Yesterday, the euro jumped above $1.10. What does it mean for the gold market?

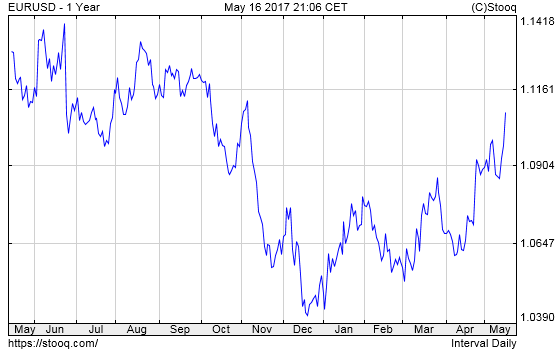

On Tuesday, the common currency rose more than 1 percent against the U.S. dollar. As the chart below shows, the euro surged above $1.10, hitting the highest level since November 2016, when Trump won the presidential election.

Chart 1: EUR/USD exchange rate between over the last year.

The upswing in the EUR/USD exchange rate was partially caused by weakness in the U.S. currency. The dollar depreciated because of soft U.S. housing data and the disappointing Empire State Index, the latest political turmoil in the Trump administration, and the rebound in oil prices. And the market odds of a June Fed hike decreased from 73.8 percent to 69.2 percent.

However, the move was also caused by the strength in the euro seen after Emmanuel Macron’s triumph in the French presidential election. As one can see in the chart below, the common currency has appreciated against the Japanese yen as well.

Chart 2: EUR/JPY exchange rate over the last year.

What does it mean for the gold market? Well, a stronger euro against the U.S. dollar should be bullish for the gold market, as the price of the yellow metal is negatively correlated with the greenback’s strength. However, if the rally in the euro reflects the increased risk appetite among investors, it’s bad news for safe-haven assets such as gold.

Let’s look at the chart below. The price of gold climbed yesterday, which suggests that the yellow metal responded more to the softness in the U.S. dollar rather than to increased risk appetites. However, the reaction was limited, given a significant jump in the EUR/USD exchange rate. The price of gold rose only about 0.62 percent.

Chart 3: Price of gold over the last three days.

The take-home message is that the euro jumped against the U.S. dollar yesterday. The price of gold moved in tandem with the exchange rate, but the reaction was limited, which may be interpreted as bearish signal. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview