In the first part of the “Preparing for THE Bottom” series, we emphasized the need to be sure to stay alert and focused on the precious metals market, even though it may not appear all that interesting. We argued that preparing for the big moves in gold that are likely to be seen later this year should prove extremely worth one’s while.

The why issue that we discussed last week is closely related to when and the link is much closer than it appears.

Many people quite often start doing things right before the deadline, regardless of how much time there is to accomplish a given goal (isn’t everyone guilty here, at least every now and then?) and even regardless of how important the goal is. Then comes the frustration and regret that we should have done it a long time ago when there was still plenty of time… And the situation repeats with the next goal as if nothing ever happened previously and we didn’t learn anything from it (because we didn’t).

What if we had all the time in the world to complete a given task? That’s right – it would never be completed at all; it would be postponed one day at a time… forever. If you’re interested in the this phenomenon per se, you will find a more in-depth discussion of the above phenomenon for instance in Chuck Palahniuk’s Fight Club (“This is your life and it’s ending one minute at a time.”)

All in all, knowing that you need to do something and that it’s critical for you and your family is only somewhat important if you don’t assign any time-frame or a “mental alert” to it.

I really should talk more with my parents / grandparents / children / grandchildren – I’ll call them some day, maybe tomorrow. – if the above quote applies to you, please pause reading this article and call them NOW. There are only so many tomorrows…

I really need to take care of my finances and have a plan for them, but if the buying opportunity is far away, I’ll have to plan my actions someday, maybe tomorrow. – if the above quote applies to you… Well, you get the idea.

OK, since we have established the necessity to take care of the important issues on time, let’s discuss how we can apply it to your financial life. The above does not mean taking your entire capital and buying gold today. It does, however, mean making sure that you start planning and preparing yourself for the upcoming bottom as soon as possible. It will take longer than a phone call, so you don’t have to do everything as of this second, but make sure you put this on your schedule and don’t move it further into the future once the time comes.

The following articles of the “Preparing for the Bottom” series will serve as reminders and we’ll provide additional details in them, so we’ll strive to help, but it will be useful only if you view planning for the upcoming bottom in the precious metals market as something important and urgent – because it is.

The when in the title of this today’s article is not only about when one should start preparing for the bottom (to which the answer is: as soon as possible). The when in the title of this article is also about the question that we have been asked tens, if not hundreds of times: When is gold going to finally bottom?

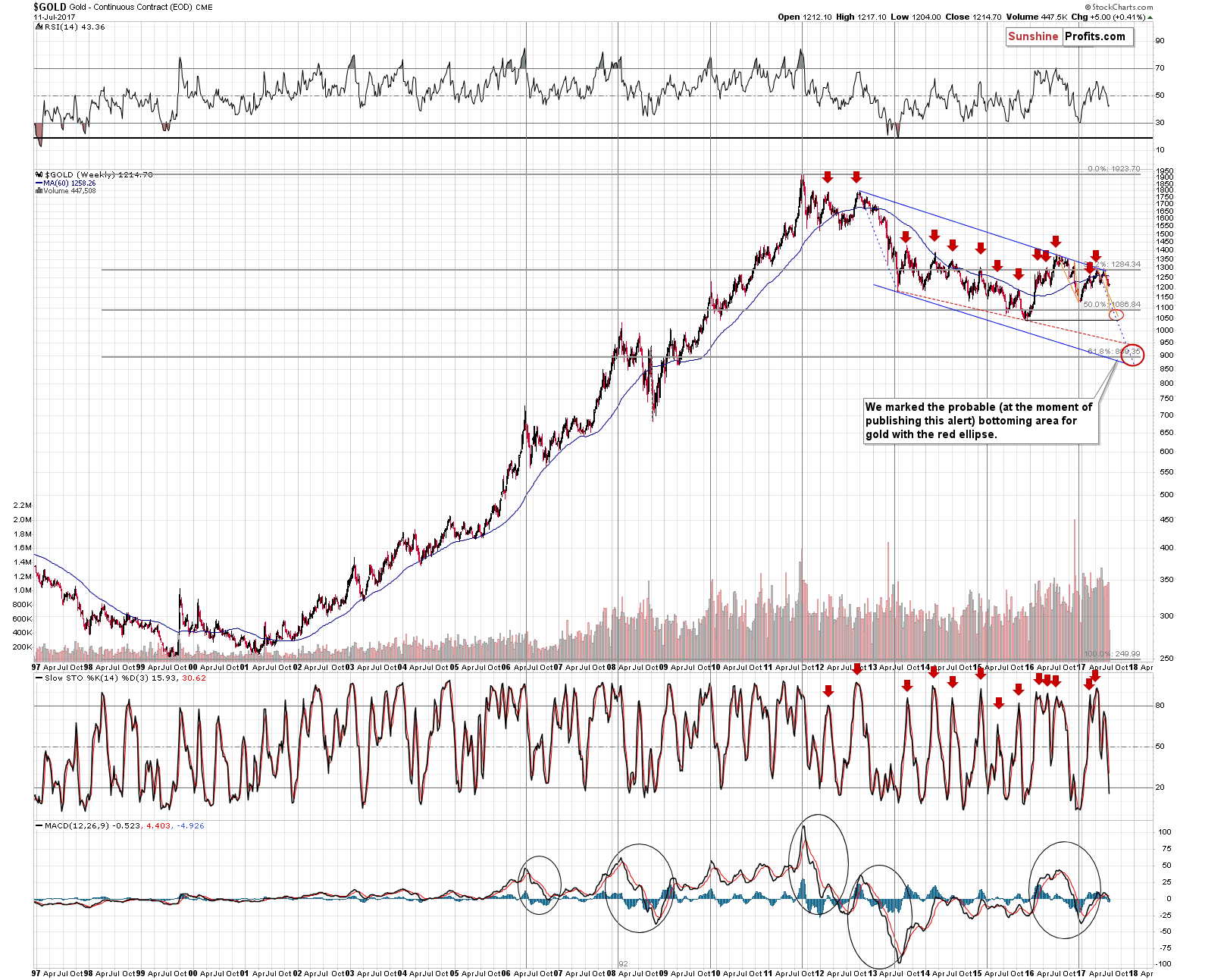

Let’s start with something less important – the long-term gold chart (charts courtesy of http://stockcharts.com).

The ellipses on the above chart mark the likely bottoming targets and they are for both the price and time. Will gold really drop as far from today’s prices? It’s impossible to know with 100% certainty, but it does appear the most likely outcome at the moment of writing these words. We don’t want to get into the technical details here (that’s what we discuss in our Gold & Silver Trading Alerts), so let’s just say that a lot of factors (some from the precious metals market, some from the ratios within it, and some from the other markets and their respective ratios) point to this outcome.

The most important thing, however, is the general reason behind gold’s likely decline in the upcoming months. While the technical factors could change, the above is not likely to go away, even if the decline is delayed (for instance based on some unpredictable fundamental events in the previous months).

The general reason behind gold’s likely decline is still the same reason that’s been in place for many months – the lack of extreme negative sentiment toward gold at the previous local bottoms. The key bottoms as well as key tops are formed when the sentiment moves to the extreme. Back in 2011, the top was accompanied by extreme interest in gold and extreme optimism. The 2015 and 2016 bottoms were not accompanied by extreme pessimism. Gold was not hated in the public media and surveys that were conducted among investors didn’t show expectations of much lower prices by most investors – conversely, on average, investors were expecting higher prices.

So, when is gold going to bottom? When the sentiment reaches the extreme low and gold is indeed hated and nobody wants to buy it. This is precisely what creates low prices and epic buying opportunities.

Naturally, here is also a possibility that something major happens (like World War III, destruction of the current financial system, etc.) and in this case gold would soar regardless of the above, but that’s not a likely outcome and even if it happens, one could still have some gold as insurance, while being prepared to make the long-term investment (the part of one’s capital, in which we expect the biggest profits to be made in the upcoming years) purchases later.

Summing up, there is likely still some time to prepare for the final bottom in gold as it’s likely to take place when gold is widely hated by the investment public, but it doesn’t mean that it’s a good idea to delay preparing yourself to take advantage of the upcoming epic buying opportunity. In the case of the latter, the best time to prepare is now.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts