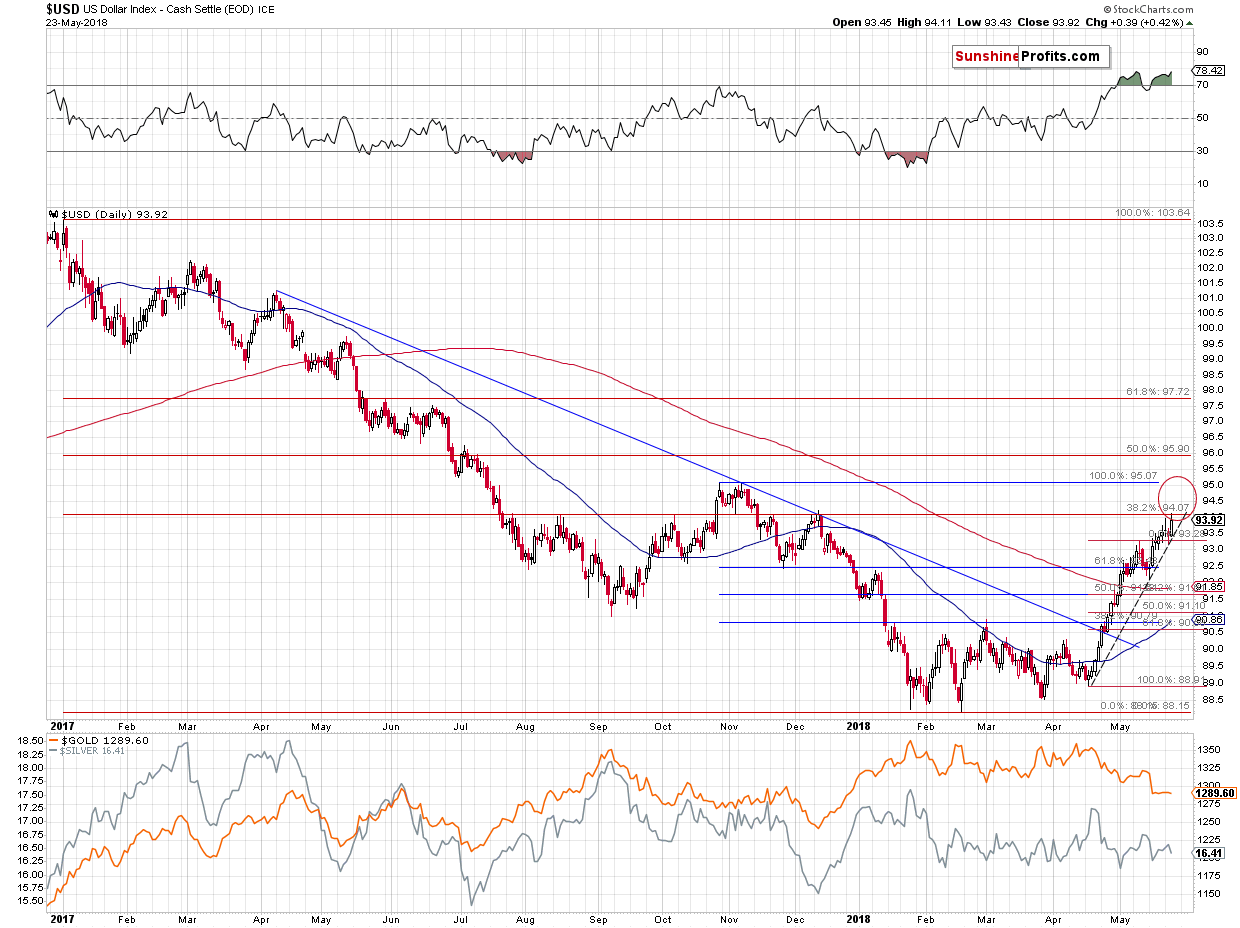

But this may not be the case in the USD Index for some time. Let’s take a closer look at the short-term chart:

The USDX has been oversold for almost a month and yet no meaningful corrective downswing took place. How could this be in the light of the above-mentioned rule? Because of a much more important rule – that the history tends to repeat itself to a considerable extent.

Yes, there are two major resistance levels relatively close to the current value of the index, but they don’t have to generate a meaningful downswing. The lower of the targets is 94 and the higher is 95. The former is provided by the December 2017 top and the latter is based on the October / November top. The 94 level seems more important as it is strengthened by the August and the early October tops and the 38.2% Fibonacci retracement level.

The USD Index just moved to the lower of the above-mentioned targets and one might have expected a corrective downswing. And it happened. Some may say that the corrective downswing was way too small to correct anything, but the king doesn’t agree. It is said that the context is king, and this phrase perfectly reflects what one needs to take into account right now.

As we discussed earlier, the history tends to repeat itself, and the way the USD Index rallied this and last month resembles only one situation from the recent past (and two others from the more distant past). The key one is the 2014 – 2015 rally and the two remaining ones are the 2008 and the 2010 rally.

They all have one thing in common – there were only very brief corrections along the way and the rally took USDX about 15-20 index points higher. So far the USDX is only 6 index points higher, so it seems that most of the rally is still ahead.

Moreover, if the current rally in the USDX is to continue to be similar to the 2014 one (and this seems likely in our view), then we shouldn’t expect a major weakness anytime soon.

Surely, there will be some local pullbacks, but most likely nothing that’s particularly visible from the long-term point of view.

Moreover, please note that the RSI is not yet overbought from the long-term point of view and back in 2014 and 2015 the rally didn’t end even when it was extremely overbought.

So, should we really expect a major decline in the USD Index shortly? Not really. The short-term USD chart includes a rising dashed support line that’s based on the most recent local bottoms. It was just reached, so perhaps the decline that was likely to be seen based on the 94 level, has already taken place.

The above is just the technical justification and let’s keep in mind Fed’s hawkish comments and overall tendency to raise interest rates in the US, while they are not being raised in most of other developed economies. This is also a bullish factor for the value of the US currency in the medium term.

The above likely makes you ask one specific question: if it’s so clear that the USD Index is going to move higher then why did we cash our profits from EUR/USD a few days ago and why are we not keeping any trading positions at this time? The reason is that while it’s more likely than not that the USDX is going to move higher, it’s not likely enough for us to open a position. Your trading success is important to us and we don’t want to make anyone open positions if a given outlook is not confirmed by several techniques at the same time. We are looking for confirmations and once we get them, we’ll know that the risk associated with opening the position is smaller. Naturally, our subscribers will be notified when that happens.

Summing up, the outlook for the USD Index is bullish for the medium term, but not yet bullish enough for the short term to justify opening a speculative long position in currency pairs that move together with the index and a speculative short position in currency pairs that move opposite to the index.

If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Oil Trading Alerts as well as Gold & Silver Trading Alerts. Sign up now.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts