Stock Trading Alert originally sent to subscribers on September 14, 2015, 6:47 AM.

Briefly: In our opinion, no speculative positions are justified

Our intraday outlook is neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): bullish

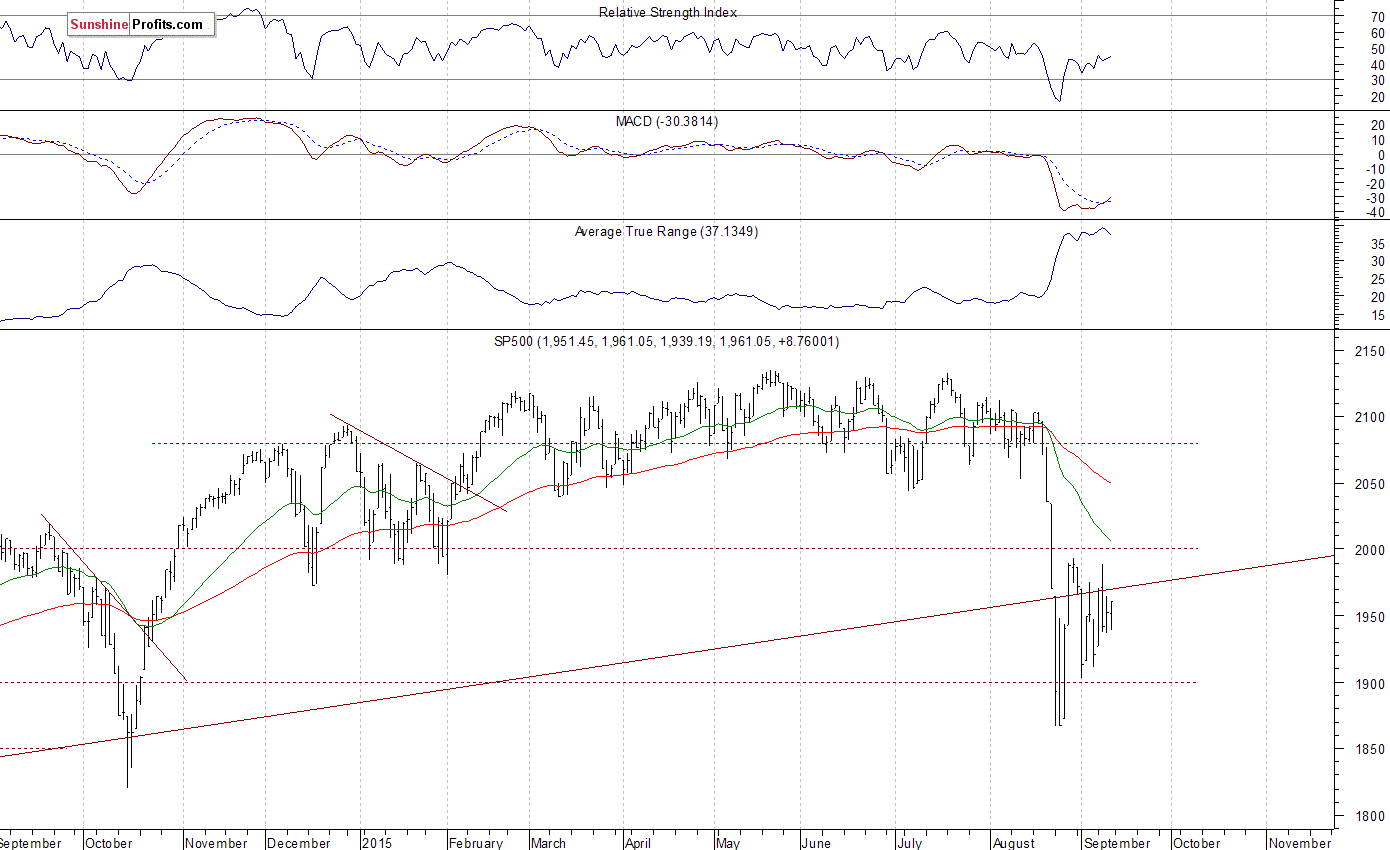

The U.S. stock market indexes gained 0.5-0.6% on Friday, as investors continued to hesitate following late August sell-off. The S&P 500 index remains below the level of 2,000. The nearest important level of resistance is at around 1,980-2,000. On the other hand, support level is at 1,900-1,920, marked by local lows. There have been no confirmed positive signals so far. For now, it looks like a relatively flat correction within a downtrend:

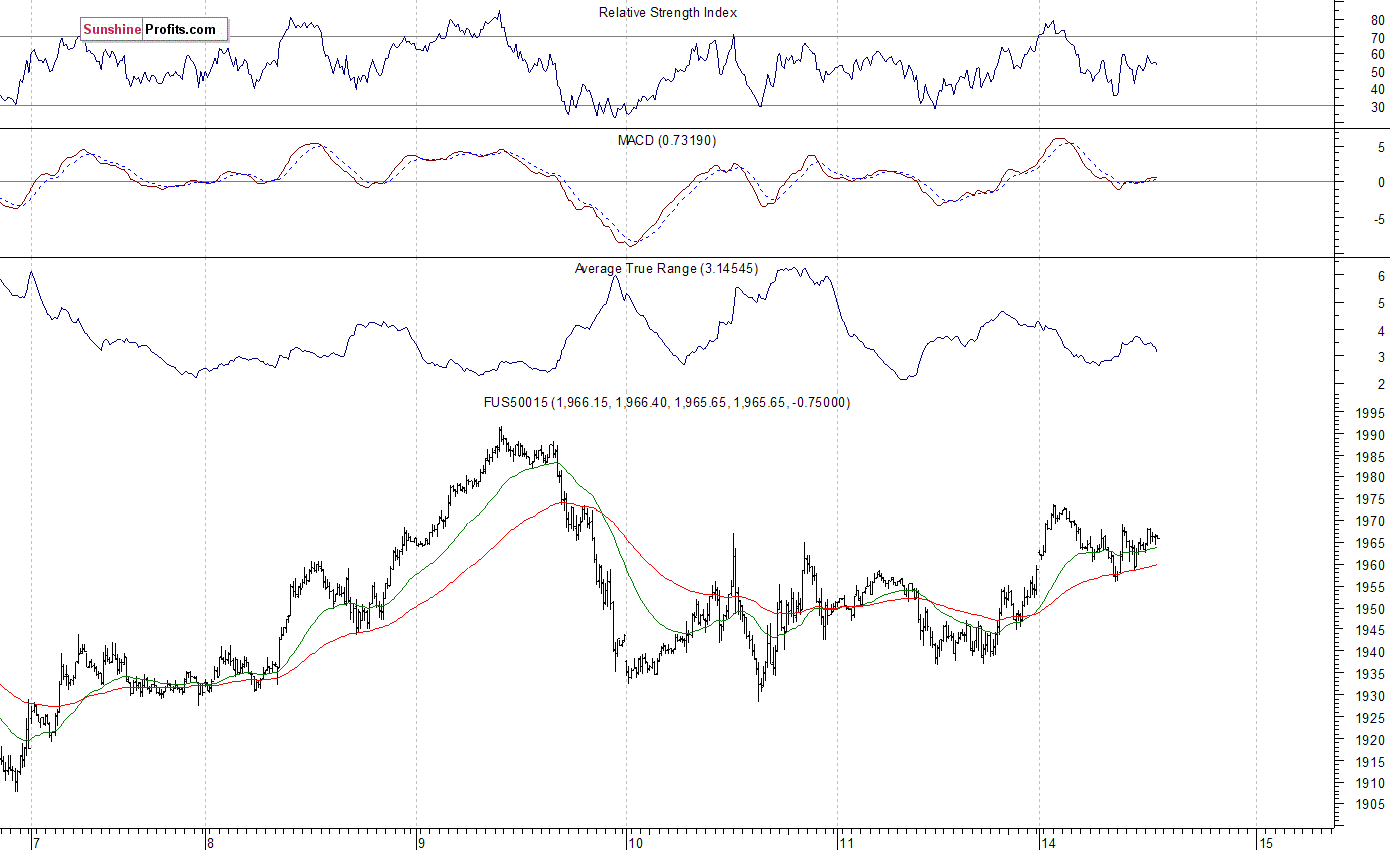

Expectations before the opening of today's trading session are positive, with index futures currently up 0.2-0.3%. The main European stock market indexes have gained 0.2-0.7% so far. The S&P 500 futures contract (CFD) trades within an intraday consolidation, as it fluctuates above Friday's closing price. The nearest important level of resistance is at 1,980-2,000, and support level is at 1,940-1,950, as the 15-minute chart shows:

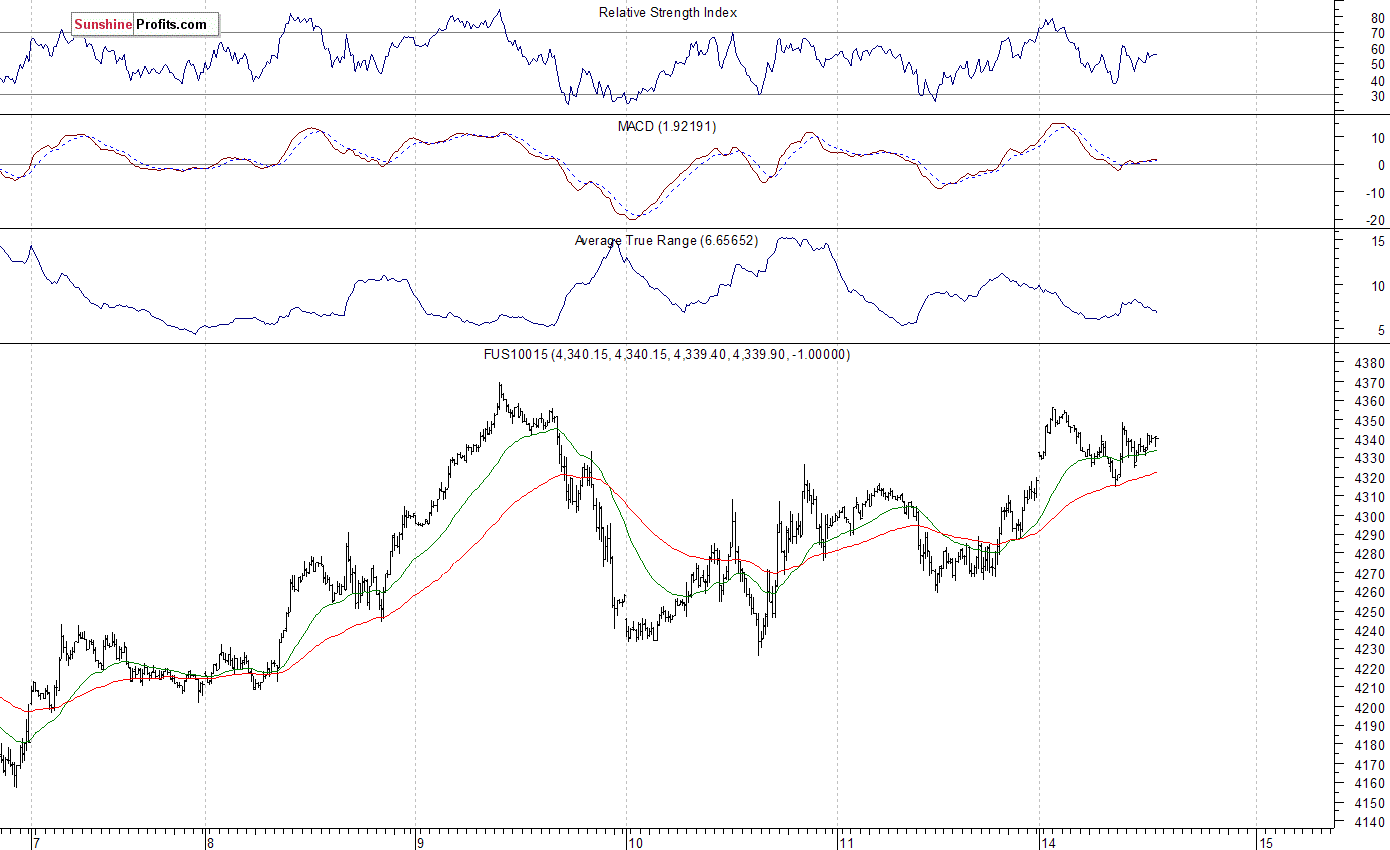

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades along the level of 4,350. The nearest important resistance level is at 4,350-4,360, marked by local highs. On the other hand, support level is at 4,300, among others, as we can see on the 15-minute chart:

Concluding, the broad stock market remains within a short-term consolidation following its late August sell-off. There have been no confirmed positive signals so far. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts