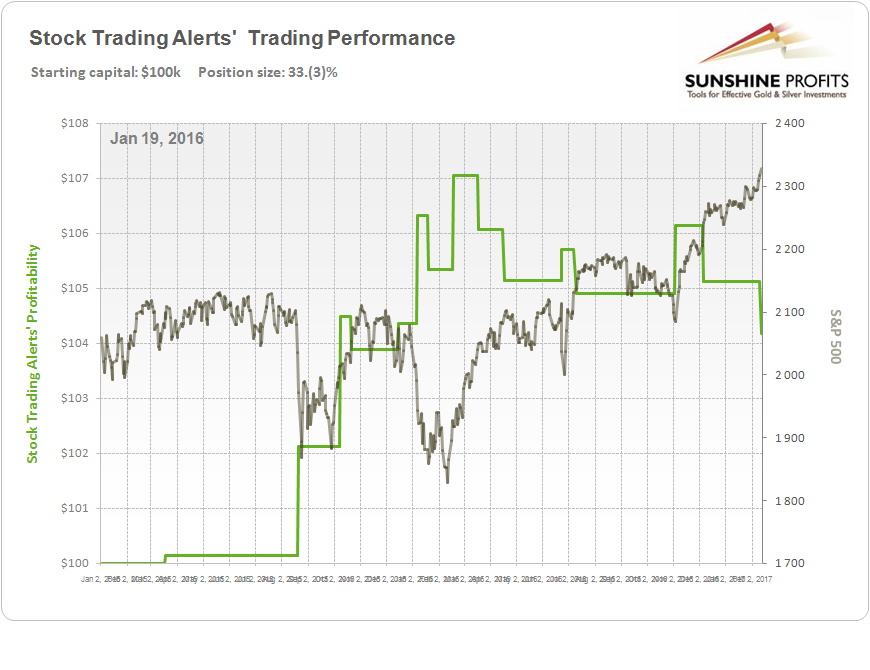

Here is the summary of our trades since the beginning of 2015, along with some more detailed statistics. Open long position, open short position or close long or short position signals are published daily, roughly two hours before the opening of the S&P 500 index trading session (the cash market). Every transaction happens at the opening of the S&P 500 index trading session, excluding stop-loss or profit target executions which may happen "automatically" outside of the cash market's regular trading hours. For more convenient statistical use, signals/transactions prices depict the S&P 500 index. So, individual trades may differ from these prices, depending on what trading instrument investor uses (futures contracts, ETFs, ETNs, CFDs, options etc.).

02-18-2015 open short 2,099.16

03-18-2015 close short (stop-loss profit taking) 2,090 +9.16

04-22-2015 open short 2,098.27

08-21-2015 close short (profit taking) 1,980 +118.2

09-29-2015 open long 1,881.90

10-09-2015 close long (profit taking) 2,013.73 +131.83

10-16-2015 open short 2,024.37

10-22-2015 close short (stop-loss) 2,060 -35.63

10-29-2015 open short 2,088.35

12-16-2015 close short (stop-loss profit taking) 2,060 +28.35

12-31-2015 open short 2,077.34

01-07-2016 close short (profit taking) 1,965 +112.34

01-14-2016 open long 1,891.68

01-20-2016 close long (stop-loss) 1,840 -51.68

02-11-2016 open long 1,835

02-18-2016 close long (profit taking) 1,925 +90.00

03-07-2016 open short 1,995

03-18-2016 close short (stop-loss) 2,050 -55.00

04-06-2016 open short 2,045.56

04-18-2016 close short (stop-loss) 2,100 -54.44

06-01-2016 open short 2,093.94

06-24-2016 close short (profit taking) 2,060 +33.94

07-05-2016 open short 2,092

07-11-2016 close short (stop-loss) 2,140 -48.00

07-18-2016 open short 2,162

11-04-2016 close short (profit taking) 2,085 +77.00

11-16-2016 open short 2,177

12-07-2016 close short (stop-loss) 2,240 -63.00

12-14-2016 open short 2,268.35

02-13-2017 close short (stop-loss) 2,330 -61.65

You can look at some statistics figures here:

- Total net profit: 231.49 index points

Gross profit: 600.89 index points

Gross loss: -369.40 index points - Total number of trades: 15

Winning trades: 8

Losing trades: 7 - Percent profitable: 53.3%

- Largest winning trade: 131.83 index points

Largest losing trade: -63 index points

Average winning trade: 75.11 index points

Average losing trade: -52.77 index points - Ratio average win/average loss: 1.42

- Maximum consecutive winners: 3

Maximum consecutive losers: 2

Maximum drawdown on one single transaction is at around 50-80 index points, as it depends on stop-loss level in relation to opening price of that particular transaction. We do not move our stop-loss level down when long position is open. Likewise, we do not move our stop-loss level up when short position is open.

The final outcome (achieved using the entire trading capital and re-investing it into subsequent trades): +12.5%.

The final outcome (achieved using one third of trading capital and re-investing the same amount percentage-wise into subsequent trades): +4.2%:

We encourage you to make the investment in our detailed alerts. While we can’t guarantee it, it’s likely to be an investment that will pay for itself soon (if not very soon) - join us today.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts