China’s economic slowdown is a fact. The Red Dragon’ growth rate declined from 10.6 percent five years ago to 7.4 percent in 2014 and will further slow to around 7 percent this year and to 5 percent by 2020 (at least officially, in reality the growth may be even lower). China is the second largest economy and market in the world, whose expansion drove the global growth after the last global crisis. Thus, it goes without saying that the slowdown in China would affect everything from global growth (the World Bank estimates that a 1 percentage-point decline in China's growth shaves a half percentage-point off global growth)to worldwide trade, commodities and emerging markets. Since China is the world’s largest manufacturing nation using enormous amounts of raw materials (for example, it used more cement between 2011 and 2013 than US during the entire 20th century), its slowdown will cause further declines in demand for commodities and will pull down their prices and the income of countries exporting raw materials like Russia, Canada, Australia, New Zealand, Brazil, Saudi Arabia, Chile, or many Asian and African countries.

According to Citi, China could be the driving force behind a global recession for the next two years, while the Daiwa’s analysts believe that the impact of the meltdown in China (now their base case scenario) could be the worst the world has ever seen. However, investors should remember that the consequences of Chinese slowdown for the global economy would be mainly coming through trade channels (by the way, China’s imports are down 14.6 percent so far over 2015), as the capital flows between China and the rest of the world are still relatively small due to capital controls. This means that any possible financial crisis in China (assuming that the government will not bailout any institution), should have a limited impact at a global level (or at least much less significant than in the case of Lehman Brothers’ bankruptcy).

What is the most important for us is how the slowdown in China will influence the U.S. economy and the gold market. Well, nobody knows it for sure, but the current economy looks like it did in 1997-1998, which offers some clues. The current developments hit mainly the emerging markets so far, just like the Asian crisis. Undoubtedly, the financial markets of developed countries suffered then, but losses were relatively contained. In fact, the U.S. boomed in 1999. The current growth can hardly be described as a boom, but the American economy is doing relatively well compared to other countries. Of course, China was not the second economy in the world which was slowing down then, but if history is any guide, the Red Dragon’s problems should not affect the U.S. significantly (partly because China's banking system is mostly state owned, so its biggest banks will not be allowed to default), just like the slowing down in 2008.

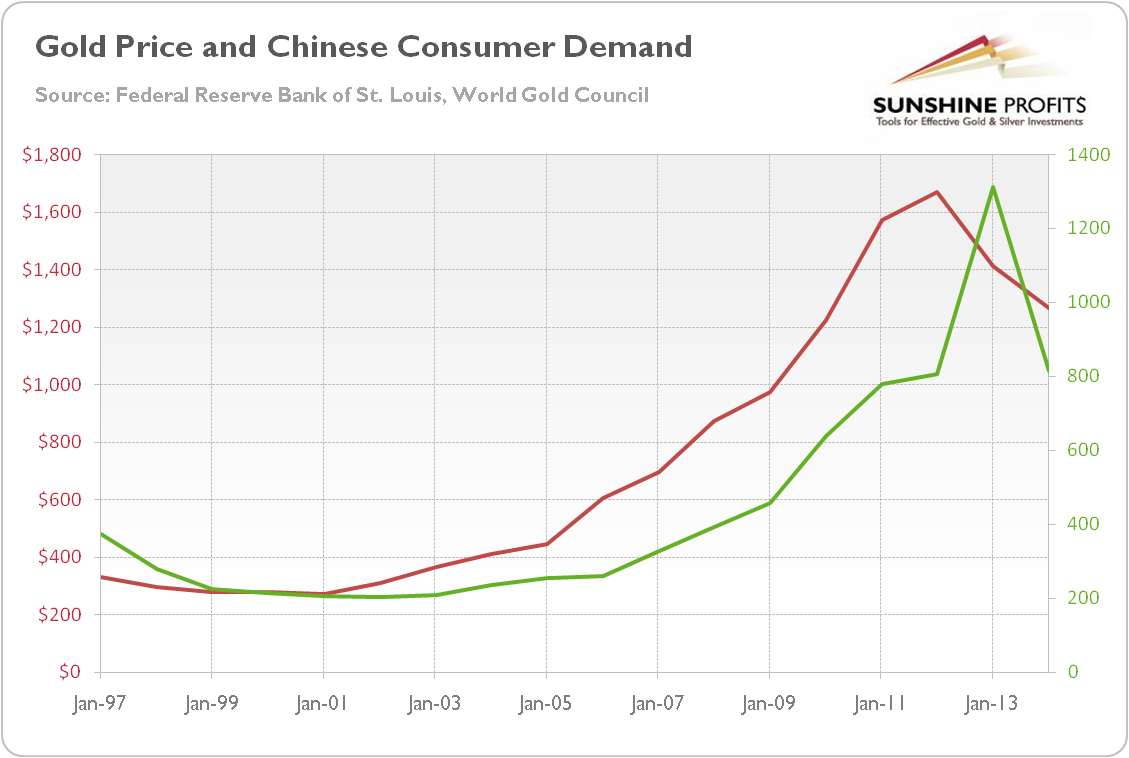

How will China’s deceleration affect the gold market? First, the emerging market crisis resulting from lower Chinese demand and commodity prices will lead capital to flow to the U.S. The result will be stronger greenback and lower Treasury yields: both factors are negative for the price of gold. Second, the slower growth will limit Chinese purchasing power and reduce demand for gold, at least to the extent it is considered a luxury consumer good, not an investment. Third, lower commodity prices could discourage some investors from investing in them, including gold, as China’s demand is considered one of the biggest factors in the gold market. We believe that the Red Dragon’s importance for the gold market is generally overrated; however, the chart below explains why the past China boom (resulting in flourishing demand for the yellow metal) and gold bull market are associated together in the investors’ minds. Therefore, the Chinese slowdown may be negative for the sentiment towards gold.

Chart 1: The price of gold (London P.M. fix, annual average, red line, left scale) and Chinese Consumer Demand (jewelry and retail investment, green line, right scale) from 1997 to 2015

Fourth, slower global growth means less intense demand for credit and thus lower interest rates. Additionally, facing low growth and deflationary pressure, central banks could adopt more dovish stance, which should be positive for the price of gold… unless it supports securities (as the price of gold is often negatively correlated with the stock market). Fifth, the slowdown in China should make the shiny metal more attractive for Chinese investors. As this inhibition results from bursting the previous construction bubble and a transition from investment and export-driven growth towards a more balanced economy with rising domestic demand, there will be many errors and crises along the way, which should spur some safe-haven demand for gold.

The bottom line is that the economic growth in China is slowing down, which will have myriad impacts on the global economy, trade, commodities and currencies. The end of the rapid, investment-led growth in China reduced global trade growth and commodity prices, putting the emerging markets (especially commodity-exporting economies) into serious problems. The accelerating concerns about growth in developing countries (particularly in China) could further undermine the investors’ confidence and spur some safe-haven demand for the yellow metal. However, although emerging markets always get the flu when developed markets catch a cold, the opposite is not true. Historically, the U.S. economy performed relatively well during emerging market crises (partially due to capital inflows). This is not good news for the gold market, as the shiny metal can be regarded as a bet against the greenback and the U.S. economy.

If you enjoyed the above analysis and would you like to know more about the recent developments in China and their impact on the price of gold, we invite you to read the October Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview