As you may know, we have 2 publications dedicated to oil traders and investors: Oil Trading Alerts and Oil Investment Updates. The latter cover major trends and long-term-oriented phenomena and take a form of big, monthly reports, while the former are – as their name says – trading alerts, which are provided on a daily basis and include direct trading details. In the following part of this performance page you will find the results of all (!) of the trades that we have described in Oil Trading Alerts since the beginning of 2015.

Since we (correctly) believed that the medium-term in crude oil remained down, we focused on providing oil trading signals for short positions.

We will calculate the profits on the short positions by dividing the entry price by exit price (effectively reversing the profits that would have been generated on a long position in case of an identical move to the upside) as this is likely closer to the real gains that one made due to employing instruments that move higher when the underlying asset’s price declines (like inverse ETNs and put options).

In the first part of the year, the situation was rather unclear and risky and we opened the first trading position on May 8, 2015. We entered a short position when crude oil was trading at about $59 and we took profits off the table on August 11, 2015 with crude oil at $43.28, which resulted in a profit of $15.72. The unleveraged (!) profit from this oil trading signal amounted to 36.3%.

We entered our second trade on August 24, 2015 when crude oil was trading at about $39.20. The position was closed when the stop-loss was reached at $45.32, on August 28, 2015. The loss amounted to $6.20, which is about 13.5%. There’s one thing that needs to be said regarding this trade. As you’ll see in the paragraph below, we effectively remained bearish, but instead of holding onto a position that was likely to become more unprofitable (but only temporarily), we chose to exit the position and re-enter it after a few days and an additional rally. Thanks to this approach, the overall profits from the year are bigger, because we re-entered the short position at a price that was more favorable than the one at which we had closed the previous trade.

We entered our third trade on September 4, 2015, when crude oil was trading at about $46.69 (over $1 higher than the price at which we had closed the previous short position) and we took profits off the table on December 14, 2015, when crude oil was trading at about $35.40, which resulted in a profit of $11.29. The unleveraged (!) profit from this oil trading signal amounted to 31.9%. Had we chosen not do close the previous position, the combined profit from the above 2 trades would have been about 10.7% - visibly less than what we managed to achieve thanks to closing the previous trade sooner.

We entered the fourth and final trade of 2015 on December 28, 2015, when crude oil was trading at about $38 and we took profits off the table on January 13, 2016, when crude oil was trading at about $31.39, which resulted in a profit of $6.61. The unleveraged (!) profit from this oil trading signal amounted to 21.1%.

To sum up, taking all our completed trades in the past 12 months (actually 13) into account, we can say the following:

- We entered 4 trades.

- The average outcome of these trades was +18.95% (with crude oil at about $40, this translates more or less into the average performance being similar to profiting on a $7.6 move in crude oil).

- The final outcome (achieved using the entire trading capital and re-investing it into subsequent trades): +88.32%.

- The final outcome (achieved using one third of trading capital and re-investing the same amount percentage-wise into subsequent trades): +26.8%.

- There were 3 winning trades and 1 losing trade.

- The only losing trade was actually a part of a bigger short trade, which proved profitable and thanks to taking the temporary loss, the overall profits actually increased.

- Many trades were not profitable immediately, but the profits proved well worth waiting for.

All of the above is verifiable - you - our subscribers - can access all alerts that we've ever posted and check why and when we had this or that outlook.

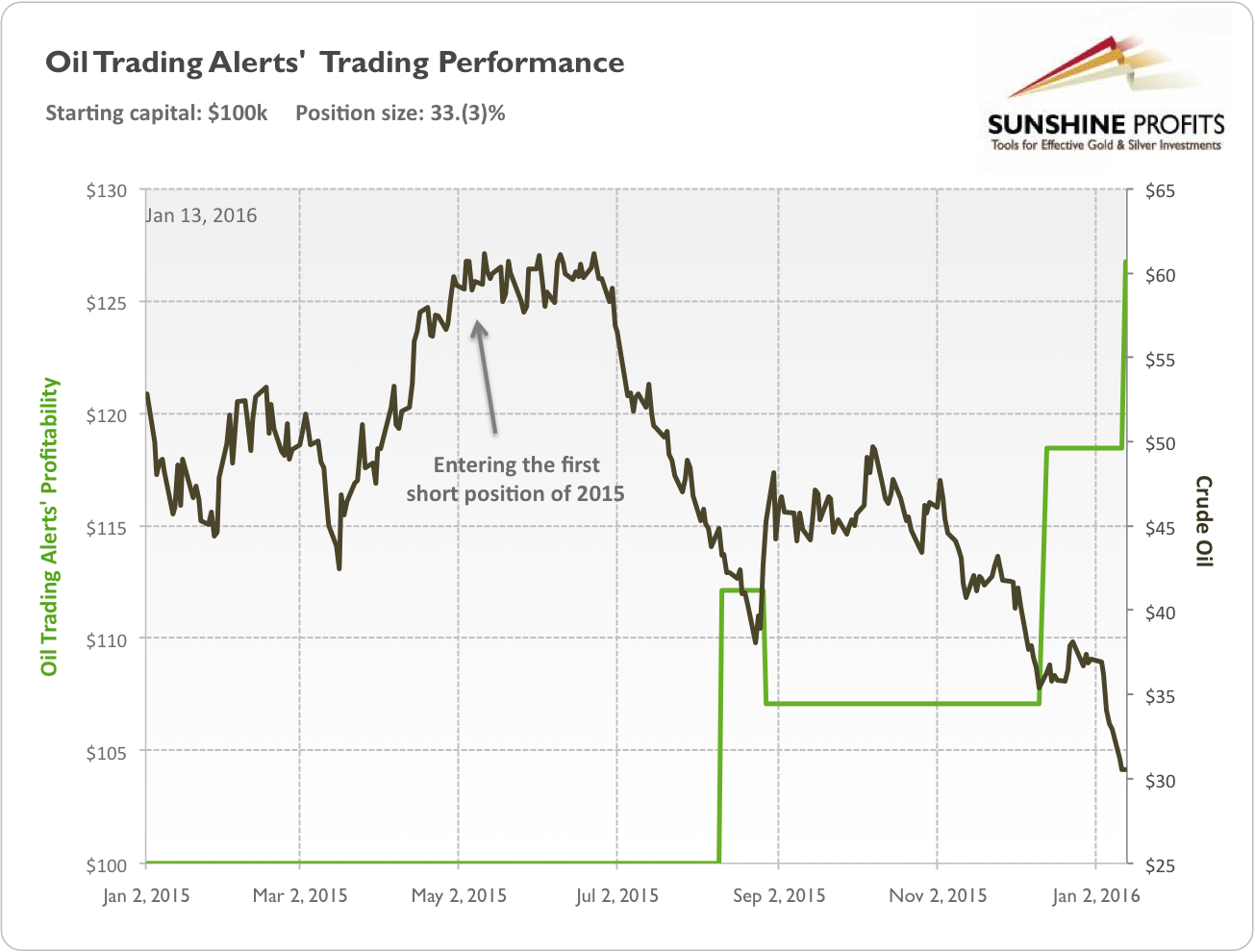

The chart below shows how the size of the trading part of the portfolio would have performed if it had been based on trading signals from the Oil Trading Alerts since the beginning of 2015. As you can see, the green line featuring the value of the trading part of the portfolio runs up with small corrections along the way. We have often written that by doing thorough research, staying focused and so on, one can achieve a 70% - 80% efficiency at best. The 3 profitable trades out of 4 are 75% (and that assumes that the losing trade was really a losing trade, not a part of a bigger trade). This is the kind of performance that we aimed to achieve (not 100% efficiency as that’s impossible to achieve and setting such a goal for oneself makes one take on either too little or too much risk, which overall decreases the profitability).

Note: The above calculations don’t take any leverage into account and the rate of returns would have been much higher if leverage had been used. Of course, this is not an encouragement to use leverage - it’s risky, and not for everyone.

Note 2: The above does not prove or show that we will be able to repeat this kind of performance and in particular it does not guarantee that we will achieve a similar rate of return in the future. It is a lengthy reply to a question that we received about our 12-month performance.

We encourage you to make the investment in our detailed alerts. While we can’t guarantee it, it’s likely to be an investment that will pay for itself soon (if not very soon) - join us today.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts