We know this… we really know it. This is awkward. Gold is a metal. This is why it used to be money for thousands of years: it was rare, tangible and its supply couldn’t be increased at will. An ideal store of value. So why are we saying that gold is not commodity?

We mean here not the physical attributes of gold, but the approach to valuing it. You can model it either as a currency, or as a commodity. From the investment point of view, we always treated gold as a currency, so in the previous part of this edition of the Market Overview, we discussed – in line with that approach – the three most important drivers affecting the price of gold. Now, we will present the final critique of treating gold as a commodity.

Many analysts attempt to develop a fundamental model for the price of gold by focusing on such statistics as mine production and industrial usage. They thoroughly analyze the changes in physical demand, supply, the marginal costs of mining, etc. However, this approach is fatally flawed since these figures constitute only a minuscule fraction of the total gold supply.

As a reminder, gold is demanded as a store of value. It is money, not an input good that is consumed over time. You see, gold is really unique. It is practically indestructible, so it is produced and used over and over again, while other commodities are produced and practically entirely consumed. Commodities are produced and then they disappear in the process of consumption. Gold does not disappear, it is accumulated.

Hence, changes in the aboveground stocks – which are crucial for typical commodity prices – are virtually irrelevant for the price of gold. As gold is not consumed, nearly all gold in the world that has ever been mined is still in existence, most of which is available for sale at what its owners believe to be the appropriate price. There is more than 180,000 tons of gold above ground. Meanwhile, the daily mining output of bullion is only about 9 tons (the annual new output adds only 1.8 percent to the global holdings). Now, it should be clear why changes in the supply have really limited impact on the price of gold.

There are also many analysts who argue that production costs provide a floor below which gold prices cannot fall. At first sight, it makes a lot of sense. If gold is priced well above production costs, investment will eventually flow into the mining sector, increasing the supply. If the price of gold is permanently below production costs, mines will eventually close and the gold supply will decline, pushing the price until supply and demand find a new equilibrium.

However, it’s not so simple after closer inspection. You see, the costs do not determine the prices. Economists have known this since the marginal revolution in 1871. Value is subjective. The price of gold depends on how badly do people want or need gold, not on the costs to mine it. And these costs differ among companies and over time. We mean that there are no set costs to mine the ounce of gold. Each year, there are some gold mining companies which operate at production costs higher than the price of gold (i.e., they lose money).

Actually, the causality runs from prices to production costs. When gold prices rise, some deposits which were previously unprofitable will start being mined. As these include deeper mines or yielding a lower quality of ore, it would push up the average cost of production. And when gold prices decline, these high-costs or lower-grade deposits will be dropped, reducing the productions costs. Hence, the cost of mining gold follows the price of gold, not the vice versa.

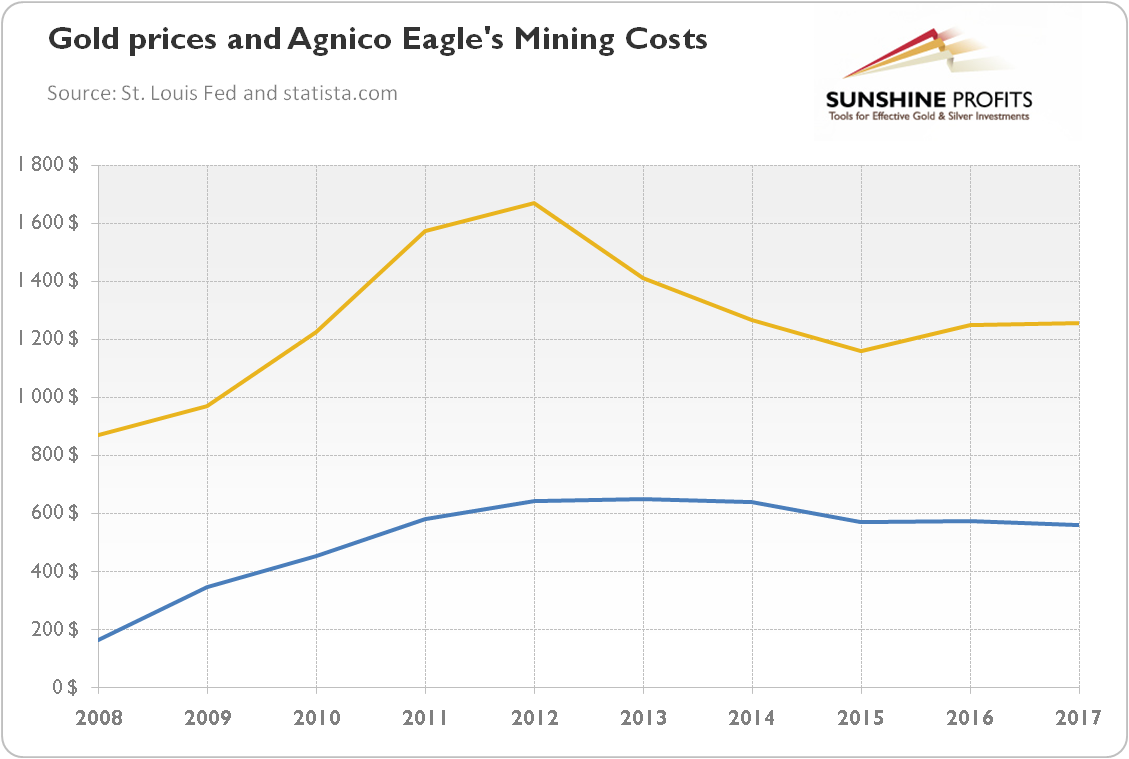

Just look at any data. The chart below shows the cost of mining gold for Agnico Eagle, one of the 10 biggest gold producers in the world, over time. It increased during the gold bull market in the 2000s and declined during the subsequent bear market.

Chart 1: Gold prices (yellow line, London P.M. Fix, yearly averages, in $) and Agnico Eagle’s mining costs per ounce (blue line, in $).

Another important issue here is that gold miners have low market power due to the enormous aboveground gold stocks. As the annual flow from mines is exceptionally small compared to gold accumulated holdings, any attempt to run a cartel and set prices would fail. Hence, gold mining companies are price takers rather than price setters. It implies that they have to accept the market price, no matter what are their costs. In other words, there is no force in place to prevent the price of gold from falling below a certain level, i.e., the particular cost to mine it.

To sum up, gold behaves like a currency, so its price has to be modeled like a currency. The commodity approach is terribly wrong. Gold is a metal, just like copper, but it has an exceptionally high stock-to-flow ratio. Many analysts forget about that. But we don’t. So we know that factors such as the annual mining production have almost no impact on gold prices. And also contrary to many erroneous opinions, mining costs do not set a floor below which gold prices cannot fall. They can, as prices depend on subjective valuation. A decline in gold prices eliminates the least effective mining companies, pushing the average production costs down. Thus, the causal relation works from prices to costs. Analysts do not have to know that, but you should!

If you enjoyed the above analysis and would you like to know more about the fundamental drivers of the gold prices, we invite you to read the May Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!!

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview