Stock Trading Alert originally sent to subscribers on August 24, 2015, 6:59 AM.

Briefly: In our opinion, no speculative positions are justified

Our intraday outlook is now neutral, and our short-term outlook is neutral. However, our medium-term outlook is now bearish:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): bullish

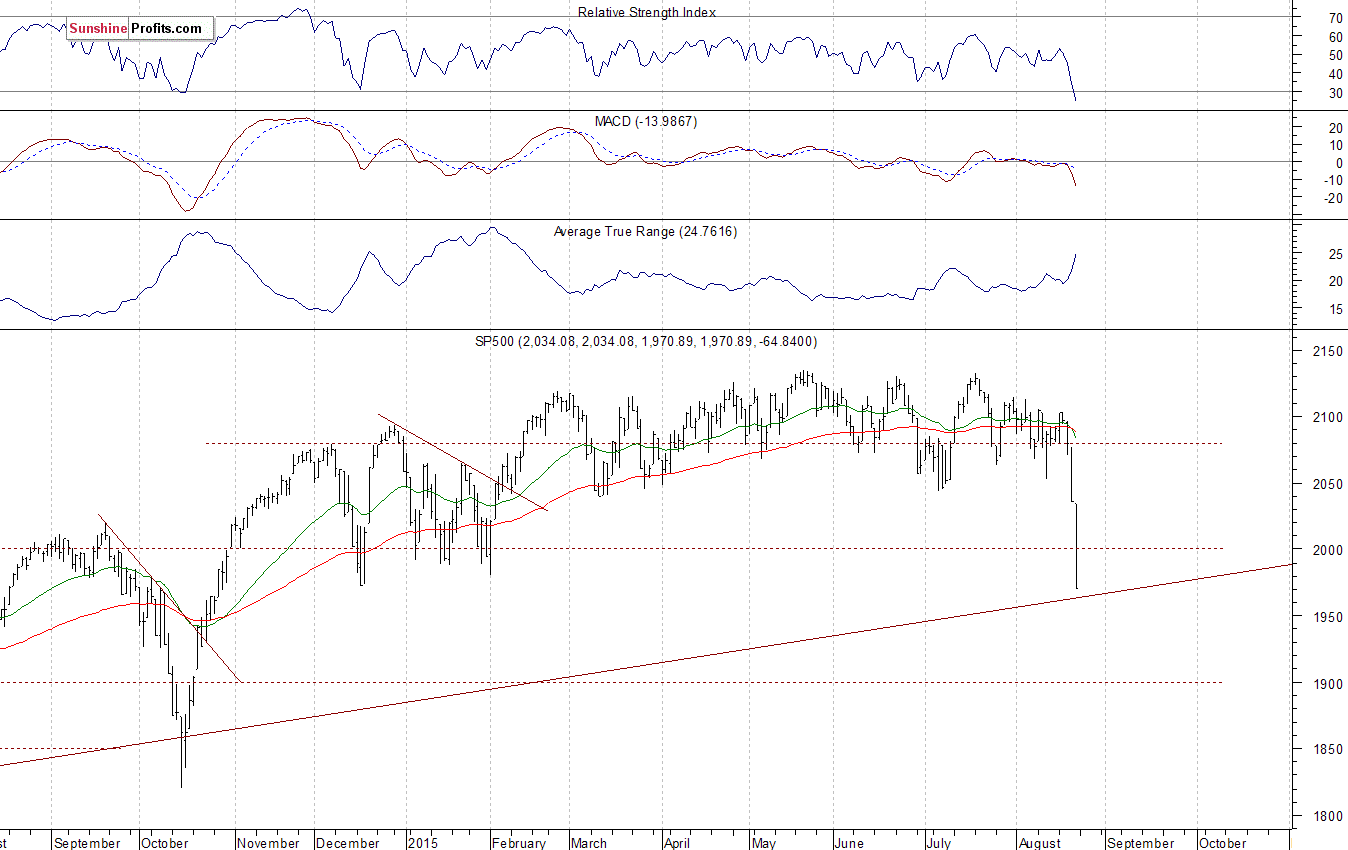

The main U.S. stock market indexes lost 3.1-4.3% on Friday, as investors reacted to global stock markets retreat, economic data releases. Our Friday's bearish intraday outlook has proved accurate. The S&P 500 index broke below the level of 2,000 which is a negative medium-term signal. It is the lowest since late October, as it currently trades below half-year long consolidation. Therefore, we change our medium-term outlook from "neutral" to "bearish". We continue to maintain our bullish long-term outlook for now. The nearest important level of resistance is at around 1,980-2,000, marked by previous support level. On the other hand, potential support level is at around 1,900-1,950. There have been no confirmed short-term positive signals so far:

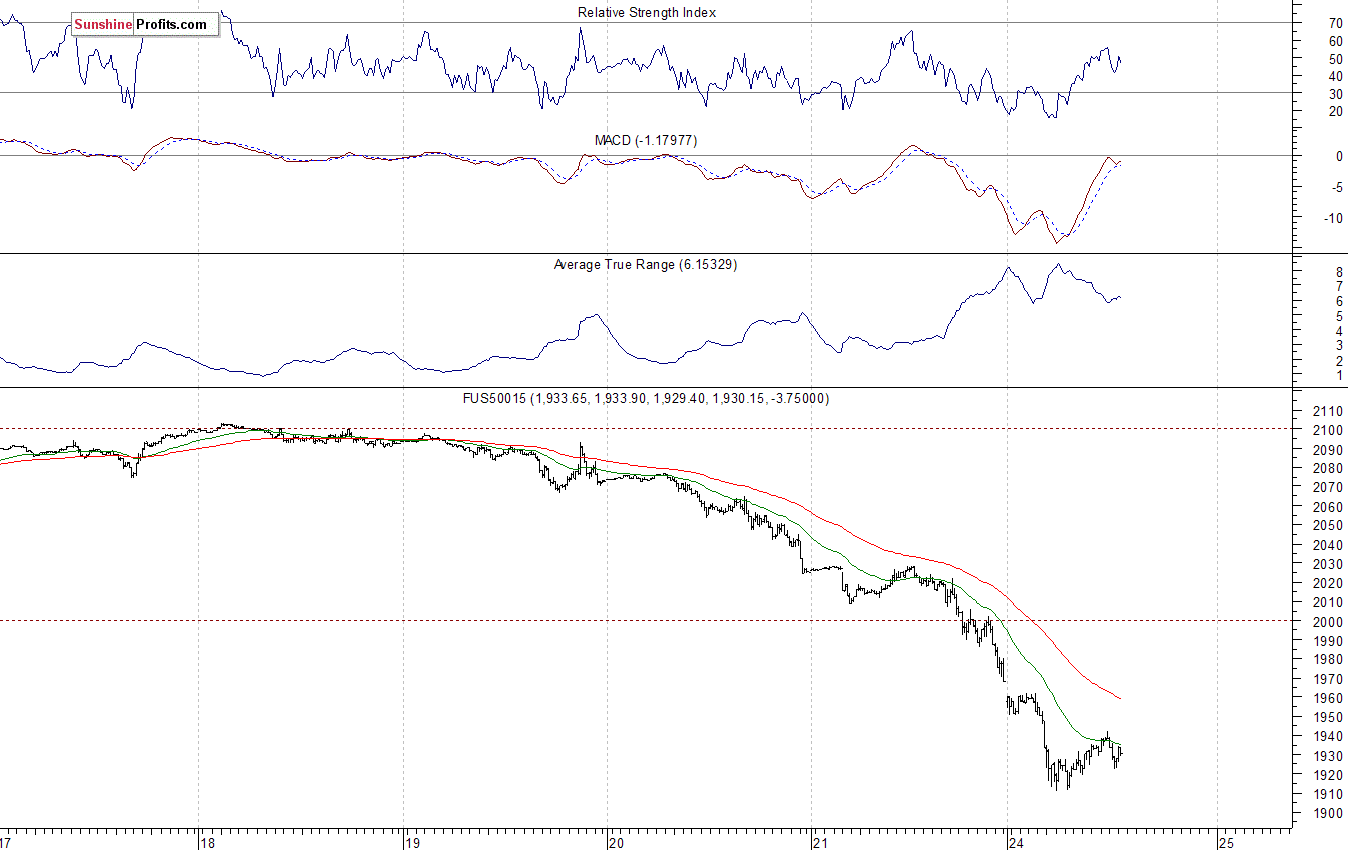

Expectations before the opening of today's trading session are negative, with index futures currently down 1.9-3.5%, following Asian stock markets panic sell-off. The European stock market indexes have lost 2.7-3.0% so far. The S&P 500 futures contract (CFD) trades within an intraday downtrend, as it is closer to the level of 1,900. The nearest important level of resistance is at around 1,930-1,950, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it continues last week's sell-off this morning. The nearest important level of support is at 4,000, and resistance level is at around 4,050-4,100, among others, as we can see on the 15-minute chart:

Concluding, the broad stock market continued its dramatic sell-off on Friday, as the S&P 500 index broke below its technically crucial level of 2,000. Our late April's short position's (2,098.27, S&P 500 index) profit target has been reached at the level of 1,980. Overall, we gained almost 120 index points on that pre-planned trade. As of this morning, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts