Have we learned anything from Lehman Brothers’ bankruptcy? On Saturday, there was a 10-year anniversary of the symbolic beginning of the global financial crisis. So it’s a great opportunity to discuss lessons from the Lehman’s collapse and the post-crisis legacy for the gold market.

Too Little Capital

10 years ago, Lehman Brothers collapsed, which is commonly considered as a symbolic beginning of the Great Recession. We analyze thoroughly lessons from the Lehman’s bankruptcy for the gold market in the upcoming October edition of the Market Overview. But it is such a vast and important topic that we decided to write about it today as well. In contrast, we will focus on what we have not learned from Lehman Brothers’ collapse.

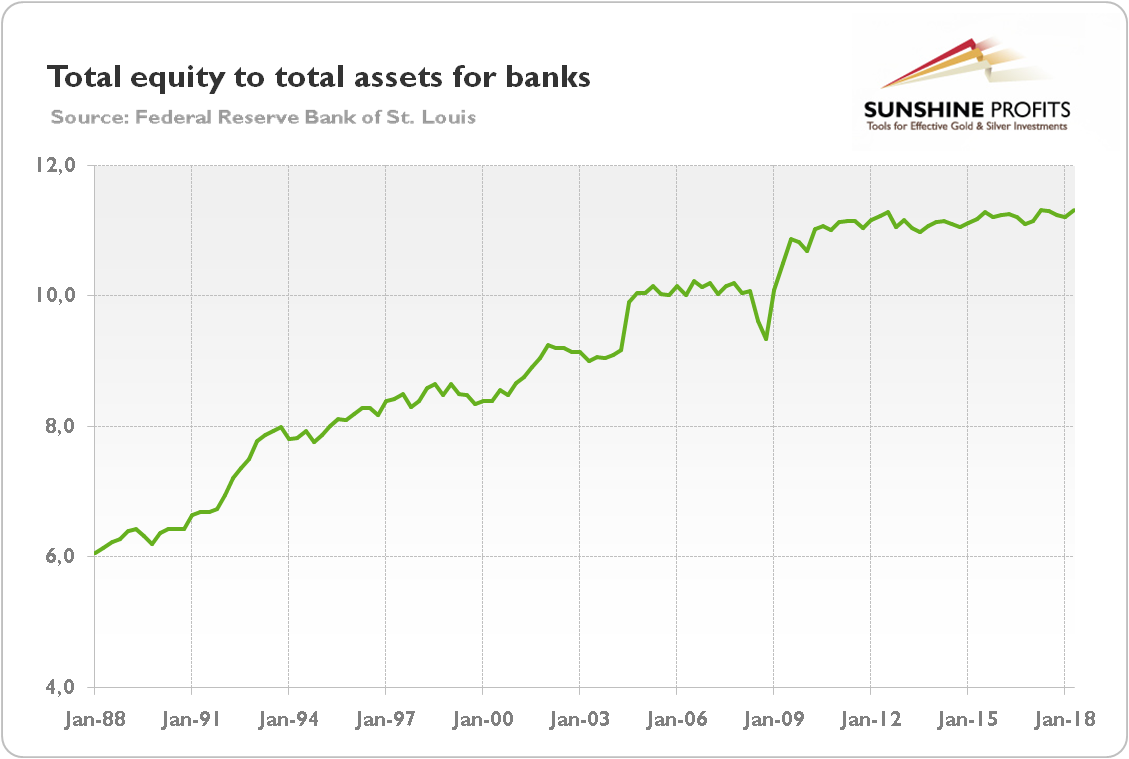

In short: the global financial crisis was caused by excessive indebtedness. Banks had too much debt and too little equity, so they couldn’t bear the losses they faced. But little has changed. Sure, the commercial banks were recapitalized, but the financial system remains generally fragile like back in 2007-2008. As the chart below shows, the total equity to total assets is 11.3 percent. It is more than one percentage point higher than banks had had on the eve of the crisis in 2008, but it is not enough, by any reasonable measure (especially that the weighted average tangible common equity ratio at the six largest U.S. banks is even lower). The implication for gold is clear: when another crash comes, it may quickly transform into a banking crisis, if banks do not have adequate capital. Gold will shine then.

Chart 1: Total equity to total assets for US banks from Q1 1988 to Q2 2018.

Too Much Debt

The pre-crisis boom was fueled by easy money and low interest rates. Even people with no income, no assets and no job were given loans. As a result, the global debt surged from $84 trillion at the turn of the century to $173 trillion at the time of the 2008 financial crisis. The problem is that 10 years after the collapse of Lehman Brothers, due to the ZIRP, the global debt ballooned to $250 trillion. We may call it the post-Lehman legacy.

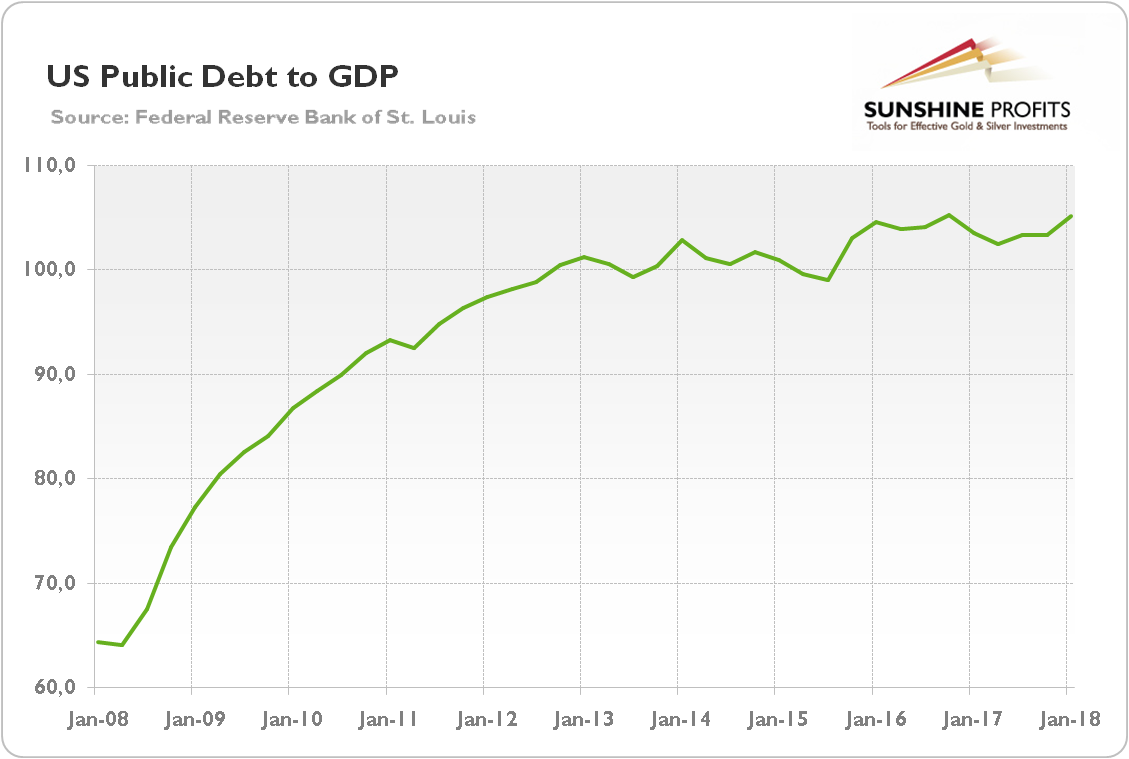

Of course, the situation differs depending on where you look. The US households and financial corporations have reduced their leverage. But nonfinancial companies and government have increased their indebtedness (as the next chart shows). Similar trends are seen in other advanced and even emerging markets. In particular, China’s debt level has exploded since 2008.

Chart 2: US public debt to GDP (as %) from Q1 2008 to Q1 2018.

Although that massive indebtedness does not have to trigger a crisis in the near future, the leverage seems to be unsustainable in the long run. Which is approaching due to the Fed’s tightening cycle. In particular, the emerging markets are exposed to higher rates and stronger greenback. But the governments of advanced countries are also in trouble. They will have to either raise taxes decisively (which are already high) or print money. If we see higher inflation and more central banks’ meddling with the economy, the price of gold should finally rise.

Implications for Gold

It’s true that the financial system is safer than 10 years ago. But it does not matter. The real question is whether it is safe enough. We are not doomsayers, but we are also not incorrigible optimists who turn a blind eye to problems. Banks have more capital, but it may be still too little, especially in Europe. The financial system is less fragile, but the governments and central banks are less capable to cope with a crisis. We have more of maybe even smarter regulations, but the risks have migrated to non-regulated areas. The global economy has recovered, but the road to growth was paved with debt. And as such it is not a sustainable growth model. It’s a one-way street. But, hey, guess what is at the end of that road. Yes, you are right: gold.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview