The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold articles.

Has the US taken more debt than it can deal with? During the first 19 months of the Obama administration, federal debt has swollen to $2.5260 trillion. This cumulative total is higher than the national debt amassed from the time of George Washington to Ronald Reagan.

Federal debt is divided into two categories: "debt held by the public" which includes government securities owned by companies, individuals, state government, local government, or foreign governments and the other one is "intragovernmental" debt which includes the IOUs by the Federal government. An example of this is when the Treasury borrows money from the Social Security "trust fund" to pay for other expenses.

Based on the report from the Bureau of Public Debt resident the total federal debt held by the public stood at $6.3073 trillion when Barack Obama took office on January 20, 2009. Nineteen months later, on August 20, 2010, the federal debt has ballooned to $8.8333 trillion.

In fact, according to the Congressional Budget Office (CBO), from May through August of this year, the administration has already accumulated a total of $464 bullion in deficit. This is more than the $458 deficit the Bush administrated accumulated throughout the fiscal year of 2008.

The CBO further predicts that the annual budget deficit for 2010 will reach $1.3 trillion; this report will be released on the last day of this month. In the first two fiscal years of the Obama administration, the US has already seen the two largest federal deficits as a percentage of GDP since the end of the Second World War.

Until now, the dollar has been seen as a "safe currency" but this can possibly be surpassed by the Chinese yuan. As the Greek debt crisis has shown, even a minor economy within the Eurozone can cause investors to seek alternative ways to preserve wealth. With the US economy in precarious position, the US dollar may eventually lose its dominance in the global economy.

The financial crisis in 2007 has allowed a government finance bubble to become a possibility. The unprecedented government response including the stimulus and monetary policy has wide ranging bipolar outcomes. If the bubble can be accommodated with loose fiscal conditions, it can gain strength.

However, fragile support leaves it vulnerable to bursting. Added to this is the fact that policymakers seem prone to attacking any potential problem quickly and forcefully. While these measures are supposed to help assume investors and the public, the opposite becomes true in some cases. In fact, uncertainties are ever-present in the economy today. Another development that should be noted is the Greece debt crisis. While the Greek economy only makes up a small part of global output, it is an example of how structural debt problems can erupt and become almost unmanageable.

China Becoming to Assert Its Dominance in Asia

China and Russia already have plans to trade each other's currencies in the next several weeks. The process will diminish the dollar's position in global trade. Trading the two currencies directly makes a lot of sense because Russia is the largest energy supplier and China is the world's second largest energy consumer.

Bloomberg reported that three bankers send documents that confirm that lenders can now apply for ruble trading licenses. Aside from this, the Micex Stock Exchange in Russia is preparing to trade the ruble with the yuan with the banking of the central bank. Bhanu Baweja of UBS AG said that "Given the risk to the dollar and US assets from their fiscal position they want to reduce their dependence on the dollar as an invoicing country."

Both China and Russia have called for policies that will dilute the dollar's role in the financial system. Zhang Ping from China's National Development and Reform Commission said that volatility in major currencies pose a risk to global recovery. For its part, President Dmitry Medvedev suggested than Russia, the third-largest foreign currency holder, lessen its dollar holdings.

China has already started trading against the Malaysian ringgit last August 19. The country is also trading versus the Hong Kong dollar, the Euro, and the Japanese yen on China's Foreign Exchange Trading Center and its interbank market. These movements point to the yuan becoming fully convertible in the future. Today, it is still a non-deliverable currency to minimize volatility.

The step forward between China and Russia is notable because of the amounts and political tensions involved. Russia's Deputy Finance Minister said that several Chinese banks can now open ruble trading accounts. The significant is more important for China. The minister added that "they are gradually allowing more currency operations with yuan." Trade between the two countries jumped $30.7 billion or 50 percent in the first seven months of 2010 compared with the same period last year.

It is apparent that China wants to lessen its dependence on foreign currency to gain access to primary goods. Dariusz Kowalczyk from Credit Agricole CIB said that "Gradually the dollar is being eliminated from foreign-trade settlement flows" because "people are beginning to trade Asian currencies without intermediation via the dollar."

Short Term USD Movement

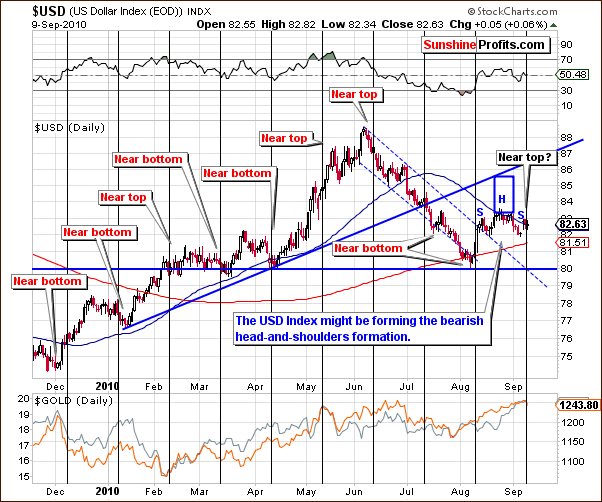

While the dominance of the dollar is uncertain in the future, it is clear that it will remains as a major currency. The worrying depreciation of the dollar was discussed in one of our previous commentaries. Let's take a look at the short-term USD Index chart (courtesy of http://stockcharts.com) for this week.

As you can see above, the Index levels improved slightly for the first straight week. The trend is opposite what happened just the previous week. Since the start of August, small declines have been noticed with weekly improvements observed in between. The closing last Thursday was similar to the close of five and eight weeks ago. In the short-term USD chart above, a head-and-shoulder pattern can also be seen. If the declines goes below the 82-level, this can indicate further declines. A more in-depth analysis of market movements is available in our Premium Updates.

Usually, the declines in the USD Index are taken as positive news by the precious metals market. However, this wasn't the case recently because in the past months, the price of gold, silver, and even mining stocks have been responding to the movements of the euro rather than the US dollar. Throughout the whole year basically, the precious metals were driven by weakness in the euro, which may indicate the influence of European investors on the prices of commodity.

Recent Gold Movements

Now let's take a look at the recent movements on the price of gold. It slid for the third consecutive day on Sept. 10, 2010 after data on Chinese trade and oil demand projection from the International Energy Agency improved the international economic outlook. Oil futures for October delivery added 3% or $2.20 to $76.45 a barrel. Chinese trade data also showed a boost in imports, giving investors hope that global growth will resume. Investors became drawn to equities and other forms of investment that are expected to benefit from growth. The S&P 500 Index rose by 0.4%.

Gold for December delivery has already lost 0.4% or $4.40 an ounce at the New York Mercantile Exchange. It is now at $1,246.50 an ounce. It actually slid to a $1,237.90 an ounce before the US stock markets opened. According to John Stolzfus of Ticonderoga Securities "The price of gold slipped on profit-taking and a lessening of risk aversion as the dollar and the euro firmed."

Currencies that are considered to be "safe" fell. The US dollar fell against the euro and the Australian dollar even as it rose against the yen. Both the dollar and the yen are considered safe assets and these tend to fall when investors see less need to protect themselves. Meanwhile, gold price was at $1,259.30 as of Sept. 7, 2010; this is the highest closing price. Gold received some support from the Bangladesh central bank with its purchase worth around $403 million from the IMF.

At this point the short-term situation remains cloudy, as gold has just closed slightly above its previous high and the HUI Index is very close to analogous resistance. Will the rally continue, or will the metals slide before the next big move up? At this point it's impossible to tell, but the next several days should provide us with some answers.

If you are interested in knowing more on the market signals we analyze, we encourage you to subscribe to our Premium Updates to read the latest trading suggestions. We also have a free mailing list - if you sing up today, you'll get 7 days of full access to our website absolutely free. In other words, there's no risk, and you can unsubscribe anytime.

Thank you for reading.

Rosanne Lim

Sunshine Profits Contributing Author