This essay is based on the Premium Update posted November 4th, 2009. Visit our archives for more gold & silver articles.

In my previous essay, apart from commenting on the current situation and suggesting that the top is in for the precious metals sector, I also wrote about the positive fundamental outlook for this particular market as far as long term is concerned. I wrote the following:

The U.S. is the world's largest holder of gold with 8,133.5 metric tones. At today's prices that is a little over $300 billion. That's not enough. If you throw in America's petroleum reserves and its foreign currency holdings, that still won't cover $2 trillions worth of debt that will mature in the next 12 months. Who will want to buy U.S. Treasury paper? India has already voted in favor of gold when it bought 200 tons of IMF gold last month.

Does the above mean the U.S. will go bankrupt?

That's hard to believe. Don't forget that the U.S. government has its own printing press and it can always print new dollars. Besides, there was no audit as far as the abovementioned gold reserves are concerned, which may suggest that the amount of gold in vaults is lower than reported.

All these economic travails can mean only one thing for gold. It's heading up. We saw Tuesday that gold broke above $1,200. In fact, gold ended the month of November with one of the biggest gains in 10 years.

And anyway, human nature is to say, this time it will be different.

In fact, "This Time Is Different: Eight Centuries of Financial Folly" is the name of a book by economists Carmen M. Reinhart (University of Maryland) and Kenneth S. Rogoff (Harvard University) who examine the financial crises of the past 800 years. They identify the singular cause of great economic contractions.

"The essence of the this-time-is-different syndrome is simple," Profs. Reinhart and Rogoff say in the introduction to their book. "It is rooted in the firmly held belief that financial crises are things that happen to other people in other countries at other times. The old rules of evaluation no longer apply. We are doing things better. We are smarter. We have learned from past mistakes. Unfortunately, a highly leveraged economy can unwittingly be sitting with its back at the edge of a financial cliff for many years before chance or circumstance provokes a crisis of confidence that pushes it off."

These plunges happen all the time and, in erratic rotation, around the world, say the authors. It's no wonder, then, that investors' confidence in debt is fickle.

Can governments prevent economic meltdowns? Profs. Reinhart and Rogoff say it's really not all that difficult, provided that governments are "sufficiently frugal," run budget surpluses, and avoid issuing bonds with shorter than 10-year maturities. (Do we know of any countries like that?)

Professor Rogoff was interviewed for The New York Times article I mentioned earlier. He said he expects a wave of defaults by weaker economies about two years from now. The stronger countries will be too busy with their own economic problems at home and will probably not be willing to bail them out.

Meanwhile, governments everywhere are plunging even further into debt. Maybe everyone thinks that this time it will be different.

In any case, the trend is clearly up for the PMs in the long run.

Moving on to the technical side of the market, in the following part of this essay, I will provide you with the analysis of the important silver-to-gold ratio (charts courtesy of http://stockcharts.com) that often provides additional insight as far as timing is concerned. The other important ratio has been featured in the previous essay.

This ratio could normally make one worried if one is currently out of the PM market, as silver tends to outperform gold near major tops, and this wasn't the case lately.

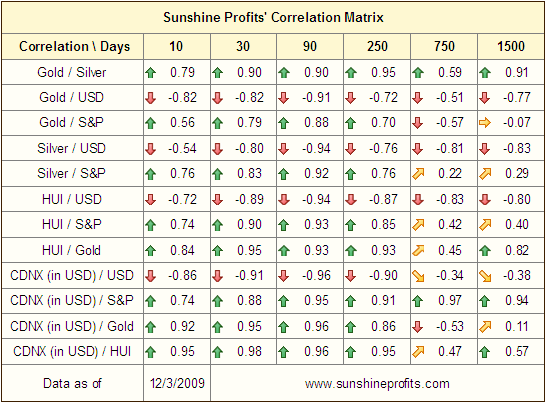

Does this mean that the move lower is a fake one and we will see a massive rally in the next few days? Not necessarily - it appears that the lack of excitement in silver may be to a great extent explained by the situation on the general stock market. After all, silver has many industrial uses, which makes it more correlated to the main stock indices than it is the case with gold. Please take a look at the following table for details:

The values of correlation coefficients with the S&P 500 Index are higher for silver than they are for gold no matter which of the above time frames (columns) you take a look at. Although these numbers are not high in the long- and very-long-term (750- and 1500-trading-day columns), they are above 0, which is not the case with gold. Consequently, the bearish implications of the current situation on the general stock market are more negative to silver than they are to gold. This means that the weakness in the silver-to-gold ratio is rather to be expected in the short run, and the fact that it does not soar right now does not make the coming top unlikely.

Summing up, the fundamental situation for the precious metals remains positive, but the price is not driven by fundamentals in the short run, but by emotions. This means that one needs to use other tools such as the technical analysis if one wants to gain additional advantage over other market participants in terms of entering and exiting positions. Silver-to-gold ratio normally soars just before local tops, but this time that was not the case, which may make you wonder whether this move is very short-lived. This may certainly be the case, but it seems that the weakness in the silver-to-gold rally can be explained by the unfavorable situation on the general stock market, and therefore the strength of the ratio's signal is very limited. Naturally, there's much more to the technical picture than featured above, but I will leave this part of the analysis (many detailed charts along with their interpretation) to my Subscribers.

To make sure that you are notified once the new features (like the newly introduced Free Charts section are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and a profitable week!

P. Radomski

--

Apart from covering the current situation on the precious metals market, the latest Premium Update includes the analysis of the USD Index (long-, medium-, and short-term perspective), general stock market (with emphasis on the relative performance of particular indices), the performance of PM stocks relative to other stocks, , Gold Miners Bullish Percent Index, and much more.