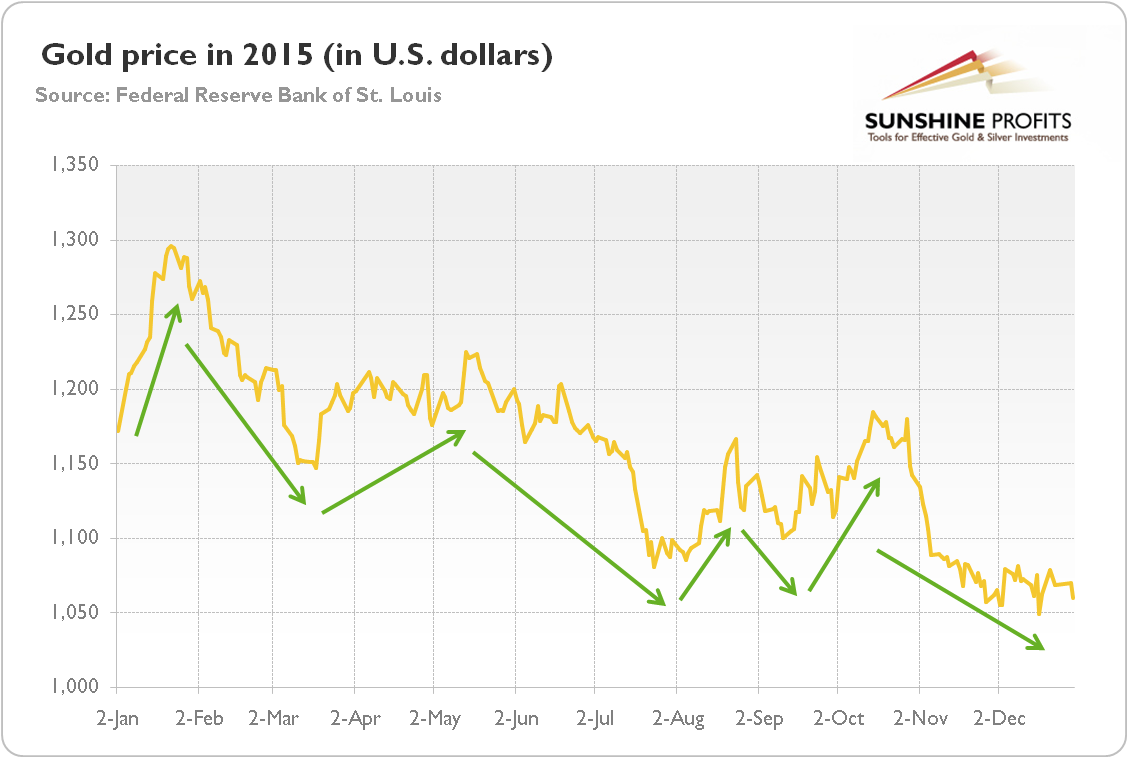

How can we summarize the last year in the gold market? First, it was not a good year for the gold bulls (however, gold performed much better than many other commodities, confirming its role as a currency). As one can see in the chart below, the London spot price of the shiny metal declined 9.56 percent from $1172 to $1060. Gold marked its fourth full year in a bear market.

Chart 1: The price of gold in U.S. dollars in 2015 (London PM Fix)

Some analysts are calling this the bottom in gold, and they could be right. However, investors should remember that picking the bottom is often like catching a falling knife. If you have not mastered advanced contrarian strategies, do not fight the trend, which is your friend until it bends (instead, we encourage you to check out our trading services for the precious metals investors or at least review our gold trading tips).

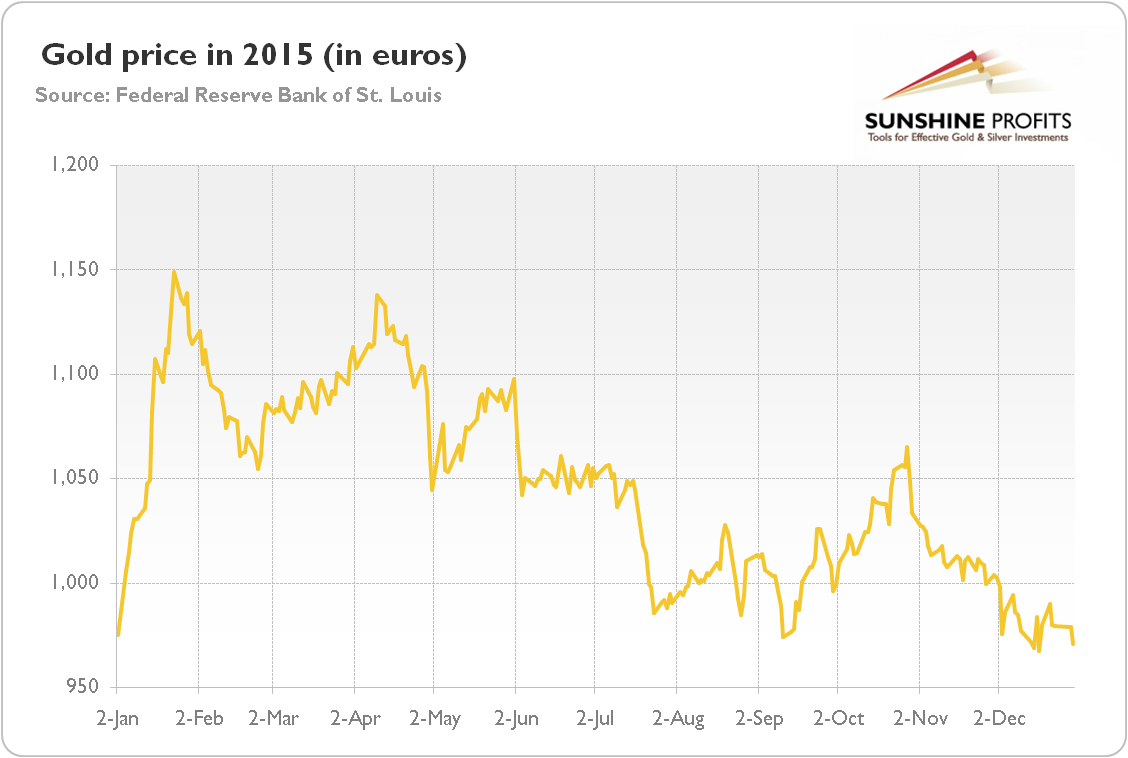

Second, two of the biggest drivers of the decline in the gold price were the rise in real interest rates and the appreciation of the U.S. dollar against other currencies, mainly against the euro. However, investors who bought gold with euros at the beginning of 2015, can sell it for about the same amount now (in several currencies the price of gold actually gained). The chart below shows the price of gold in 2015 expressed in euros.

Chart 2: The price of gold in euro in 2015 (London PM Fix)

The divergence in the gold prices quoted in different currencies shows that the downward move in the price of gold in 2015 simply reflects the strong greenback. It proves that the yellow metal may be considered as a bet against the U.S. dollar.

Third, the price of gold was not falling linearly, but fluctuated intensely in response to macroeconomic factors. As one can see in the first chart, there were six major periods in the gold market in 2015. In January, gold was rising and almost touched $1.300, mostly gaining from the uncertainty about the ECB’s quantitative easing, negative interest rates in Europe, global slowdown, the currency shock from Switzerland, and the falling real interest rates in the U.S.

As those concerns weakened, the gold price fell to $1,147 in mid-March on a strengthening U.S. dollar and rising real Treasury yields. But between mid-March and mid-May, after weak economic data was published (like disappointing nonfarm payrolls) and a dovish March FOMC meeting was held, the U.S. dollar index decreased more than 6 percent against the major currencies. Consequently, the price of gold rose 6.8 percent from $1,147 to $1,225.

The revival of the American economy, elevated expectations of the Fed’s hike in September, disappointing news about Chinese official gold reserves and an agreement between Greece and its creditors on the third bailout exerted downward pressure on the price of gold, which fell to $1100 just a few days before the FOMC meeting (to be more precise, the price of gold bottomed at the turn of July and August, then it was rising for most of August due to the stock market crash in China, and was falling afterwards).

Since the Fed officials didn’t raise interest rates in September, the U.S. dollar and real interest rates plunged, while the price of gold was rising for the second half of September and most of October, touching $1,184. Then, the Fed turned out to be surprisingly hawkish in its October meeting. As the U.S. central bank opened doors for an interest rate hike in December, the greenback and real interest rates accelerated again, while the yellow metal started its decline.

To sum up, the price of gold remained in a bear market last year. The main factors contributing to the 9.56-percent decline were the appreciation of the greenback and the rise in the U.S. real interest rates. The gold trade last year was essentially about the expected Fed's hike or – more generally – about the divergence in major central banks’ monetary policies, as those factors were shaping the U.S. dollar exchange rate and real interest rates. This observation is extremely valuable for investors wanting to enter the gold market this year. The gold trade will neither be about the geopolitics (last year, gold did not react significantly to geopolitical risks), nor China’s official gold reserves, nor European crises. The price of gold will be shaped by global macroeconomics and currency markets, with a very strong emphasis on the situation in the U.S. If the divergence in monetary policies between the Fed and the rest of world (especially the Eurozone) deepens, due to the next interest rate increase in the U.S., the price of gold will decline further. On the other hand, if investors consider the Fed’s move as a one-and-done hike, the U.S. dollar exchange value will stabilize and the price of gold will catch its breath.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the January Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview