The below report is a free, introductional version of the upcoming service from Sunshine Profits: The Oil Updates.

From today’s point of view, it seems that the situation hasn’t changed much since our last Oil Update, because light crude is trading between $105 and $107 per barrel once again - just like it did a week ago. However, last week was very interesting and brought a significant improvement in the oil market – a positive change which, eventually, turned out to be only temporary.

The crude market is always sensitive to Middle East conflict. As you remember, prices rose to $115 on the unrest in Libya two years ago and to $110 on Iran’s nuclear program. In the previous week we saw similar price action.

On Wednesday, light crude surged to its highest level since May 2011 on concerns that the conflict in Syria would spread and threaten oil supplies from the Middle East. According to Reuters, the price of crude oil gained 2.9% and reached over $112 per barrel as Foreign Minister Walid al-Muallem said that Syria’s defenses would “surprise” the world if the U.S. and its allies attempted military strikes.

Syria itself is not so important for the oil market, since it produced just 164,000 barrels a day of the 28.3 million pumped in the Middle East last year, according to BP’s Statistical Review of World Energy. However, the fear here is that a strike on Syria would lead to a broader regional conflict. This region accounts for 35% of the world oil production.Syria borders Iraq and is near Iran, countries that together hold almost a fifth of the output capacity of the Organization of Petroleum Exporting Countries, according to Bloomberg estimates.

Iran, a longtime Syrian ally, warned that a U.S. attack on Syria would drag the whole region into the conflict. Any use of military force in Syria would “engulf the whole region,” Foreign Ministry spokesman Abbas Araghchi told reporters in Tehran. Russia also warned against an attack on Syria.

In the following days, the price of crude oil dropped as the U.K. and France said they favor waiting for the results of a United Nations investigation into Syria’s alleged use of chemical weapons. On Friday, WTI extended its decline for a third day after President Barack Obama said he would seek authorization from Congress before ordering military action against Syria, easing concern that an imminent strike would disrupt Middle East oil exports.

Taking the above into account, we can conclude that the geopolitical risk drove the market higher. Although, the prospect of imminent attacks on Syria receded, it seems that as long as tension escalates in the region, specifically in Syria and Iran, you can expect prices to move higher.

Another factor, which fueled the price of light crude were supply cuts in Iraq and Libya.

According to Bloomberg, Iraq will reduce daily exports of Basrah Light crude from the Persian Gulf in September to the lowest in at least 20 months. The Middle Eastern producer, the largest in the Organization of Petroleum Exporting Countries after Saudi Arabia, will ship about 52.86 million barrels, or 1.76 million barrels a day, from the Basrah Oil Terminal, according to the plan. This is the lowest since at least February 2012 when Bloomberg started tracking the data and compares with 2.09 million a day this month.

What about Libya? The North African nation’s export capability has been crippled since members of the Petroleum Facilities Guard seized control of terminals last month to press for better working conditions.

Libya has reduced exports as a result of oil worker strikes and civil unrest. According to Libya National Oil Corp. Chairman Nuri Berruien, the nation’s oil output may have dropped below 200,000 barrels a day amid protests, the lowest level since 2011.

Once we know the situation in the Middle East, let’s focus on the factor, which seems to have been terrorizing the markets for weeks. What do I mean? The Fed and its stimulus program, of course. As the prospect of imminent attacks on Syria receded, it seems that investors came back to focusing on economic data and the Fed tapering once again. In the previous week the better-than-expected U.S. economic data were an additional bearish factor, which pushed the price of light crude lower. The U.S. economy expanded at a faster pace in the second quarter and first-time jobless claims fell more than forecast, which raised speculation that the Fed would reduce its $85 billion monthly bond buying in September.

Keeping in mind these factors and their impact on the price of light crude, let’s now move on to the technical part of our Oil Update. Just like a week ago, we take a look at the charts from different time perspectives to have a more complete picture of the current situation in the oil market.

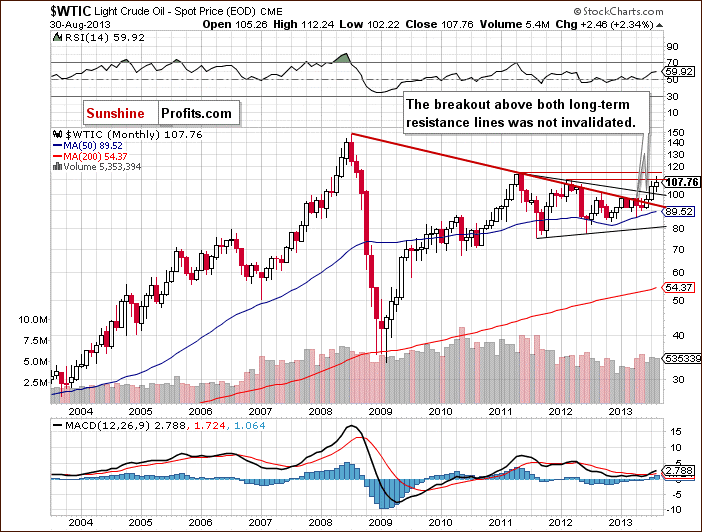

Let’s start with a look at the monthly chart of light crude (charts courtesy by http://stockcharts.com).

Looking at the above chart, we clearly see that light crude still remains above the two long-term declining resistance lines: one of them (bold red line) is based on the July 2008 and the May 2011 highs, and the second one is based on the September 2012 and March 2013 highs (the upper black line).

The breakout hasn’t been invalidated since June. Therefore, from this perspective the picture is bullish.

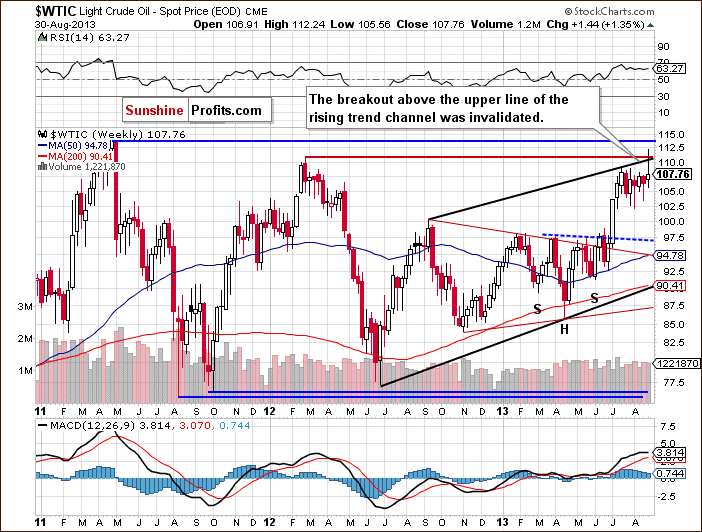

Now, let’s zoom in on our picture of the oil market and see the weekly chart.

Quoting our last Oil Update:

(…) the recent weeks have formed a consolidation. The inside bar candlestick pattern is worth mentioning at this point. It is characterized by the inside candle’s price action being completely covered by the price action the week before. According to theory, if the buyers manage to break above the resistance level (the July top), the price target for the pattern will be around the May 2011 top.

Please keep in mind that there is a strong resistance zone based on the March 2012 top and the upper border of the rising trend channel which may encourage oil bears to go short and trigger another corrective move.

On the above chart, we see that there was a breakout above the July and the March 2012 highs in the recent days, however, the above-mentioned strong resistance zone stopped further increases. Oil bulls showed their weakness and the pro growth scenario was not realized. The proximity to the May 2011 top encouraged oil bears to go short and trigger another corrective move, which took the price of light crude back to the consolidation range.

Despite this fact, the outlook is still more bullish than not at this time.

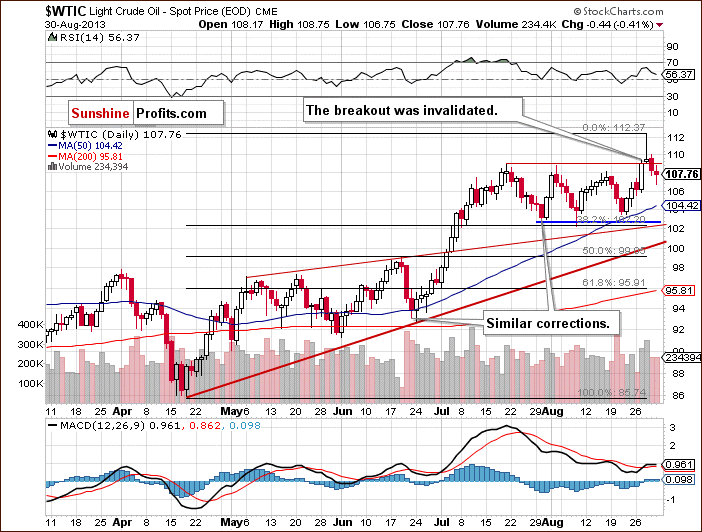

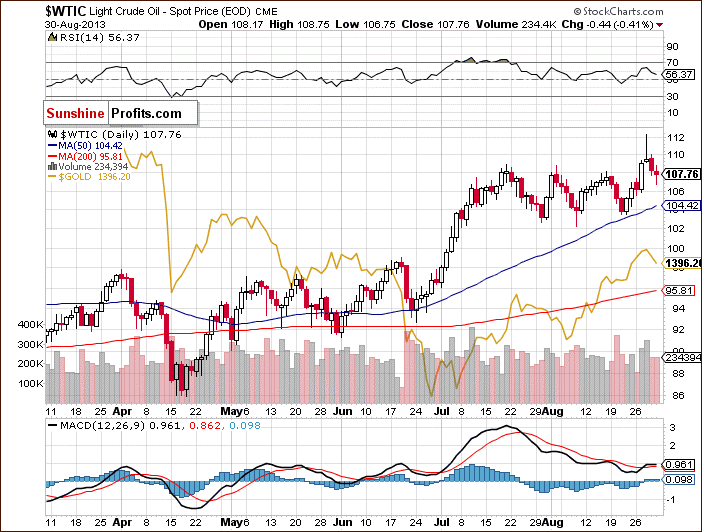

Now, let’s check the short-term outlook.

In this daily chart, we see that the situation hasn’t changed much in the recent days. Although light crude climbed and reached its highest level since May 2011, this improvement didn’t last long and the price slipped below the March 2012 and the July highs once again. In this way, the breakout above these peaks was invalidated.

Despite this downward move, the correction is still shallow at the moment and much smaller than the previous ones. From this point of view, the short-term situation is bullish.

Additionally, when we factor in the Fibonacci price retracements, we clearly see that the correction is quite small because it hasn’t even reached the 38.2% level. In my opinion, this is a bullish factor.

Where are the nearest support levels? The first one is the 23.6% Fibonacci retracement level based on the entire April-August rally (slightly above $106). The second one is a support zone (between $102.22 and $103.50) based on the bottom of the previous corrective move (the August 21 low) and the August low. As you see, there is also the 38.2% Fibonacci retracement level, which reinforces this support zone. The third one is the upper line of the rising wedge (currently close to $102).

Summing up, although there was an invalidation of the breakout above the July top and the March 2012 top, technically, the short-term outlook for light crude is still bullish. The uptrend is not threatened at the moment, because the recent decline is still shallow and smaller than the previous ones.

If you want to be an effective and profitable investor, you should look at the situation from different perspectives and make sure that the actions that you are about to take are really justified. That’s why you should pay attention to the oil stocks index even if you only trade crude oil. In today’s Oil Update, we examine the NYSE Arca Oil Index (XOI) once again to find out what the current outlook for the oil sector is.

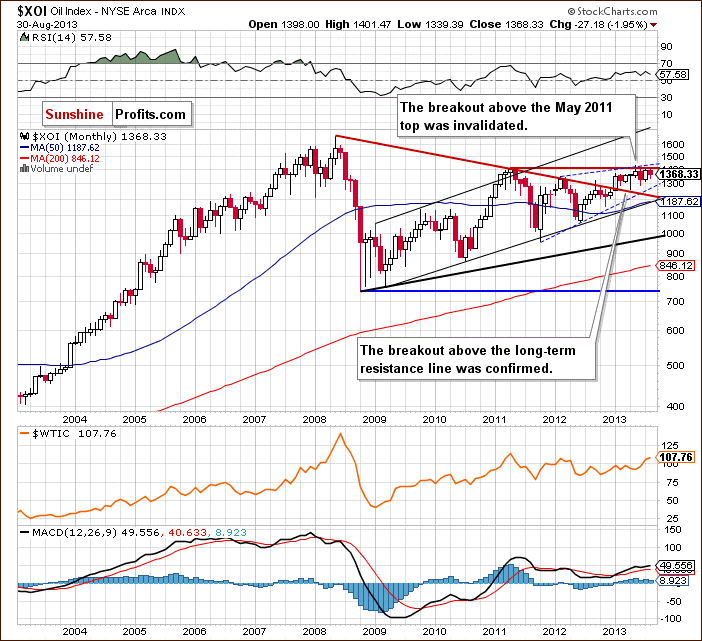

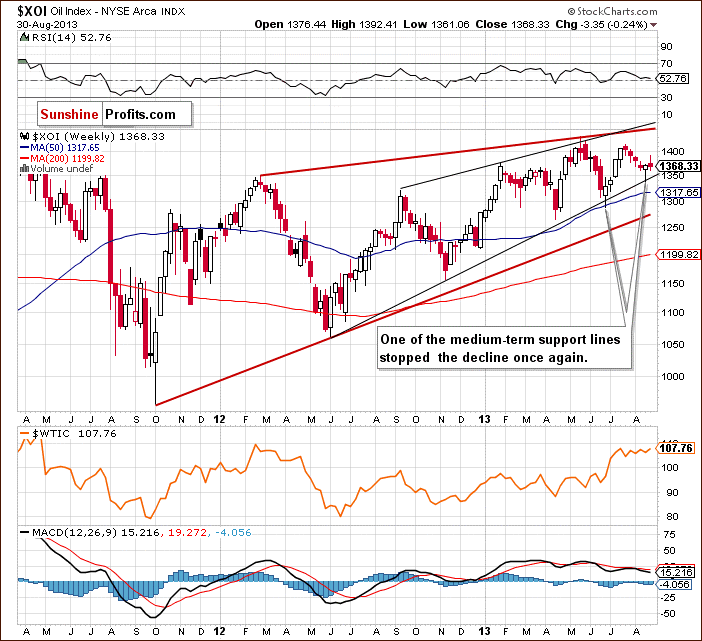

Let’s start with the long-term chart.

Looking at the above long-term chart, we see that the situation hasn’t changed and the oil index remains quite close to the May 2011 top.

As we wrote in our previous Oil Update:

(…) the NYSE Arca Oil Index still remains above the previously-broken long-term declining resistance line based on the 2008 and the 2011 highs and the breakout hasn’t been invalidated. Additionally, the oil index is still in the rising trend channel.

Taking the above-mentioned into account, the situation is still bullish.

What about the relationship between light crude and the oil stocks? When we take a look at the above chart (and also at the chart below) and compare the price action in both, it seems that oil stocks were weaker in August, because they didn’t reach a new local top. However, it’s worth noting that the XOI climbed above the 2011 top in May and light crude didn’t make it, in spite of the recent attempt.

Let’s take a closer look at the weekly chart.

On the above chart, we see that the NYSE Arca Oil Index still remains above the medium-term support lines. Keep in mind that the strong support line (marked in black) stopped the decline in June, which resulted in a rally in the following weeks.

Although, history didn’t repeat itself in the recent week and the XOI didn’t rally as it had previously done, the medium-term uptrend is not threatened currently, and the situation remains bullish.

Please note that we should still keep an eye on the above-mentioned support line, because it is also the lower border of the rising wedge. As you know, this is a bearish pattern and if buyers fail, it will likely lead to a decline which may take the oil index at least to the lower medium-term support line (the red one).

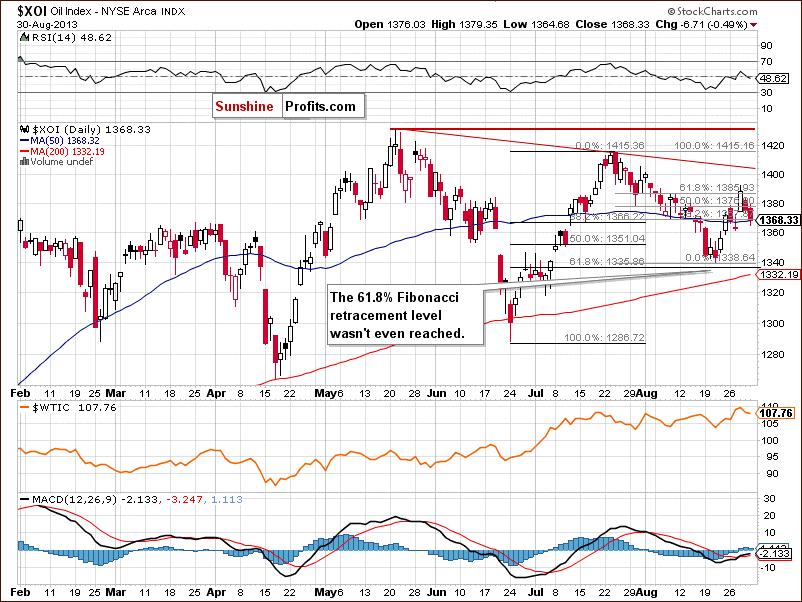

Now, let’s turn to the daily chart.

From the short-term perspective, we clearly see that the recent increases have taken the XOI slightly above the 61.8% Fibonacci retracement level based on the entire July-August decline. This quite strong resistance level in conjunction with the July 30 low (in daily closing prices) encouraged sellers to act and the oil index dropped below 1,370 on Friday. In this way, a small breakout was invalidated.

At this point, it’s worth noting that the XOI closed the previous week at the 50-day moving average, which still serves as support. If it holds, we may see a pullback to the Wednesday high. However, if it is broken the nearest support level will be the Tuesday low, and the next one will be based on the last Wednesday bottom and the 61.8% retracement level.

Please note that the next resistance level (above the Wednesday high) is the declining resistance line based on the May and the July highs (currently close to the 1,404 level). If it is broken, the buyers’ next target will be the July peak, and then the May top.

Before we summarize, let’s check the relationship between the WTI and the XOI in the short term. Despite the negative divergences at the beginning of the previous week, the second half looked pretty much the same in both cases and we saw declines.

Summing up, from the long and medium-term perspectives the outlook for oil stocks is bullish and the uptrend is not threatened at the moment. Taking into account the relationship between light crude and the oil stocks, we see that crude oil is still a step behind the oil index.

Speaking of relationships, let’s take a closer look at the chart below and check the connection between crude oil and gold. Has it changed in the recent days? Let’s examine the daily chart.

Quoting our last Oil Update:

(…) the July rally in gold took place along with a rally in crude oil. Both commodities declined after oil reached its new local top. From this point of view we can conclude that the corrective move in light crude triggered another move lower in gold.

On the above chart we clearly see that the price action was similar to what happened last week. However, this time light crude hit its bottom a bit earlier and when we saw a downward move in oil, gold was still rising. Nevertheless, after the yellow metal reached its highest level during Wednesday’s session, light crude accelerated its declines.

As you see on the daily chart, this positive correlation between both commodities continued in the following days.

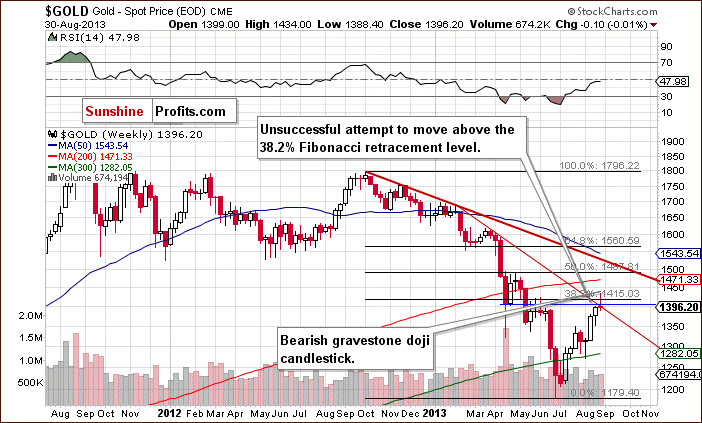

Taking the above into account, I think it’s worth taking a closer look at the medium-term outlook for gold.

Let’s turn to the weekly chart of the yellow metal.

On the above chart we see that gold continued its rally in the previous week and reached a strong resistance zone based on three important levels: the first of them is the June’s top; the second one is the April’s bottom (in terms of weekly closes); and the third one is the 38.2% Fibonacci retracement level based on the September 2012 - June 2013 decline.

At this point, it’s also worth mentioning the declining resistance line based on the October 2012 and February highs, which strengthens the above-mentioned area at the moment.

Connecting the dots, the medium-term situation seems quite bearish. Yes, there was a small breakout above a strong resistance zone, but from this point of view it was not confirmed. Additionally, the last week’s candlestick is a bearish gravestone doji.

Summing up, in our last Oil Update we wrote that there are periods when the relationship between crude oil and gold works. The recent positive correlation seems to confirm this theory. Taking this into account and combining it with the current situation in gold, the next big question is: will this short-term link change? Please note that the medium-term and the short-term outlook for crude oil is still bullish, while the medium- and short-term picture for gold is more bearish than bullish. From this point of view, it seems that the acceleration of the downtrend in gold is still ahead of us. However, even if gold leads oil down, the uptrend in crude oil will be not threatened as long as the current correction remains smaller or similar to the previous corrective moves.

The above report is a free, introductional version of the upcoming service from Sunshine Profits: The Oil Updates.

Thank you.

Nadia Simmons

Back