In my latest commentary regarding current market situation in the precious metals and related equities (The January Effect or Another January Disaster), I wrote the following:

No asset can go straight up or straight down and a pause in the gold stocks should be expected. Are we there yet? I think that a local top in the PM stocks within the next few days is quite possible.

In fact gold stocks topped at just at the moment of writing that essay.

My essays are posted every 7-14 days or so, whereas the situation on the market changes every second. I may change my mind the very next day, after an article is posted, based on various factors and I am then unable to change that particular essay. I can only send a Market Update to my Subscribers.

Several days ago, I notified my Subscribers that this correction may be ending, and that betting on lower prices does not seem profitable any longer. Having gained over 25% on the position taken with this particular correction in mind, I suggested getting back on the long side of the market. So far this has proven profitable. In the following part of the essay, I will present several key reasons that I based my decision on. Most charts are courtesy of stockcharts.com.

First of all, the USD Index has more than reached levels that were expected to be taken out with this rally.

Naturally, USD Index may not top here. However, in my view, that does not make much of a difference for the precious metals. It seemed that the dollar upswing would cause much damage to the precious metals market, but these hard assets held up very well. This is another proof of how strong the buying pressure really is on the gold and silver markets. Silver and gold have managed to rise despite rallying dollar and I dont see signs that this is about to change in the next several days/weeks. For more details please take a look at the picture below:

Not only does gold rise despite rallying USD Index, but it takes place after having reached a triple support level. The latter is created by a combination of a rising trend line, 50-day moving average, and a Fibonacci 38.2% retracement level. Currently it seems that all of the technical puzzles are in place, which creates an overall bullish picture for the yellow metal.

What about gold stocks? They too have been rising, despite higher dollar and declining general stock market. From the long-term perspective prices of precious metals stocks are driven mostly by the prices of underlying metals. However, during short periods silver- and gold stocks often move in the same direction, as the general stock market. This tendency can be explained by emotions, and by the existence of purely technical traders.

Many investors/speculators purchase gold stocks just because they have been rallying, without any regard to the fundamental situation of the whole sector. As they see that stocks are falling on average, they cut their positions, thus selling also their precious metals stocks as well. On a day-to-day basis, these transactions have a significant impact on the price, however the longer period we take into account, the smaller the impact gets.

The important point here is that in during the last several days, gold stocks managed to rise despite the short-term negative influence caused by the mechanism described in the previous paragraph. This can be observed on the following chart, on which you will find the HUI to DJIA ratio. This ratio shows gold stocks outperformance regarding the general stock market, and it currently gives several bullish signals.

After dramatic plunge in October 2008, this ratio has been rising in a rather steady manner. There have been local tops and bottoms, but the medium term trend remains up. What is not visible on the HUI chart, but can be observed here, is the bullish cup and handle pattern. This is just another sign that we are likely to see higher gold stock prices in the following weeks.

The breakout above the declining trend line (blue thick line) has been verified ratio touched the support line of the rising trend channel. The fact that it did not go to the lower support level (blue thick line) is itself a bullish development. The next serious resistance level of this ratio is considerably higher at 0.043 level, which gives precious metals stocks a green light for further advances.

Of course, another dramatic downleg in the general stock market would diminish the effect that rising HUI to DJIA ratio would have on PM stocks, however I do not view that outcome as very probable.

Before entering a specific trading position I usually wait for my unique indicators to confirm other methods of analysis. This allows me to enter trades at the most profitable risk/reward combinations. Although the price may change direction without the confirmation, the probability that such a turnaround will materialize is smaller in this case.

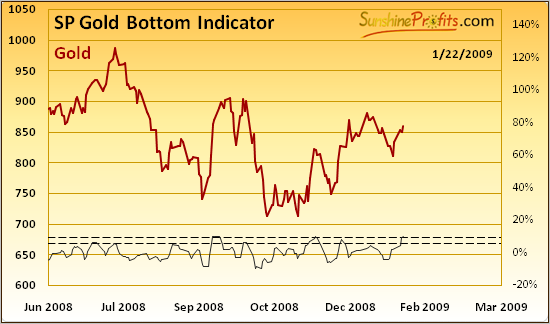

The above indicator gives a buy signal, when it breaks above the upper dashed line or below the lower dashed line. As you may see, it has just suggested entering a long position, if one has not entered it before. Additionally another indicator gave the same signal for the gold stock market a few days earlier.

Summing up, dollar has been rising and the general stock market has been falling during previous several days, however gold and gold stocks managed to rise despite these unfavorable conditions. This, accompanied by many other noteworthy bullish signs, suggests higher prices for gold, silver and PM stocks.

Of course the market might prove me wrong, as nobody can be right 100% of the time. Should my view on the market situation change substantially, I will send an update to the registered Users along with suggestions on how to take advantage of it. Register today to make sure you wont miss this free, but valuable information. Youll also gain access to the Tools section on my website. Registration is free and you may unregister anytime.

P. Radomski

Back