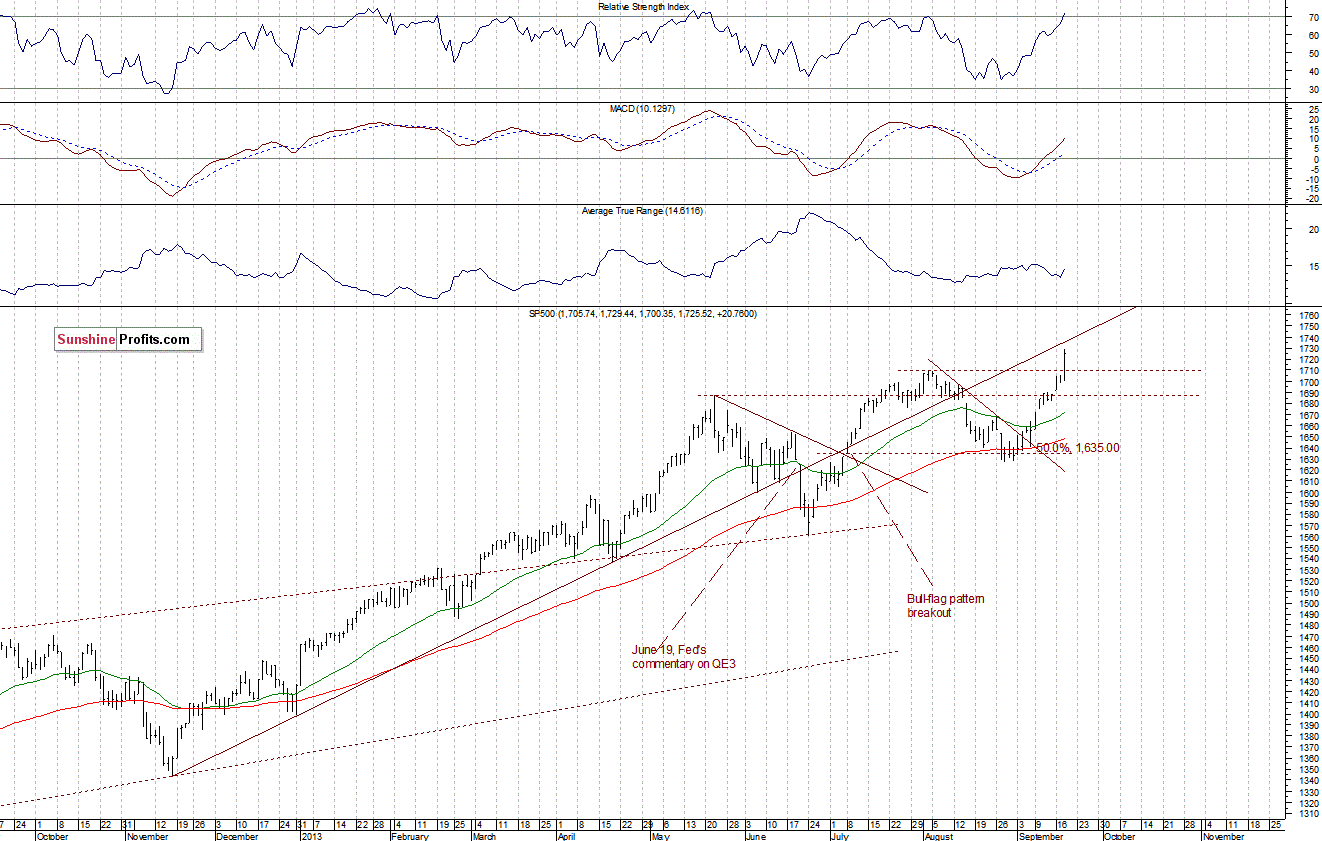

The major U.S. stock market indexes gained 1.0-1.2%, reaching new all-time highs yesterday, as investors reacted to the Fed’s decision not to taper its bond-purchasing program of $85 billion a month. The indexes moved sharply higher, with the S&P500 breaking through the level of resistance, marked by the August 2 high of 1,709.67. The new all-time high in the S&P500 is at 1,729.44. Therefore, the nearest support is currently at around 1,710. The important level of support remains at 1,688.73-1,691.70, marked by Monday’s daily gap up. So, the index continues its long-term uptrend, as we can see on the daily chart:

Expectations before the opening of today’s session are positive, as the index futures gain 0.3-0.4%. The European stock market indexes have gained 1.0-1.4%. In the short-term, we may see a continuation of this upward pressure, however profit-taking phase cannot be excluded at some point. The investors will now wait for the economic data announcements: Initial Claims at 8:30 a.m., Existing Home Sales numbers, Philadelphia Fed index and Leading Indicators at 10:00 a.m. The S&P500 futures contract (CFD) continues its uptrend, reaching beyond the level of 1,700, following bounce off the two-week long trend line. The nearest important support is at around 1,700, as the 15-minute chart shows:

Thank you,

Paul Rejczak