This essay is based on the Premium Update posted on July 23rd, 2010. Visit our archives for more gold & silver articles.

In our previous essay entitled Dollar's Never-Ending Plunge and Its Golden Consequence we have analyzed the current situation in the USD Index and its possible influence on the prices of gold, silver and mining stocks (generally we were bearish on gold). We have also provided our thoughts related to one of the questions that we've received from our Subscribers.

Since that essay caused a very positive feedback, we would like to provide you with a similar one - however this time we are going to cover the situation on the general stock market, but the emphasis will still be on the influence this might have on the precious metals market.

Let's use the SPY ETF as a proxy for the general stock market (courtesy of http://stockcharts.com).

While the bias for the main stock indices is now more bullish than was the case when we've created the above chart, we would still like to bring your attention to the relative performance of gold, silver, and mining stocks.

Even though stocks moved higher in the previous days, the precious metals' reaction has been quite weak. Whereas the general stock market has moved nearly all the way back to its pre-decline levels (second week of July), gold silver and mining stocks have not followed suit. This is indeed a bearish indicator for precious metals Investors and Traders alike.

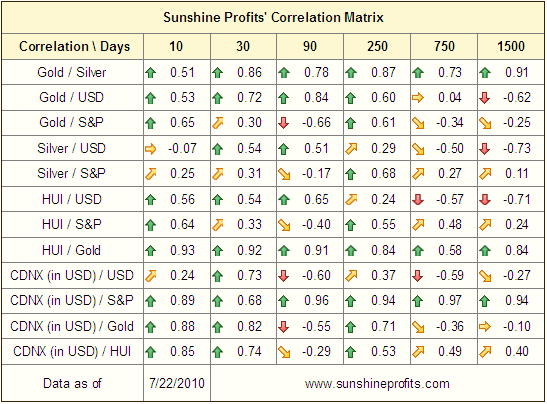

While we have covered the readings from our correlation matrix in our previous essay, we would like to provide it once again, as it provides us with a useful illustration.

The correlation matrix is a tool that we use to quantify observations made throughout the update - at times it provides insight not visible directly on the charts or by analyzing the fundamental situation of the precious metals market. When two markets or indices move in a similar fashion, the correlation coefficient in the matrix table above will be high, that is above 0.50.

Precious metals and the general stock market have some positive correlation but the levels are quite low. It appears that in recent weeks, the general stock market has been leading the precious metals sector to some extent, and the correlation values would not reflect that (they don't take into account the fact that one market may lead or lag another one - come to think of it, this is something that we might want to develop in the future).

Summing up, there are bearish indications for gold, silver and mining stocks in the next several weeks (we are likely to see a short-term bounce to the upside though - perhaps very soon) due to the recent recovery and rally seen in the Euro Index, and the fact that it has been rallying rather poorly given recent upswing on the general stock market. Much more detailed information is available to our Subscribers (we have sent out a Market Alert today.)

Before finishing this essay, we would like to share our thoughts regarding two additional issues - we have received several questions last week, and we will provide you with our replies to two of them.

The first question is about copper - would copper, as a purely industrial metal, be a relevant proxy measure for the industrial forces acting on silver? These would obviously be visible through a suitable spot price or ETF etc.

Generally yes, but what we would be looking for in copper is the "general stock market influence" in order to apply that to the analysis of silver market. It would be imperative to do so if we didn't have any other measures available. However, since we can analyze the main stock indices or even check volume trends through ETFs, we are not missing much information by analyzing them directly. We agree that the analysis of the copper market might be more useful if we determined that it is the general stock market that is the main force behind silver's moves - which is not the case at this point.

At times we can see copper leading the main stock indices, which would be bullish here as copper (and copper mining stocks) appear to have broken out of the downtrend. However, on the other hand, we have seen the death cross meaning that the 50-day moving average moved below the 200-day moving average, which is commonly referred to as a bearish signal. The previous time that we've seen it take place was at the very end of 2007, just before the massive plunge materialized. Still, at this time, the bias is slightly bullish.

Another question is about the flag formation (price trading sideways but generally moves slightly in the counter-trend direction) - is it bearish or bullish for a given market. The answer is that the flag formation is often a sign of continuation of a previous move. In other words, if the price was moving lower before entering the flag formation, the formation is bearish, and if the price was moving higher before entering the flag formation, the formation is bullish.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

While last week's report was mostly about price targets (we have updated them) for gold, silver and mining stocks, and this is the case also this time, but the report that we have just completed includes also our initial thoughts about the possible time, when the current decline is likely to end (and we make additional comments in today's Market Alert.)

The 15 charts featured in this week's Premium Update include: Gold (also from the non-USD perspective), Silver, HUI Index, GDX ETF, our Correlation Matrix, USD and Euro Indices, and SPY ETF as a proxy for the general stock market, and many of the abovementioned charts include price/time targets. We also let you know what signal to look for in order to determine the entry point to add to the current speculative position. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.